Stellar Diamonds (STEL.L) has released the results of a Preliminary Economic Assessment on the Tongo-Tonguma project (which is now one large project after Stellar and Octea Mining decided to combine both projects.

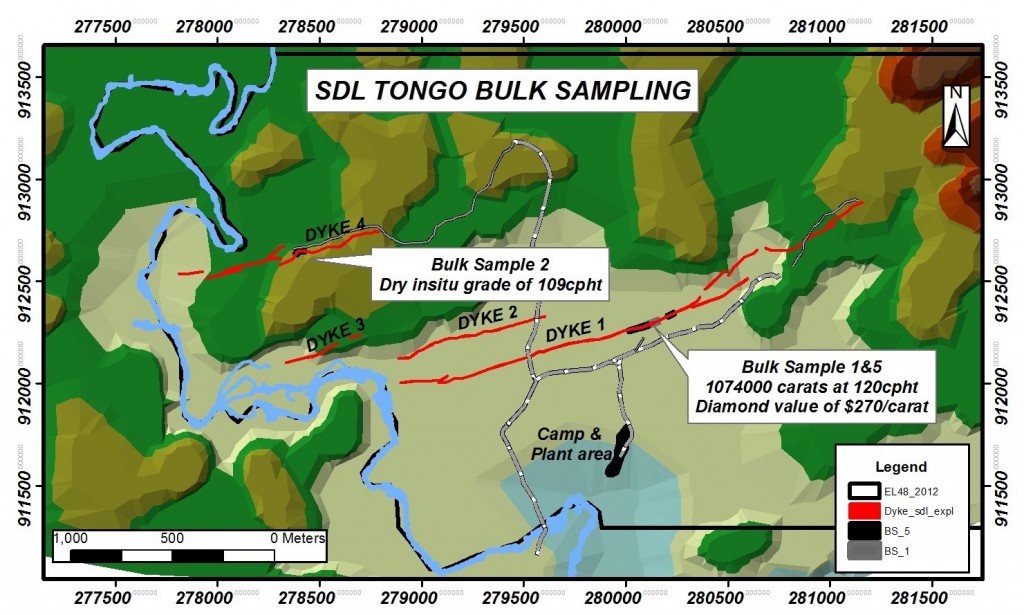

The PEA is based on a 21 year mine life and aims to recover 3.9 million carats (of the 4.5 million carat resource), excluding the potential of the high-grade kimberlite dykes on the property which haven’t been added to any resource category just yet. The operating cost is expected to be just $115/carat and as Stellar thinks it will be able to sell its diamonds at almost $230/carat, the operating margin is just over $110/carat, resulting in an annual cash flow of $18M. That’s indeed low, but as the initial capex is less than $32M, the IRR comes in at 49% whilst the pre-tax NPV10% is approximately $172M.

The discount rate of 10% is quite high, and if you’d take the net cash inflows into consideration (pre-tax, and undiscounted), Stellar’s mine will generate $580M in net cash inflow.

Go to Stellar’s website

The author has no position in Stellar Diamonds. Please read the disclaimer