Pacific Ridge Exploration (PEX.V) announced earlier this week it closed the first tranche of a non-brokered placement for a total of C$1.68M. That first tranche consisted of 16.25M flow-through units at C$0.08 per unit for a total of C$1.3M. The hard dollar portion of the financing resulted in 5.5M units issued at C$0.07 per unit for total proceeds of just over C$380,000.

Each unit contains a full warrant with an exercise price of C$0.12 valid for two years.

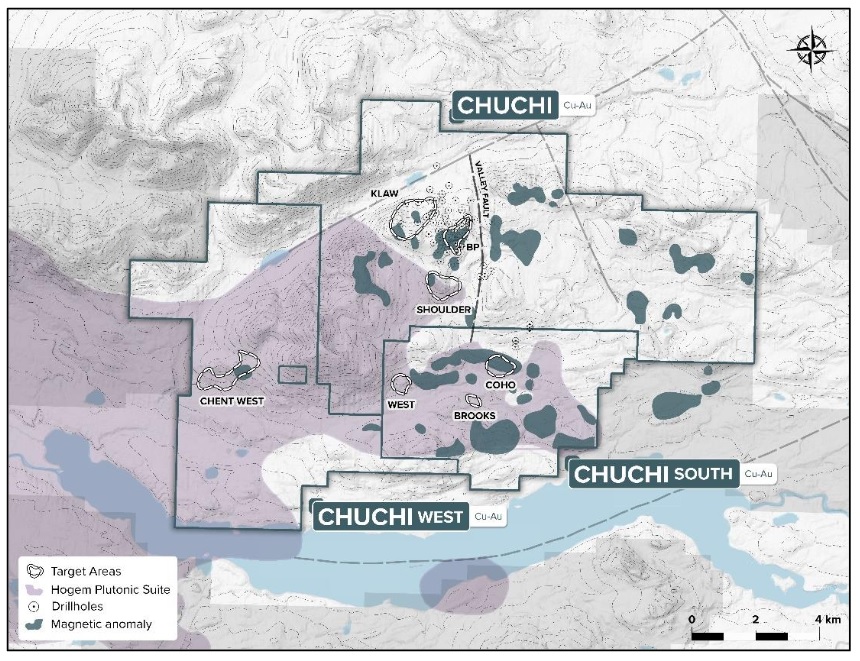

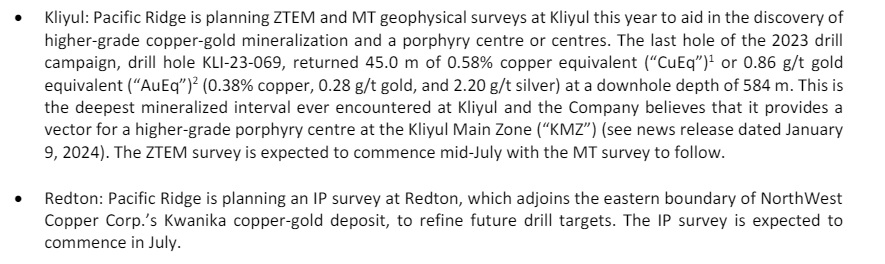

The proceeds of the financing will be used for the 2,400 meter diamond drill program on the Chuchi copper-gold porphyry project in British Columbia (where the company has option agreements with Centerra Gold and American Copper Development Corp.). As disclosed in a previous update, Pacific Ridge will be pretty active this year as it will complete a ZTEM and MT survey on its Kliyul flagship project, while Redton will be the subject of an IP Survey.

At Chuchi, the planned 2,400 meters of diamond drilling will be the company’s first ever dril program at Chuchi, and the holes will be zooming in on the BP zone where historical holes ended in mineralization. Needless to say this does provide some low-hanging fruit for Pacific Ridge and it only makes sense to follow up on that.

Meanwhile, Pacific Ridge will also be active on the other two projects:

The ZTEM and MT surveys should help the company to figure out if and where there are higher grade areas on the Kliyul Main Zone and to define other priority drill targets along the six kilometer long trend at Kliyul.

Disclosure: The author has a long position in Pacific Ridge. Pacific Ridge is a sponsor of the website. Please read the disclaimer.