After a stellar 2020, the share price of most gold equities has been on a continuous slide for the past few months as it looks like the market is back to its ‘instant gratification’ requirement. After the initial run-up in the share prices of pretty much any company with the words ‘gold’ or ‘silver’ in the company name throughout the summer of last year, investors appear to be impatient and don’t seem to fully realize how slow exploration can be. The mining sector is not like the old western movies or Deadwood-esque series where a gold vein is found and prospectors start to mine the gold right away.

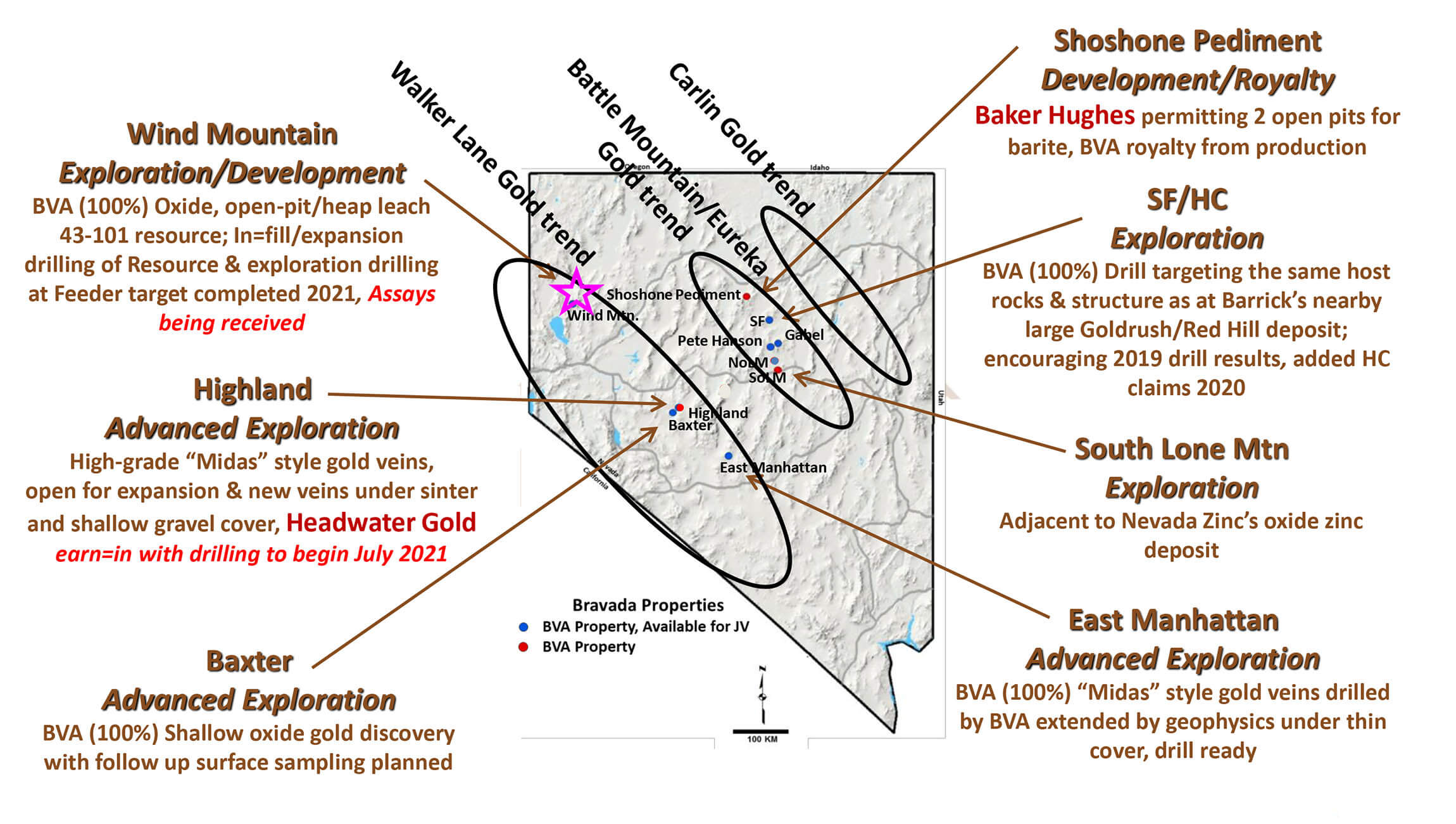

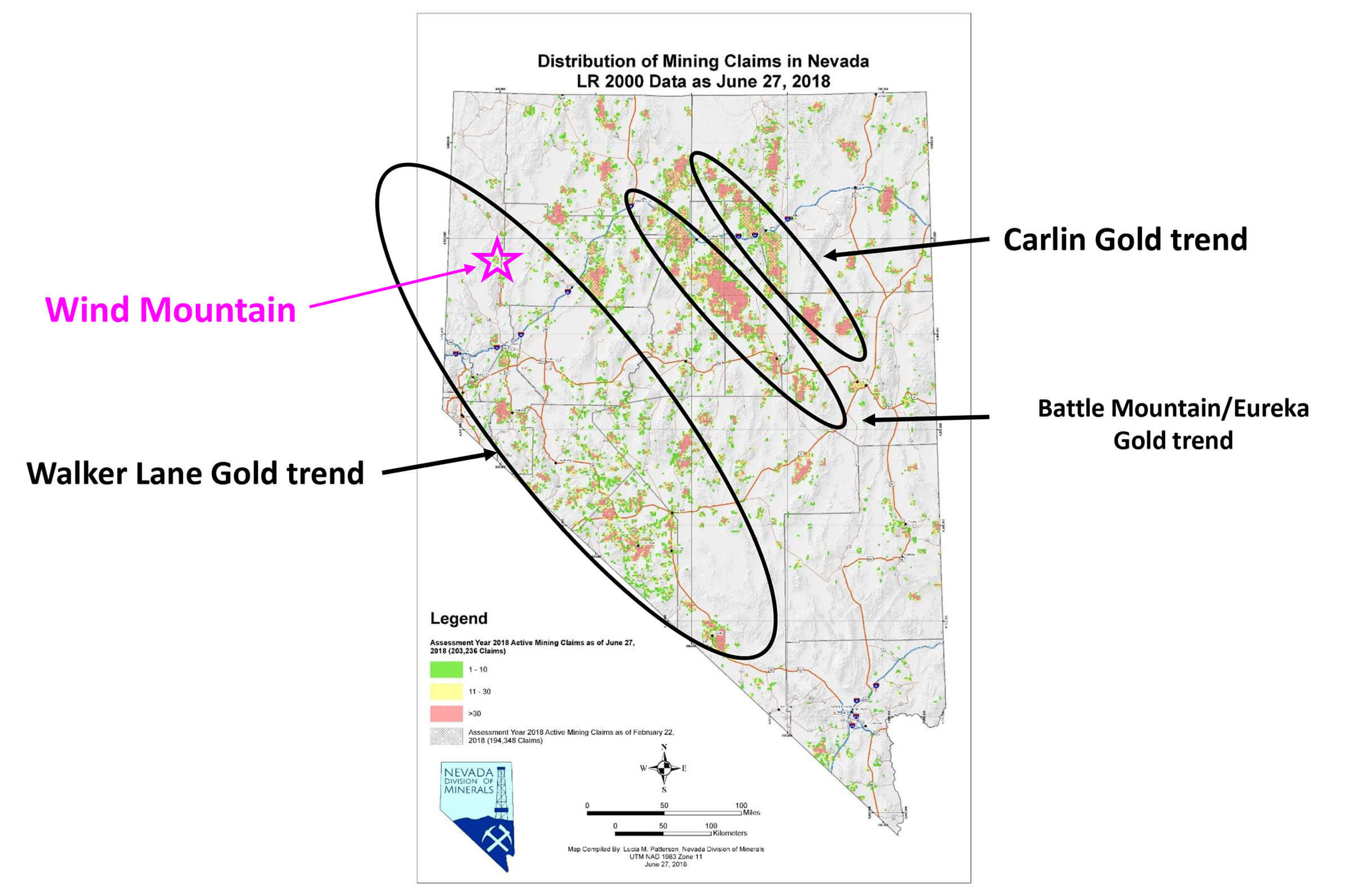

The truth is less romantic and it generally takes at least a decade to go from discovery to commercial production. It obviously helps when a company has a more advanced stage project on the shelf, which is the case for Bravada Gold (BVA.V). While the company was focusing on exploring its large Nevada portfolio either on its own or in a joint venture with other companies, it looks like the next little while the focus will be back on the oxide resource at the Wind Mountain project. There is an existing resource estimate and a Preliminary Economic Assessment, but as both are very outdated (they were completed in 2012), Bravada Gold will now fully focus on expanding the resource and updating the PEA. And we believe this likely is the best way forward as the market could re-rate Bravada Gold based on its potential near-term development plans rather than giving it the discounted project generator valuation.

The first batch of assay results from the 2021 drill program has now been released and we had a chat with President Joe Kizis to discuss Bravada’s plans for Wind Mountain, the other projects in the asset portfolio and how the company plans to unlock value for its shareholders. Bravada closed a first tranche of its C$700,000 placement in August, and is currently working towards closing a second tranche and is applying for a 30 day extension from the exchange to close the next tranche. The placement is priced at C$0.07 per unit with each unit consisting of one share and a full warrant exercisable at C$0.12 for a period of 2 years.

