The hottest exploration result of the week undoubtedly was released by Vizsla Resources (VZLA.V) which published the assay results of the newly discovered Napoleon vein on its project. The new holes seem to confirm the ultra high-grade silver-gold mineralization over mineable widths and with a 3.7 meters containing almost 13 kilos of silver-equivalent per tonne of rock, the market obviously reacted positive. Vizsla’s share price tripled this week and the company was able to raise C$25M on the back of these new holes.

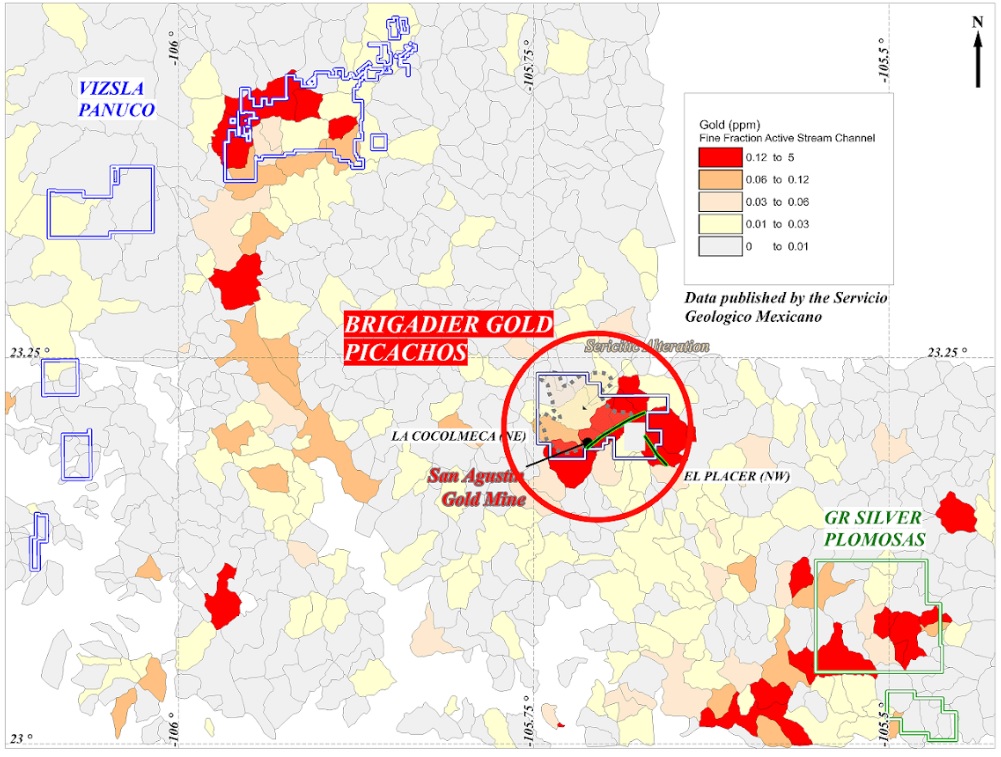

Investors subsequently took a step back and started to look in the same Sinaloa region to see who else owns land nearby that could benefit from the ‘nearology’ game. On Monday night, coincidentally just 36 hours before Vizsla announced its barn-burner hole, Brigadier Gold (BRG.V) announced it had snapped up the Picachos project from Minera Camargo. Picachos is located pretty much in the middle between Vizsla Resources’ Panuco project and GR Silver Mining’s (GRSL.V) assets in the Rosario mining district. As the crow flies, we estimate it’s just about 25 kilometers from Brigadier’s Picachos asset to either Plomosas or Vizsla Resources.

