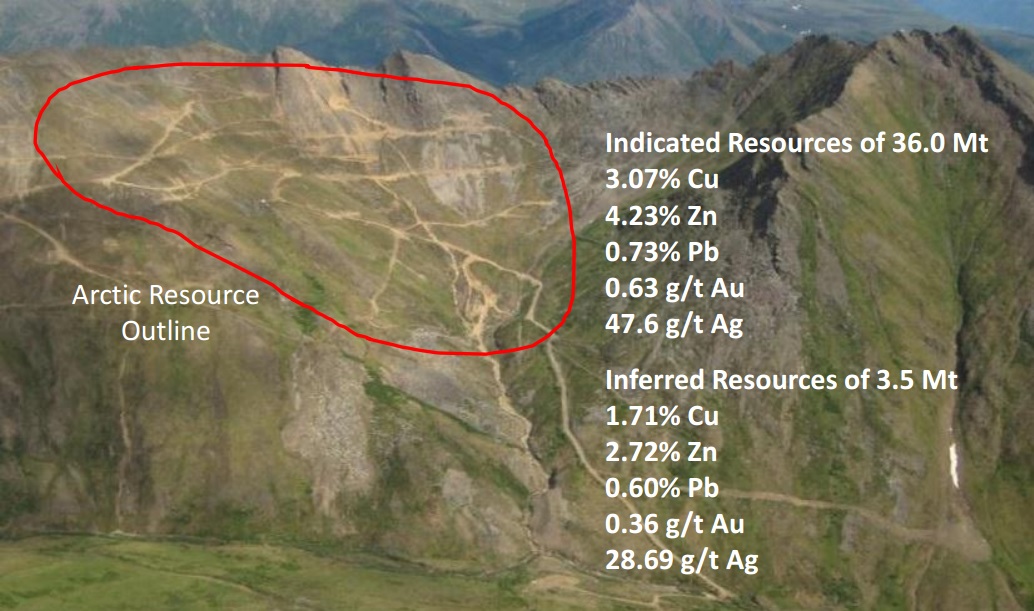

Trilogy Metals’ (TMQ, TMQ.TO) most recent resource update at the Arctic zone in Alaska was pretty impressive, as the deposit is now expected to contain a pit-constrained (!) resource of 36 million tonnes at an average grade of in excess of 3% copper, 4.23% zinc, 0.73% lead, 0.63 g/t gold and approximately 1.5 ounces of silver per tonne of rock.

