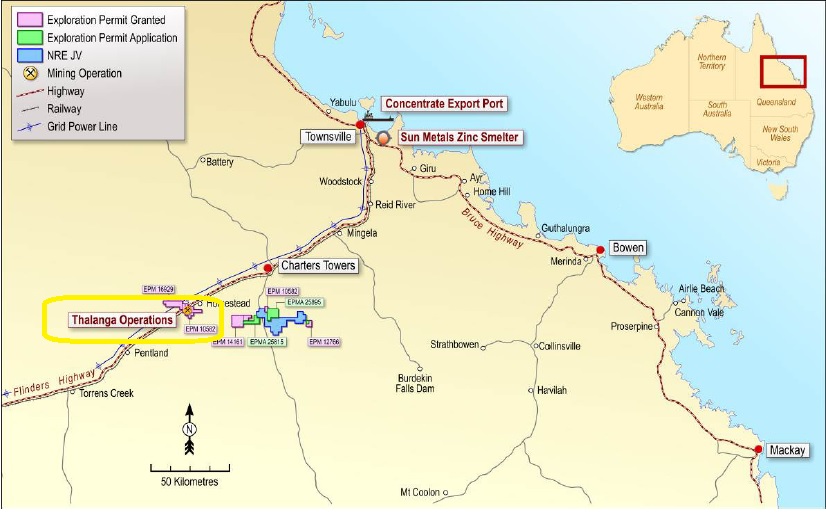

Red River Resources (ASX:RVR) has released a study discussing the potential re-opening of the Thalanga zinc mine in Queensland, Australia. Red River plans to be fully ready by the time the zinc deficit will be widely noticed and the study is now focusing on a 650,000 tonnes per year production scenario at Thalanga where an initial mine life of just over 5 years has been outlined based on an existing resource of 1.7 million tonnes at 7.5% zinc (as well as 2.1% lead, 1.4% copper, 54 g/t silver and 0.5 g/t gold) and a zinc-equivalent grade of 15.2%.

The initial capex is really low at just A$17.7M, and Red River expects it will need just six months to get the mine operational again, resulting in an annual zinc production of 21,400 tonnes (47 million pounds) at a C1 cash cost of US$0.18 per pound. The NPV8% of A$84M sounds great, but the commodity prices used to get this result are a bit outrageous. The economics are for instance based on a silver price of $20/oz from Y3 on, as well as a gold price of $1300/oz, a zinc price of $1.2/lbs and a copper price of in excess of $3/lbs from Y2-3 on.

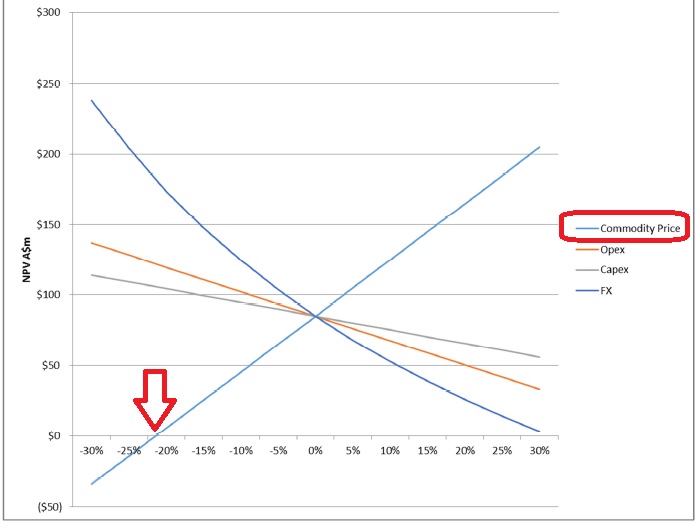

That’s really high, and according to the sensitivity analysis, a 20% lower commodity price deck (which would still be incorporating a higher revenue per pound and ounce than the current spot prices!) would reduce the net present value to close to zero.

Red River’s intentions are honorable, but the project doesn’t make any sense at all at the current base metals prices.

The author holds a long position in all stocks mentioned in this article. Please read the disclaimer