Sitting down with Joe Kizis

Wind Mountain

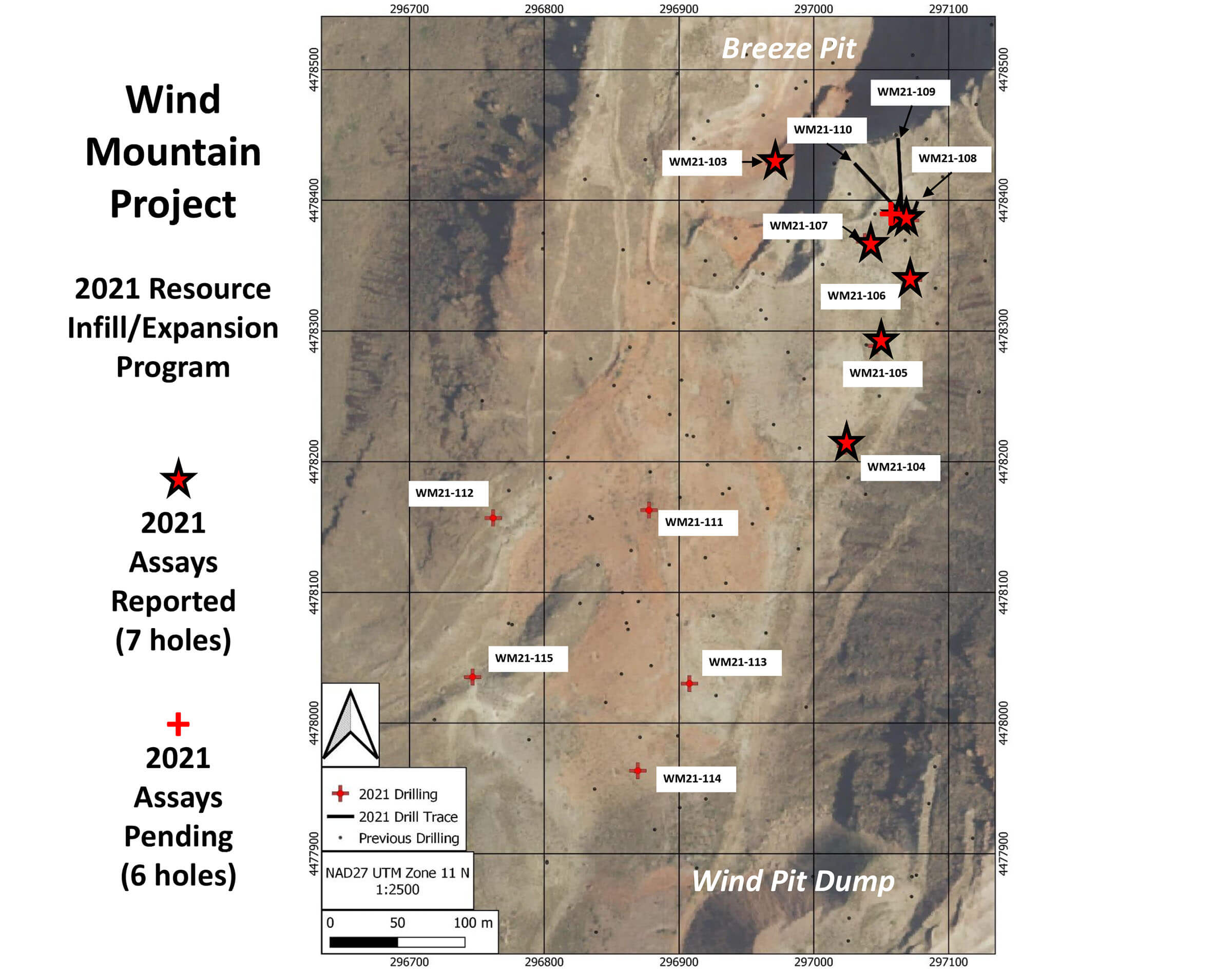

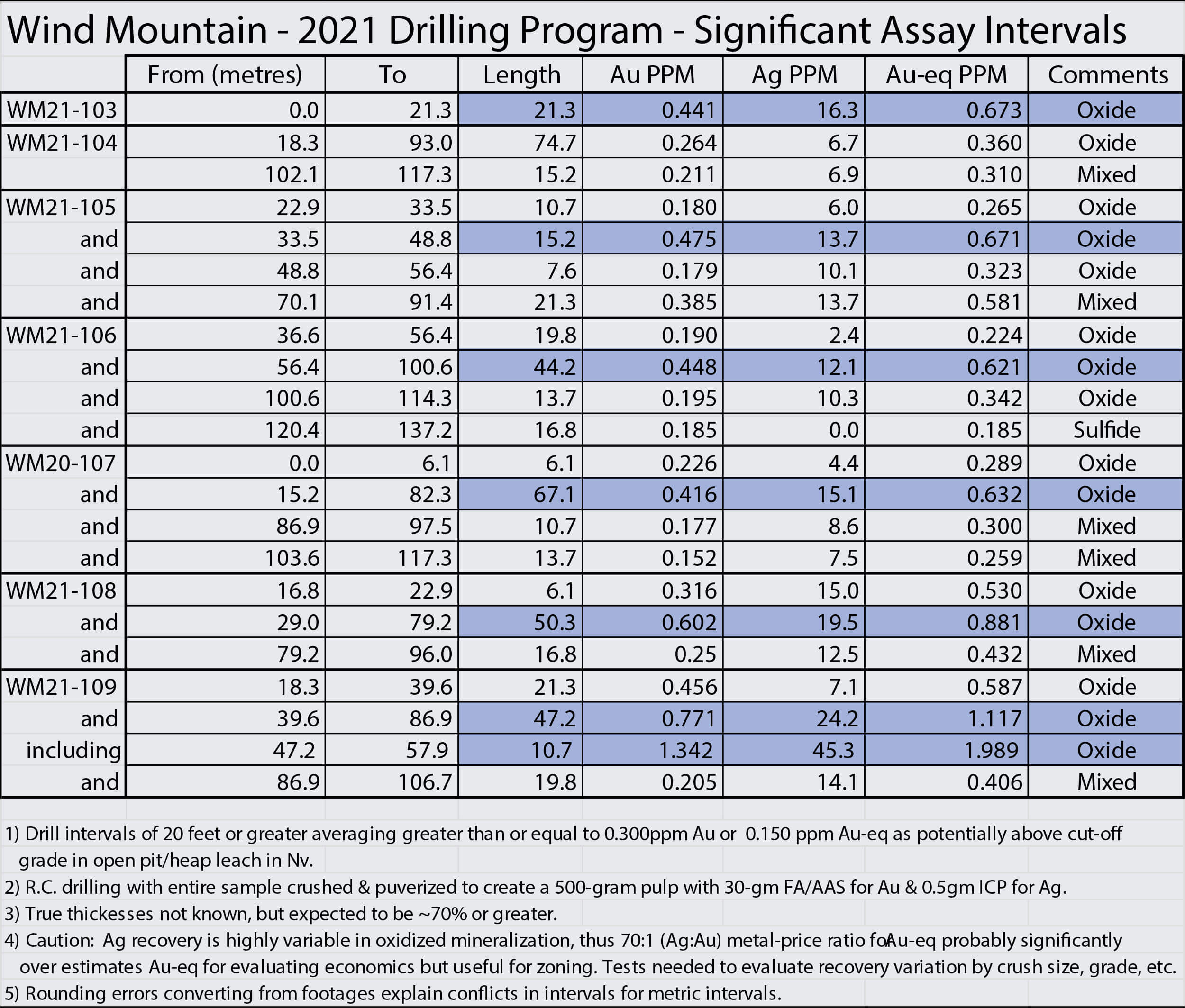

Let’s zoom in on Wind Mountain first as that will now very clearly be the flagship project with a lot of action going forward. While we are still waiting for the final six holes from the resource program and all four holes from the Feeder Target to be released, may we say the initial assay results are encouraging? Of course, Wind Mountain will never be a high-grade oxide gold project but at the current gold price and your recently encountered grades handsomely meeting the cutoff grade for these types of projects, we are cautiously optimistic on moving the project forward with a specific focus on the oxide zones, what’s your take?

Yes, we are very encouraged by assays from the seven holes that we have received so far from the 2021 resource drill program. We have demonstrated that our evolving geologic model of the disseminated oxide mineralization is successful in identifying areas where additional drilling can add to or improve our gold and silver resource.

We know oxide mineralization is easiest for fast cash flow; thus, a “Starter pit” concept concentrating on oxide mineralization makes sense. Yet, Bravada’s company goal still is to discover large and high-margin gold/silver deposits, and I believe our best opportunity to achieve that goal at Wind Mtn lies within upwelling zones (also called Feeder zones); thus, we are taking a two-prong approach: evaluate the known oxide mineralization as a first priority for early mine production and evaluate high-grade feeder mineralization as a second priority for major value enhancement.

We are still waiting for those final holes from the early 2021 drill program, but could you already walk us through the next steps and the timelines you are envisioning? Will drilling restart to add more data to the resource update? When do you anticipate an updated resource and PEA to be completed?

