We expect the company to release its September production results any day now and despite a setback due to the unfortunate death of a contractor’s employee at the mine site, Silver X Mining (AGX.V) should be able to report a strong production result as the company continued to ramp up its output.

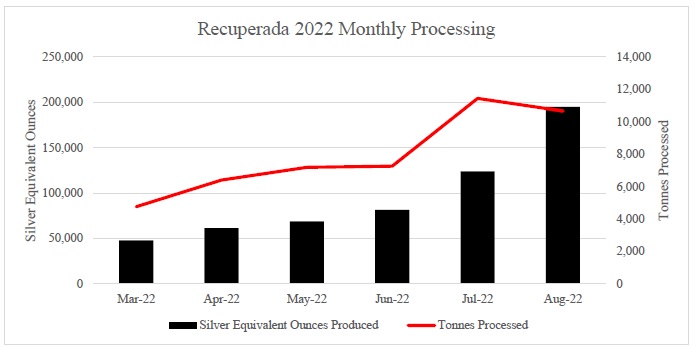

In August, for instance, the total silver-equivalent output was just under 200,000 ounces thanks to a very high head grade of almost 600 g/t silver-equivalent and strong recovery rates with for instance 87% for the silver, 80% for gold, 84% for zinc and almost 90% for lead. The recovery rate for gold is interesting and we are looking forward to seeing how the trend further evolved in September as the company planned to have a new centrifugal gravity circuit in place.

The company should now be cash flow positive (we are looking forward to seeing the Q3 financial results to see how much cash flow Silver X actually generated) and this also increases its flexibility as AGX can now easily spend more money on for instance exploration (unlike so many other cash-strapped companies). Just last week, the company released an update on new diamond drilling and channel sampling results.

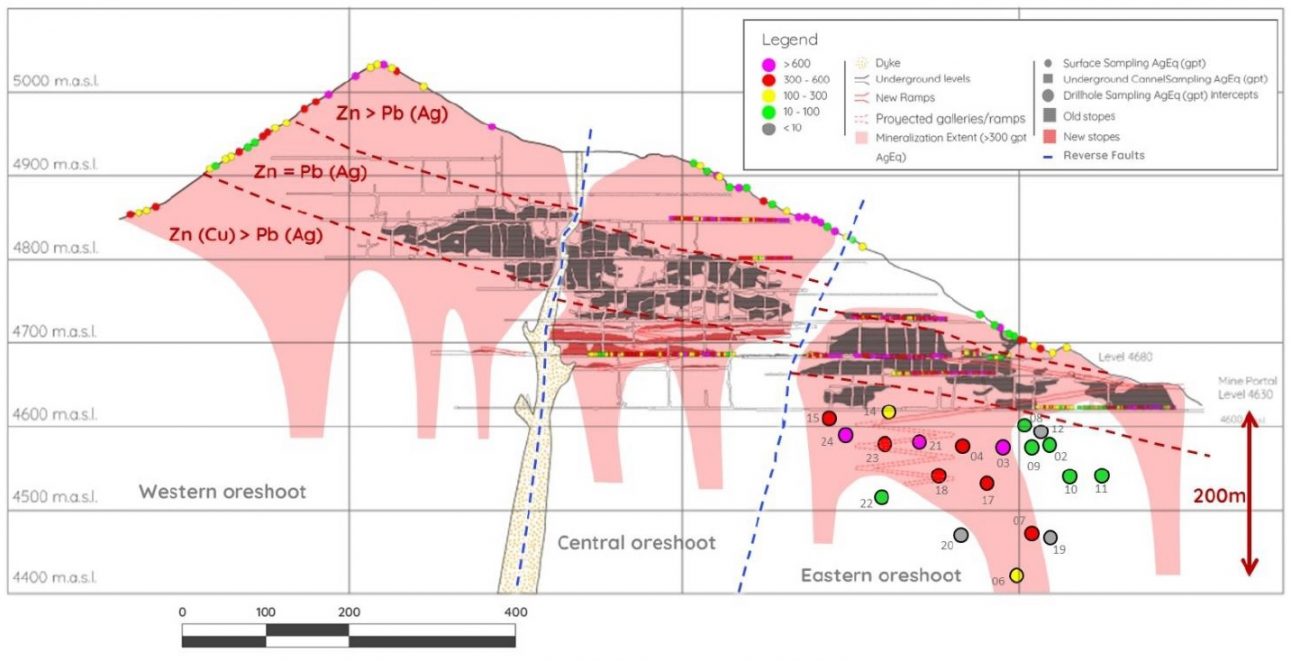

According to the interpretation of the exploration results, the 1.4 kilometer long Tangana 1 vein has been offset by a series of cross-cutting faults, essentially creating three separate blocks. And according to this interpretation, the Western block is now anticipated to contain higher grade silver mineralization. That would be a very positive development as this area of the Tangana vein is completely preserved. Additionally, the new exploration theory outlined at Tangana 1 could now also applied on the other veins on the property.

Disclosure: The author has a long position in Silver X Mining. Please read our disclaimer.