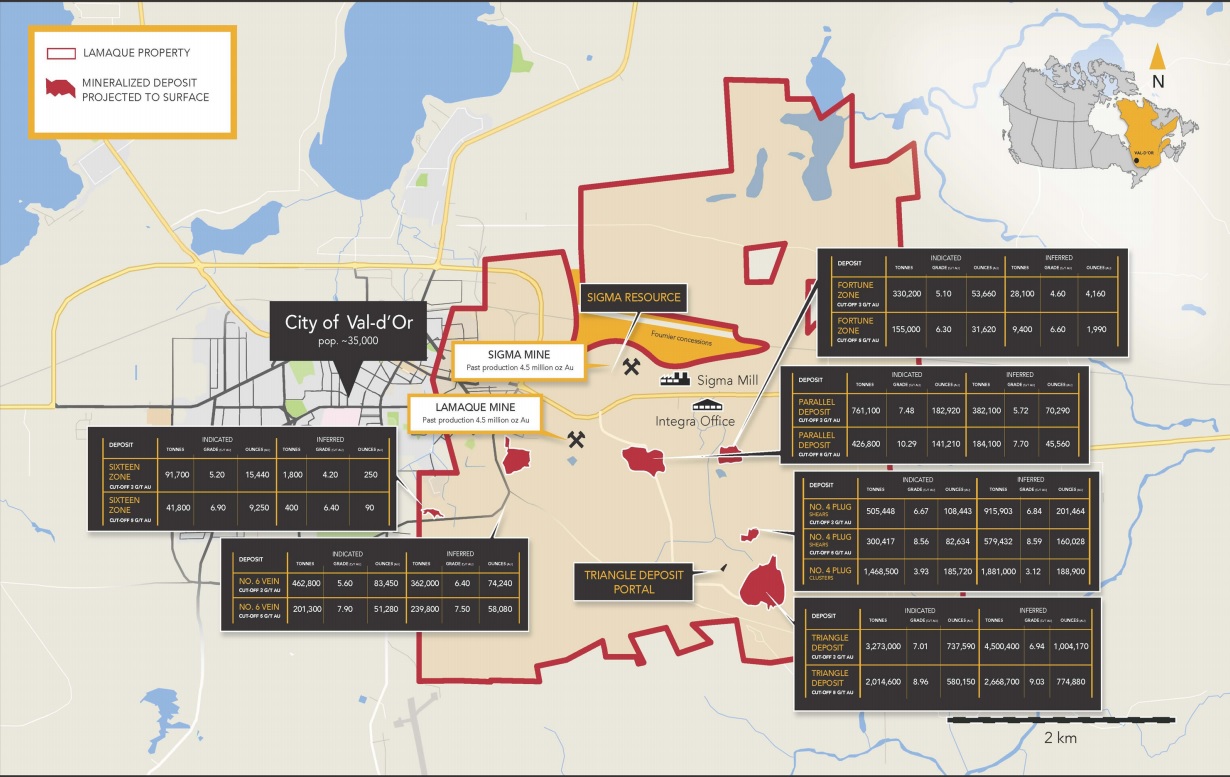

Integra Gold (ICG.V) has just released an updated resource estimate for the Lamaque project in Val D’Or, Québec. Using a cutoff grade of 5 g/t, the total resources now stand at almost 900,000 ounces in the indicated category with an additional 1.04 million ounces in the inferred category, at an average grade of in excess of 8.8 g/t.

Even if you’d use a lower cutoff grade of 3 g/t, the average grade remains pretty decent at approximately 6.8 g/t, for a total of 2.53 million ounces of which the majority is (obviously) located at the Triangle deposit, where a total of 1.75 million ounces has now been outlined (+242,000 ounces). At the No4 Plug, the total resource now contains almost 310,000 ounces. That’s indeed just marginally higher (72,500 ounces), but that’s entirely caused by Integra Gold being more cautious about how it should interpret its assay results. In the previous resource estimate in November of last year, Integra’s consultant included several holes which have now been excluded due to inaccurate downhole surveys, caused by the magnetite.