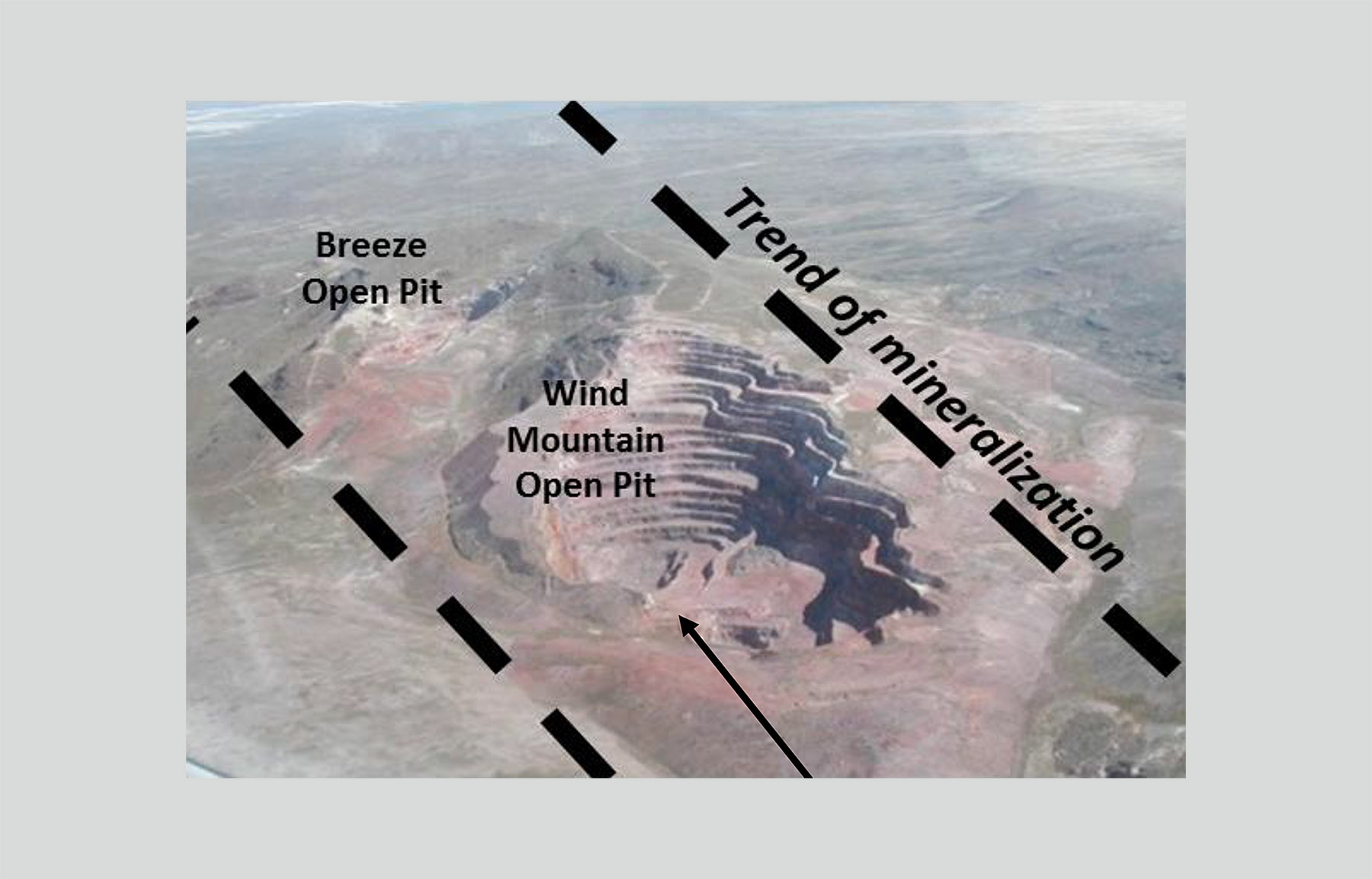

The 13 holes additional holes we drilled this year will be sufficient to update a key portion of the Resource. We also have drill results between the Breeze portion of the Resource and the DeepMin portion of the Resource that was completed after the 2012 Resource estimate was completed; those holes connected mineralization between the two areas where no previous drilling had occurred. Although the resource for the entire property will be updated, we will evaluate doing a PEA only on a Phase I Starter pit, which should be very attractive. We have a limited area to place a heap-leach pad between the mine and a major powerline that probably cannot be moved. Placing a heap-leach pad that close to the Starter pit will result in much lower cost to deliver ore to the heap leach pad compared to the site considered in the 2012 PEA, which is located farther to the north.

Our existing drill distribution in the Phase I area is adequate for a detailed PEA, and with some additional engineering studies we could expand the PEA to a Pre-Feasibility study. Our plans are to complete the Resource update and the PEA update in Q1 2022, deciding upon further upgrading to a Pre-Feasibility based on those studies to justify the additional engineering costs.

Any additional drilling will focus on our secondary priority upwelling/feeder targets. That effort to date concentrated on an area we call the Feeder target where in December we discovered our first banded quartz vein zone at Wind Mtn. The vein zone contains high-grade silver and other encouraging features and is located south of the main oxide resource. We are hopeful that our recent four holes at this target will justify further drilling to test the vein zone deeper, where high silver values should transition to high gold values.

