It has come to our attention our report on Oroco Resource Corp. (OCO.V) has been used in a few Youtube videos of a third party. While we are obviously happy to see our back of the envelope calculations being widely accepted as reasonable, we would like to clarify a few things regarding our calculations.

Please be aware our calculations are based on about a dozen of assumptions. Assumptions we deem to be very reasonable (to the best of our knowledge), but that doesn’t change the fact they are just assumptions and most definitely not the Holy Grail of the Santo Tomas copper project. We used metallurgical data, copper concentrate specs and operating expenditures and capex levels used by other companies at similar project but keep in mind a ‘similar project’ does not mean it’s an ‘identical project’. A 10% difference in the capex level could have a nine digit impact on the net present value of a project and we are humble enough to even take our own calculations with a grain of salt.

Those are back of the envelope calculations, and should be interpreted as back of the envelope calculations. And just to clarify: there is absolutely no official NPV calculation readily available for the Santo Tomas project. As you undoubtedly know, companies are bound by the rather strict rules of the National Instrument 43-101. This places a burden on companies, but it also means investors can generally rely on the findings in a NI 43-101 report which are meant to be a detailed and realistic overview of a project.

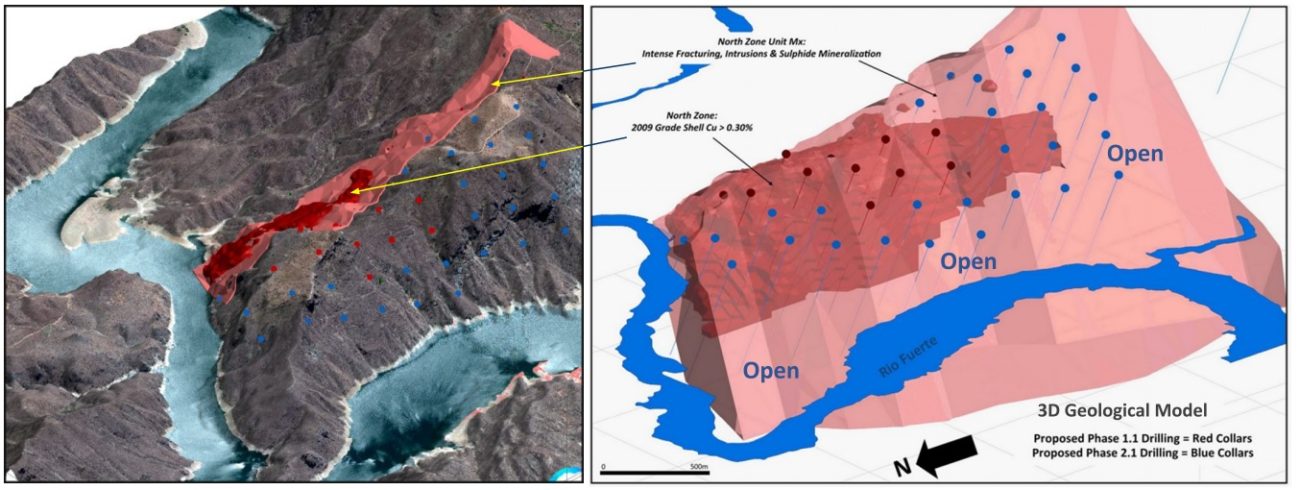

Right now, Oroco Resource Corp. does not have a resource estimate that meets the NI43-101 guidelines, and next year’s drill campaign will be fully focusing on bringing as many tonnes from a historical resource into a compliant resource estimate. That estimate will subsequently be the platform for a Preliminary Economic Assessment, which will be the first time the Santo Tomas project will be looked at based on its economic potential since 1994, when the Bateman pre-feasibility confirmed the viability of the project. Of course, a study completed in 1994 (followed up by an update in 2003) is not something you should rely upon to make an investment decision as the report is per definition outdated and the main takeaways from that report aren’t the NPV and IRR, but the historical pit shell and resources. We encourage everyone to read the full technical report on Santo Tomas to come to an informed decision. Oroco does a good job in making all relevant information accessible to its shareholders, you don’t even have to look on SEDAR to find the NI43-101 report, you can find it right here, on Oroco’s website. Read it.

We are very much looking forward to seeing a maiden NI43-101 compliant resources as that will allow us to narrow down our back of the envelope calculations based on updated grades and potential pit shell. But the real test will be the PEA as we would love to compare our back of the envelope calculation with the official studies on Santo Tomas. Maybe our calculations will come pretty close to the scenario outlined in the PEA, maybe they won’t.

Until then, if we are humble enough to take our own calculations with a grain of salt, so should you. Do your research and feel free to tweak our inputs and numbers. And don’t get carried away. Oroco has a great project and the company is diligently working towards unlocking the value. But this doesn’t happen overnight.

Disclosure: The author has a long position in Oroco Resource Corp but has sold shares in the first half of November to exercise some warrants. Oroco is a sponsor of the website. Please read our disclaimer.

Iour reality based comments are much appreciated by this OCO shareholder. But the historical drill and assay results have good lineage, no? Awaiting new results to confirm.