We usually get very nervous when we see a non-revenue, exploration stage company enter into a convertible debt agreement as the terms usually don’t favor the junior company.

We feel like NevGold (NAU.V) has set an example of how these deals should be structured. It entered into an agreement with a division of an existing shareholder to raise money in a convertible security with terms that are likely better than the sole other alternative: a private placement at a discount to the market price.

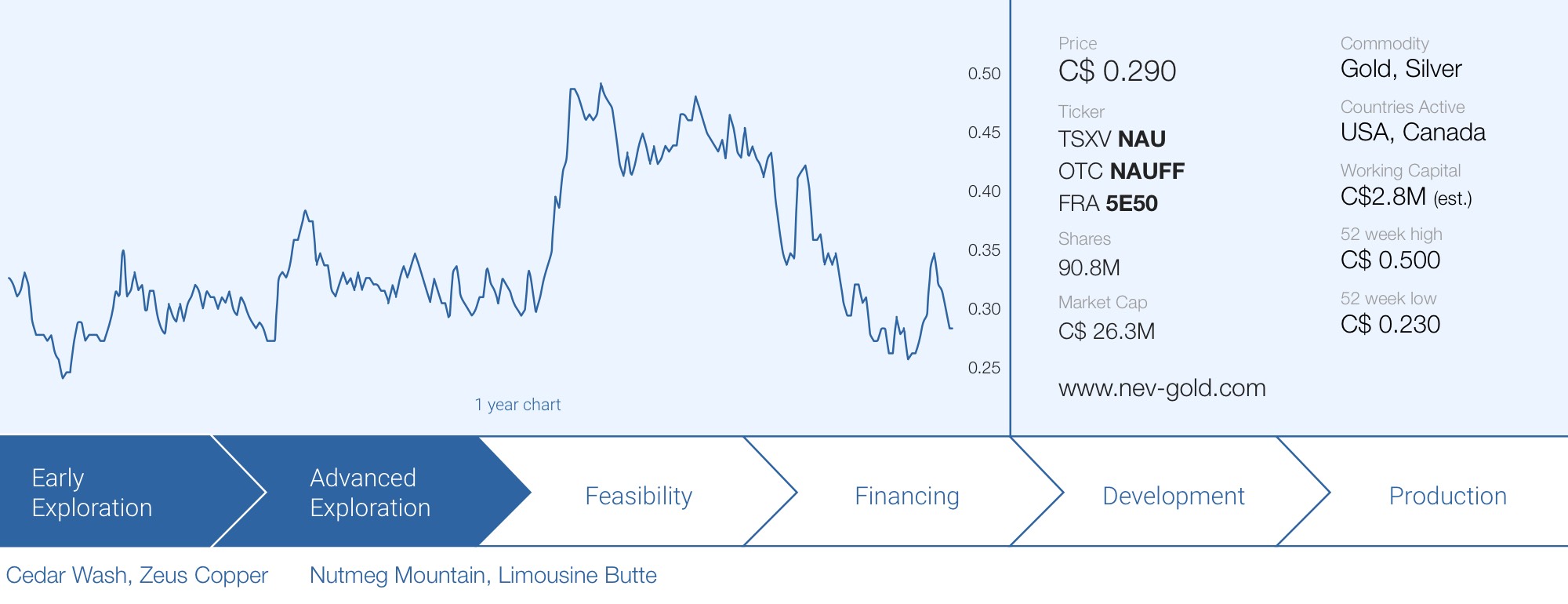

Although original and creative and perhaps not well understood by the market, it is a good financing. The risk for NevGold is limited given the floor price on the convert is C$0.35/share (currently NevGold is trading around C$0.30 per share) and the certainty to settle the convertible security in shares (i.e. there is NO repayment in cash at all, the C$3.5M will be settled in equity) and that’s what makes this a good deal.

With C$3.5M in cash to be added to the treasury, the company can now start focusing again on generating value through its three projects as the immediate funding needs and concerns have been alleviated. The negative working capital position as of last June will be converted into a positive working capital position of in excess of C$2.5M now the first tranche of the financing has closed.

Explaining the convertible financing

NevGold signed an agreement with Mercer Street Global Opportunity Fund II for a financing to the tune of C$8M. While the details of the second tranche have not been negotiated with, both the company and the investors have agreed to the terms of an initial tranche of C$3.5M.

