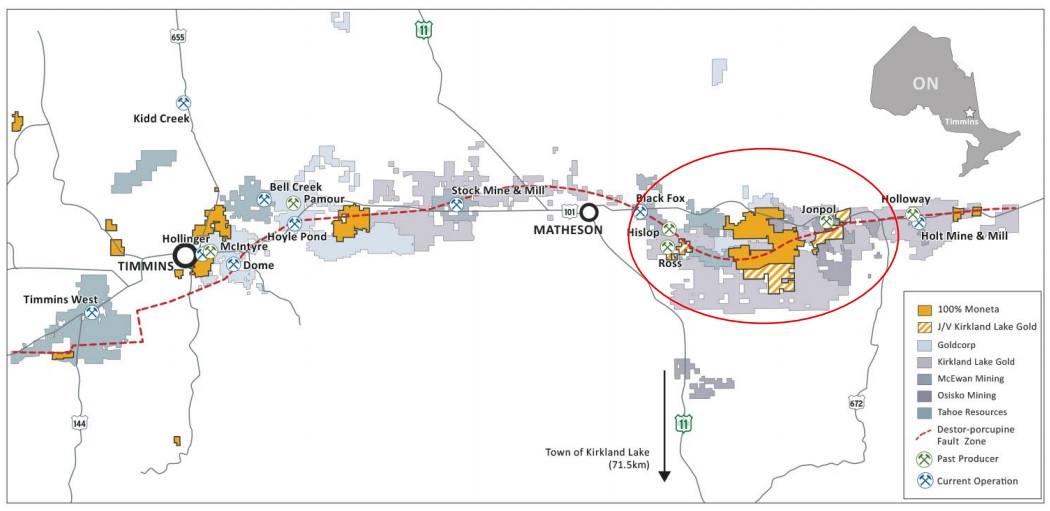

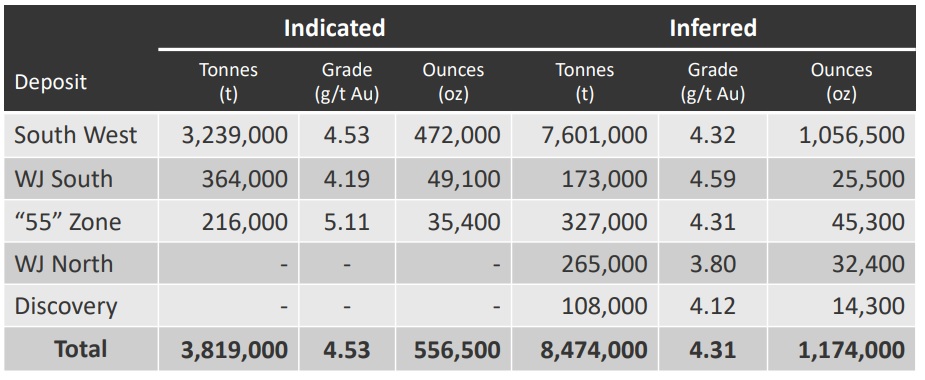

Moneta Porcupine (ME.TO) has closed its C$6.3M placement that was announced earlier in July. The company raised a total of C$6.3M in cash by issuing C$2.1M worth of common shares (15.04M shares issued at C$0.14) and C$4.2M worth of flow-through shares (just short of 20M shares priced at C$0.21). Eric Sprott subscribed to 6.4M new shares and has now increased his position to 9.9% in the company as he ended up owning 34.3M shares in total.

Closing the placement comes hot on the heels of Moneta’s exploration update in July as the assay results of the final two holes that were designed to drill-test the southern extensions of the Westaway target confirmed the presence of gold. Hole 150 contained intervals such as 35.5 meters of 2.96 g/t gold while hole 155 hit 1.22 meters of 10.06 g/t gold in a wider interval of 2 meters of 6.15 g/t gold (which indicates the remaining 78 centimeters of that interval had an average grade of just 0.04 g/t (which basically is barren).

Both holes are outside of the mineralized envelope used to calculate the gold resource and could result in a higher amount of gold in the future resource updates. More gold is good, but it will be up to Moneta Porcupine to connect the dots and figure out which gold-bearing zones will be viable, even at a lower gold price than what we’re trading at now.

Disclosure: The author has no position in Moneta Porcupine.