In large “hot springs” systems like Wind Mtn, it is likely there are other zones of upwelling. One may be below WM21-109 near the Breeze pit. I have an idea where another may be located at the Wind pit, but that is more speculative. I would love to drill a few new holes below our 2021 Feeder target holes and a couple of holes at the possible new upwelling targets. Assay results from the remaining 2021 holes and the market will determine how quickly we proceed on this secondary priority, but the primary focus will be the Resource update and PEA on the known oxide mineralization.

Let’s take a step back and look at the 2012 resource estimate. That estimate is now obviously outdated and obsolete given the more recent drilling. In your recent news updates you mentioned the 2021 drill program encountered thicker zones with higher-grade areas than the data the 2012 resource model was built on. Did you exclusively drill in new areas, or did you go back at some known areas to get a better understanding? Where else do you expect resource growth to come from?

We chose the sites based on our detailed evaluation of the 2012 resource block model after we realized there were certain areas where drill holes were too far apart for statistics to project higher-grade gold and silver mineralization and other areas that were never drilled near holes with attractive grades. We chose the 13 holes that we thought would provide our best additions to a portion of the resource that could evolve into a Phase I Starter pit.

As mentioned above, I believe the upwelling zones will provide the best opportunity for high-margin resource growth. In addition to the potential for deeper, high-grade vein mineralization along the feeder structures, there should be opportunities to discover narrow, but good grades of shallow oxide resource along those same Feeder structures into areas that only have anomalous metal values in widely spaced historic drill holes that did not intersect those structures.

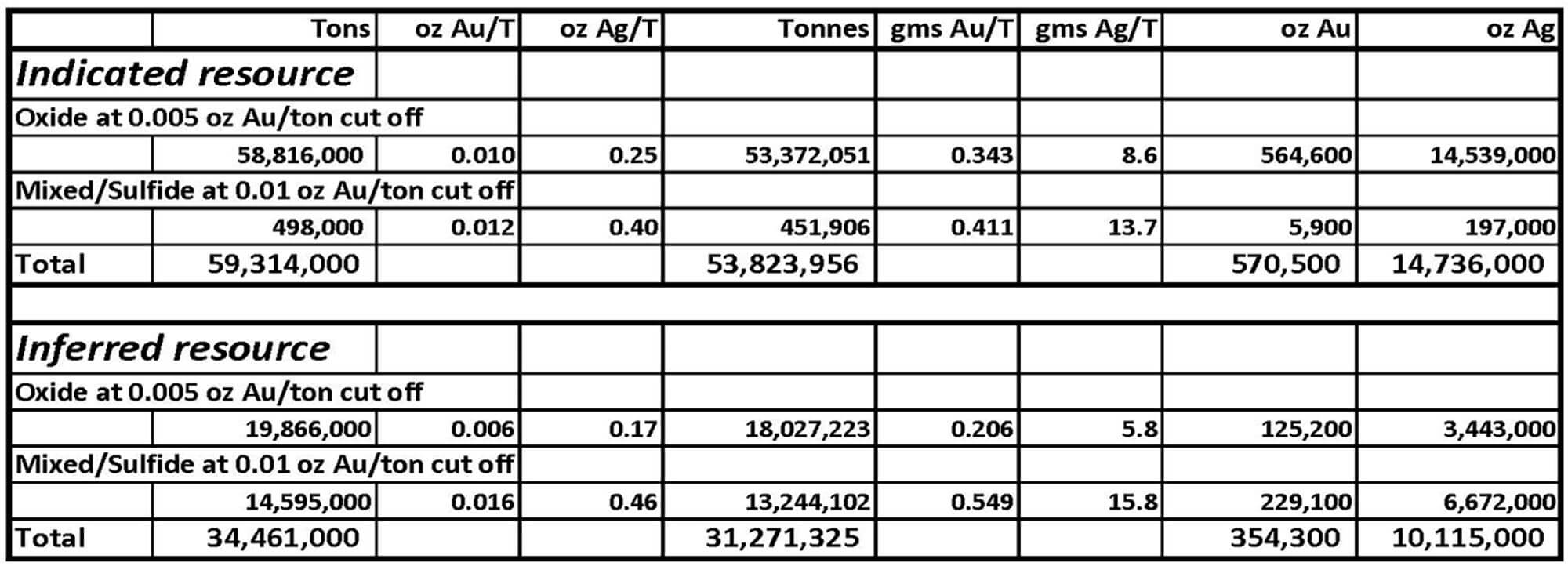

And what would be your initial target for the oxide resource? The 2012 resource ended up at 565,000 ounces of gold at 0.34 g/t in the indicated category and 125,000 ounces of gold at just under 0.21 g/t in the inferred category. While we realize Bravada Gold isn’t putting out an official exploration target, is there a ballpark number that you would be happy with?

