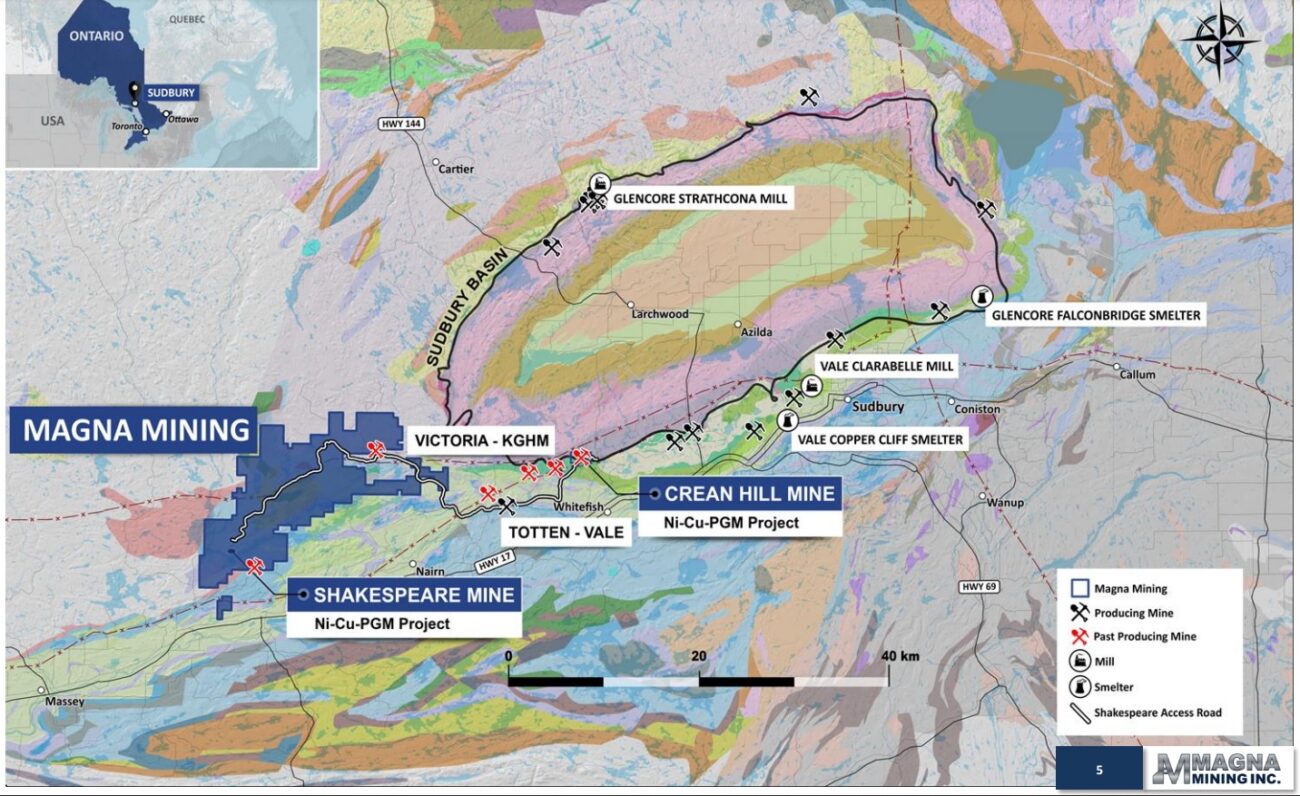

Magna Mining (NICU.V) released the outcome of an updated Preliminary Economic Assessment on its Crean Hill nickel project in Canada’s Ontario province. The updated mine plan calls for an initial capex of just C$28M which should result in a 13 year mine life at almost 2,200 tonnes per day with an average nickel grade of around 0.83% in combination with 0.72% copper and around 2.2 g/t Pt-Pd-Au.

Using a base case nickel price of $8.50 per pound and a copper price of $4 per pound, the after-tax NPV8% is estimated at C$194M while the after-tax Internal Rate of Return comes in at 129%, mainly due to the exceptionally low initial capital expenditures. The sustaining capex is estimated at C$213M which sounds pretty high but still represents just over C$1 per pound of nickel that will be produced.

The initial capex can be kept low as the material will be processed at a third party facility.

Magna has been pretty active lately as the company also announced an agreement with KGHM and is currently taking advantage of its strong share price to raise C$15M at C$1.05 per share (no warrants will be issued in this financing).

Disclosure: The author has no position in Magna Mining. Please read the disclaimer.