Bigger isn’t always better. As the market has moved from preferring projects with a high Net Present Value to Internal Rate of Returns to emphasize the profitability of said projects, several large projects were suddenly no longer considered to be interesting (think about the Livengood gold project in Alaska, or NovaGold’s large but high-CAPEX gold projects).

There are exceptions to these preferences. Unlike precious metals projects, large companies in the base metals space usually prefer assets with a long mine life and multi-decade assets are preferred over smaller assets that run out of ore after 10-15 years.

Oroco Resource Corp (OCO.V) is earning into one of those assets with a potentially long mine life as preliminary indications show the potential of the Santo Tomas could be huge. Historical reports indicate there’s an established circa billion-tonne development target on the property, with considerable additional exploration upside, and the main question is not whether or not there is a huge porphyry system present on the claims, but how many of those tonnes would be viable at a consensus copper price. As the back of the envelope calculations will show, Santo Tomas appears to be viable, even at the current copper price but its total size and value remains to be determined.

It’s still early days for Oroco but after winning a multi-year legal title battle, the company can finally focus on advancing the property towards a resource compliant under NI 43-101 and perhaps to a pre-feasibility study over the next few years, both of which should drum up significant interest from strategic parties and possible suitors due to the size of the project.

The successful conclusion of the legal title dispute in Oroco’s favor will remove important ownership complications and make the earn-in scheme more comprehensible

The recent legal victory clears up almost two decades of legal title uncertainty, ensuring an ownership structure that will be more straightforward than before (although the situation will still remain complicated – see later). Now that the issues are effectively all resolved, Oroco can start planning its exploration programs at Santo Tomas, and this would be the first time in about 20 years any serious work will get done.

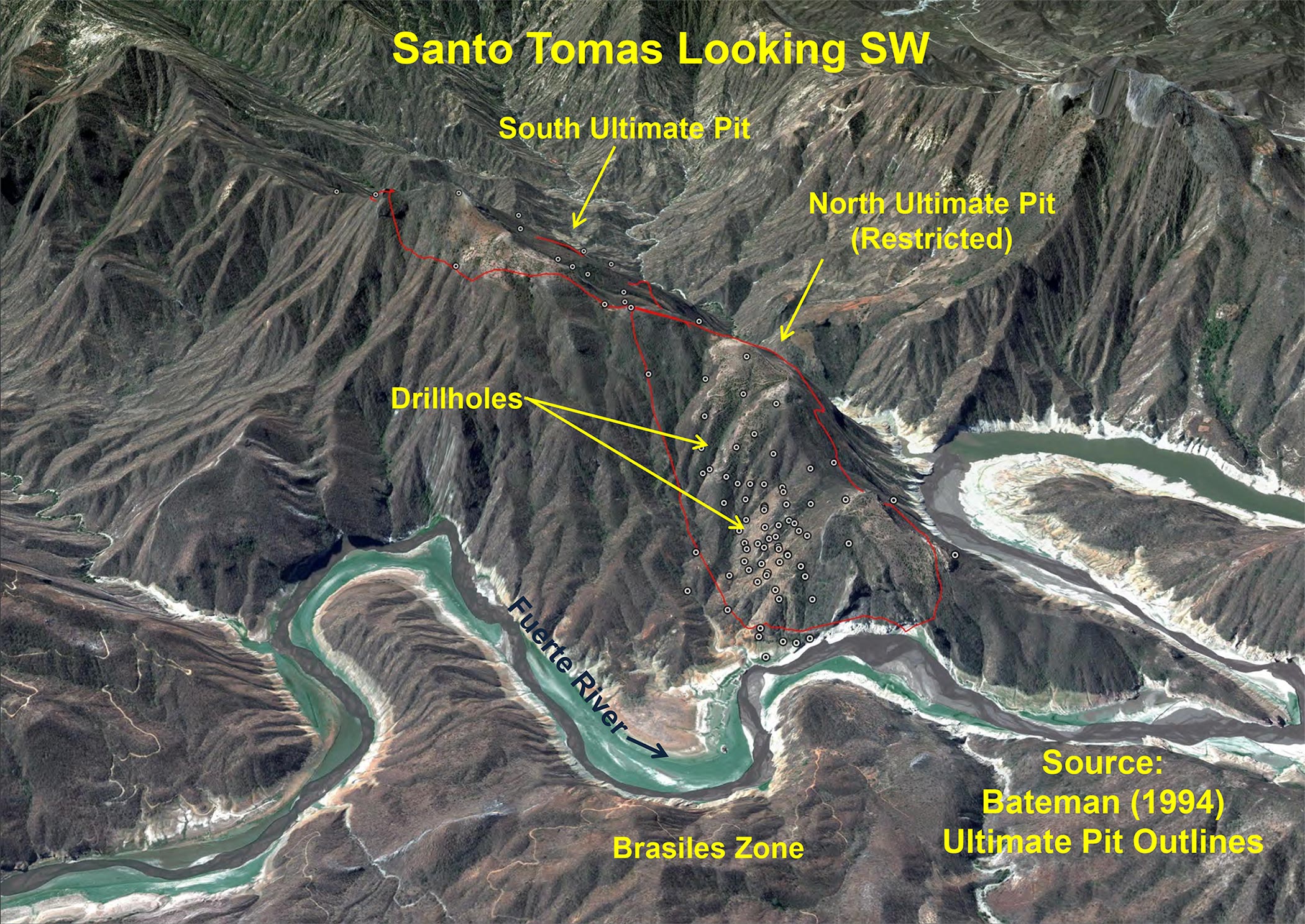

Since the publication of a PFS in 1994 (conducted by Bateman Engineering with input from Mintec), low copper prices and a legal title dispute starting in 2005 have prevented further advances at Santo Tomas. A lengthy legal battle covering a decade was required to resolve unwarranted claims and fraud on the part of an adversary. The adversary’s claims were thrown out in court in a final decision rendered in a court in May of this year, and Oroco is now in the final stages of the process to get all the claims re-registered to the rightful owner. When completed, Oroco’s ownership of Santo Tomas becomes more comprehensible.

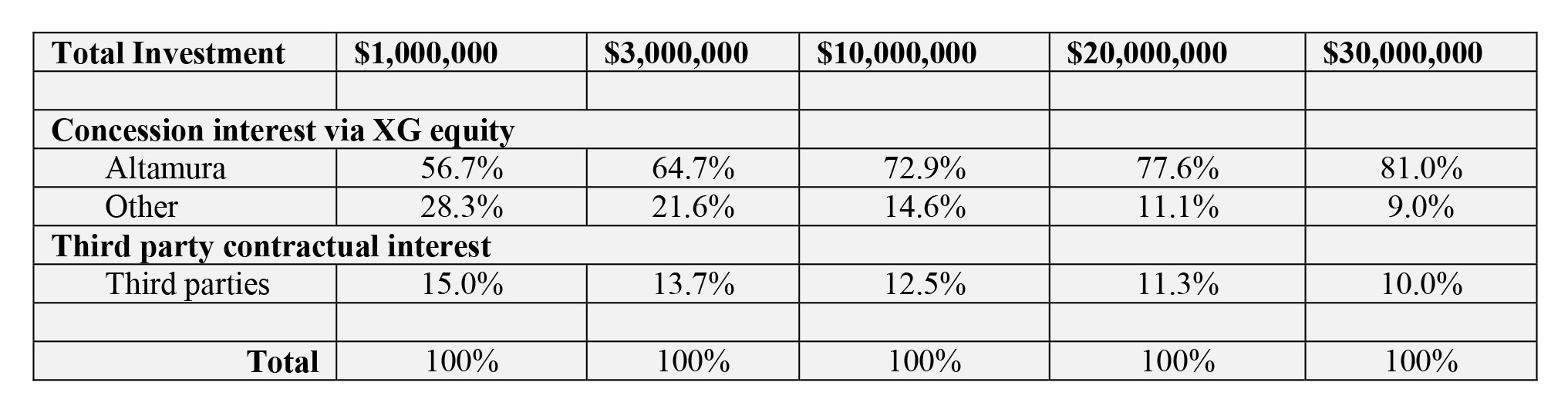

The first step is simple. Upon exercising its irrevocable option to acquire the private company Altamura copper (by issuing 39.8M shares), Oroco will control an effective interest of 56.7% in the core Santo Tomas claims.

