It took the company a bit longer than we expected, but Jericho Oil (JCO.V) has now finally released an updated reserve report on its American activities.

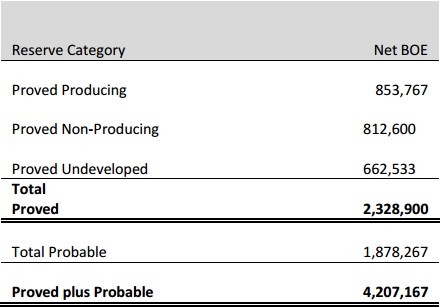

To make our life easier, Jericho has reported all results based on its effective interest in the properties, which provides us with a very clean overview. The total proved reserves contain approximately 2.33 million barrels of oil (of which 854,000 barrels are proved and producing), and the total 2P reserves contain 4.21 million barrels of oil. This means that per 19 outstanding shares of Jericho Oil, you are basically buying one barrel of oil in the ground.

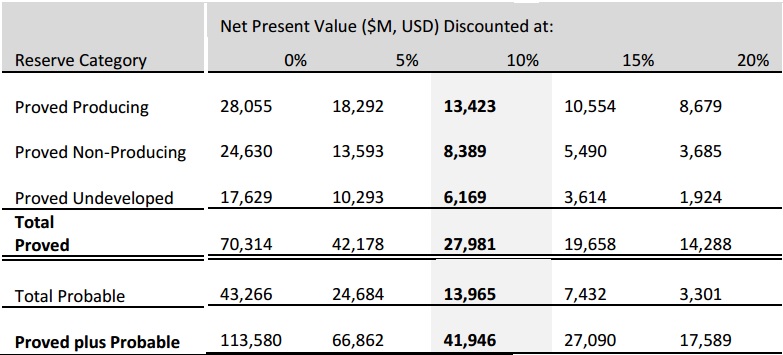

Jericho has also released its PV10 values and whilst we are waiting for additional filings to see the oil price that has been used in these calculations, we are already pretty optimistic. The 1P reserve value comes in at US$28M, and throwing in the US$14M in probable reserves, the total PV10 value is approximately US$42M which corresponds to US$0.53 per share (CHECK SHARE COUNT). After deduting the net debt, the fair value per share of Jericho Oil is approximately US$0.51-0.52, which is C$0.69 using an USD/CAD exchange rate of 1.35.

The reserve report and PV10 values are better than we expected (but we will look into the used oil price), and you should keep in mind the total amount of barrels and the PV value will only increase when Jericho acquires the additional 25% in the Postrock asset.

Go to Jericho’s website

The author has a long position in Jericho Oil. Jericho is a sponsor of the website. Please read the disclaimer