Integra Resources (ITR.V, ITRG) and Millennial Precious Metals (MPM.V) announced earlier this week an at-market merger whereby Integra Resources will absorb Millennial. Shareholders of Millennial Precious Metals will receive 0.23 shares of Integra per share of Millennial they own. Directors and officers of Millennial, owning about 9.2% of the shares, have already entered into voting support agreements.

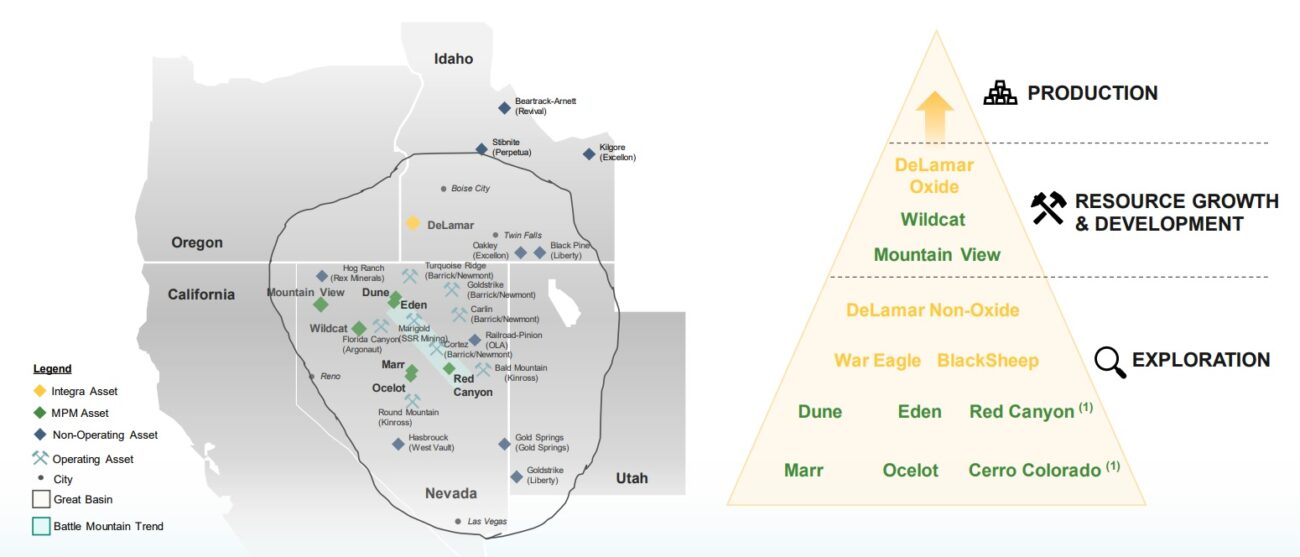

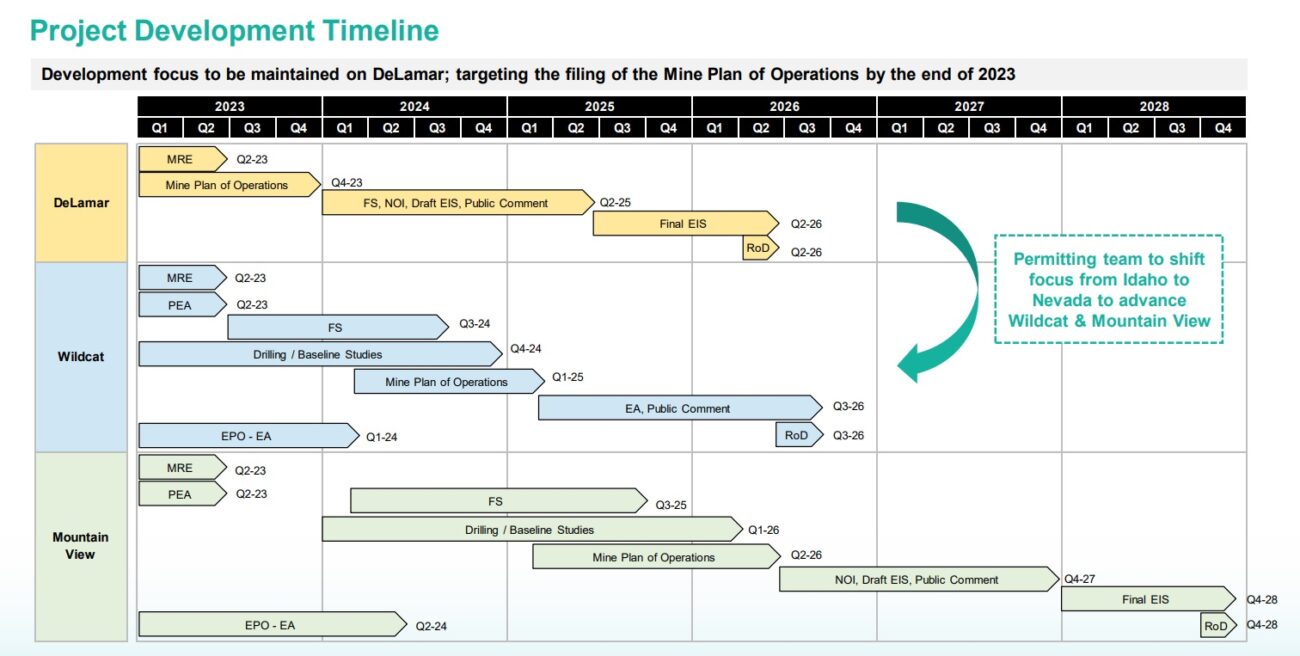

Although there are very little synergy benefits (Integra’s project is in Idaho, Millennial’s assets are in Nevada), the merger does create a large oxide-focused gold company in the Great Basin. The company will own in excess of 4 million ounces of gold and about 143 million ounces of silver across all resource categories, while it will have one project in the PFS stage (DeLamar), one project in the PEA stage (Wildcat, with a PEA expected by this summer) and one project in the resource stage (Mountain View).

Perhaps even more important than creating a large Great Basin focused exploration (and hopefully development) company is the access to tens of millions in funding. There will be a bought deal for 35 million subscription receipts priced at C$0.70 to raise C$24.5M (which could be upscaled to C$28.2M) while Wheaton Precious Metals (WPM, WPM.TO) has committed to invest the lesser of C$15M or the total amount needed to obtain a 9.9% stake in the company once the merger closes. It’s probably fair to assume about C$35-40M in gross proceeds will be raised with net proceeds of approximately C$30-35M to Integra once all the bankers and lawyers have been paid.

We will catch up with CEOs George Salamis (who will move to an Executive Chairman position) and Jason Kosec (who will take the reigns of the combined entity) to discuss the rationale and the path forward into more detail.

Disclosure: The author has a long position in both Integra Resources and Millennial Precious Metals. Integra is a sponsor of the website, Millennial isn’t. Please read our disclaimer.