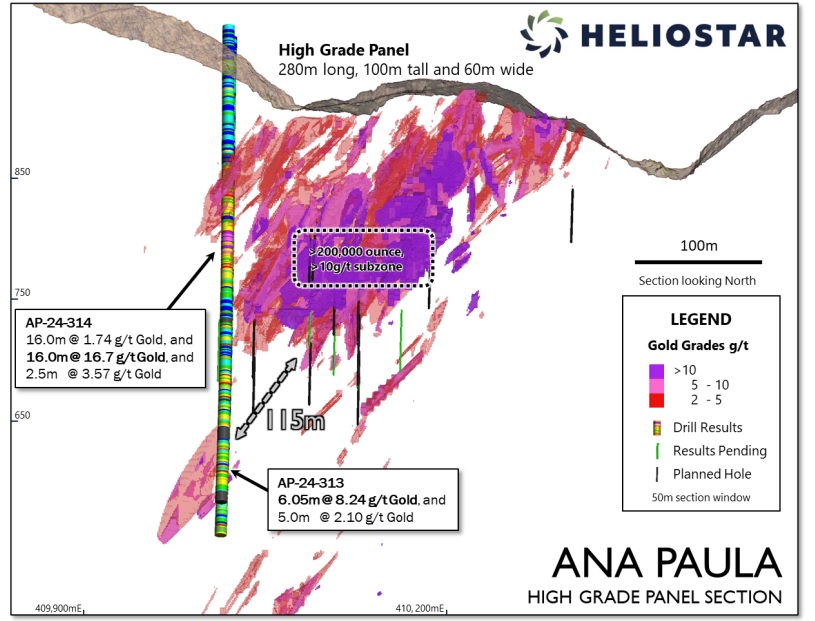

Heliostar Metals (HSTR.V) released the first assay results of the 2024 Ana Paula drill program last week. An initial 2,600 meters is focusing on extending the high grade panel and parallel panels to the west, drill-testing the down-dip extension of the High Grade Panel and complete some infill holes at the Parallel Panel. On top of that, two holes are designed to intersect the potential mine stopes to collect metallurgical samples for the feasibility study.

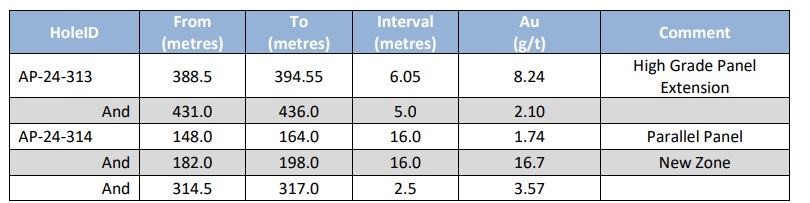

Hole AP-24-313 was the largest step-out hole, and aimed to connect a deeper zone of higher grade gold mineralization. This hole was a success as the drill bit intersected just over 6 meters of 8.24 g/t gold. This could indicate the size of the High Grade Panel could be expanded by over 115 meters further down plunge.

Hole AP-24-314 was even more intriguing as it defined a new zone of gold mineralization in between the High Grade Panel and the Parallel Panel. More drilling will be needed to figure out the full extent of the mineralization, after the company encountered 16 meters of 16.7 g/t gold.

Heliostar Metals has now completed five holes for a total of almost 2,000 meters. The assay results of the other holes will be released in due course.

Meanwhile, the company has now officially closed the acquisition of Florida Canyon’s Mexican assets for US$5M in cash. Heliostar is now the owner of the San Agustin and La Colorada mine as well as the Cerro del Gallo and the San Antonio project. But one of the additional reasons to acquire the Mexican assets is that it eliminates the US$20M contingent cash payment for Ana Paula. We will be visiting the Ana Paula and La Colorada assets next week to get a better understanding of the recently acquired assets.

Disclosure: The author has a long position in Heliostar Metals. Heliostar is a sponsor of the website. Please read the disclaimer.