The convertible security has a total term of 24 months and an ‘original issue discount’ of C$650,000. The initial payment of C$3.5M will be repayable in stock, at a conversion rate that’s very favorable to NevGold. The principal amount of C$3.5M will be convertible into the amount of shares based on the greater of 90% of the 5 day VWAP or C$0.35 per share.

Tranche 1 (“ First Convertible Security”)

| Term: | 24 months |

| Funded Amount: | $3,500,000 |

| Use of Proceeds: | General working capital and to advance mineral properties |

| Original Issue Discount (“OID”) | $650,000 |

| First Investment Conversion Terms: | Principal amount of $3,500,000 will be convertible at the option of the Investor for a 24-month period into up to 10,000,000 common shares of the Company (each, a “Share”) at a price per Share equal to the greater of (i) 90% of the volume-weighted average trading per Share (in Canadian dollars) for the five(5) consecutive trading days immediately prior to the applicable date that the Investor provides notice of conversion, and (ii) $0.35. |

Tranche 2 (“Second Convertible Security”)

| Term: | 24 months |

| Funded Amount: | Up to $4,500,000 |

| Use of Proceeds: | General working capital and to advance mineral properties |

| Original Issue Discount (“OID”) | Up to $810,000 |

This is important as the C$0.35 price is the floor price. Whatever happens, Nevgold won’t have to issue more than 10 million shares under this agreement. Even if the stock would be trading at 5 cents, Nevgold would still only have to issue 10 million shares to Mercer Global as per the deal terms. But if the stock would for instance be trading at C$0.50 (for illustration purposes), the C$3.5M would be converted into stock at 90% of the VWAP, and that would be C$0.45. That would result in just 7.78M shares being issued (C$3.5M / C$0.45). This is a very important element for NevGold, which we normally do not see in convertible financings. The downside from a dilution standpoint is protected, and if they have success at the projects, there will be even less dilution.

So what’s in it for the lender? The lender (which really ultimately is an equity investor as the convertible security will be repaid in stock) will make some money on the original issue discount. But rather than so many other financings where the discount is 100% applicable from the moment the deal gets signed, NevGold played its cards right and made sure the C$650,000 OID will be pro rata’ed over 24 months. This means that if NevGold wants to retire the security at any given time, and it wants to do so before the 24 months are over, it would only have to pay a fraction of the C$650,000. In a hypothetical scenario, if NevGold would want to retire the security after nine months, it would have to pay 9/24 * C$650,000 = C$243,750 in cash or stock at the option of the investor.

Additionally, the lender will receive a C$120,000 closing fee which represents 3.4% of the total size of the convertible security, and will receive 5 million warrants with an exercise price of C$0.525 valid for a period of two years.

We usually get cold shivers running down the spine when we see a non-revenue company sign a convertible debt agreement as the terms usually favor the lender. But the NevGold deal appears to be fair, and in return for providing C$3.5M in what essentially is equity, the lender will earn up to C$770,000 should the security remain outstanding for the entire 24 month term. This represents a total cost of capital of just over 10% if you’d also include the closing fee.