We expect to increase our overall resource to be comfortably over 1 million ounces of gold and 25 million ounces of silver, which shouldn’t be too difficult because we were already close to that goal in 2012. More economically important in the near term, part of the Resource near the Breeze open pit is shallow with a very low strip ratio and higher-than-average gold and silver grades. We think this area can make a very attractive, high-margin starter pit. I think a minimum target for Phase I would be to produce at least 50,000 ounces per year for at least five years, while we continue to develop additional reserves for Phase II expansion. We also need to evaluate recovery in mixed oxide material because recovery can be attractive, but mostly likely at a slower rate than fully oxidized material based on our limited work to date.

One significant cost saving for a starter pit, compared to the 2012 study, would be to utilize a limited space for a Phase I heap-leach pad between the bottom of the hill below the Breeze open pit and a major power line. We roughly estimate that we have enough room to stack about 20 million tons of oxide mineralization on that pad site, but engineering studies will determine how high we can stack the pad and thereby determine the ultimate tonnage to be mined from the starter pit to load that pad. The 13 holes we recently drilled were designed to increase the grade in this shallow part of the resource so we can do studies to determine if we should crush or do run-of-mine for leaching. So, we have a lot of variables to work out… but that’s why we do a PEA.

In your 2012 PEA you looked at the difference between run of mine leaching and crushed leaching. Will you do more metallurgical testing to further investigate both options from an economic perspective? And would it be right to assume that the larger the resource gets, the more sense it makes to focus on crushed leaching? What would be the incremental capex for a 20,000 tpd crusher?

Crushing is most beneficial in heap leaching at higher grades. Silver often is especially improved by finer crushing. Geology and metallurgy strongly affect crushing, so mineralization along late fractures, such as found in Wind Mtn oxide material, can be a good candidate to process run-of-mine material, whereby close-spaced blasting is sufficient to expose the gold along fractures to leaching fluids without any crushing. Also, there are relatively new types of crushing equipment that should be evaluated, such as impact crushers that may be effective for hard, but brittle, silicified rock found at Wind Mtn.

Capital costs are determined by how much ore needs to be crushed and how fast. We can either purchase or rent crushing equipment, so that gives us the option to only crush some of the deposit during part of the mine life. For the original Wind Mtn mine, AMAX crushed some ore that ran about 1.3g/t Au near the top of the original deposit. They loaded crushed material onto their heaps first to get fast cash flow, but there was another reason. After leaching the crushed material, they overlaid the crushed material with run-of-mine (ROM) ores, taking advantage of the permeable crushed material to provide rapid drainage for the gold-laden leaching fluid to exit the heap after leaching the less permeable ROM ore.

If the grades are high enough in the feeder zone, we will need to determine if milling the ore would be more profitable than heap leaching. Options include building a mill if sufficient material justifies capital costs or trucking to a contracted existing mill in northern Nevada. But for now, we are obviously focusing on the scenarios for the oxide resource.

The past year or so you have been chasing the feeder zone of the Wind Mountain project, which is believed to contain high-grade sulphide mineralization. So far, drilling has not intersected said feeder zone and while the focus is now on expanding the oxide mineralization to advance the project, you mentioned in a July exploration update one of the areas you have been working on could be a possible up-welling zone from the feeder system. Could you elaborate on this statement?

Just to clarify, the term “sulfide mineralization” does not necessarily mean gold is tied up within sulfide minerals or that the ore is refractory, although our work at Wind Mtn indicates recovery in disseminated “Mixed” oxide/sulfide zones does have lower recovery, at least initially, oxidation occurs rapidly in drill samples. In typical low-sulfidation veins, the rock may not be oxidized but the gold usually occurs as metallic gold or electrum along bands within vein quartz. For those high-grade gold veins, crushing followed by cyanide leaching in a mill is usually the most profitable and efficient approach.