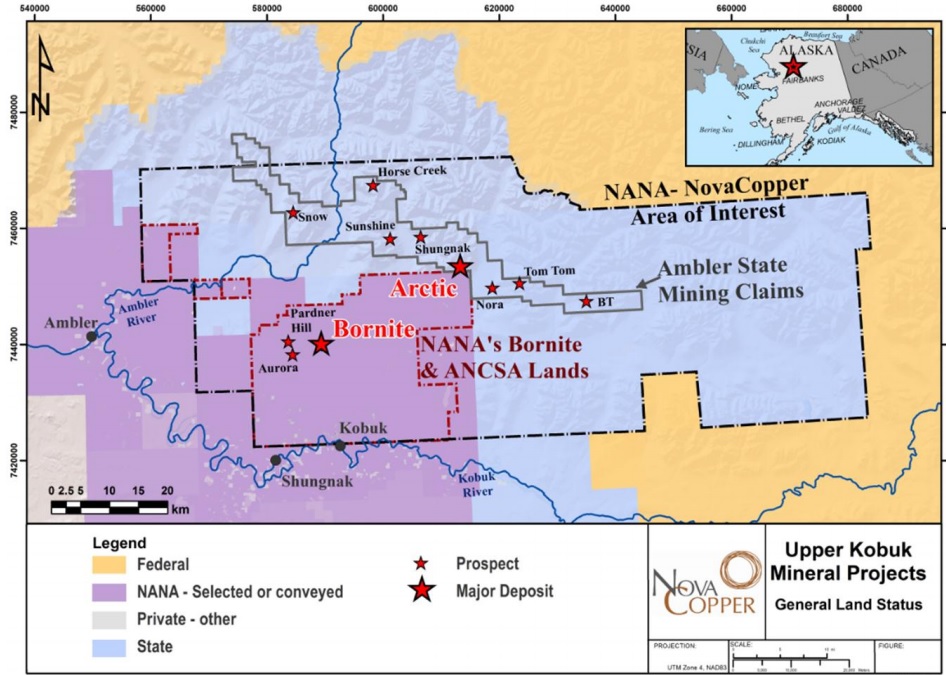

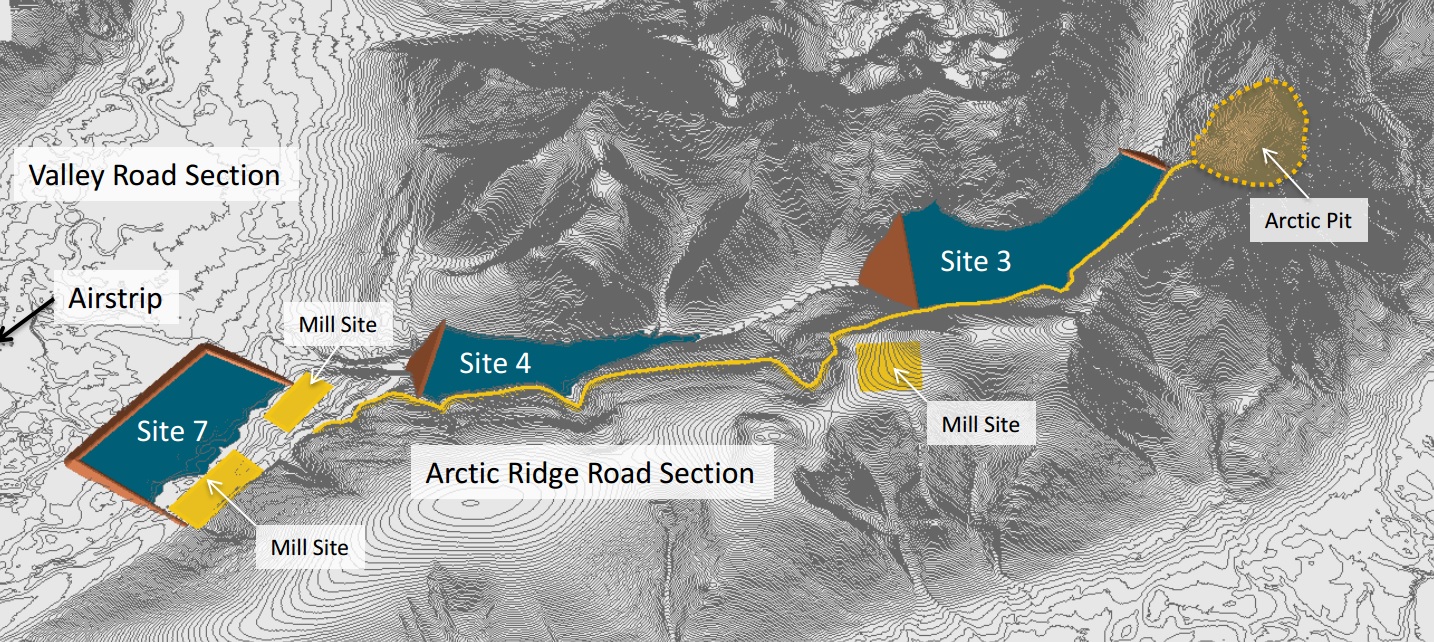

The average grades are absolutely stunning, and even though the Arctic deposit is pretty much located in the middle of nowhere (we hope to see the road construction activities to unlock the Ambler district to start soon), with this average grade you can make pretty much anything work. On top of that, the average recovery rates remain high at 92% for the copper and 88% for the zinc with both the copper concentrate and zinc concentrate having a high average grade as well which could very well result in a premium pricing.

This resource update will also be very interesting for South32 (ASX:S32, S32.L), which has taken an option to form a 50/50 joint venture with Trilogy on its Alaskan assets. As part of the agreement, South32 will be required to pay $10M per year for the next three years to keep the option in good standing. That cash will be used to further advance the Arctic project, and the initial $10M will be spent on the Bornite deposit.

After these three years, South32 could elect to exercise the option and pay $150M to acquire a 50% stake in Trilogy’s assets, and Trilogy’s management team thinks this cheque will be sufficient to cover the feasibility and permitting expenses.

Go to South32’s website

The author has a long position in South32. Please read the disclaimer