Through a detailed earn-in schedule (which is not subject to any time limits so theoretically Oroco can take as long as it wants to complete the next stages), Oroco can increase its stake in Xochipala through expenditures on exploration and development – expenditures “into the ground” (rather than making cash option payments), advancing the project resulting in the dilution of the minority interest holders. Oroco’s MD&A filings contain the earn-in table, detailing that after spending C$10M, Oroco will have an attributable interest of 72.9% in the project, increasing to 77.6% after spending C$20M and 81% after spending C$30M.

Additionally, Oroco has a binding option to acquire approximately half of the minority interest (the ‘Other’ shareholder in the table) with the balance (defined as ‘Third Parties’ in the table) required to follow Oroco’s decision as to when to sell, giving Oroco an ability to market a 100% interest in Santo Tomas to a prospective buyer.

Ideally, Oroco Resource Corp would try to buy out the interest of the ‘other’ party, perhaps at an even more advantageous purchase price to make the ownership structure more comprehensible. It would, for instance, make sense to just purchase that part of the ownership structure in a combination of cash and stock to eventually end up with an 88.7%-11.3% ratio after having spent C$20M.

About the project

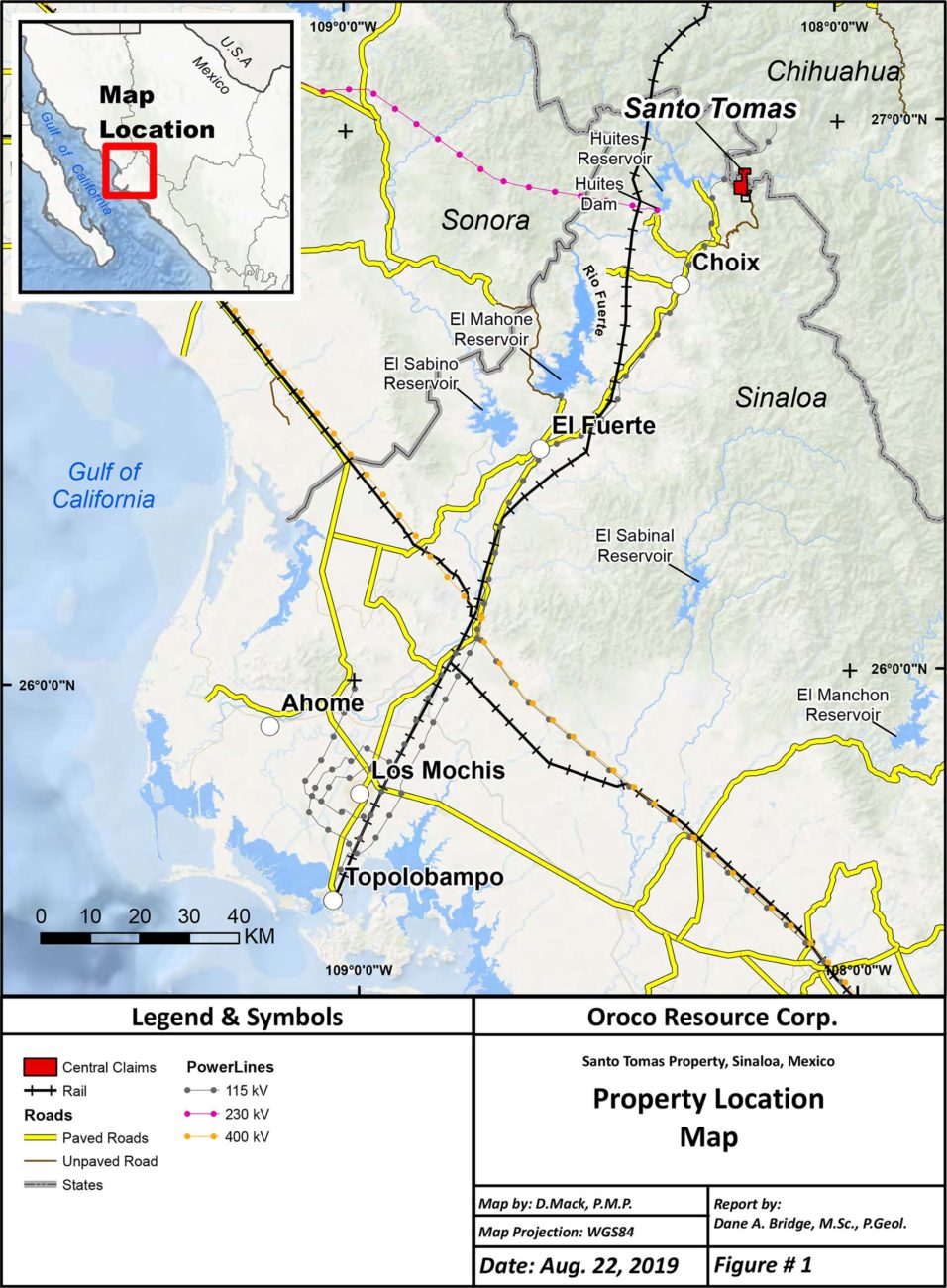

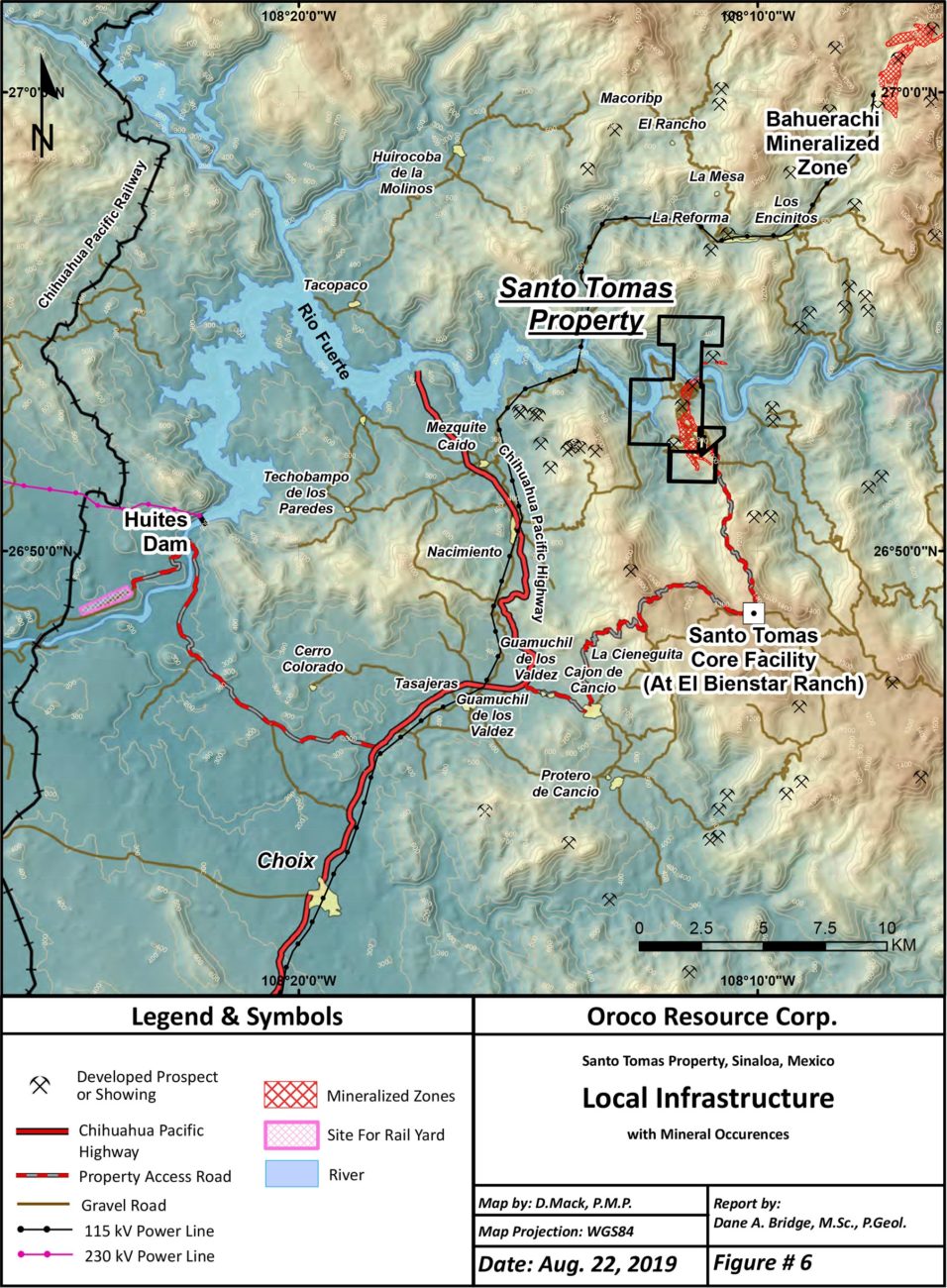

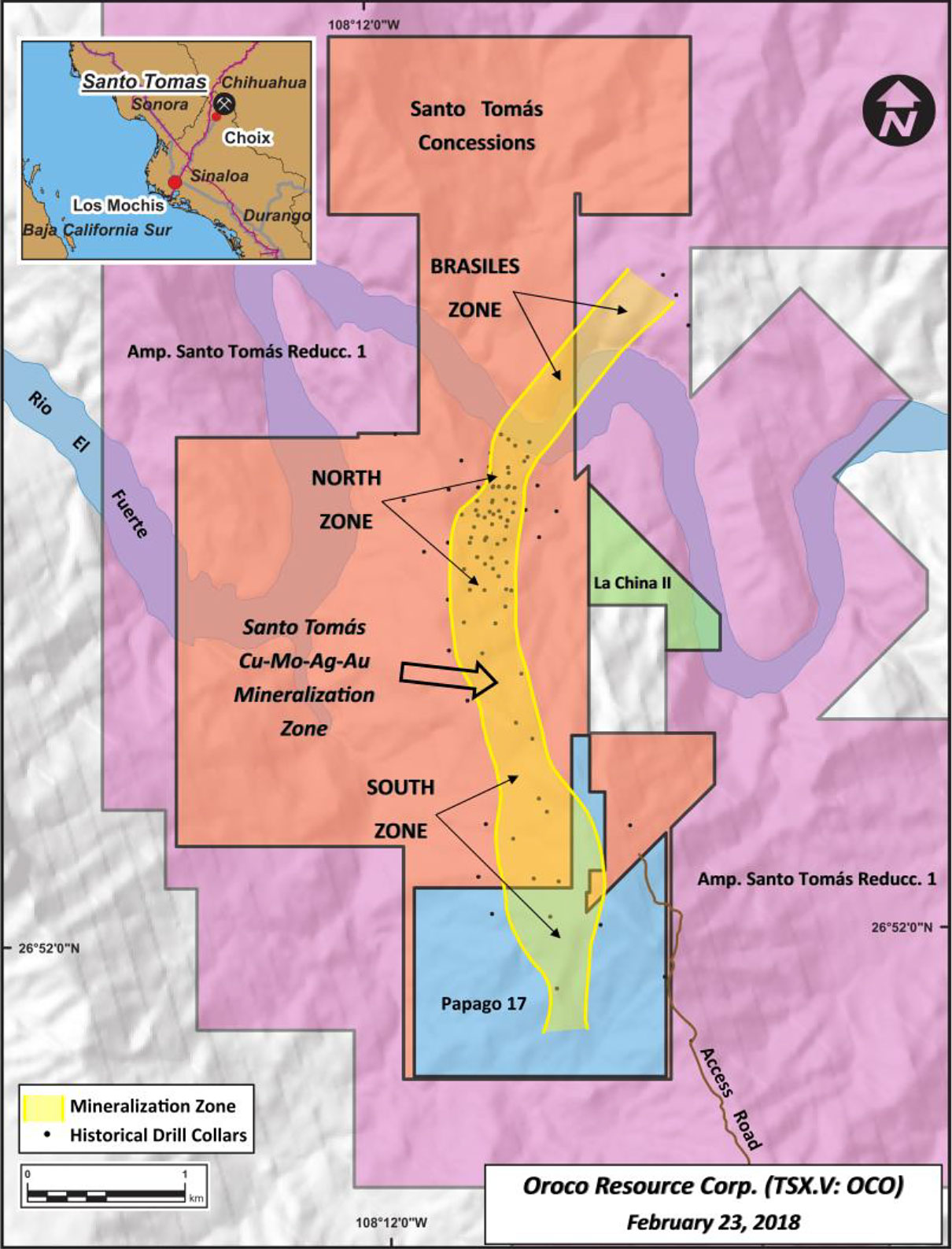

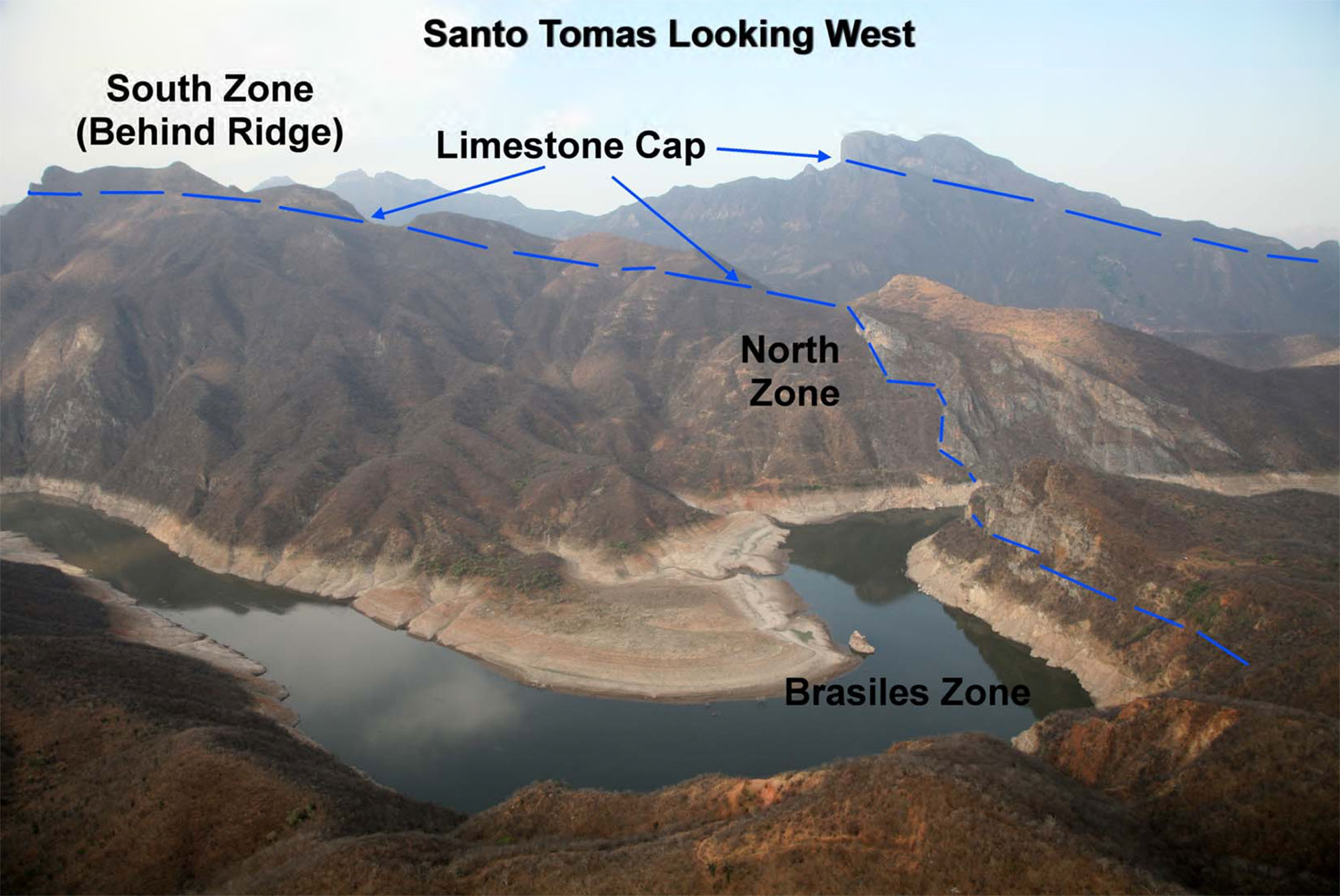

The Santo Tomas project is located at the southern end of the Laramide copper belt which hosts the massive copper mines in Arizona and extends into Sonora, Sinaloa, and Chihuahua. Santo Tomas is actually located on the border of Sinaloa and Chihuahua and the nearby Bahuerachi South project is just a short walk away (albeit at a brisk pace) from the main zone at Santo Tomas. Remember that name as that deposit was purchased in 2008 for in excess of $200M by a Chinese group, and has been dead money ever since. Although both types of mineralization aren’t similar (Bahuerachi is a poly-metallic deposit), the fact that both deposits are just 10-15 kilometers away from each other creates possibilities.