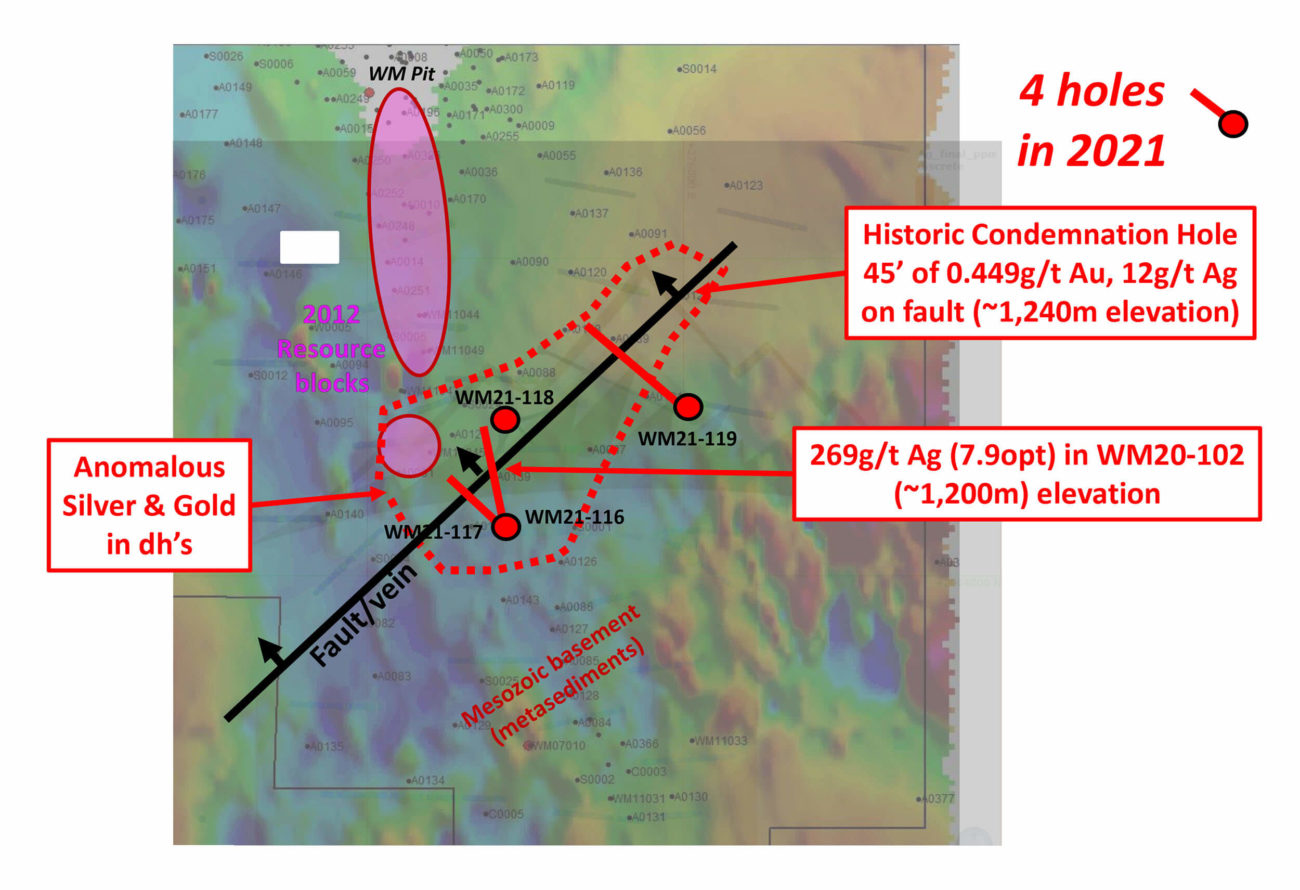

The idea of a “feeder zone” as an attractive high-grade gold target is based on studies of many low-sulfidation gold deposits. Underlying structures that provided channel ways for upwelling auriferous hydrothermal fluids to reach shallow levels and form “hot springs” disseminated precious metal deposits can be much higher grade than the disseminated mineralization. There are many documented examples of this relationship, and many feeder zones are even completely devoid of gold and silver above a certain level along their fluid pathway, having deposited all the precious metals at deeper levels. Recently reported holes WM21-109 and -108 in the Breeze portion of the resource may be close to, or at the top of, an upwelling zone. With the best grades in -109 only 50m below surface (10.7m of 1.332g/t Au and 45.3g/t Ag), a high-grade feeder vein zone may lie below, well within open-pit depths.

In our 2021 program, we drilled four holes at our Feeder target into what we interpret to be the upper part of feeder vein zone. This target area is south of the majority of the 2012 Resource and mostly covered by overburden and mine waste. However, historic shallow condemnation holes in the area do contain widespread low-grade anomalous gold and silver. We intersected the vein zone first in our limited December 2020 proof-of-concept drilling program. The vein zone consists of quartz veinlets with locally abundant silver sulfide minerals (maximum 5-feet of 269g/t Ag and 0.402g/t Au). In 2021, we drilled four holes to test the possible strike of the vein zone based on geophysics, as well as to test somewhat down dip of the 2020 intercept. We anxiously await analyses of these holes, but visually we traced the vein zone beneath cover for about 330m, demonstrating a significant strike length that is still open along strike. The zone has characteristics indicative of the top of a feeder vein system, which is very encouraging if the grade and width increase with depth as predicted. Understanding this feeder zone also provides us with an idea of what other feeder zones might look like elsewhere on the property.

