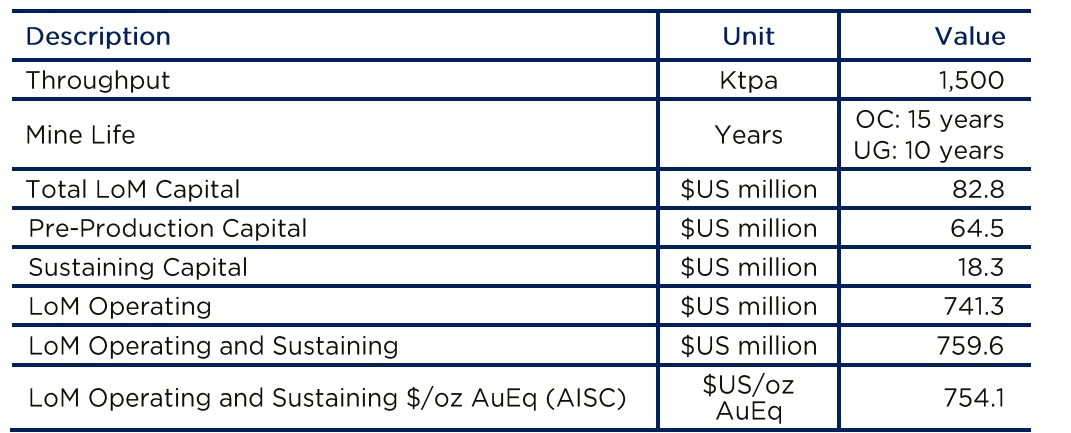

Metalstech (MTC.AX) has published the results of a scoping study on its flagship Sturec project. The mine plant currently on the table calls for a combined open pit and underground mine plan with an anticipated initial capex of just under US$65M and a sustaining capex of US$18.3M over a 15 year mine life. The 4,000 tpd plant has a cost estimate of just US$44M based on a quote from Yantai Jinpeng, a Chinese manufacturer. That’s low as for instance a pre-feasibility study released by Integra Resources (ITR.V, ITRG) in Q1 of this year included a US$132M capex for a 6,000 tpd mill. While a China-built mill will always be cheaper, the difference is remarkable as the Chinese mill is essentially half the price (on a relative throughput basis) of the Integra mill. An interesting cost saving.

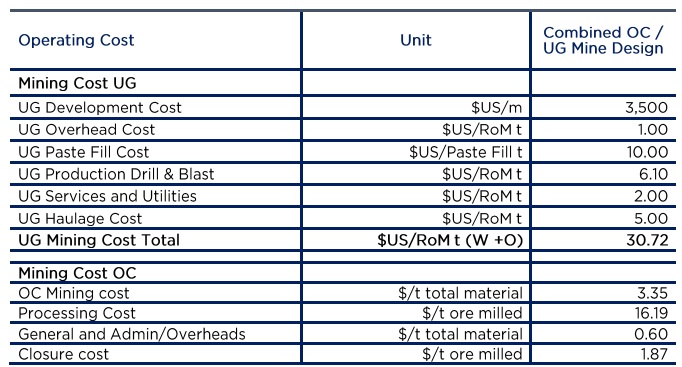

While we had anticipated the study to be good, the initial scoping study exceeded our expectations so we dug into the details to make sure the study isn’t ‘too good to be true’. As you can see below, the underground operating cost is estimated at just $13.1/t excluding backfilling costs. The development cost per meter is estimated at US$3,500.

With an average development of 3,000 meters per year, the development cost per year will be just around US$10M (rounded) or $12.5/t considering the combined production plan calls for about 700,000 tonnes per year to be processed from underground mining activities. The development cost appears reasonable. The total underground operating cost per tonne of less than $27/t (excluding backfilling) appears to be very low, despite the anticipated low mining dilution given the consistency of the mineralization.

To be fair to Metalstech, the report does contain a warning that the input costs are based on the operating costs from experienced underground miners in Australia (no details were provided) and subsequently adjusted for Slovakia salaries. As there’s virtually no (decent-sized) underground mining in Slovakia that we know of (leave a comment if you are aware of underground mines with a production rate exceeding 2,000 tpd in Slovakia), we doubt that there is plenty of experienced staff available that could achieve same efficiency as Australian colleagues willing to work for a Slovakian salary. So the warning provided by Metalstech is something to seriously keep in the back of our heads.

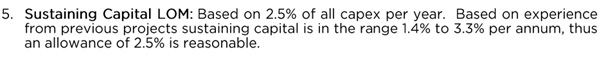

The sustaining capex of US$1.5M per year outlined in the scoping study also seems to be pretty arbitrary. Sure, Metalstech will use contract mining which reduces the need for high capex items and the UG development costs are expensed rather than capitalized, but still. This number will likely be a bit higher than the $1.5M in real life.

