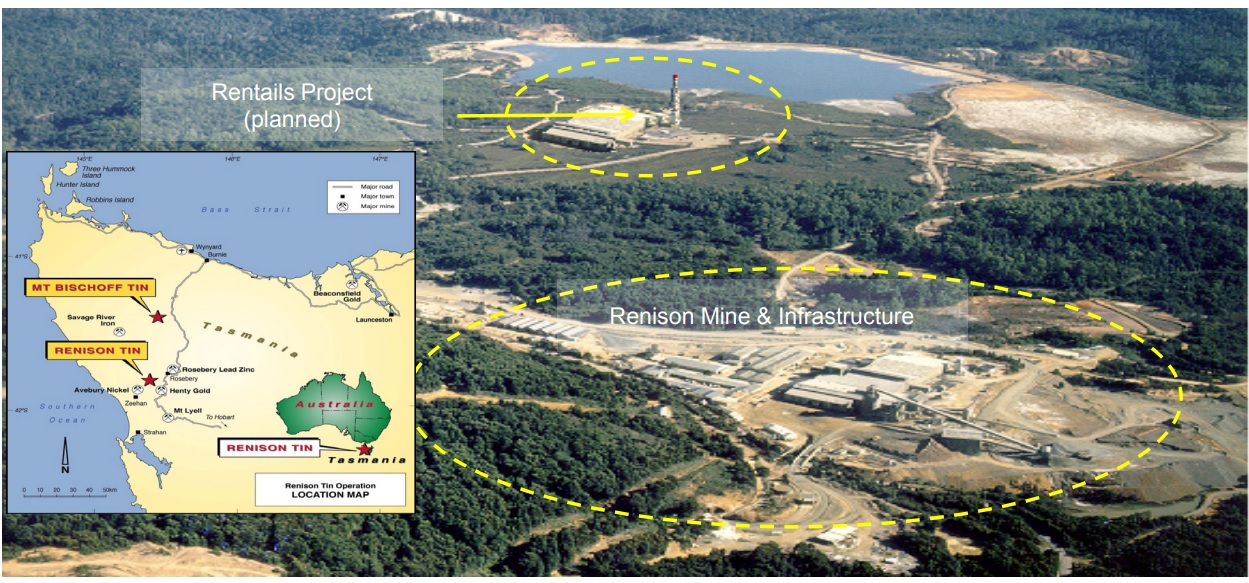

Metals X (MLX.AX) will recommence the activities at the Renison tin operation where it is looking into the possibility to reprocess the tailings of the tin mine which is part of a 50/50 joint venture between Metals X and BMT.

Those tailings currently consist of almost 24 million tonnes with an average grade of 0.44% tin and 0.22% copper and based on the current spot price of respectively $36,000/tonne and $9,800/tonne, the gross rock value of the tailings resource is approximately US$180/t.

The 2022 DFS, slated for completion in 2023, will actually be the third economic study on the Rentails project as there already is a 2009 DFS and a 2017 DFS update. That 2017 update already confirmed the economics as it outlined a mining scenario requiring an upfront capex of A$205M but would generate a pre-tax IRR of 37% and a pre-tax NPV8% of A$260M. That study used a tin price of just $20,000/t and a copper price of $5,000/t so it will be interesting to see the outcome of the updated feasibility study.

Disclosure: The author has no position in Metals X. Please read our disclaimer.