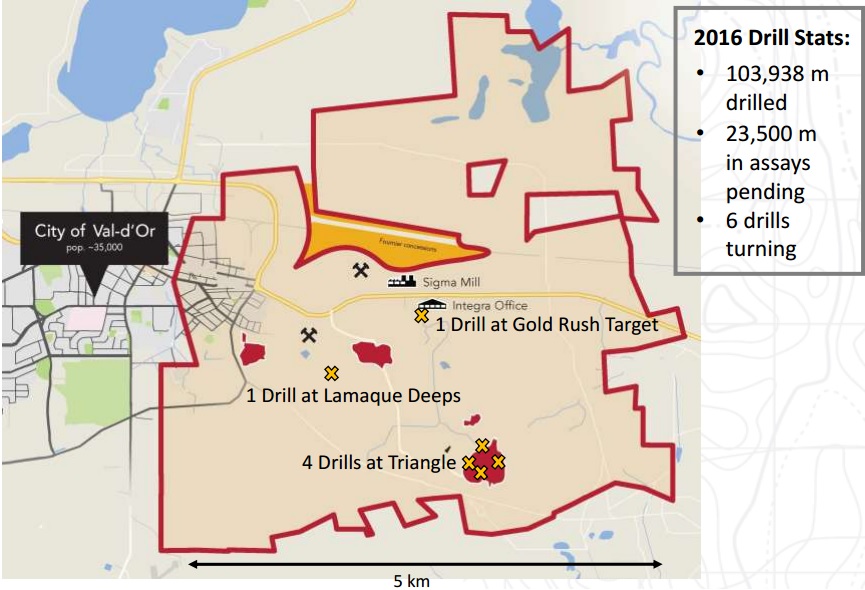

We received a few enquiries from readers who were disappointed with this resource update, but we think it’s important to realize this was just an ‘amuse-gueule’ which incorporated just over 20,000 meters of additional drilling. That really isn’t much, and Integra Gold is aiming to release another resource update in February/March of next year which will include an additional 105,000 meters of drilling (for a total of 129,000 meters of drilling on top of the previous resource estimate) and that’s really something you’ll want to look forward to (as for instance the bulk tonnage target at the No4 Plug hasn’t been included in this estimate at all).

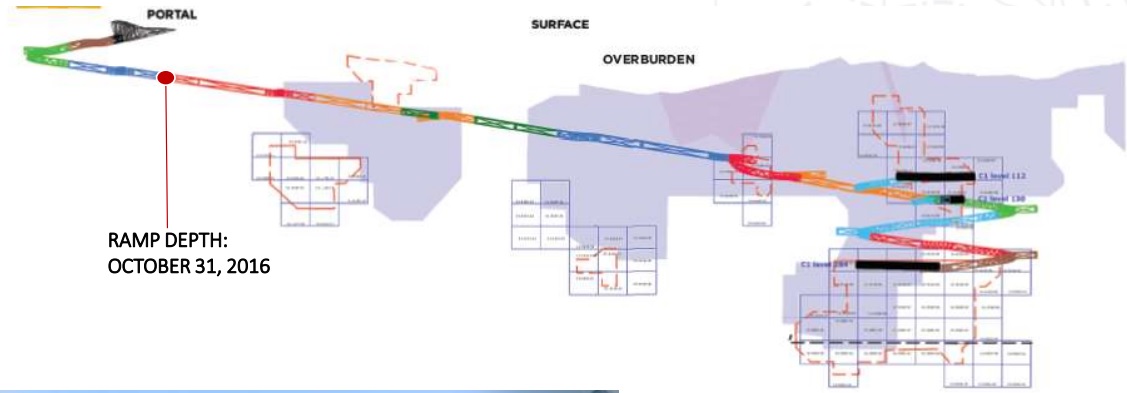

So why did Integra Gold bother to release this ‘interim’ resource update? There’s a straightforward and valid reason for doing so. Integra plans to release an updated Preliminary Economic Assessment in January 2017, and this ‘interim resource’ will be the basis for the new mine plan which will include more than three times as much gold and should have a tremendous impact on the Net Present Value of the project.