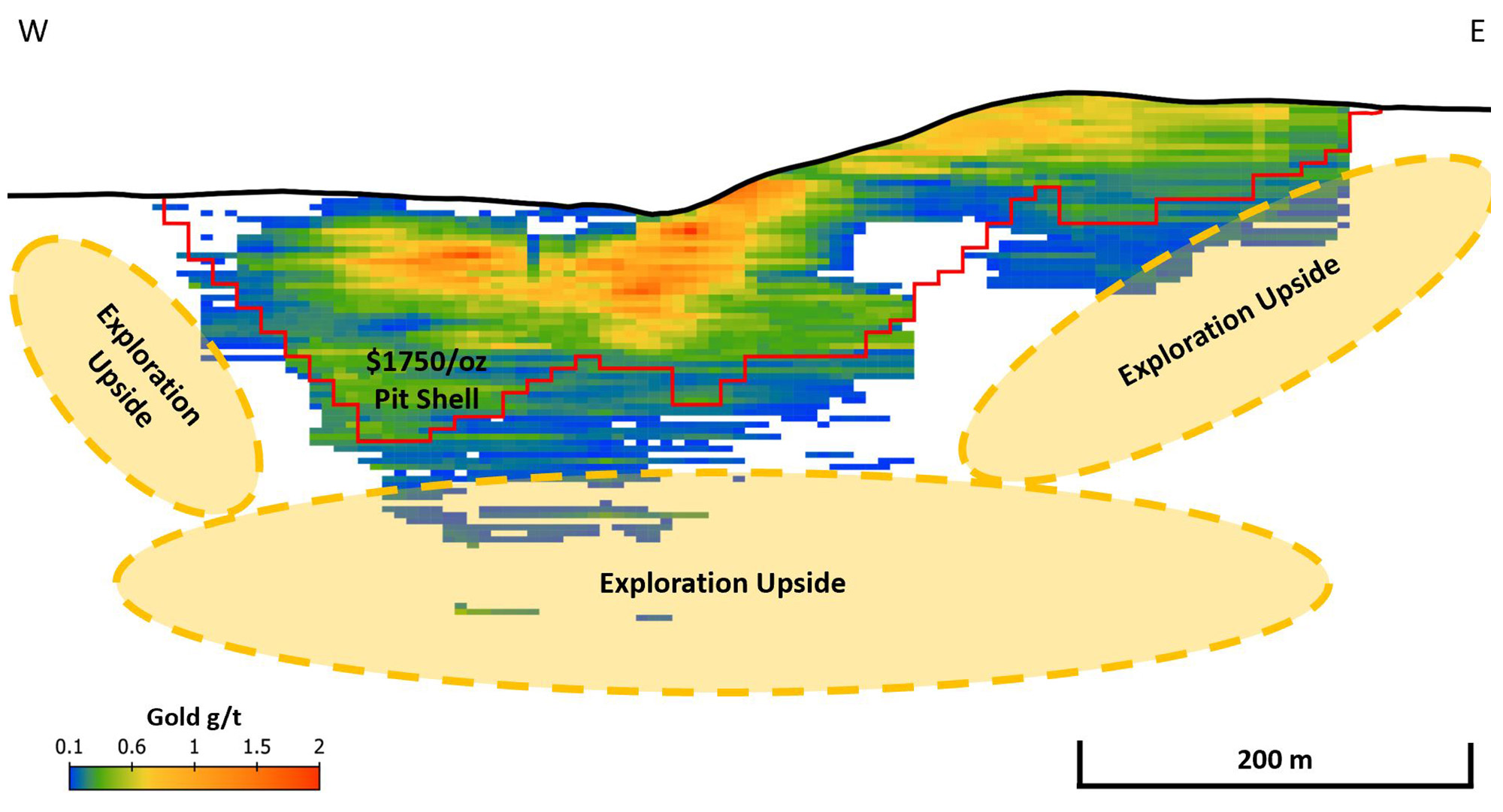

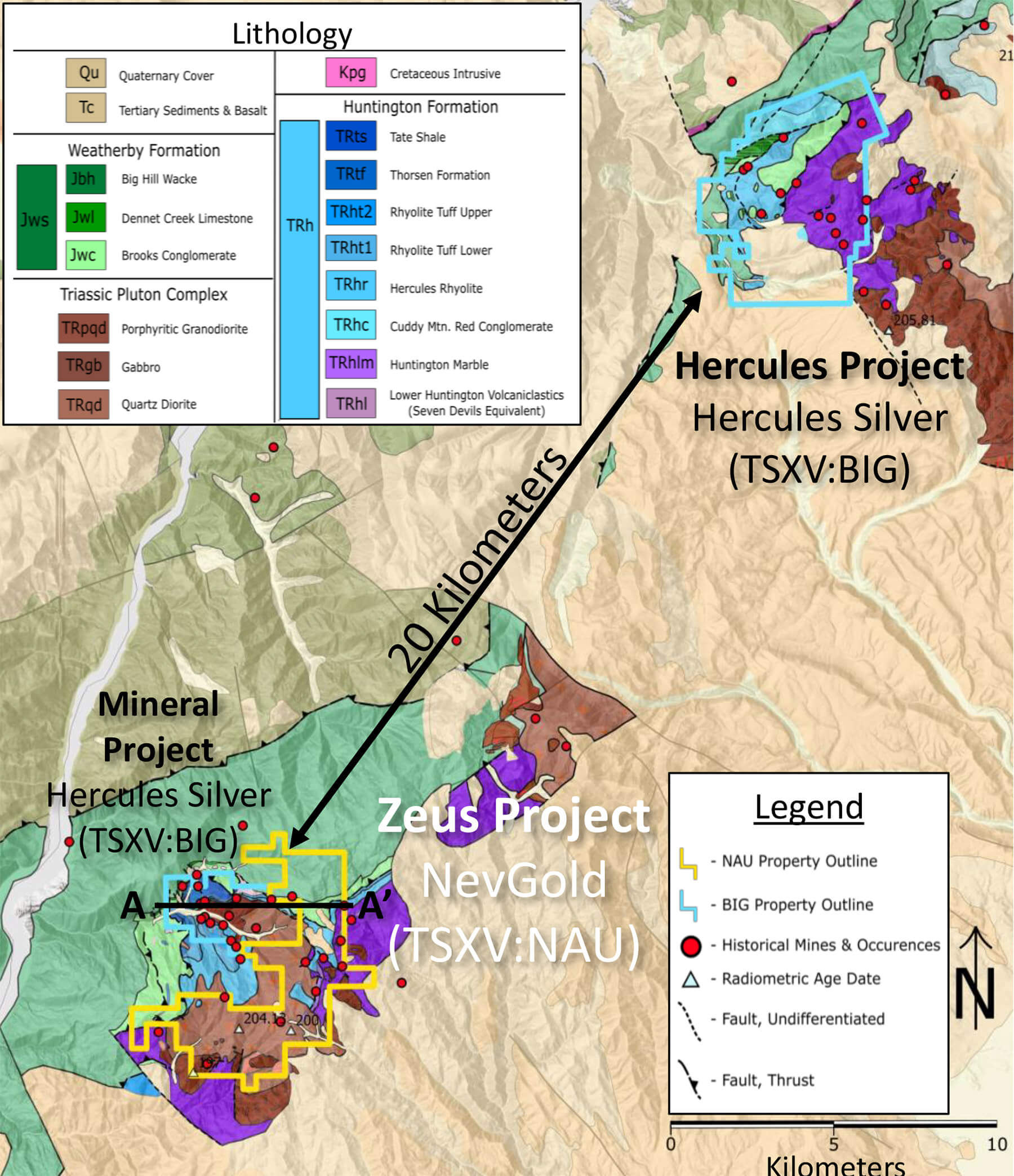

NevGold isn’t exactly secretive about its plans to advance the Zeus project in Idaho, and the beauty of this financing deal is that should there be a catalyst at Zeus (or on any other project, or even just a general market uplift), NevGold can retire the convertible security and settle all outstanding amounts in higher-priced shares (or cash, but if funding still isn’t easy in the junior mining space we’d prefer to see a settlement in shares while a 10% discount to VWAP incentivizes the lender to take the repayment in stock).

Considering all other options that were on the table, this financing is a pretty good agreement. The company needed cash and the structure of the Mercer Global agreement work in NevGold’s favor. The stock was trading at about C$0.35 right before the deal was announced (and the share price was even lower in the days leading up to the announcement), and raising C$3.5M in a normal private placement would likely have resulted in a placement price of C$0.28 (a 20% discount), resulting in 12.5M shares being issued (and a minimal chance to maintain the warrant pricing of C$0.525).

