Sun Peak Metals (no ticker symbol yet) still is a private company but is planning on completing its IPO later this summer. The company will be presenting today at the Virtual Metals Investor Forum where it very likely plans on releasing the drill results from the 12 hole drill program. While those holes have not been released on the company website, the recently filed prospectus on SEDAR does already contain the assay results from the 6 holes drilled at Mai Argab and Adi Ekele.

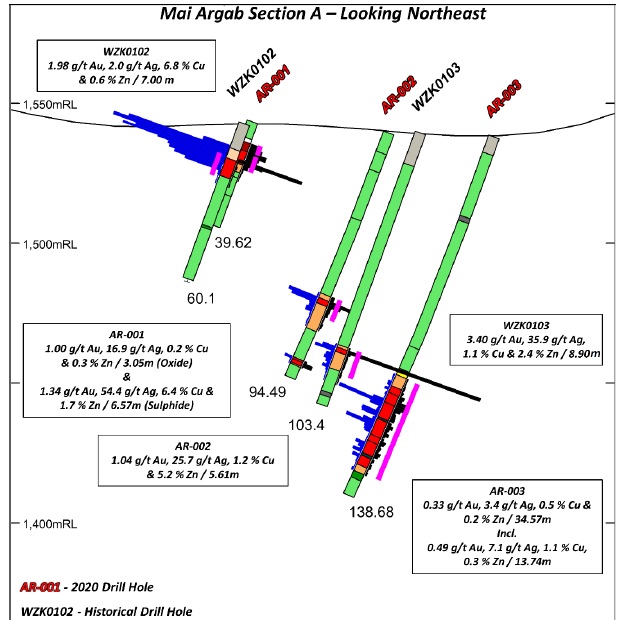

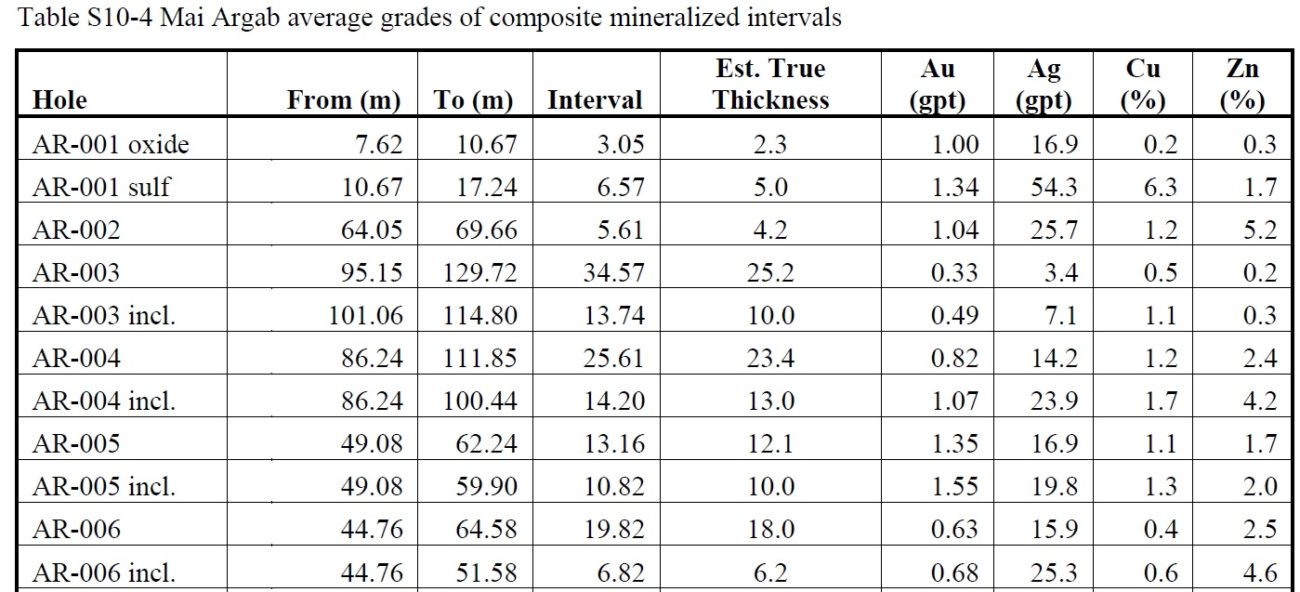

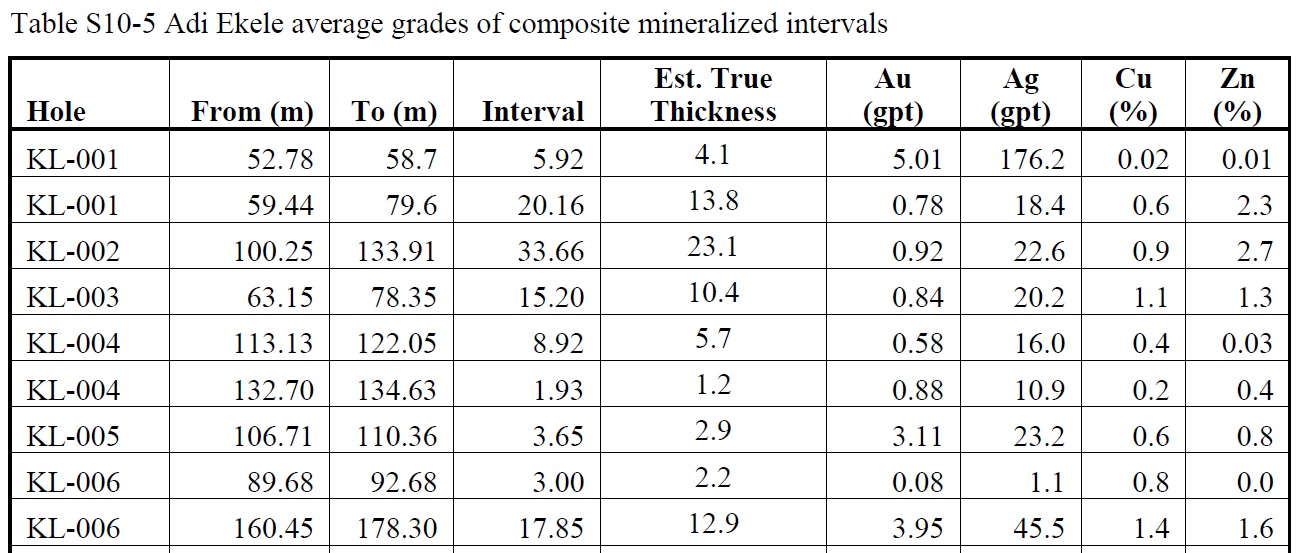

All twelve holes have hit the mineralization they were targeting, confirming the presence of a polymetallic VMS-type system reminiscent of the Bisha mine across the border in Eritrea.

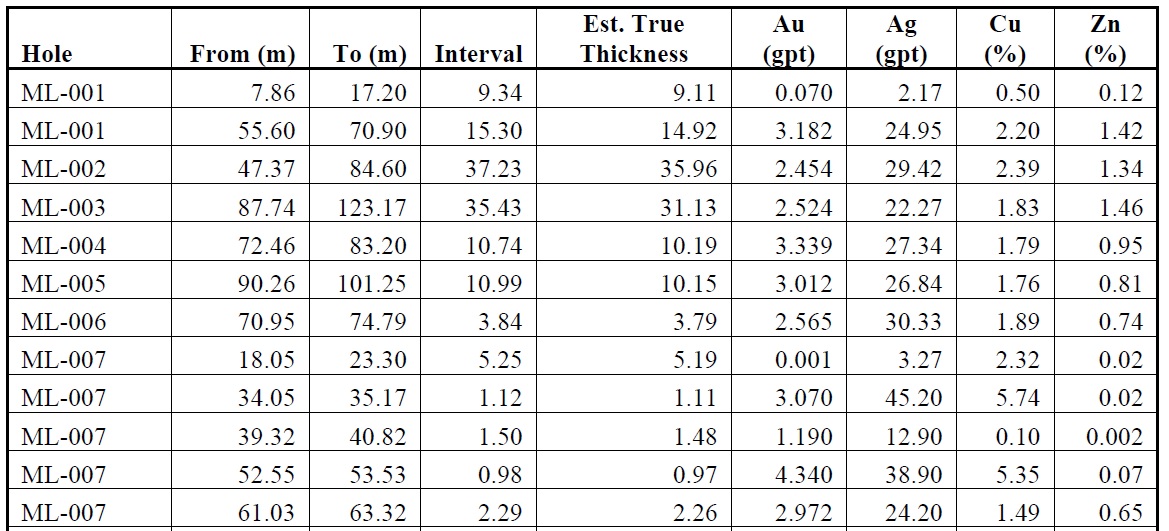

The main attention grabber were the drill results at Meli. Whereas the company did encounter intriguing mineralization on the two aforementioned zones, the thickness and grades appear to be much more consistent (and much closer to surface) at Meli:

Sun Peak will very likely ramp up its marketing efforts in the coming weeks in anticipation of the IPO (which will very likely happen in July), and we are looking forward to seeing more details about the upcoming drill program. Sun Peak won’t have to raise money when it goes public as the most recent financial statements (March 31, 2020) indicate the company had a working capital position exceeding C$12M (page 178 of the prospectus). As the drill program was completed in the first quarter, the remaining working capital position should exceed C$10M by a wide margin, allowing Sun Peak to continue drilling.

Sun Peak’s presentation will be held at 12:05 PM PST (1:05 PM Calgary time, 3:05 PM Toronto time, 8PM London Time and 9PM Paris/Brussels/Frankfurt time) and can be accessed here.

Disclosure: The author has a small long position in Sun Peak Metals, acquired during the most recent private round at C$0.35.