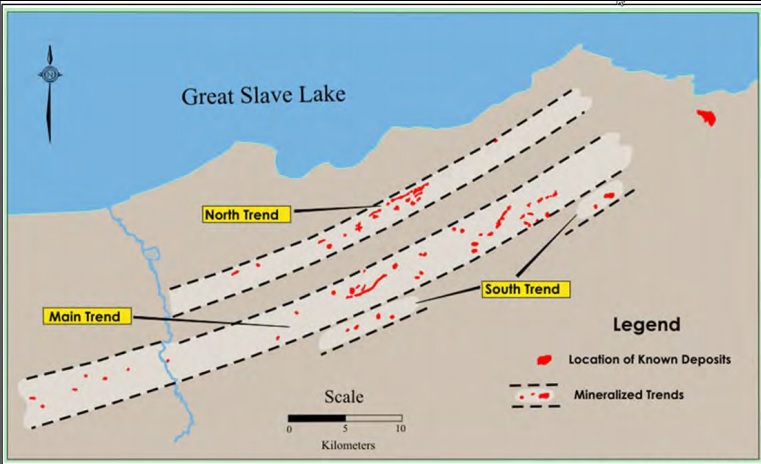

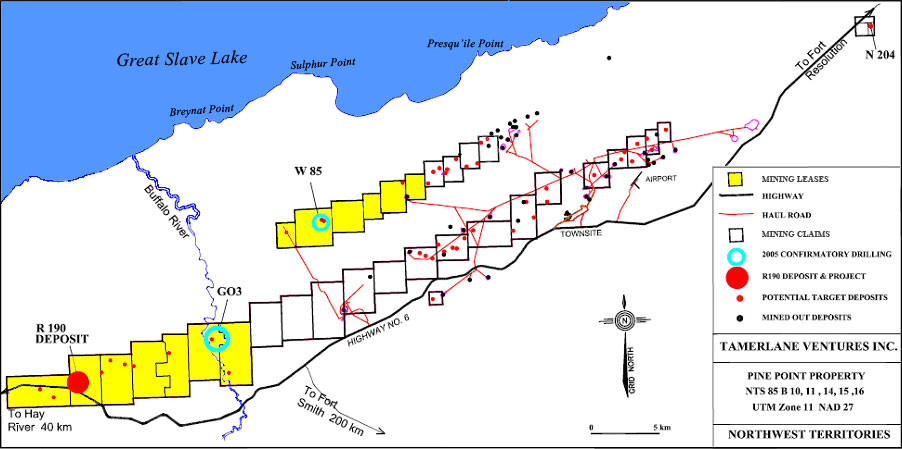

Darnley Bay Resources (DBL.V), which aims to develop the Pine Point zinc project in Canada’s Northwestern Territories, has closed a first tranche of its private placement. The company issued 25 million shares at C$0.20 to raise C$5M, and an additional 10.6 million flow-through shares at a price of C$0.25 per flow-through share to raise a total of C$7.65M. What’s interesting is the fact Zebra Holdings (a Lundin trust) and Rob McEwen/Evanachan have subscribed for 70% of the C$5M in hard dollars, and this could be seen as a vote of confidence from these resource sector titans.

CEO Jamie Levy participated for 450,000 units (C$90,000) and now controls 4.4 million shares whilst Kerry Knoll, a director, added 225,000 units to his position for a total of 3.45 million shares.

By closing this first tranche, Darnley Bay was able to complete the purchase agreement to acquire 100% of the Pine Point zinc project in NWT. Darnley Bay had to pay C$3M upon closing and issue 26.25 million shares of the company to the receiver who owned the assets. The Pine Point project has been around for quite a while, so it will be really interesting to see Darnley Bay’s plans for 2017.

Go to Darnley Bay’s website

The author currently has no position in Darnley Bay but expects to initiate a long position soon. Please read the disclaimer