Minera Alamos (MAI.V) has released the long-awaited results of a preliminary Economic Assessment on the La Fortuna project in Mexico’s Durango state. It took Minera a while to complete this study as the main focus in the first months of this year was on completing the merger with Corex Gold (CGE.V) to create a dominant gold development company with a focus on Mexican projects.

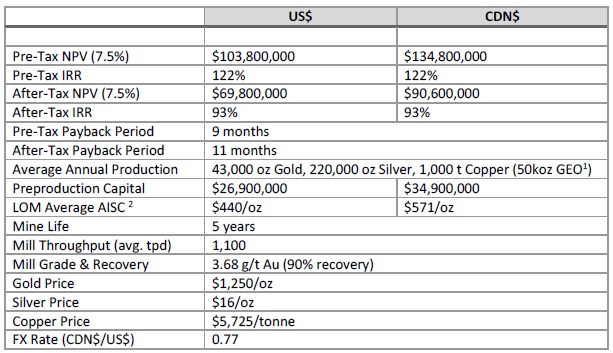

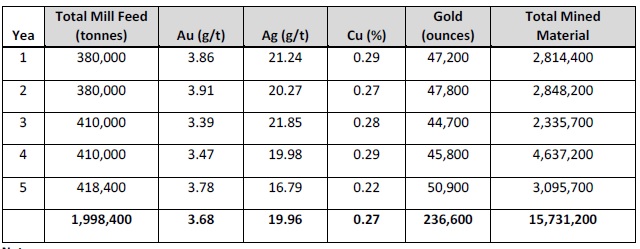

The La Fortuna pea is based on a 5 year mine life (using a starter pit, indicating the throughput could increase or the mine life could be extended when additional resources are being incorporated in the mine plan) wherein approximately 2 million tonnes of rock will be processed at a daily throughput rate of 1,100 tonnes per day. Considering the average grade of the rock is approximately 3.68 g/t gold, in excess of half an ounce of silver and 0.27% copper, this high-grade gold project also generates above-average margins. With an AISC of US$440/oz, La Fortuna would generate margins of $700/oz even at $1150 gold, and the initial US$27M capex would be repaid in no time considering the average production rate will be 43,000 ounces of gold (whereby the silver and copper sales will provide a small by-product credit).

All this results in La Fortuna boasting a 93% Internal Rate of Return (on an after-tax basis) and an after-tax NPV7.5% of US$70M, or C$91M using a CAD/USD exchange rate of 0.77. A good start, considering this represents a value of approximately C$0.30 per share of Minera Alamos, and given the company is backed by Osisko Gold Royalties (OR, OR.TO), we have very little doubt the majority of the equity portion to fund the initial US$27M will be provided by a royalty sale. Will this weigh on the NPV and the net operating margins? Sure. But there’s considerable room for improvement to mitigate the impact of a royalty sale. One example would be the average recovery rate. The PEA uses a recovery rate of 90%, but should Minera Alamos be able to increase this to 92%, it would already reduce the impact of a royalty sale by almost 50%.

Also keep in mind the mill has a nameplate capacity of 2,000 tonnes per day so the anticipated throughput of 1,100 tpd results in 900 tonnes per day of ‘spare capacity’ which could be filled with additional ore should Minera Alamos discover more mineable resources within trucking distance from the La Fortuna mill.

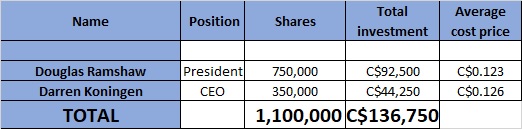

So in a base case scenario, based on this PEA, Minera Alamos is worth approximately C$0.30/share, and you get all the other projects and the exploration upside thrown in for free. There’s a reason why the Minera management has been buying boatloads of stock lately:

The President and CEO have spent a combined C$136,750 on buying more stock (and spent even more in the first half of the year). And given there very likely was a black-out period before the PEA was released, we wouldn’t be surprised to see more insider buys.

Go to Minera Alamos’ website

The author has a long position in Minera Alamos. Please read the disclaimer