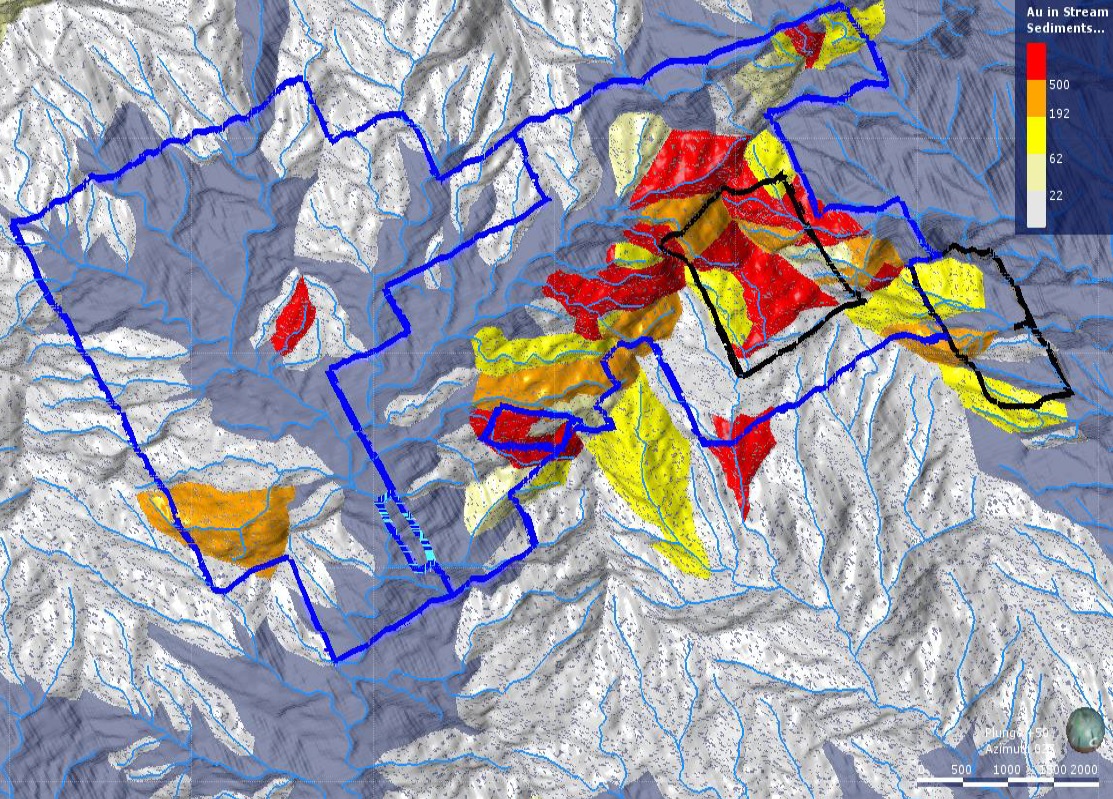

Brigadier’s website is now back online, and the details unveiled in the acquisition press release sound promising. The almost 4,000 hectares form a contiguous land package (with two small third party owned concessions that could potentially be sufficiently interesting to consolidate the entire area) with both a copper porphyry zone but more intriguingly, a vein system where previous exploration and mining activities have encountered an abundance of gold and silver. At this point, the precious metals bearing veins are the most interesting part of the project as the largest vein system has been traced for about 7 kilometers along a fault zone in a northeasterly direction, but a northwest trending different vein system (traced for about 4 kilometers, of which 1.5 kilometers is on the Picachos concession) is crosscutting that 7-kilometer long vein system.

