Red River Resources (ASX:RVR) has cracked the code at its Thalanga zinc project as the improvements in the second half of its financial year are pushing the company into a positive free cash flow territory as the production of a separate copper concentrate increases the value of the lead concentrate. Meanwhile, the grades of the zinc and led concentrates continue to comfortably meet the smelters requirements, and those are the main recipes for Red River’s free cash flow performance in the second half of its financial year (which ended on June 30).

As Red River is currently cash flowing, the company is already thinking about its next steps as the reserves and resources at its flagship Thalanga project are relatively small. Red River has just entered into an agreement to acquire the Hillgrove gold-antimony project and if it’s able to come up with a fine-tuned mine plan, the current high gold price may make this cheap acquisition very interesting.

The first full year of mining operations

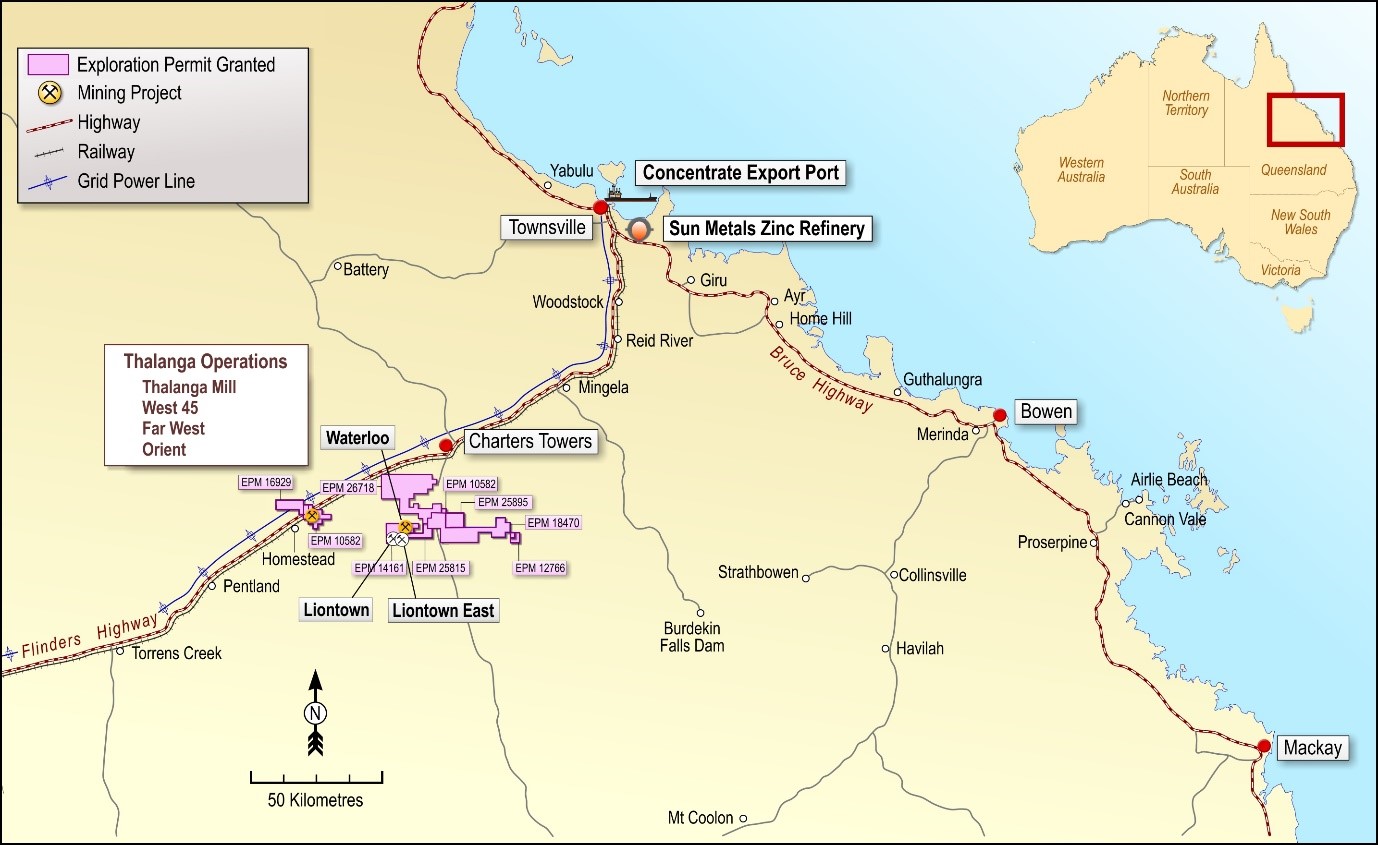

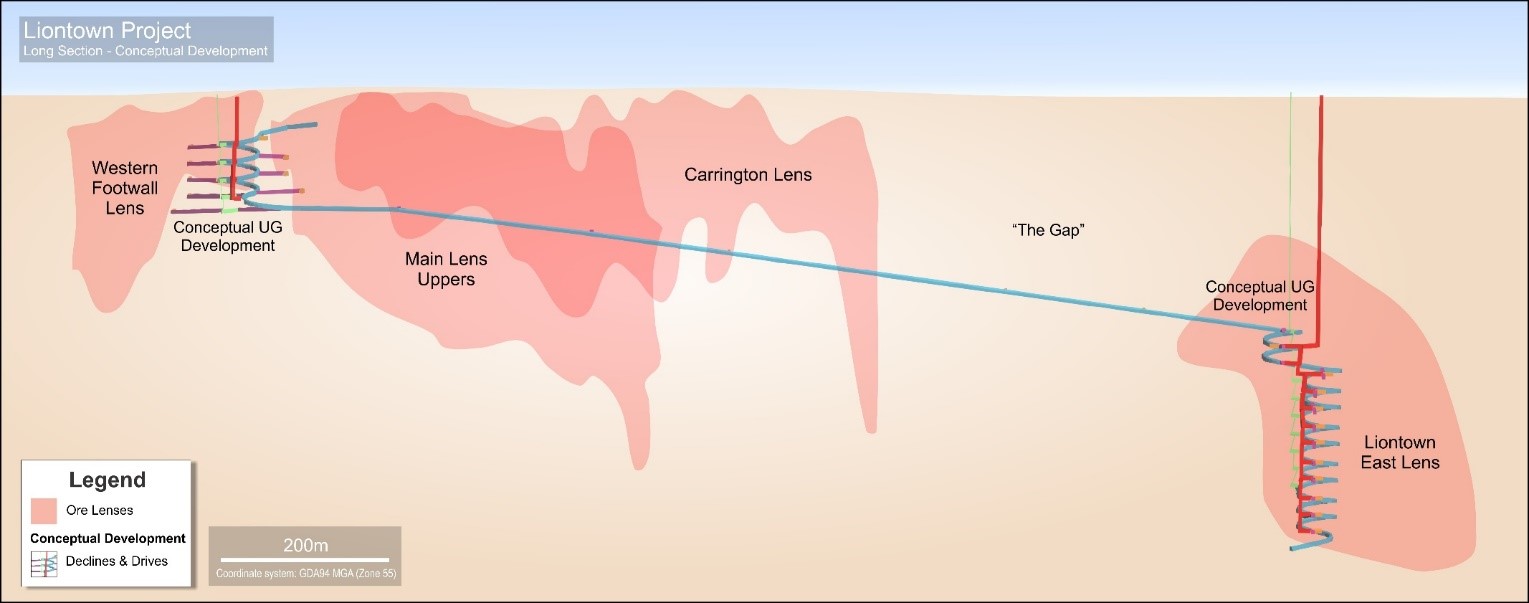

Red River Resources has now completed its first full year of mining at the Thalanga polymetallic deposit (which hosts a zinc-lead zone as main mineralization with a 0.5% copper grade 47 g/t silver grade and 0.2 g/t gold grade as additional kickers).

The recovery rate of the zinc remains high at 88.6% throughout the financial year, and the zinc grade in the concentrate remains excellent as well; notwithstanding a small bump in the road in Q4 when the zinc grade in the concentrate was ‘just’ 55.4% (which still comfortably meets the offtake requirements), the very high concentrate grade in Q3 of 59.3% was a real eye-catcher. A total of 32,504 tonnes of zinc concentrate were produced and given the 56.7% zinc grade and 85% payability of zinc in the zinc concentrate, Red River produced just over 40 million pounds of zinc, of which approximately 34-35 million will be payable.

