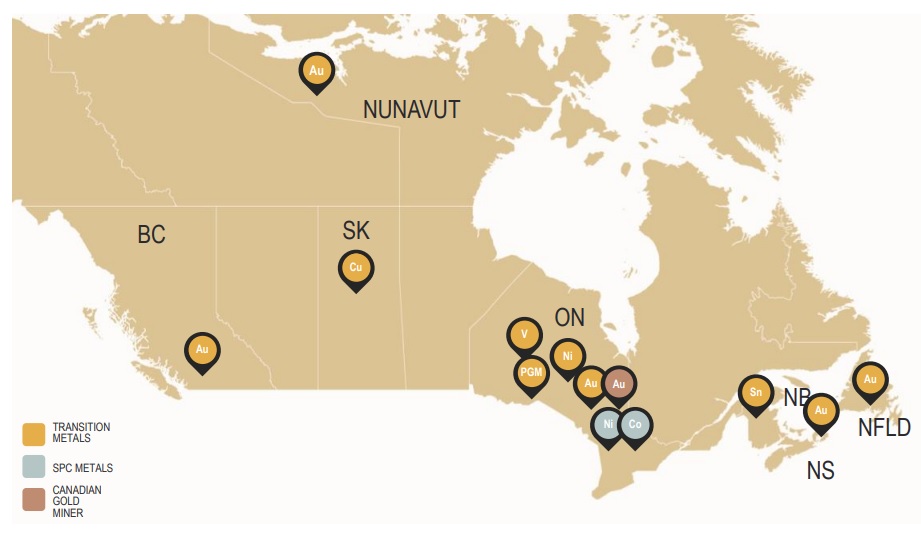

Transition Metals (XTM.V) has now sold its Dundonald Nickel project (located in Ontario, Canada) to VaniCom, an Australian company. Transition has now received C$150,000 in cash and will also receive C$350,000 worth of stock in VaniCom. On top of that, VaniCom pledged to spend at least C$750,000 on exploration during the initial 36 month period of the agreement, and it will issue a 2.5% NSR to Transition Metals. It looks like the NSR agreement does not include a buyback option for VaniCom.

Taking all elements of the deal into consideration, Transition Metals did negotiate a good agreement as it will receive C$0.5M in stock and cash, while VaniCom will spend an additional C$750,000 on advancing the property, and that’s a good deal for an early stage exploration property. The historic resource estimate of 116,000 tonnes of rock with a nickel value of 3.16% is an interesting project but should VaniCom indeed be able to confirm the viability of the project, Transition’s stake in VaniCom and the 2.5% NSR will allow Transition to maintain exposure to (potential) further exploration and development success.

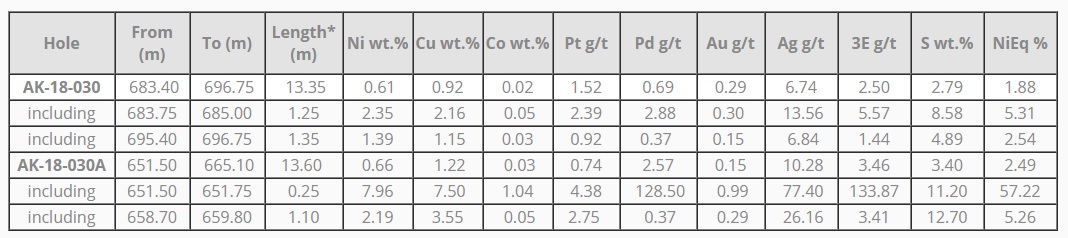

Meanwhile, Transition Metals continues to work on its own (an joint ventured) assets, and a recent update on its Aer-Kidd project in Ontario (which is part of a joint venture with SPC Metals wherein it owns a 28% stake) confirmed the presence of polymetallic mineralization down-dip of the past-producing Robinson mine. The drill bit encountered 13.35 meters containing 1.88% Nickel-equivalent (with 0.61% nickel), including 1.25 meters carrying 5.31% nickel-equivalent (including 2.35% nickel).

Go to Transition’s website

The author has no position in Transition Metals. Please read the disclaimer