Assuming a fixed price of C$0.35 for the closing fee and the Original Issue Discount, the C$0.77M would be converted into 2.2M shares, so in a worst case scenario, NevGold would only issue 12.2M shares under this scenario. While in a C$0.28 PP scenario it would have to issue 12.5M shares and pay a 6-7% finders fee to brokers on top of that.

Conclusion

Convertible funding agreements rarely work out in a junior’s favor, but NevGold’s deal structure almost makes it look like the company was negotiating from a point of strength rather than a non-revenue company. Having a ‘friendly party’ on the other side of the table obviously also helps, and we consider this raise to be a win-win situation. NevGold fills up its treasury without having to bend over backwards when it comes to the terms while Mercer Global will make some money on the closing fee and the original issue discount.

This clears an important hurdle for CEO Bonifacio and his team and the focus can now fully go back to the projects. It has been a while since we saw an update on the Zeus project in Idaho so hopefully we hear more news in the near future. And with the gold price reaching and exceeding $2500, the company’s Limousine Butte gold project in Nevada and Nutmeg Mountain project in Idaho are becoming increasingly attractive as well.

Now that the treasury is full again, the NevGold team can focus on generating value in the field again.

Disclosure: The author has a long position in NevGold. NevGold is a sponsor of the website. Please read our disclaimer.