Inca One Gold (IO.V) has announced it is purchasing the Koricancha toll mill in Peru (ex-Anthem United) from Equinox Gold (EQX.V), as the latter will be solely focusing on its mining projects in Brazil and California.

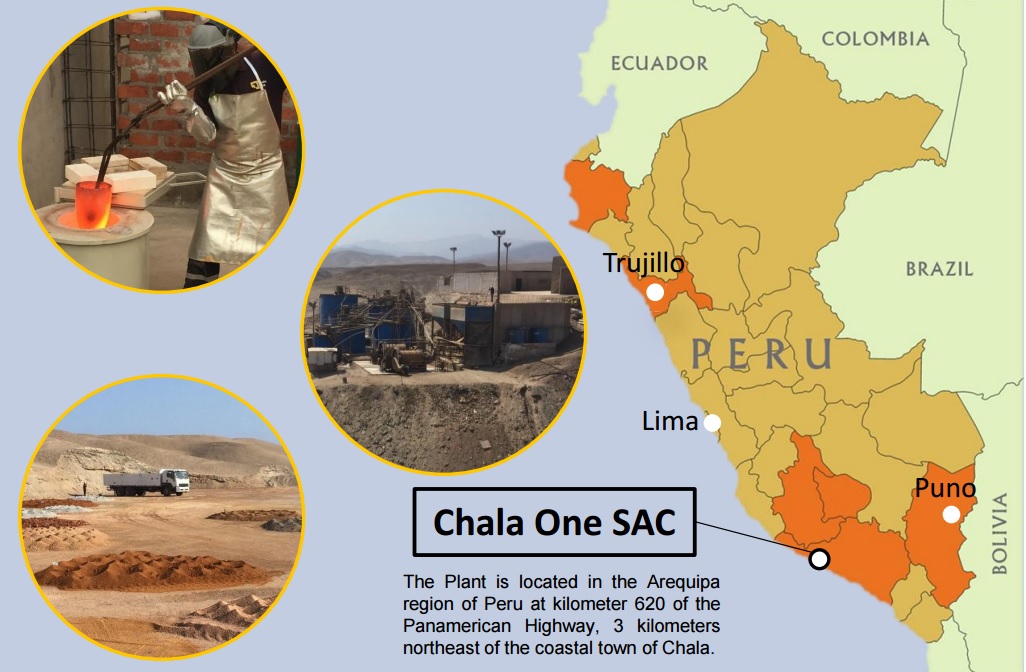

The Koricancha mill has been operating at a throughput of 150 tonnes per day, and combined with Inca One’s own throughput at the Chala One processing facility, the combined entity will immediately increase the production ate to 250 tonnes per day. This still represents just 56% of the total permitted capacity as Koricancha is fully permitted for a throughput of up to 300 tonnes per day, making it three times as large as Chala One.

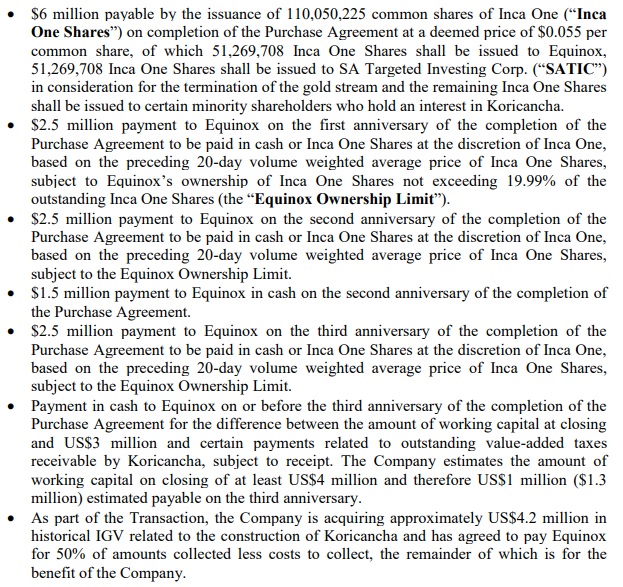

Inca One will acquire the 90.14% ownership from Equinox in a relatively straightforward deal consisting of cash and shares. The exact terms are nicely listed by Inca One Gold:

This will indeed result in some dilution, but this (initial) dilution of approximately 75% will result in a 350% increase of milling capacity (315% if you adjust the results for the 9.86% non-controlling interests at Koricancha). It’s now up to Inca One to use the existing US$5M in working capital to purchase more ore to increase the throughput at Koricancha from the current 150 tonnes per day to the full capacity of 350 tonnes per day.

We will report back on this acquisition with a more in-depth report, explaining how this dramatically improves Inca One’s position on the Peruvian toll milling market.

Go to Inca One’s website

The author holds a long position in all stocks mentioned in this article. Please read the disclaimer