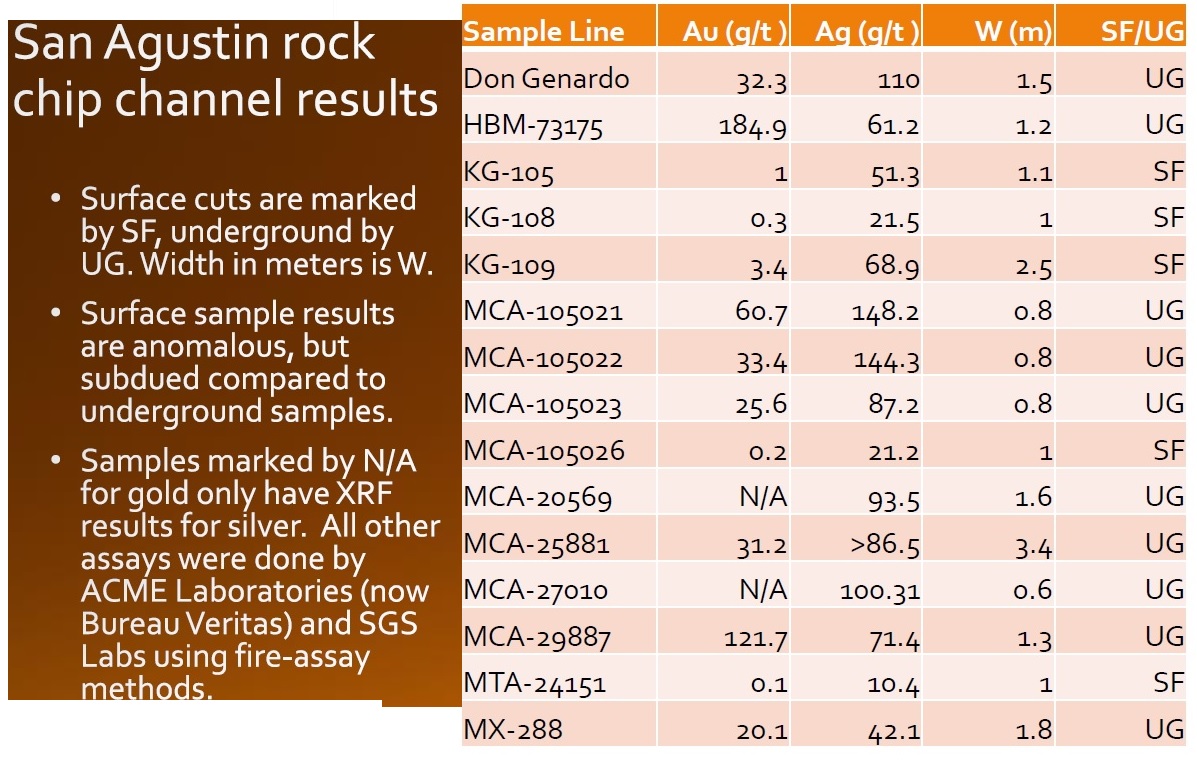

These vein systems host the past-producing San Agustin gold mine. There are thousands of these type of small mines in Mexico and having two past producing mines on the concessions doesn’t necessarily mean much, but when a previous operator in 1997 sampled the stoped area, it encountered 1.2 meters of 81.2 g/t gold and just over 73 g/t silver. Excellent grades which were subsequently mined out, but a more recent exploration program by London-listed Vane Minerals reported assay values of about half an ounce of gold and 2 ounces of silver per tonne of rock recovered from a test mining program.

Both the 1997 and 2014 gold (and silver) values were encountered in a sampling program and it’s important to note the San Agustin vein (which hosts the small mine) has never been drill tested.

Brigadier started the week with a market capitalization of around C$12M based on the 26 cent share price but ended the week at 50 cents per share (after hitting C$0.62/share on Friday) for a market cap of around C$22M. Brigadier Gold is taking advantage of the situation by raising money and a C$2.5M private placement was upsized on Friday. Brigadier now aims to raise C$3.5M by issuing 13.46 million units priced at C$0.26 (which, surprisingly, is one cent higher than the original placement price of C$0.25) with each unit consisting of one common share and a full warrant with a C$0.40 exercise price.

We have scheduled a call with Brigadier’s management team next week and hope to get more clarification on a few additional details but one thing’s certain: Brigadier’s timing to acquire the asset was impeccable.

Disclosure: The author has no position in Brigadier Gold but plans to participate in the 26 cent financing. Brigadier Gold currently is not a sponsor of the website, but could become one.