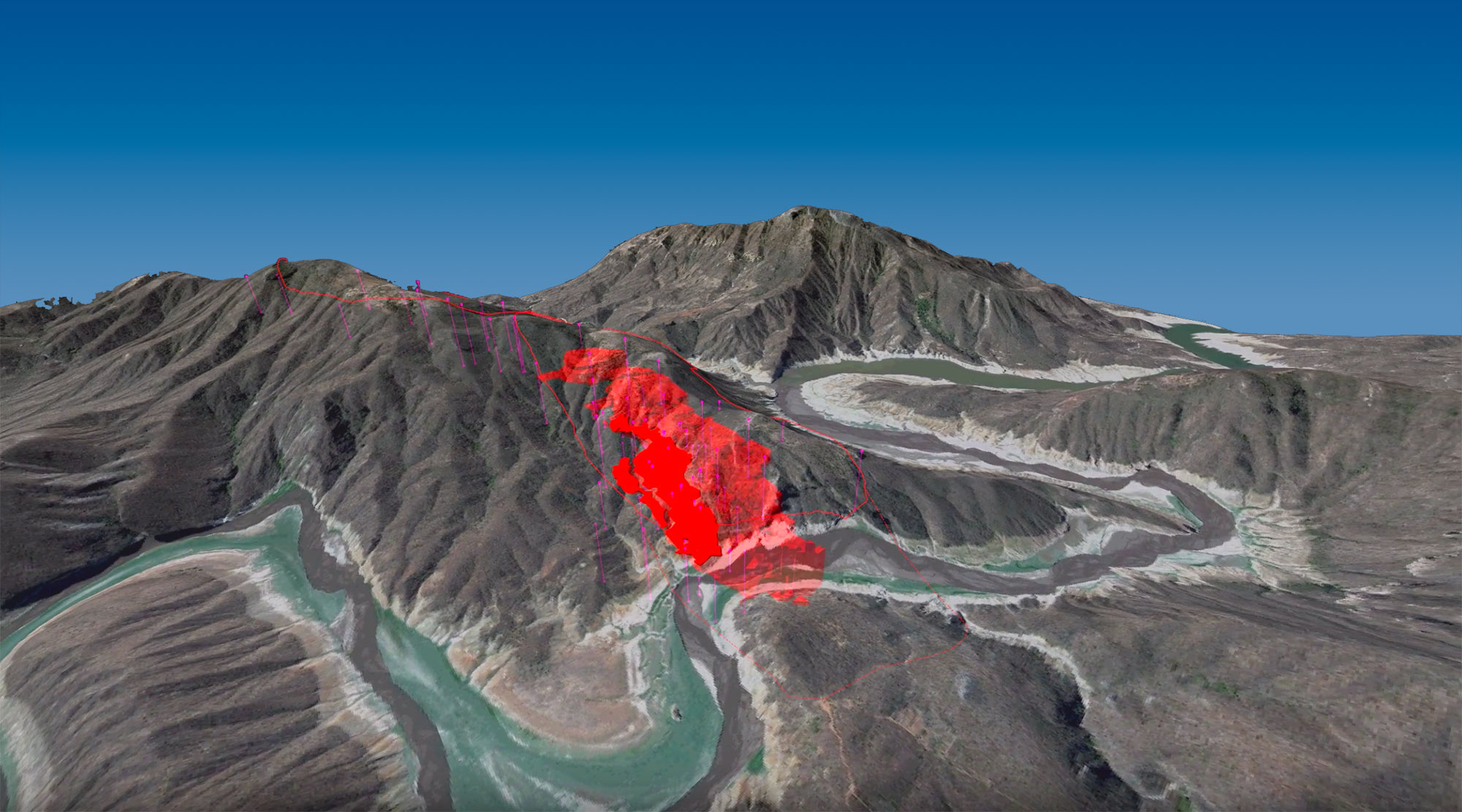

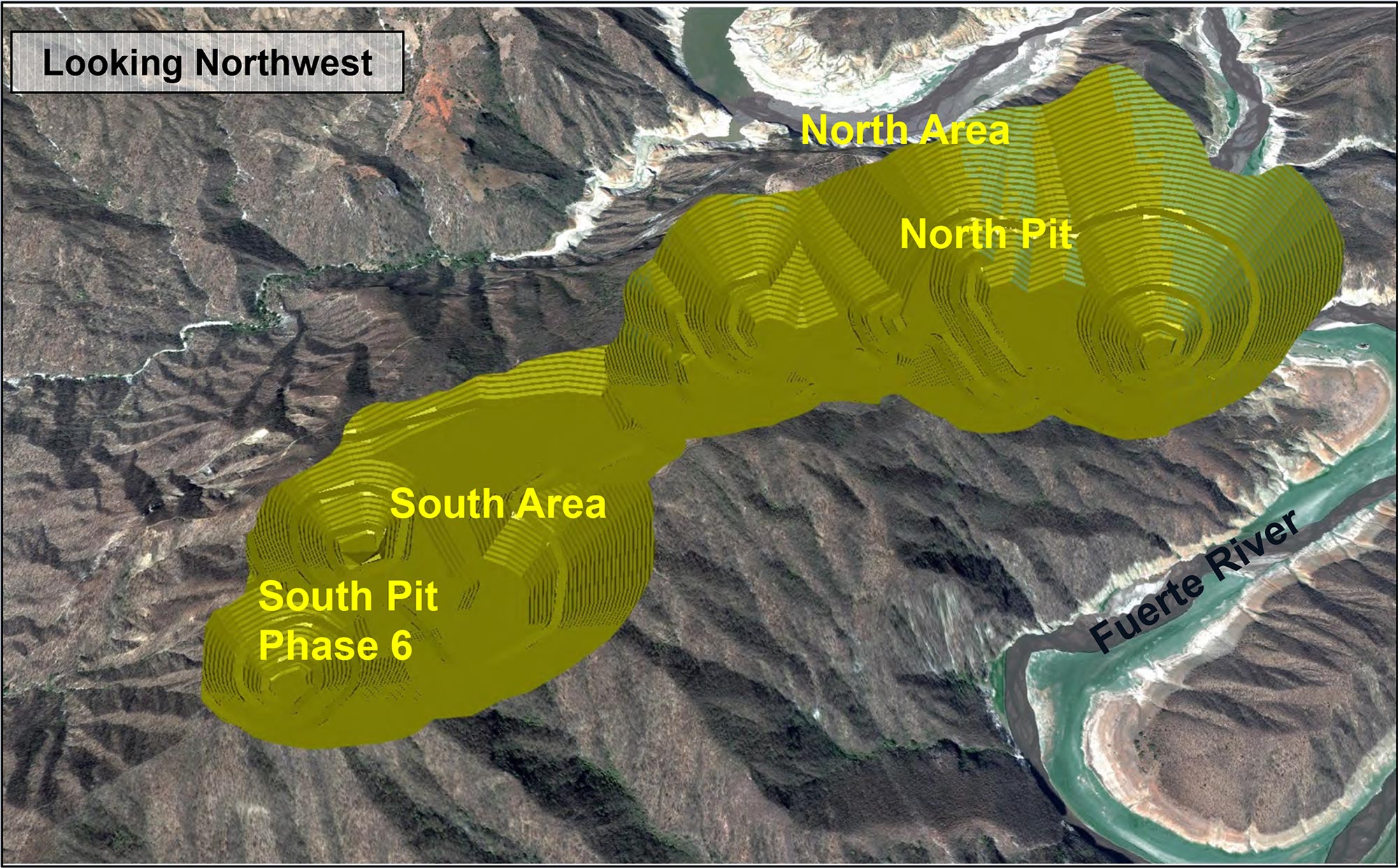

There is a river running through the property, which both is a curse and a blessing. It’s a blessing because the river feeds the Huites reservoir where a hydro dam is generating electrical power but the majority of the potential open pit is located on land as it basically would be a ridge that will be excavated resulting in a low strip ratio and thus a reduced mining the cost per tonne of ore, but unfortunately the river will very likely have to be rerouted anyway, over a distance of a few kilometers.

That’s not necessarily an issue as the cost to do so should be relatively minimal: Los Andes Copper requires a 7km river diversion and estimated it needs just over $50M to do that. In comparison, the diversion required at Santo Tomas would be less than two kilometers and would only be needed once mining activities are already well underway so the river reroute would be a deferred cost.

Additionally, this isn’t a river used by domestic water-based traffic or by local fisheries: just 15 kilometers away, the Fuerte River ends up in the Huites reservoir, the main water reservoir for the Huites hydroelectric dam which generates almost 900 million kWh per year at full capacity. Indeed, there’s (cheap!) hydropower available within hiking distance from the Santo Tomas project. There obviously are no guarantees Santo Tomas will be hooked up with the hydropower station (as the main powerline goes west, into Sonora), but it would make sense for the Dam operator to have a large industrial buyer of power just down the road.

But there are more infrastructural advantages. A new highway was recently constructed to connect the city of Choix with the Huites hydropower dam, and at the Huites dam site, there is a rail siding that connects directly to the port of Topolobampo, which is able to service Panamax-size vessels. These vessels can usually carry between 60,000 and 80,000 tonnes. And just to give you an idea: using an average copper concentrate grade of 28% (which is what the 1994 test work indicated), Oroco Resource Corp would only need to load a Panamax vessel every 5-6 weeks to ship its (average) concentrate production in the first ten years of the mine life. Conclusion: a port able to handle Panamax-size vessels will do the trick and is suitable for the potential mining activities at Santo Tomas.

