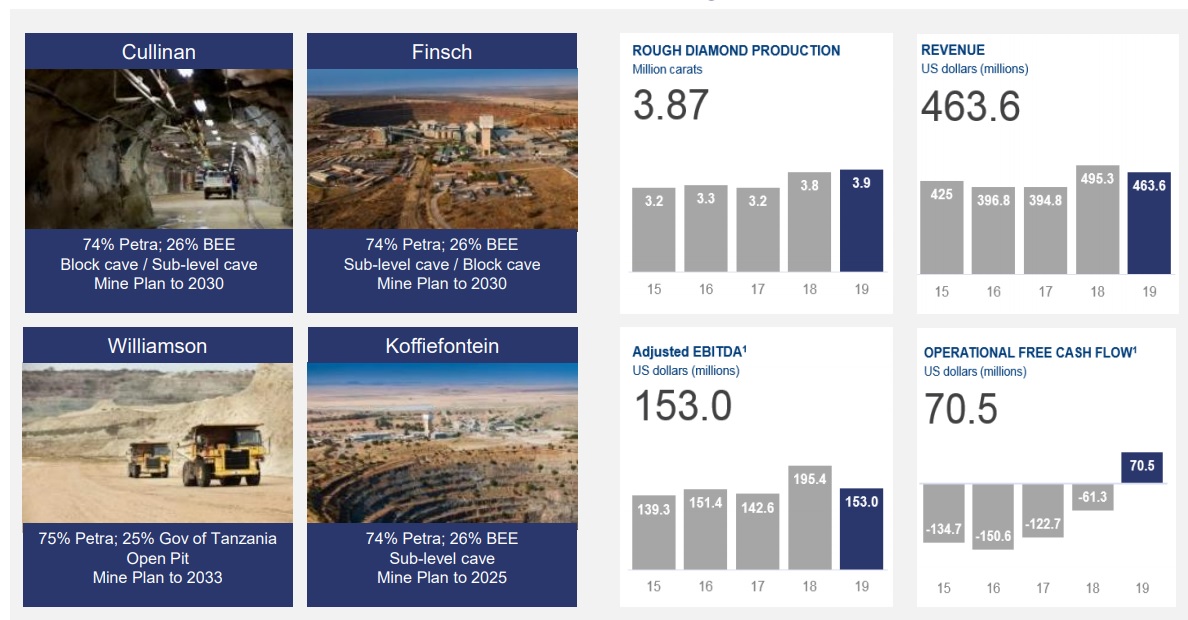

As the diamond sector is in crisis and Petra Diamonds (PDL.L) needs to figure out how to refinance the $650M in debt (senior notes due in 2022), the company has completed its strategic review reaching one simple conclusion: Petra Diamonds is now available to be acquired by another (larger and preferably cash-rich) competitor as the company isn’t quite sure how to deal with its net debt of $596M as of the end of December 2019.

In the first half of its financial year 2020 (which ended in June), Petra Diamonds reported an operating cash flow of just over $9M including working capital changes and approximately $36M before working capital changes. This was sufficient to cover all capex ($27M) and a loan advanced to a BEE partner ($11.3M) so although Petra isn’t bleeding cash, it also doesn’t look like it will be in a position to repay the debt in 2 years.

A cash-rich company that could pay off the debt would probably still be interested in Petra. Excluding the interest payments, the pre-WC operating cash flow actually was a very respectable $60M in H1 2020. At 1.8 pence, the market capitalization of Petra is just 15.6M GBP which is roughly 20M USD making the company an interesting speculative bet in case a buyer emerges that would value th company more than its enterprise value of less than $650M.

Disclosure: The author has no position in Petra Diamonds.