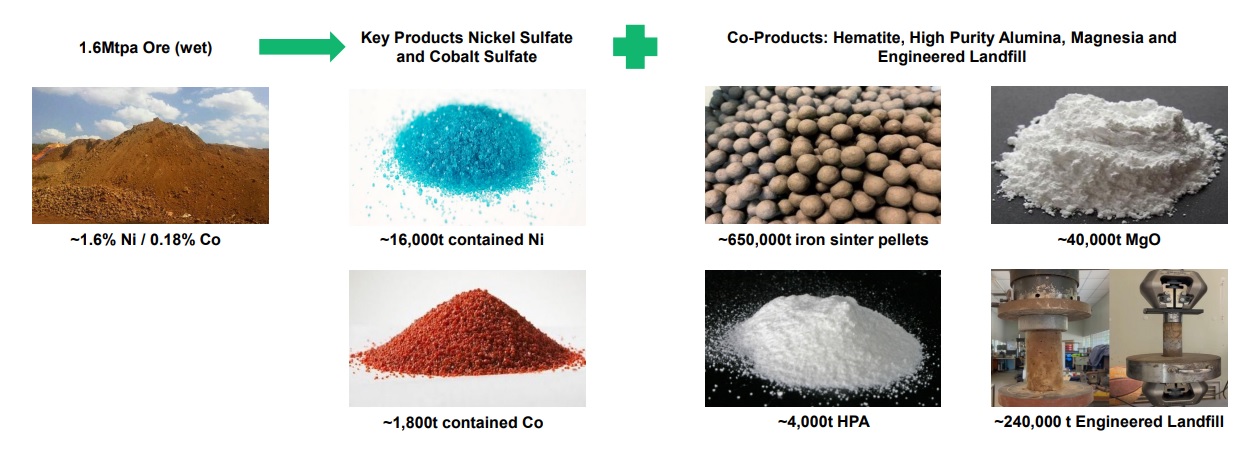

US car manufacturers are increasingly looking at Australia for their nickel and cobalt needs. General Motors (GM) announced earlier this month it has entered into an agreement with Queensland Pacific Metals (QPM.AX) whereby GM has secured the right to all the nickel and cobalt sulphate production that hasn’t been committed yet to other buyers (LG and POSCO). Additionally, when GM steps up the place again when QPM reaches a final investment decision, GM’s offtake rights will be valid for the entire mine life of Phase 1 as well as for 100% of the Phase 2 expansion of the TECH project.

General Motors has entered into a commitment to invest up to US$69M in Queensland. An initial investment of US$25M will be completed right away as GM will subscribe for just under 175 million new shares of QPM at A$0.18 per share for a total of A$31.4M, which was approximately US$20.1M as of the time of signing the agreement. QPM will also issue just under 47 million options with an exercise price of A$0.20 which can be exercised within three years after the agreements gets signed.

GM will also invest an additional amount of up to US$44M in Queensland Pacific Metals when a Final Investment Decision to actually build the mine has been made (this is subject to GM being satisfied with the definitive feasibility study).

Disclosure: The author has no position in Queensland Pacific or GM.. Please read our disclaimer.