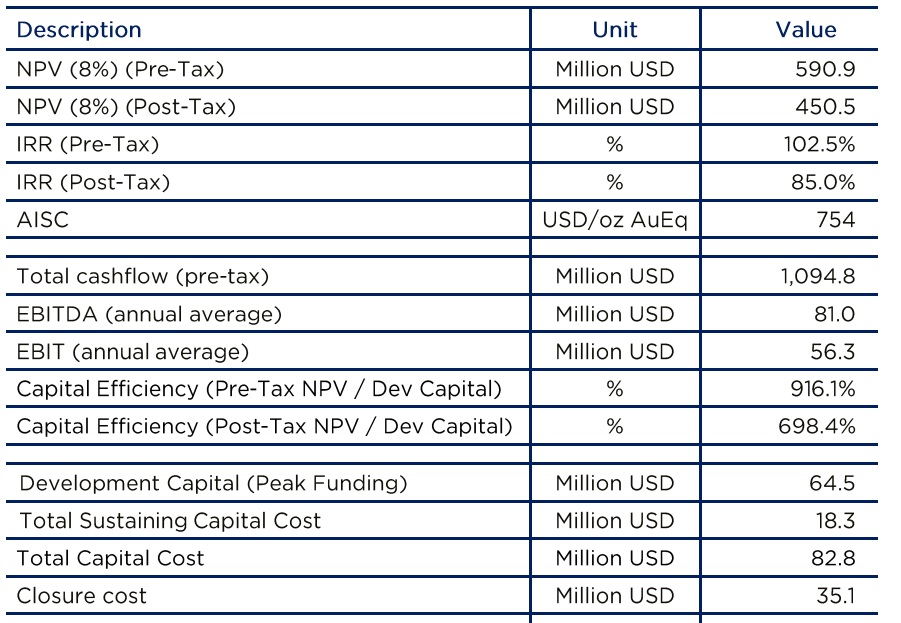

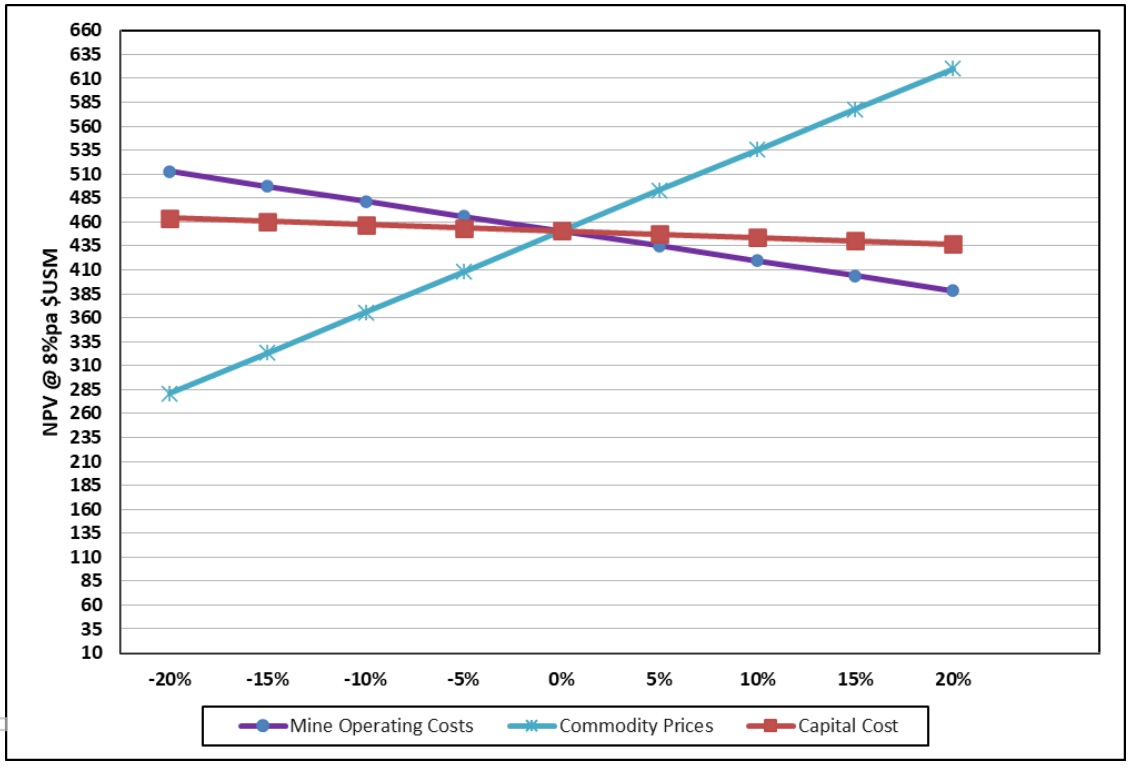

If Metalstech can indeed confirm what the scoping study shows, that would be a world class act. However, keep in mind the after-tax NPV8% of US$450M is based on a gold price of in excess of $2,000/oz while the silver price used for the base case scenario is approximately US$29.5/oz. While precious metals bulls will likely think these numbers are very achievable, it highlights another important difference between North American and Australian studies. Applying a 20% discount to the metals prices (which would work out to be $1620/oz for gold and $23.5 per ounce of silver), the after-tax NPV8% drops to approximately US$280M.

In a scenario with a combined 20% increase in the operating costs (which is not unrealistic at all as a scoping study usually is the most optimistic study as a pre-feasibility study and feasibility study will have to adhere to more strict input requirements) and a 20% decrease in the commodity prices, the after-tax NPV8% will come in at approximately US$200M.

And to once again be fair to Metalstech, most of its North American peers use a discount rate of 5% rather than the more conservative 8% applied by Metalstech so the NPV5% of Sturec would for sure come in higher, even in our more conservative scenario. But perhaps using an 8% discount rate at this stage is just about correct given the plans to develop an open pit at Sturec. There has been local opposition against open pit mining in and around Kremnica (despite, or perhaps because of the historical mining activities in the area) and Metalstech will need to engage with the communities to change the perception of open pit mining. In our initial report last year, we were under the assumption Metalstech wasn’t really considering an open pit exactly because of the local opposition. As the scoping study is now clearly incorporating an open pit again, the permitting risk has increased.