So, Santo Tomas is close enough to existing infrastructure (power, roads, railroad, port) yet far enough away from local villages and towns to make sure the project won’t bother anyone. And that’s an excellent combination.

It’s still very early days, but we wanted to check if the project could be viable

Bigger isn’t always better and the era when supersized projects with high NPVs were prioritized over IRRs is over. The focus in the past few years has shifted on the return on investment and shorter payback periods and higher IRRs are favored over high NPVs. But there are some exceptions. If a junior company would like to build a mine, it will have to convince its financiers that it will effectively be able to repay the borrowed money as fast as possible. But in some cases the projects are so large it’s unthinkable a junior exploration company will be able to develop the assets themselves, but they are attractive to majors as they are capable of generating annual revenues of several hundred million dollars or more for several decades, carrying miners over numerous price cycles. These are the Tier One assets of the world’s largest mining companies, and copper is and will remain a metal that is the backbone of major mining companies.

Oroco’s Santo Tomas project falls into that category. It’s almost unthinkable this asset will not end up with a BHP, Grupo Mexico or Chinese conglomerate as it will very likely be too large for Oroco to even consider developing themselves. Ideally, the asset would find a ‘middle way’ between a high NPV (and long mine life) and a relatively high IRR signifying a moderate payback period. And as explained in the previous paragraph, because of the existence of a higher-grade core, Santo Tomas actually does offer that optionality as it looks like the initial higher grade shell will boost the IRR and payback period while the lower grade zones will provide additional flexibility: when the copper price is high, the future operator of the project may decide to mill some of the lower grade rock as well.

Santo Tomas will still need about 5-8 years before a development decision will be made (and the timeline depends on how aggressive Oroco will be able to advance its exploration activities and complete a new pre-feasibility study. Remember, Oroco basically just needs to recreate the old 1994 pre-feasibility study using up-to-date assumptions.

