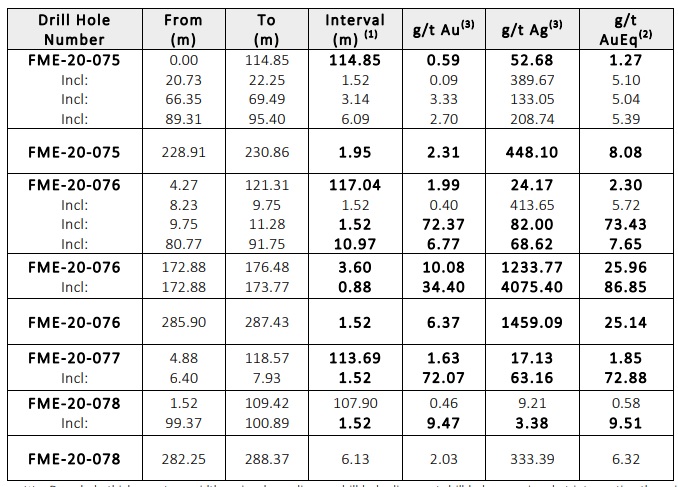

At the end of July, Integra Resources (ITR.V, ITRG) released the assay results of four holes that were targeting the high-grade gold-silver systems at Florida Mountain. All four holes encountered precious metals mineralization, and some intervals are better than others with one common theme: all mineralization appears to be economic. The lower-grade zones start close to surface while the deepest intervals (hole 76 and 78) are relatively deep but with 1.52 meters of 6.37 g/t gold and almost 1.5 kilo of silver per tonne of rock, it’s definitely worth pursuing these deeper zones as well, especially at the current precious metals prices.

These holes continue to confirm Integra’s exploration theory; the large bulk tonnage but lower grade zones appear to be underlain by the higher grade narrower vein zones and now it will be up to Integra’s technical team to continue to map these higher grade veins and investigate the economic potential (determined by grade and width). Drilling is ongoing at Florida Mountain and the drill bit will be focusing on adding more extensions at depth of other plunging shoots that are known to be underlying other areas of bulk-tonnage mineralization.

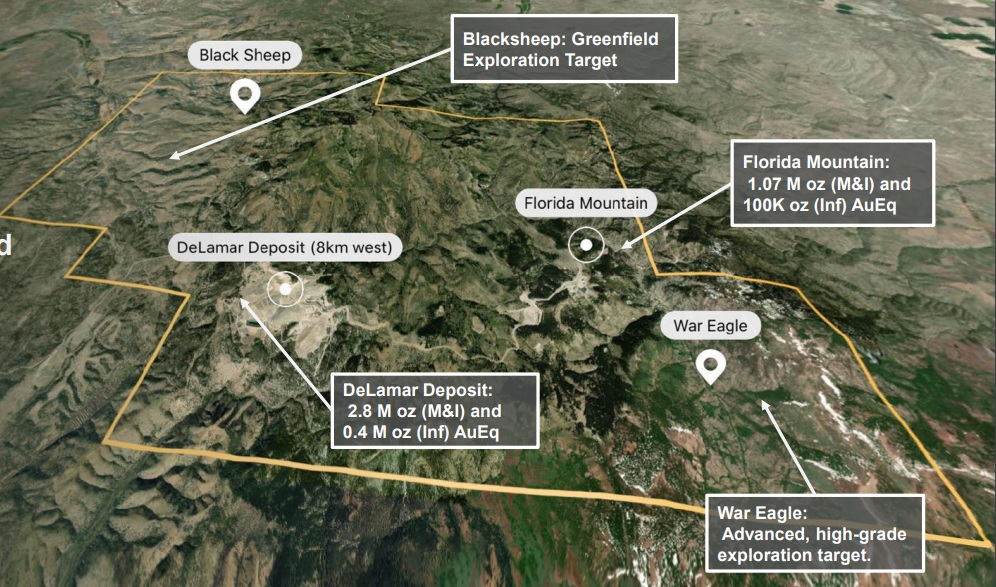

A third rig has now arrived on the scene which will be taking care of the planned 5,000 meter drill program at War Eagle where Integra plans on tackling the high-grade feeder veins where mining took place back in the day. Once the War Eagle program will be completed, the rig will be moved to the Blacksheep area at DeLamar where it will complete a 3,000 meter drill program in an attempt to add more ounces to the DeLamar and global resource.

Meanwhile, Integra is taking serious steps towards establishing a serious presence in the USA with its full listing on the NYSEMKT (the junior exchange of the NYSE, formerly known as the AMEX) while it also signed a MOU with the Bureau of Land Management to streamline future permitting processes.

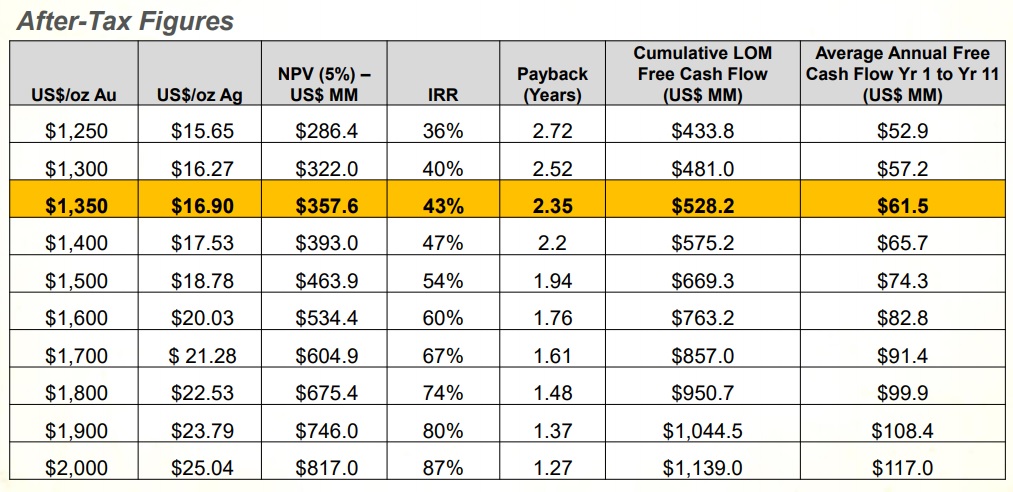

We haven’t seen a lot of M&A in the precious metals space yet (apart from Chinese companies acquiring companies with assets in Tier-2 and Tier-3 jurisdictions (Continental Gold, Cardinal Resources, Guyana Goldfields) or with serious issues (TMAC Resources), but Integra seems to be positioning itself well as a prime takeover target. The 6 million ounces gold-equivalent should be achievable after the current drill program.

Integra recently filed a short form prospectus which will allow it to immediately act on a bought deal potential when the opportunity arises. Not that there’s any urgent need to raise money; as of the end of June, the company had a positive working capital position of around C$21M.

Disclosure: The author has a long position in Integra Resources. Integra is a sponsor of the website.

Sounds pretty nifty!