While the company’s focus has now shifted to developing the DeLamar project as a heap leach project, Integra Resources (ITR.V, ITRG) obviously still has the high grade portions of Florida Mountain and War Eagle in its portfolio. As the mill scenario doesn’t add a whole lot of value due to the limited amount of recoverable ounces in the mine plan, adding more ounces to the mine plan could drastically improve the economics of DeLamar.

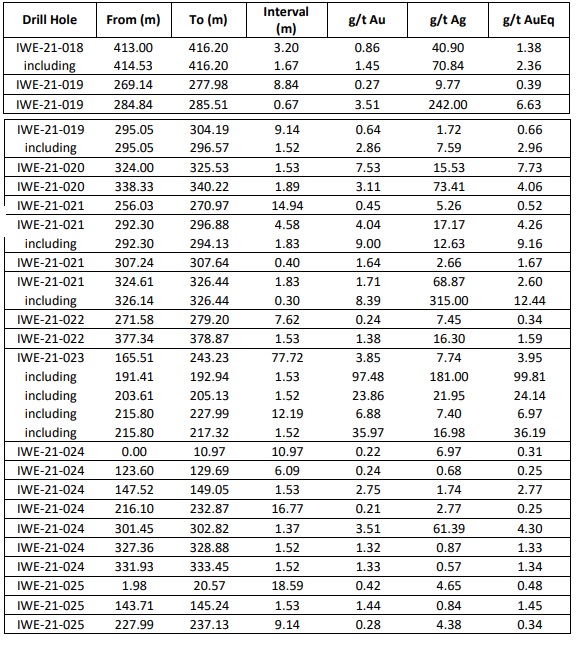

Integra Resources recently announced the assay results from eight holes drilled at War Eagle as part of its 2021 exploration program. The company proudly singles out hole 23 as headline result and deservedly so as the drill bit encountered almost 78 meters containing just under 4 g/t gold-equivalent (3.85 g/t gold and just under 8 g/t silver) including several narrower intervals of high-grade to very high-grade gold with for instance 12.19 meters of almost 7 g/t AuEq (including 1.52 meters of 36.1 g/t AuEq) while the other noticeable intervals in that hole were 1.52 meters of 99.1 g/t AuEq and 24.14 g/t AuEq over the same distance just ten meters deeper.

These holes were following up on previously defined mineralization and the eight holes were aiming to expand the mineralized envelope at depth.

While the focus remains on the heap leach scenario, we haven’t written off the mill scenario yet. It all comes down to adding ounces to the mine plan to justify the capital expenditures related to building a mill. As mentioned in a previous report, there are two keys to unlock value in the mill scenario: adding more ounces and increasing the recovery rate where possible.

Disclosure: The author has a long position in Integra Resources. Integra is a sponsor of the website. Please read our disclaimer.