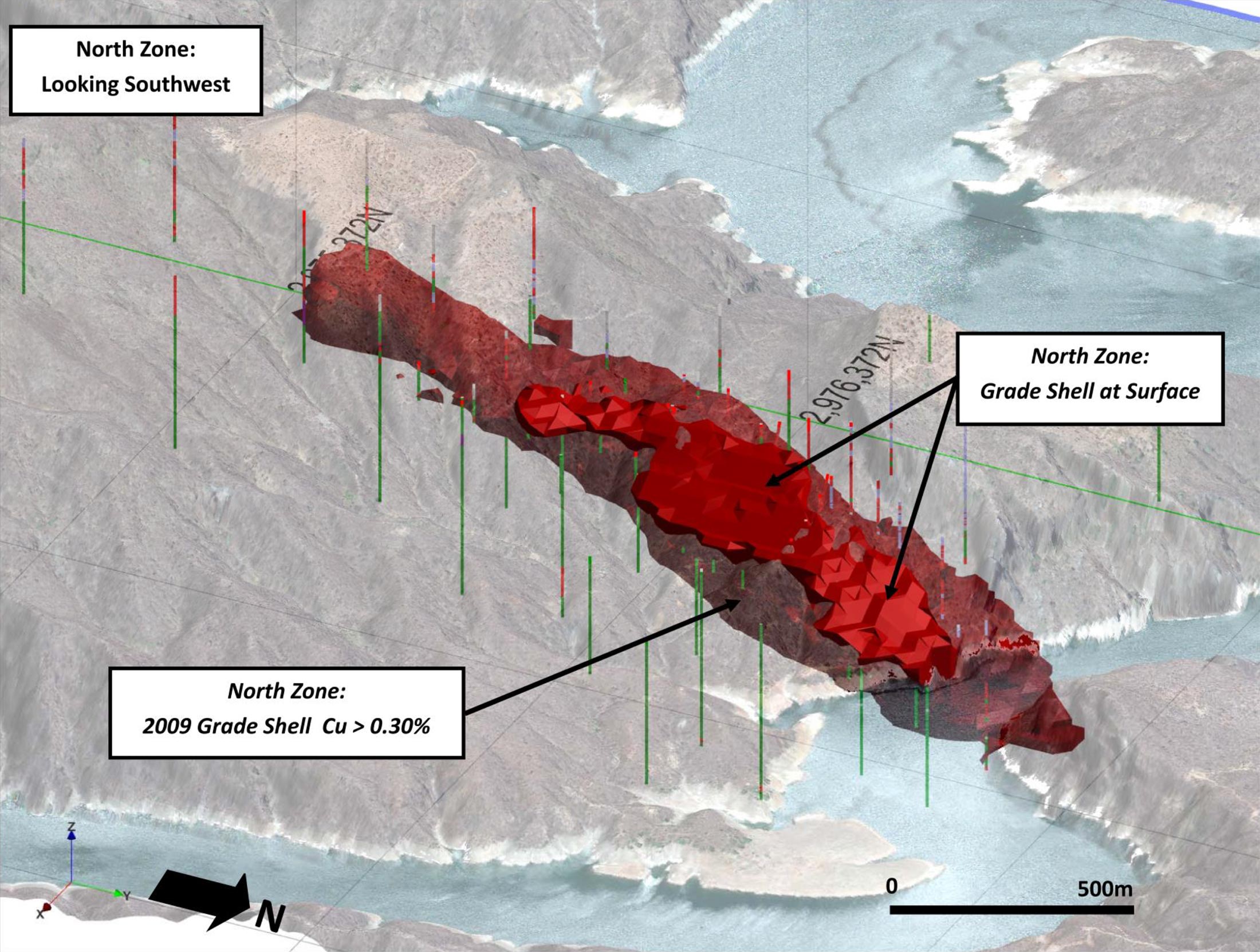

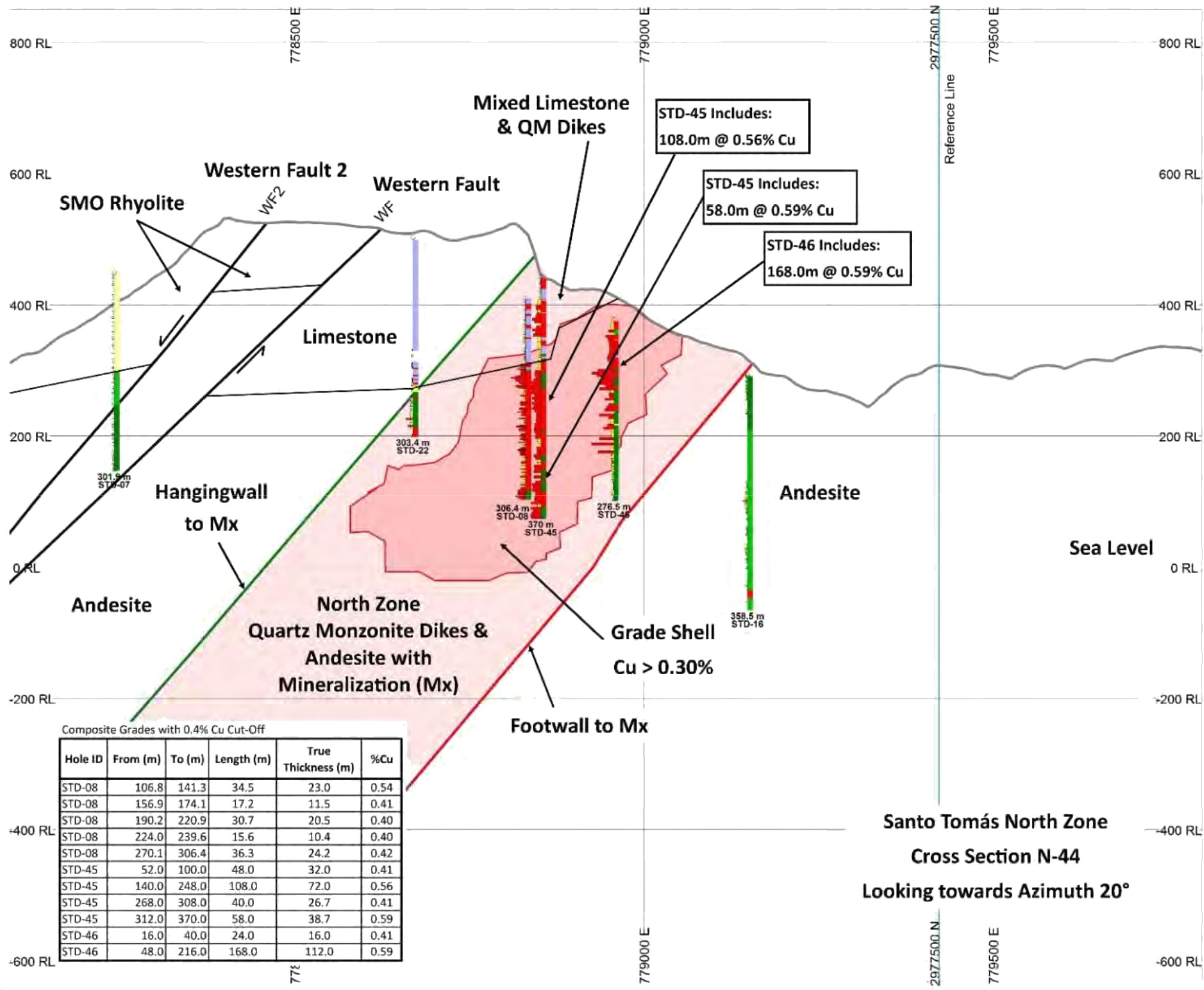

Although we realize the scope of the project might change drastically over the next few years; the mineralization at Santo Tomas remains open in several important directions, 24 of the 49 holes drilled in the Nineties ended in ore and will be re-drilled deeper, and the historical work did not thoroughly assay for gold, silver, and molybdenum. In addition to the estimated ~950 million tonnes of what would be classified today as Measured and Indicated rock, the historical reports include another 855 million Tonnes of inferred material, and with additional drilling, it is expected some portion of this will be upgraded. Long story short: Oroco will have plenty of value-accretive ideas it will want to follow up on.

Nevertheless, we decided to work on some back of the envelope calculations, just to make sure we have a decent idea of what we could expect. We will use a blend of the feasibility study on HudBay Minerals’ (HBM, HBM.TO) Rosemont project in Arizona and included a few elements from the Vizcachitas PEA, a project owned by Los Andes Copper (LA.V). As the scope of the Rosemont project is almost identical to Santo Tomas and as both projects are located on the same Laramide copper belt, we think the operating expenses on a per tonne basis may be the best comparable project. Also, keep in mind the metallurgical test results at Santo Tomas indicate higher recovery levels than the Rosemont project.

A caveat

And of course, we would like to emphasize again the following calculations are our back of the envelope numbers based on a comparable project and only have an educational purpose while waiting for the company to publish an updated compliant resource estimate and a PEA study. We will use assumptions that we think are reasonable and realistic.

