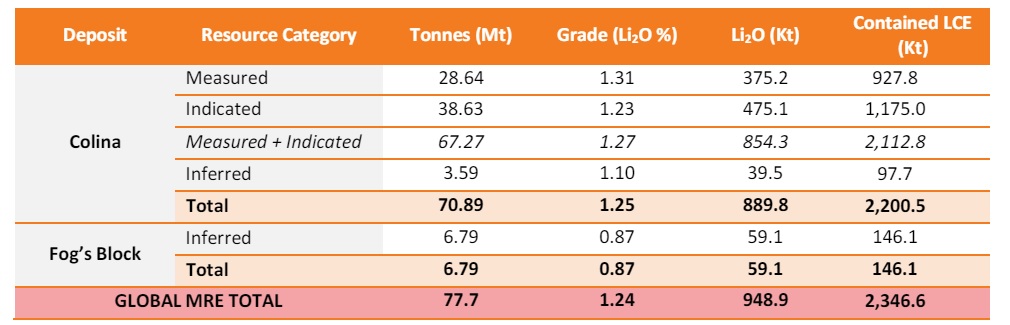

Latin Resources (LRS.AX) has released an updated resource calculation for its flagship Colina lithium project in Brazil. The updated resource now contains 77.7 million tonnes of rock at an average grade of 1.24% Li2O with an additional exploration target of 7-18 million tonnes in the Fog’s Block which should easily push the total resources over 80 million tonnes.

95% of the total tonnage at the Colina zone is currently in the measured and indicated resource categories and this has the potential to improve the economics of the deposit (using a more realistic spodumene price). The company highlighted the A$3.6B after-tax NPV8% in the PEA but that PEA was using a base case scenario with a spodumene price of US$1699 per tonne which is obviously not very realistic in the current price environment. While we also don’t expect lithium companies using spot prices, the base case price may come down a bit in the next study although a $1700 spodumene price could be an acceptable long-term price. It will be interesting to see the price used by the company as that would set the tone for other spodumene hopefuls.

Disclosure: The author has no position in Latin Resources. Please read the disclaimer.