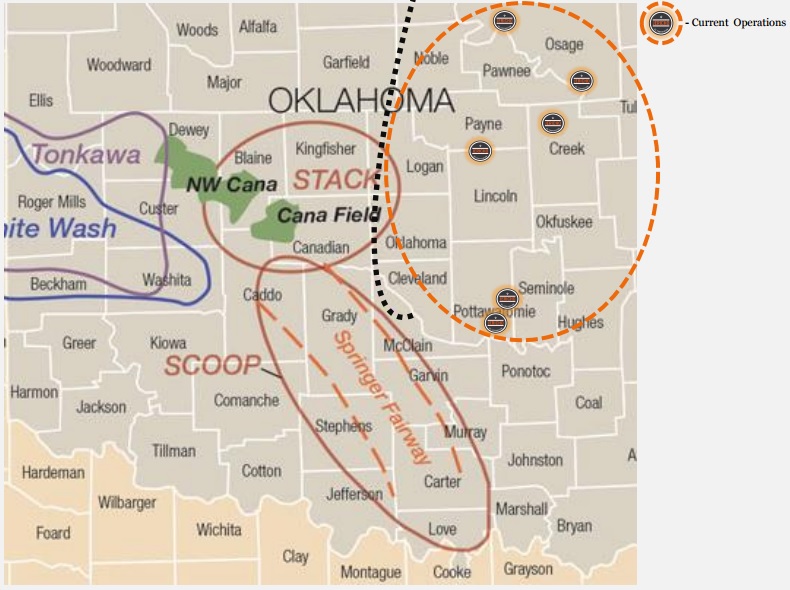

Jericho Oil (JCO.V) has now released the updated reserve report for its properties in Kansas and Oklahoma. We were really looking forward to this update as this was the real ‘test’ to find out how accretive the most recent acquisitions were.

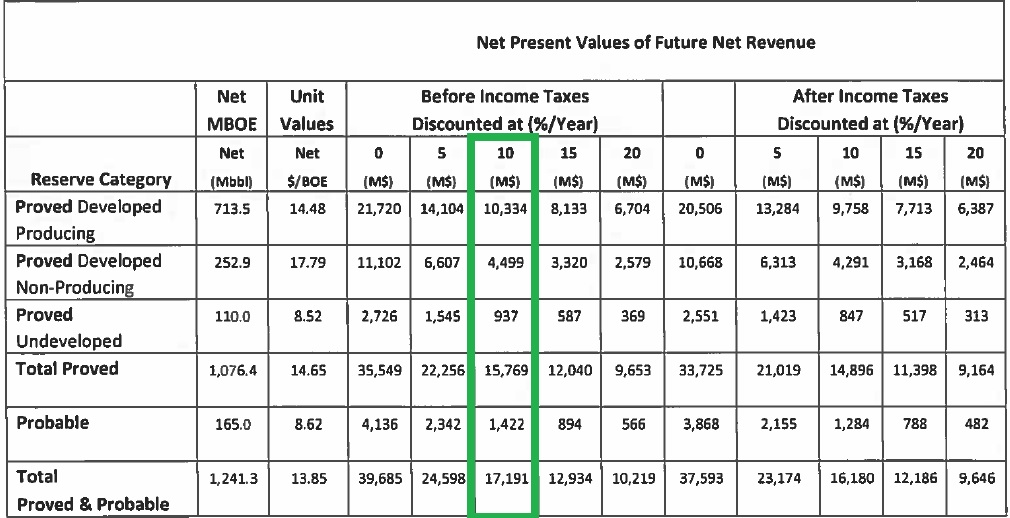

And we weren’t disappointed, as Jericho’s total amount of oil in the proved developed categories increased to almost 1 million barrels, whilst the PV10-value increased to US$14.8M, an increase of 277% compared to the PV10 value one year ago (which was calculated using a higher average oil price).

The total PV10M for all proved and probable reserves was approximately US$17.2M which is approximately C$0.34 per share. Keep in mind this does NOT include the acquisition of the remaining 25% of the most-recent deal. Jericho is currently pursuing several possibilities to fund the exercise of the option and we expect to see the company closing the deal (and owning 50% of the Central Oklahoma asset) by this summer.

We are currently working on a more detailed update report on these reserves (which will also contain a closer look at the financial statements that have been filed last week), and we expect to release this report shortly.

Go to Jericho’s website

The author holds a long position in Jericho Oil. Jericho Oil is a sponsor of the website. Please read the disclaimer