Quick and dirty: a very preliminary cash flow model

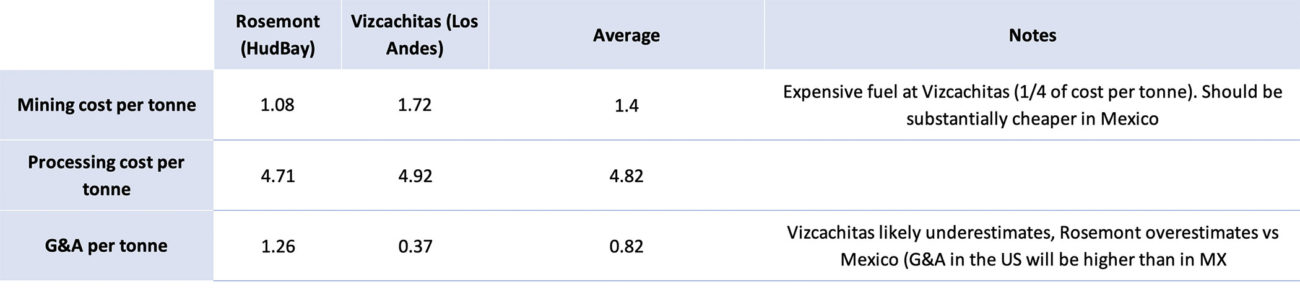

As a first step, we checked up on expected operating expenses at both Rosemont and Vizcachitas (mining cost per tonne and the processing cost per tonne) based on their official studies:

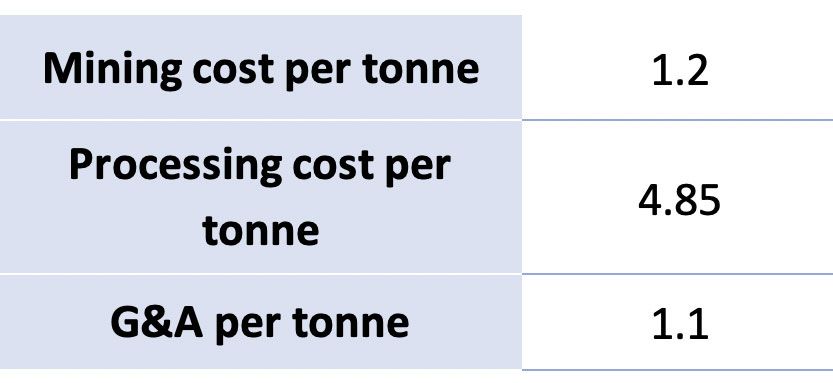

Based on these elements, we are using the next few assumptions:

We will use the CAPEX used for HudBay Mining’s Rosemont project which was estimated at $1.45B excluding pre-stripping expenses but including a 15% contingency. We will also apply a $20M annual sustaining CAPEX (which excludes any pre-stripping activities Santo Tomas may need during the mine life), which works out to be $0.59 per processed tonne of copper mineralization. Additionally, our assumptions will include 360 operating days per year at 90,000 tonnes per day, for an annual throughput of 32.4 million tonnes. There’s no reason why a large ground moving operation like Santo Tomas shouldn’t be operating 24/7, but we are allocating some downtime as a buffer.

Additionally, we are using a recovery rate of 89% of the copper (slightly below historical metallurgical test results of 89.5%), a payability of 87% (which takes care of the TC/RC charges) and a 2% royalty (the current royalty is just 1.5% payable to ATM Mining, a private company with the wife of the Oroco president as one of the shareholders, so we are leaving some space for an additional royalty).

It’s still incredibly early days at Santo Tomas and there still are hundreds of hectares of ground to be covered, but after talking to the Oroco management and seeing the cross-sections of the past drill programs, it looks like the strategy to first chase the higher grade shell with an average grade of approximately 0.50% copper would be the best way forward as this would ensure a shorter payback period. Note, we will be using a 0.50% copper grade and 325 million tonnes, compared to 333 million tonnes at 0.437% in the recently filed technical report. We think 0.50% CuEq is a reasonable assumption after adding a small by-product credit (gold, silver and molybdenum) and assuming a positive impact from an infill drill program).

One issue. To get through to the 0.50% zone, Oroco will have to dig through some of the lower grade rock with an average grade of 0.25-0.30% copper (we will use 0.28%). In our first model, we will assume the low-grade ‘cover’ will NOT be milled immediately but will instead be stockpiled to be processed at the end of the mine life once Oroco has processed all of the higher grade rock and the main zone which contains copper mineralization at an expected average grade of 0.40% copper (we will call this the medium zone). That’s why we will use a 2.5:1 strip ratio during the first 10 years of the mine life, dropping to 0.9:1 for the subsequent 15 years when the ‘medium zone’ is being mined, slightly increasing again to 1:1 when the final batch of 0.28% rock is being processed as we will be assuming a handling cost of $1.20/t to move the pre-stripped rock from the stockpile to the mill.

This results in the following production expenses for the three different phases over the 33 year mine life:

A. Production expenses

Production cost in Y1-10: 3.5 X $1.2 (consisting of 2.5 tonnes of ‘waste’ per 1 tonne of processed rock) + $4.85 + $1.1 + $0.59 (sustaining capex) = $10.74 per tonne of processed rock

Production cost in Y11-25: 1.9 X $1.2 + $4.85 + $1.1 +$0.59 = $8.83

Production cost in Y26-33: $1.2 (handling cost) + $4.85 + $1.1 + $0.59 = $7.74

As you notice, the average production cost is decreasing thanks to the lower strip ratio, but keep in mind the revenue per processed tonne will decrease as well, as the average grade of the processed rock will decrease as well:

B. Gross Recovered Metal per tonne (at $3 copper)

In Y1-10: 89% (recovery) X 87% (TC/RC) X 98% (royalty) * 0.50% (head grade) = 0.38% recoverable and payable copper. That’s 8.375 pounds per tonne of processed rock, is US$25.12/t in net smelter revenue.

In Y11-25: 89% X 87% X 98% * 0.40%= 0.3035% recoverable and payable copper. That’s 6.69 pounds per processed rock, or $20.07/t in NSR

In Y26-33: 89% X 87% X 98% *0.28%= 0.212% recoverable and payable copper. That’s 4.68 pounds per tonne of processed rock, or $14.04/t in NSR.

C. Pre-tax margins

This results in the following pre-tax margin per tonne of processed rock:

Y1-10: $14.38/t

Y11-25: $11.24/t

Y26-33: $6.3/t

D. Taxation

This is the difficult part as we will have to keep an eye on several different balls in the air, including the depreciation schedule, corporate tax rate, the Mexican mining tax,… So, while this is an attempt to recreate the Mexican tax environment, keep in mind there obviously still is a margin of error and especially the depreciation schedule could be very different, impacting the average tax rates. So, we emphasize again this is just a ‘thinking exercise’ based on a back of the envelope calculation.

We are applying an accelerated depreciation schedule whereby 50% of the initial CAPEX is being depreciated in the first 10 years of the mine life ($73M per year or $2.25 per processed tonne) followed by depreciating the remaining 50% over the subsequent 15 years (at $48M per year or $1.48/t). We are using an assumed total tax rate of 40% on the taxable income.

