K92 Mining (KNT.V) has just closed an upsized private placement raising C$12.5M in units priced at C$1 (with each unit consisting of one common share and half a warrant with each full warrant allowing the warrant holder to acquire another share at C$1.50 within the next 12 months), but it immediately announced another C$2M placement with just one strategic party.

This new placement has been priced at C$1.17 per unit and consists of one share and one full warrant with an exercise price of C$1.75. This means K92 is raising almost C$15M and the strong institutional demand should be considered a ‘thumbs up’ for K92’s development plans.

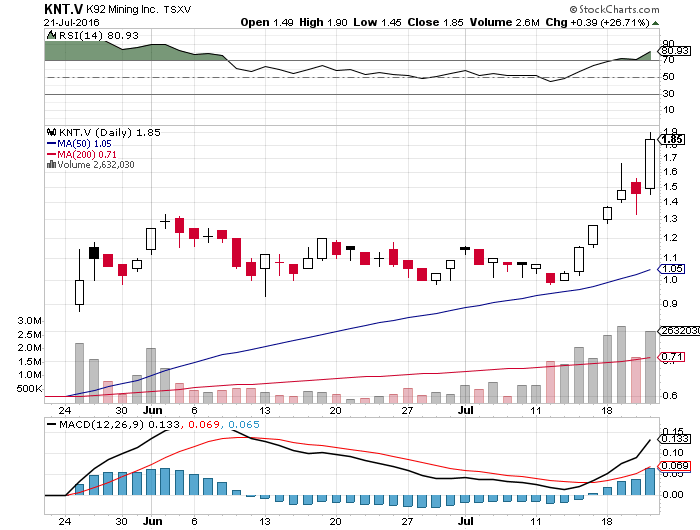

Meanwhile, the company’s share price is on fire as the market is now really giving K92 the credit it deserves for bringing the Kainantu mine back into production. On May 25th, the day we published our first report on K92 Mining, the company’s share price was C$0.90 at the opening bell, which means that since yesterday, practically anyone who has bought stock on the first trading day is zeroing in on a 100% return.

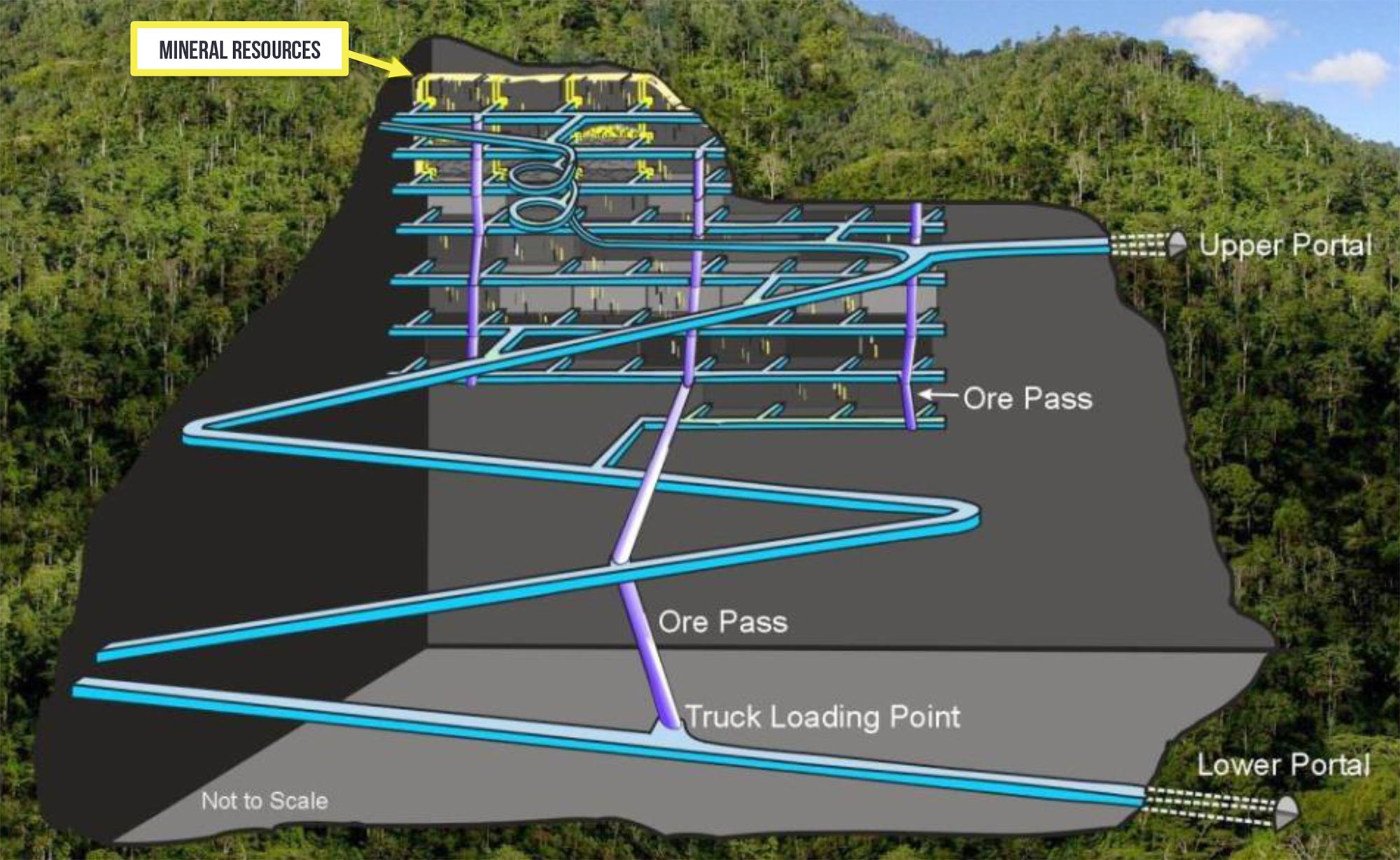

And there might be more to come! In a recent interview with BNN, President Slusarchuk confirmed the company remains on track to produce its first gold later this quarter, which will be a huge catalyst for the investing community.

Go to K92’s website

The author has a long position in K92 Mining. K92 Mining is a sponsor of the website. Please read the disclaimer

Pingback: K92 Mining revives an old Barrick asset – South Pacific Metals