The lead concentrate also comfortably meets the offtake specs with a lead grade of almost 66% while the 809 g/t silver grade will provide a nice boost to the lead concentrate revenue. The average copper grade in this concentrate remained high (2.5% on an annual basis) but has been trending down as the production of a separate copper concentrate should add tremendous value for copper payabilities.

The current mining rate is approximately 350,000-400,000 tonnes per year and based on the current reserve estimate of 1.55 million tonnes, the remaining mine life based on the reserves is just 4 years. However, Thalanga contains an additional of 3.55 million tonnes of rock if you include the inferred resource categories and Red Rivers first and only priority should now be to convert a large part of the inferred resource into a reserve category and bring it into the mine plan to ensure the mill remains filled for the next few years. The Thalanga plant has been designed for a throughput of 650,000 tonnes per year, so if Red River is successful in finding more higher-grade resource zones, there’s no reason why Thalanga couldn’t (temporarily) increase the throughput to process those tonnes as fast as possible.

It’s also very interesting to see the average grade of the inferred resources contains higher copper, zinc and gold grades than what has been mined in the past few quarters, but the silver and lead grades are slightly lower. This should have no impact on the economics as the higher-grade material of the other commodities compensates for this.

What does this mean for the financial results?

The first half of the year wasn’t too impressive, so the financial results of Red River are predominantly skewed towards the second half of the year.

The full-year revenue was approximately A$97.4M, of which A$3.76M was reported as a net income after deducting the operating expenses and the depreciation and finance expenses.

While the company was profitable, it usually matters more how much free cash flow it’s generating as the cash will be needed to convert resources into reserves before incorporating those into the mine plan, while the redevelopment of the Hillgrove project (see later) will also require Red River to spend quite a bit of cash.