Other projects

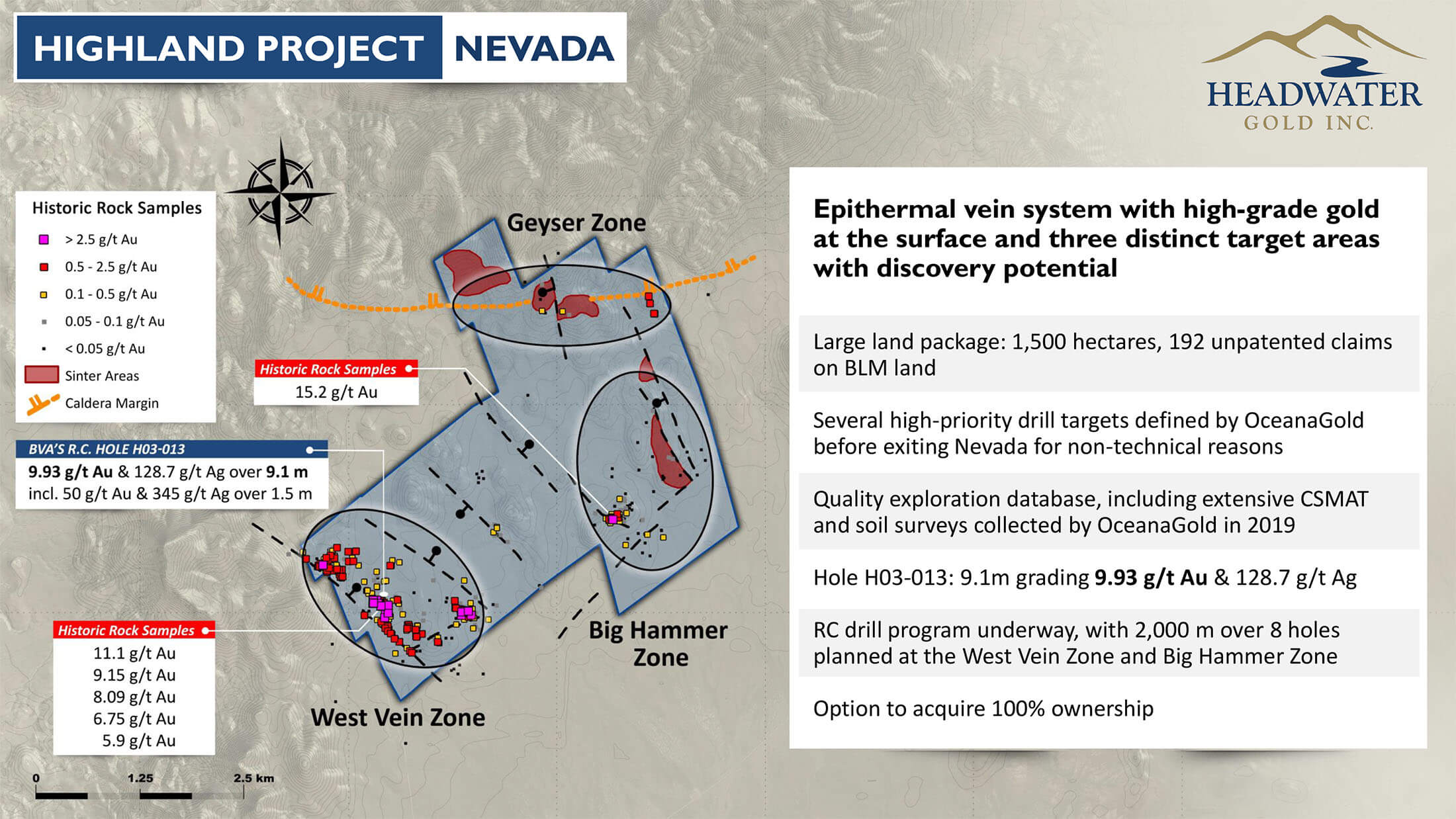

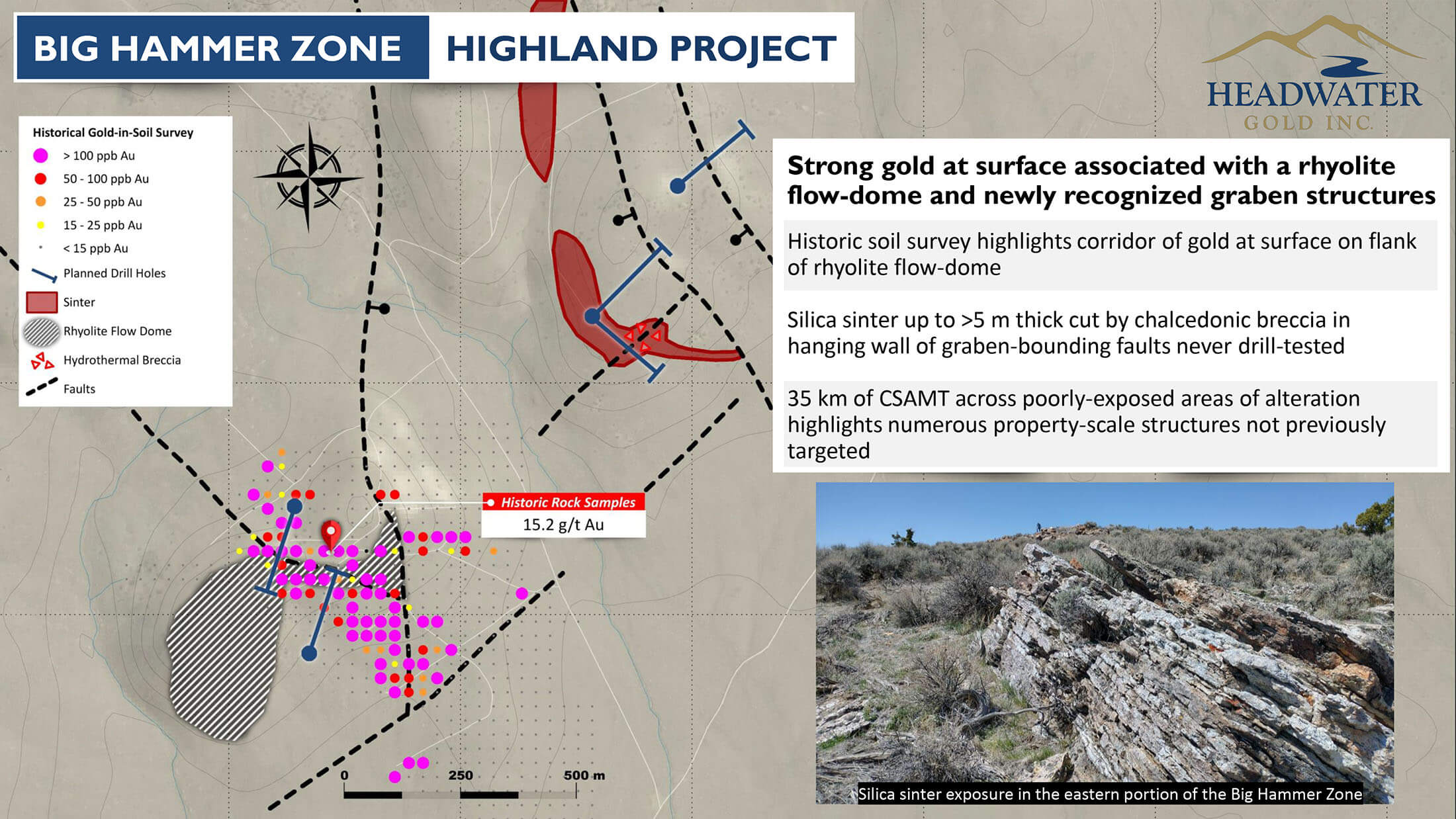

It’s probably safe to say Highland is your second-best project. OceanaGold dropped out of the earn-in agreement in December last year, but you were able to replace them quite fast with Headwater Gold (HWG.V). Why did you decide to deal with them? Was their C$6M cash pile an important factor? Who will design the exploration activities, Bravada or Headwater?

It was a disappointment to lose OceanaGold due to their corporate decision to close their Reno exploration office and to focus exploration on their mine properties, but their geophysical program in 2019 really advanced our targeting in the eastern part of our Highland Property. We previously had some success in drilling high-grade veins in the western part of the property and still had attractive untested targets in that area, so along with the additional targets in the eastern part of the property, we received quite a bit of interest by potential JV partners after OceanaGold dropped out. Covid-19 travel restrictions prevented many groups from outside the US to visit Highland (as well as our other BVA properties), but I was very happy to do a deal with Headwater for several important reasons. They were cashed-up, as you mention, but more important to me was their experience with low-sulfidation gold deposits like Highland and their aggressive exploration plans for the property. Their group includes several individuals that I have known for many years while they were with Kinross, so I am very comfortable with their technical expertise.

They modified some of our targets and developed a few of their own for the first phase of drilling, which has now been completed with samples submitted for assay. They drilled seven deep RC holes for a total of 2,100m and visually “…encountered quartz veining and alteration…“ according to their recent news release.

We provide technical and historic input to their program, but they determine, and fund, specific work programs until they earn an initial JV interest in the property after US$5 million in work expenditures. After initial earn-in, we will form a formal technical committee to determine work programs and they have the option to earn additional ownership by sole-funding additional exploration programs.

We noticed Endeavour Silver (EDR.TO, EXK) acquired the Bruner gold project in Nevada, which is literally bordering your Baxter project (and pretty close to Highland as well). Does the Endeavour acquisition of the neighbouring property change your approach towards Baxter? Did you get approached by other companies wanting to strike a deal to take advantage of the nearology-effect? And finally, are there similarities between Bruner and Highland, or is that a stretch?

