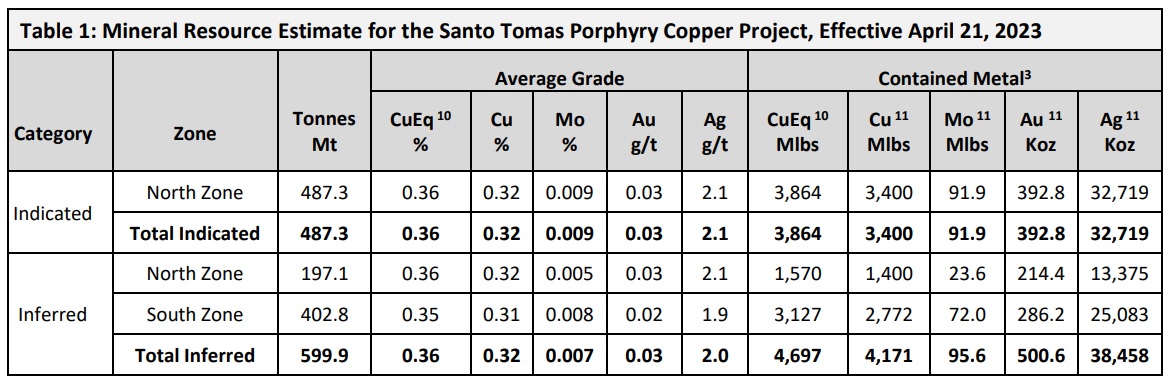

Oroco Resource Corp. (OCO.V) released its maiden resource on the Santo Tomas copper project last week. Interestingly, almost half of the consolidated amount of tonnes is already part of the indicated resource category, which contains 487 million tonnes at an average grade of 0.36% copper-equivalent (and the equivalent calculation already takes the lower recovery rates for the other metals into consideration) for a total of 3.9 billion pounds of copper-equivalent (including 3.4 billion pounds of copper). The inferred resource category contains an additional 600 million tonnes at a similar average grade of 0.36% CuEq for a total of 4.7 billion pounds of copper equivalent (of which 4.2 billion pounds are copper).

Considering this is just the very first resource estimate on the Santo Tomas project (using today’s standards), the results are very encouraging. The grade is perhaps a bit lighter than we had expected but fortunately the mineralized area is very consistent (so there shouldn’t be a whole lot of grade variation) while we are waiting for the technical report to be filed to see how easy it would be to access higher grade zones as early in the mine life as possible. Based on the metal prices used by the company, there are 6.7 pounds of net recoverable copper-equivalent per tonne of rock and at $3.80 copper the net recoverable rock value will just exceed US$25 per tonne (before taking payabilities into consideration).

With an anticipated mining cost of $2.25/t, a strip ratio of 1:1 (and perhaps a bit lower, let’s wait for the Preliminary Economic Assessment for more details), a processing cost of $5/t (which is higher than what peers have been using in their economic studies) and G&A and selling costs of $2/t combined, the margin would be around $13.5/t using $3.80 copper as base case scenario. Using a copper price of $4/lb would increase the margin by almost 10% which confirms Santo Tomas will provide excellent leverage on the copper price going forward.

Oroco Resource Corp is currently touring through Europe with its updated resource and will present in Brussels this coming Friday.

Disclosure: The author has a long position in Oroco Resource Corp. Oroco is a sponsor of the website. Please read our disclaimer.