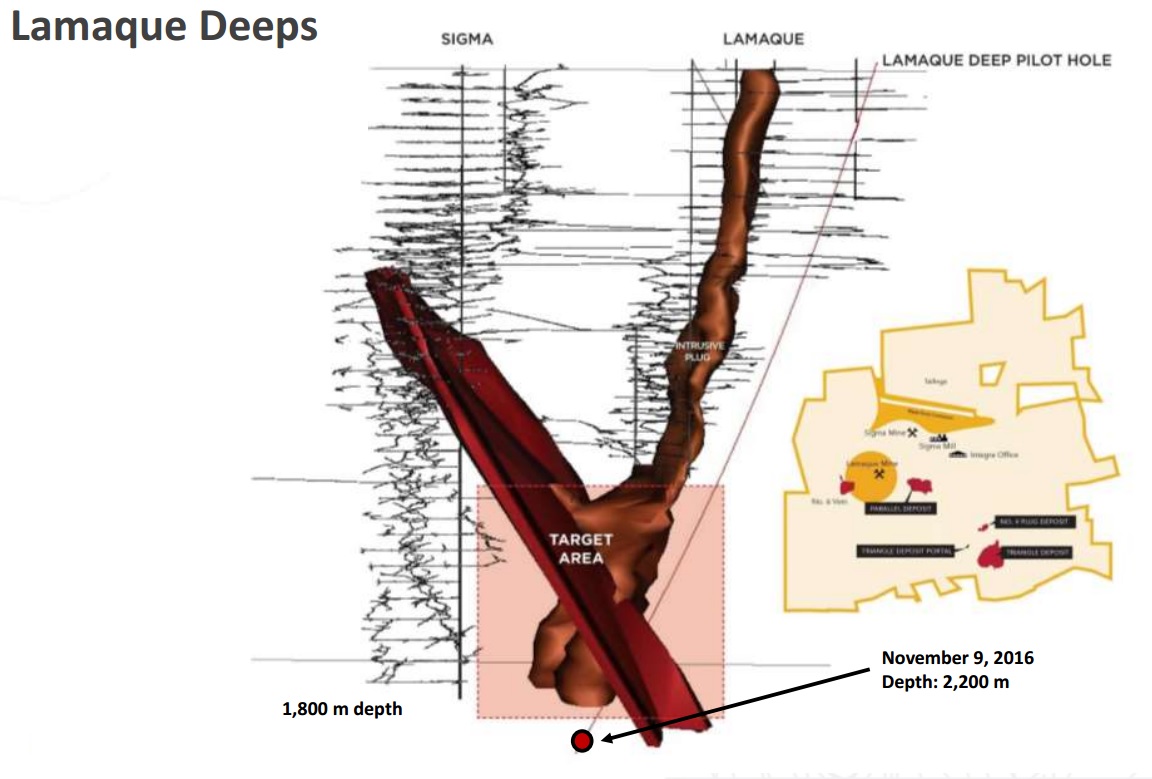

Another catalyst for Q1 2017 will be the assay results from the Lamaque Deep exploration program. The pilot hole has now reached the target depth of 2,200 meters, and a first wedge will start shortly.

Everything is still going according to plan at Integra Gold, and we’re looking forward to see the updated PEA, as well as the Lamaque Deep drill results and yet another resource update in Q1 2017.

Go to Integra’s website

The author has a long position in Integra Gold. Integra is a sponsor of the website. Please read the disclaimer

Integra Gold has had an abysmal record in releasing 43-101 technical studies, incorporating new meters drilled. With even the overdue, upcoming PEA coming out early Q1 2017, that study will be without incorporating the 105K meters from Triangle from the RE to be released late Q1 2017, a few weeks after the PEA is announced.

Integra Gold, over the last 3 years, having one of the most prolific drilling campaigns of any exploration company around, (290K new meters drilled, 2014-2016) have commissioned zero (0) PEA’s using those new meters drilled over those three (3) years.

Their last PEA, January 13, 2015 had zero (0) meters of new drilling included, and the resource estimate they used for that study was one issued September 25, 2013.

My question is why would management been delaying/withholding these critical 43-101 technical studies from the markets to view, and evaluate?

As you might recall, the original plan was to publish a PEA in May/June of this year, but this has been postponed to be able to add more drilling/resources to the mine plan. The next PEA will contain quite a bit of additional drilling, but due to the high pace of drilling, any PEA will immediately be outdated again and will be followed by another resource update 1-2 months later.

That’s the ‘curse’ of being so active on the drilling front, and it never is an easy decision to make regarding the cutoff date ‘this is IT, and this is what we will use in our mine plan’. Sure, Integra could have published new PEA’s every six months, but that wouldn’t have taught us much more and only have costed several million dollars, which we would think are better spent on drilling rather than writing reports that are outdated the moment they are being published.

We are as keen as you to see a new PEA in Q1, and we hope to see an NPV of C$400M+, but we will update our expectations after the technical report will be filed.

Thank you for your reply, and a few follow-up comments:

You wrote – “the original plan was to publish a PEA in May/June of this year, but this has been postponed to be able to add more drilling/resources to the mine plan”.

In the original planned PEA, the No.4 Plug was not to be included, this course of direction was changed to include a new geological model of No.4 Plug, hence a 5+ month delay on that study’s release.

What we learned from this delay is that their will be no mine plan for No 4 in the upcoming PEA, and a trade-off study is currently underway determining what mining scenario to undertake, that will require more drilling to take place throughout 2017, and beyond.

Your wrote – “That’s the ‘curse’ of being so active on the drilling front, and it never is an easy decision to make regarding the cutoff date ‘this is IT, and this is what we will use in our mine plan’.

Integra has an RE coming out only a few weeks after the Q! 2017 PEA, incorporating over 105,000 meters of new drilling taking from Triangle, plus a remolded Sigma resource.

If the objective of commissioning a PEA study, was one of a more comprehensive mine plan, one with increase conviction , would not incorporating these additional 105 K+ new meters drilled from Triangle, into that PEA, make that PEA one having more confidence in?

And let us not forget about shareholder’s value. With those added resources from Triangle, comes added metrics on the project. Metrics relating to Gold Production, LOM, NPV, IRR, and so forth. All critical numbers that the markets need in determining the up-to-date valuation of the Lamaque Project, and is not shareholder value management’s priority No 1?

Your wrote – “Sure, Integra could have published new PEA’s every six months but that wouldn’t have taught us much more”

Whatever excuses are made for Integra Gold’s lapse of releasing 43- 101 technical studies , there can be no excuse in having drilled 290K meters of new drilling, 2014 – 2017, and having Integra’s management team commissioned zero (0) PEA’s that incorporate those new meters drilled over that timeframe.

It is no wonder that writing these reports are grossly outdated the moment they are being published?

How outdated will those 105K new meters drilled from Triangle become before a study is commissioned by the Integra Team to incorporate them?