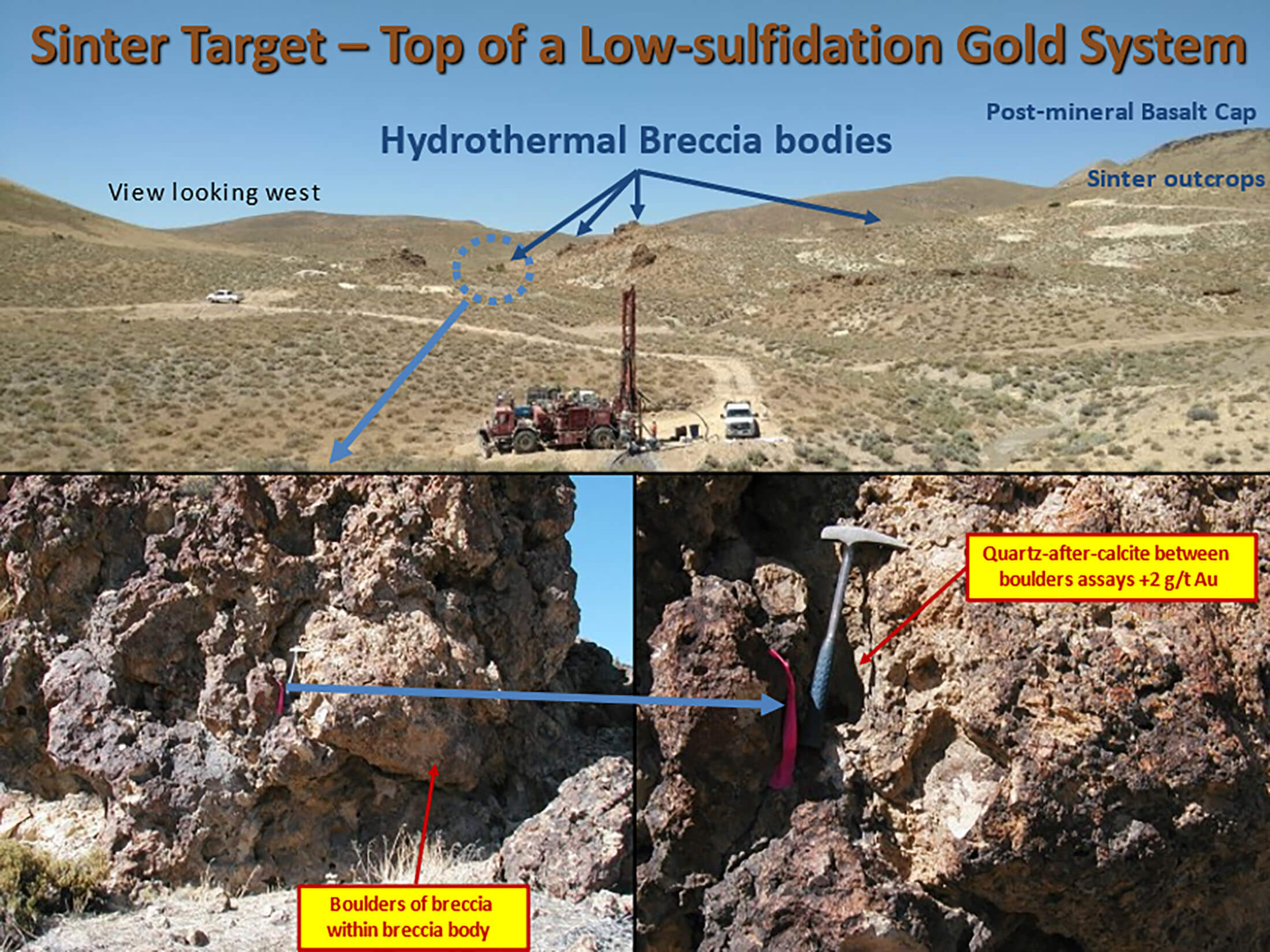

Baxter and Highland are both low-sulfidation types of gold/silver properties, like the Bruner property. We have plans to conduct a soil survey at Baxter this fall in a poorly exposed area west of our Sinter target. Kinross discovered shallow, oxide gold mineralization at the Sinter target that is open-ended to the east and west. Approximately 500m to the west of Kinross’ Sinter drilling was one of their best exploration holes. Our planned soil survey covers the undrilled and poorly exposed region between these two areas of drilling by Kinross.

Endeavour’s acquisition of Bruner is good for our properties because it brings attention to this region of the Walker Lane Gold trend. Unfortunately, the original company advancing Bruner ran out of money to further explore and develop their attractive property. The heap-leach pad site that the original group was permitting directly abuts our southern claim boundary, so there are obvious potential benefits for Baxter. Several companies were looking at Baxter prior to Endeavor’s announcement, so we are hoping a relatively low-cost soil survey will add significant value to Baxter.

Anything else we should keep an eye on?

We also plan to conduct soil sampling this fall on our Carlin-type gold SF/HC property. We had encouraging results in two proof-of-concept holes in 2019, and in 2020 we acquired the adjacent prospective HC claims for BVA shares and a retained royalty. Confirming a gold-bearing hydrothermal system within favorable structure and host rocks, and proximity to Barrick’s fabulous Gold Rush/Red Hill gold discoveries make this a very attractive exploration property.

One other property we are carefully monitoring is our Gabel property, also located along the Battle Mountain Gold Trend like SF/HC. An unrelated junior explorer has discovered indications of a Carlin-type gold system that projects onto a target that we identified previously on our claims based on rock-chip sampling and mapping. The junior is currently drilling holes on their ground to offset their holes drilled earlier this year, so we are following their progress in news releases with great interest.

The Barite royalty

Do you have any updates on the Barite project? Baker Hughes should be doing well with the current high oil prices, may we assume things will get moving again on the Barite front? And remind us, what are the terms of the NSR again?

The rumor is that Baker Hughes may be exiting the barite business, so we expect that any purchaser would be more aggressive in developing the new Scruffy barite mine, which includes our Shoshone Pediment property and their adjacent Scruffy property. The mine is close to being fully permitted, as I understand, and was supposed to replace Baker Hughes’ exhausted Argenta mine, which fed their nearby processing plant for decades. We are not privy to their plans, so I cannot verify the rumor or speculate when Bravada may begin receiving royalty payments. Certainly, the increase in oil price and related oil-field drilling should benefit the likelihood of Bravada receiving royalties at some point. Bravada’s royalty is $1/ton of barite produced after 150,000 tons. It will not be a huge amount of cashflow to BVA, but it will be a welcome source of funding for overhead and exploration.

Corporate

Your previous financing was in June last year when you raised just under C$700,000 in a unit financing priced at C$0.08. You are currently raising C$700,000 again in a unit financing at C$0.07. In between both financings, your share price reached a high of C$0.235. We know you are mindful of dilution but would you do things differently in the future and perhaps try to capitalize on the higher share price to raise money even if you don’t need it at that very moment?

It is always difficult balancing financing requirements against shareholder’s legitimate concern for dilution. Unfortunately, my crystal ball doesn’t work very well, but yes, we missed an opportunity. At the time, however, we had a lot of warrants that were well in the money and many of our shareholders thought we should rely on those funds. Indeed, some of those warrants were exercised and that funded our recent drilling program at Wind Mountain, but a lot of warrant holders also must have poorly working crystal balls because most of the warrants expired unexercised when gold prices dropped after the high in BVA’s price per share.

Conclusion

While we expect to see assay results released by Joint Venture partner Headwater Gold on the Highland project, we expect Bravada Gold will be on its own to create value for its shareholders. We certainly like the renewed focus on Wind Mountain as it should be easier to raise money in the future when a company is actually advancing a heap leach oxide project towards production, compared to a company with a pure exploration focus or project generation focus.

As the upcoming resource update will be the very first in almost 10 years, we hope to see a meaningful increase in the resource as the recent drill program seems to indicate the 2012 resource may have been very conservative and the ongoing infill drill program is filling the gaps. The larger resource, in combination with a grade bump, should then result in a positive PEA update, despite the likely higher capex and opex due to inflationary effects since the 2012 PEA.

The next 6-9 months will likely determine the future of Bravada Gold as a company. And the focus on bringing the most advanced project closer to development should have a positive impact on Bravada Gold and its C$5.5M market cap based on 94 million shares outstanding.

Disclosure: The author has a long position in Bravada Gold and participated in the current placement. Bravada Gold is a sponsor of the website. Please read our disclaimer.