Red River reported an operating cash flow of A$23M, but it’s always worth the time to have a look in the footnotes (in RVR’s case, we refer to footnote 32 in the annual report) to check on how the company got to this result. In Red River’s case, there was a substantial contribution from changes in its working capital position and if we would adjust the operating cash flow for these additions, we end up with a corrected operating cash flow of A$17.4M, which we consider to be a better starting point to determine how much free cash flow Red River is generating.

Going back to the cash flow statement, we see Red River spent almost A$13M on mine development and capitalized A$4.3M in exploration and evaluation expenditures (no exploration costs were expensed during FY 2019). This means Red River was almost exactly cash flow neutral, and it looks like this was done on purpose as Red River has the ability to throttle a part of its mine development expenditures and a large part of its investments in exploration.

The majority of the exploration budget at Thalanga was focusing on the Kitchen Rock Hill, where 2,660 meters were drilled in seven holes, but an independent consultant ruled that zone wasn’t expected to host viable mineralization so the drill program at Kitchen Rock Hill was suspended until Red River gets a better interpretation of the mineralized structures there.

It’s also important to emphasize virtually the entire operating cash flow was generated in the second half of the financial year (Jan 1- June 30) as that’s when the Thalanga mine was finally reaching its designed and expected throughput and recoveries. In the first half of the year, for instance, Red River generated zero operating cash flow (although we have to admit the company did not provide a detailed operating cash flow statement, so perhaps some investments in the working capital position were hiding the true underlying cash flow).

Adding an antimony project to the asset portfolio

Red River continues to look for new projects and has now signed an agreement with Bracken Resources, a private company, to purchase the past-producing Hillgrove project in New South Wales. An asset with a history as mining commenced in 1857 for an initial period of approximately 65 years before shutting down for about 45 years.

Hillgrove – Bakers Creek Waste Rock Dump (August 2019)

Hillgrove –

Bakers Creek Waste Rock Dump Sampling Locations (Sept 2006)

The mine reopened in the 60s and different owners have been trying to keep the mine open. The current seller, Bracken Resources, has purchased the property for A$33M in 2013 and subsequently invested an additional A$40M in the asset before shutting the mine down in 2016 due to the low antimony prices. On a combined basis, the previous owners have invested almost A$200M in the asset and Red River is now picking it up for A$4M in stock (23 million shares).

Although the historical production at the mine totalled 730,000 ounces of gold and 50,000 tonnes of antimony, there still appears to be plenty of gold and antimony left. A 2012 JORC compliant resource estimate contains 2.8 million tonnes (including 1.8 million tonnes in the measured and indicated resource categories) at a grade of 5.1 g/t gold and 1.7% antimony for 459,000 ounces of gold and 48,000 tonnes of antimony. Admittedly, this resource isn’t huge but as pretty much all of the infrastructure is already in place, the resource doesn’t have to be big to justify looking at a scenario to re-open the mine as the current high gold price (around A$2000/oz) will compensate for the lower antimony prices. In fact, Red River could look into the potential scenario to just stockpile (a part of) the antimony and only sell it once the antimony price has gained some strength. This would obviously depend on the company’s cash needs.

Red River obviously will have to complete a lot more work at Hillgrove before making a development decision, but it looks like the vein deposit has a good shot at being redeveloped as the metallurgical test work (conducted in 2016 and 2017, so that’s quite recent) shows a 91% recovery rate for the gold and 86% for the antimony. Additionally, at the Sunlight deposit (which hosts 680,000 tonnes at an average grade of 8 g/t gold and 0.3% antimony of which 530,000 tonnes are in the measured and indicated categories), approximately 20% of the gold could be recovered through gravity separation. Hardly a surprise as this zone is particularly gold-dominant with very little antimony.

Conclusion

It’s tough to be a zinc producer right now, and we aren’t sure Red River will continue to keep up its strong H2 FY 2019 performance as the zinc price is currently trading lower while the TC/RC expenses charged by the smelters who treat the zinc concentrate have gone up. Given these circumstances, it would probably make sense to expect a weaker start of the current financial year, and whether or not Red River will be able to show a positive free cash flow will depend on its development and exploration pace.

Adding the Hillgrove project to the asset portfolio appears to be a good move as Red River is gaining more experience as an underground mining company while the current gold price might create some momentum for Red River. And of course, having a net cash position of in excess of A$25M is also very helpful as Red River is undoubtedly looking to aggressively (re)develop Hillgrove and is perhaps looking for other acquisitions.

Given the company’s success with the Thalanga deposit, we hope Red River has Vendetta Mining’s (VTT.V) Pegmont project on its radar as it could apply the skills it earned by mining Thalanga to Pegmont, which consists of an open pit and an underground phase. Additionally, Red River already has the zinc- and lead concentrate offtake agreements and connections in place, so adding a new Australian lead-zinc project to its portfolio perhaps isn’t too far-fetched.

Disclosure: The author has no position in Red River Resources. Red River is not a sponsor of the website.