Although the scoping study appears to be overly optimized there are some positive elements that may mitigate the impact of the optimistic capex and opex. First of all, we know the ore at Sturec is ‘nuggety’ as the drill bit has intersected some ultra high-grade results. We checked the data from the 2021 resource estimate but unfortunately no mention was made of ‘capping’ the grade. We would assume that the JORC code has strict rules on capping grades. This means that the likelihood of positive surprises in the processing phase is real as the ultra high-grade intervals should be heavily discounted in a resource estimate. This could potentially lead to more contained and produced ounces per tonne of rock than anticipated in the study and this could mitigate the impact of a higher operating cost per tonne than what has been assumed in the scoping study.

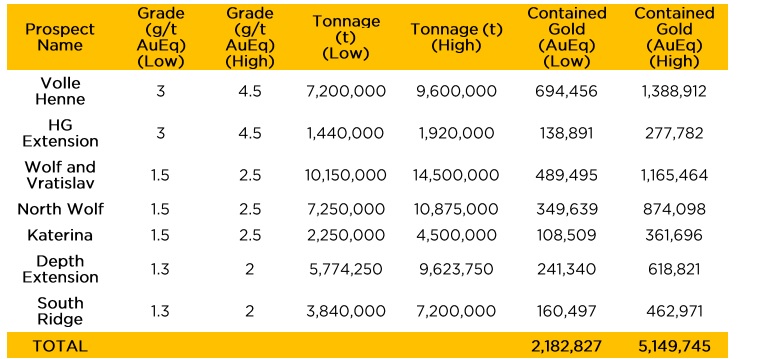

Secondly, the scoping study is based on the ‘current’ resource estimate. As Metalstech points out in its study, there is an existing exploration targer of 38-58 million tonnes of rock at an average grade of 1.79-2.75 g/t gold-equivalent for a total of 2.18-5.15 million ounces in additional gold-equivalent. There is no certainty this exploration target will make it into a resource or mine plan but once the infrastructure is built, it is a sunk cost and extending the mine life by a few years will have an impact on the NPV. Drilling is ongoing and assay results can be expected soon.

Metalstech was trading at A$0.255 when our initial report was published in June 9, 2021. The current share price of A$0.38 and the pro-forma value of the Winsome Resources (WR1.AX) spinout (Metalstech shareholders received 1 share of Winsome for every 3.86 shares of Metalstech owned) of A$0.05 result in a total return of almost 69% (using the current share price of Winsome of A$0.19). A very strong result in this market, handsomely beating the total market returns of almost all North American exploration companies.

We will continue to keep an eye on Metalstech as the underground exploration program continues to yield good drill results.

Disclosure: The author has no position in Metalstech and no intention to go long. Metalstech was a sponsor of the website in the preceding twelve months, but currently is not a sponsor of the website. Please read our disclaimer.