This creates the following tax pressures and net post-tax margins per tonne:

Y1-10: $14.38 – [($14.38 – $2.25) * 40%] = $9.53/t

Y11-25: $11.24 – [($11.24 – $1.48) * 40%] = $7.34/t

Y26-33: $6.3 X 0.60 = $3.78/t

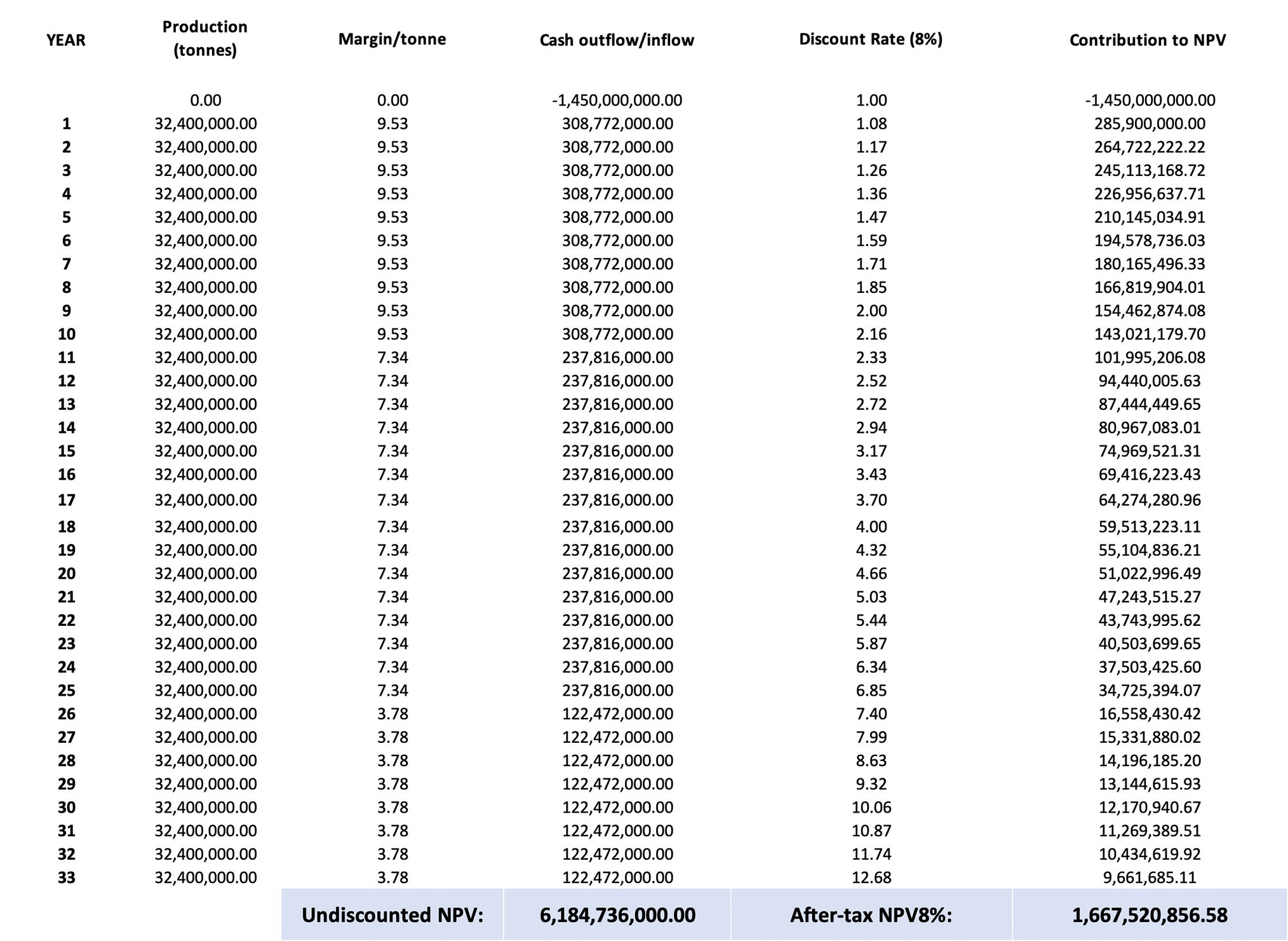

E. A NPV Model

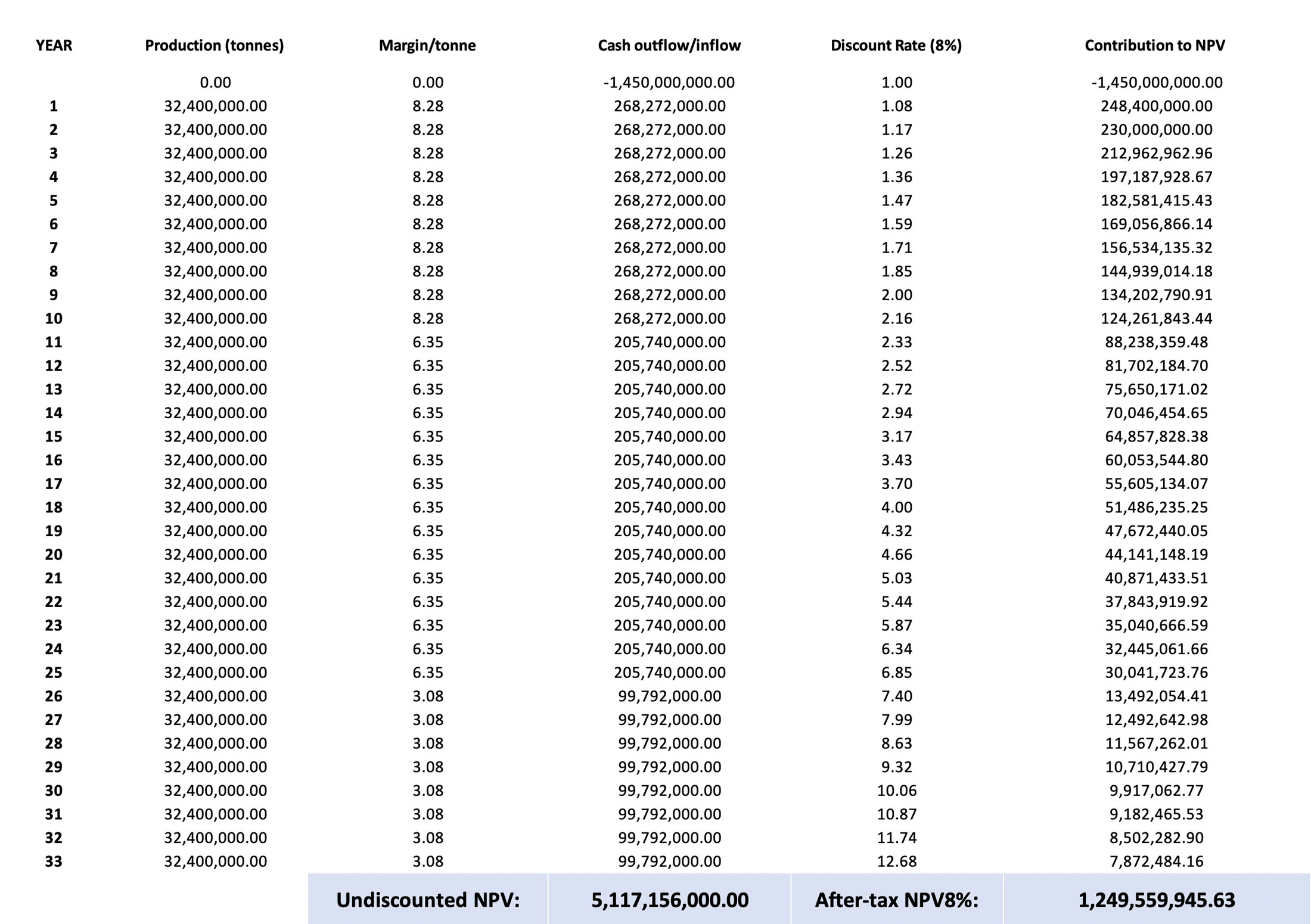

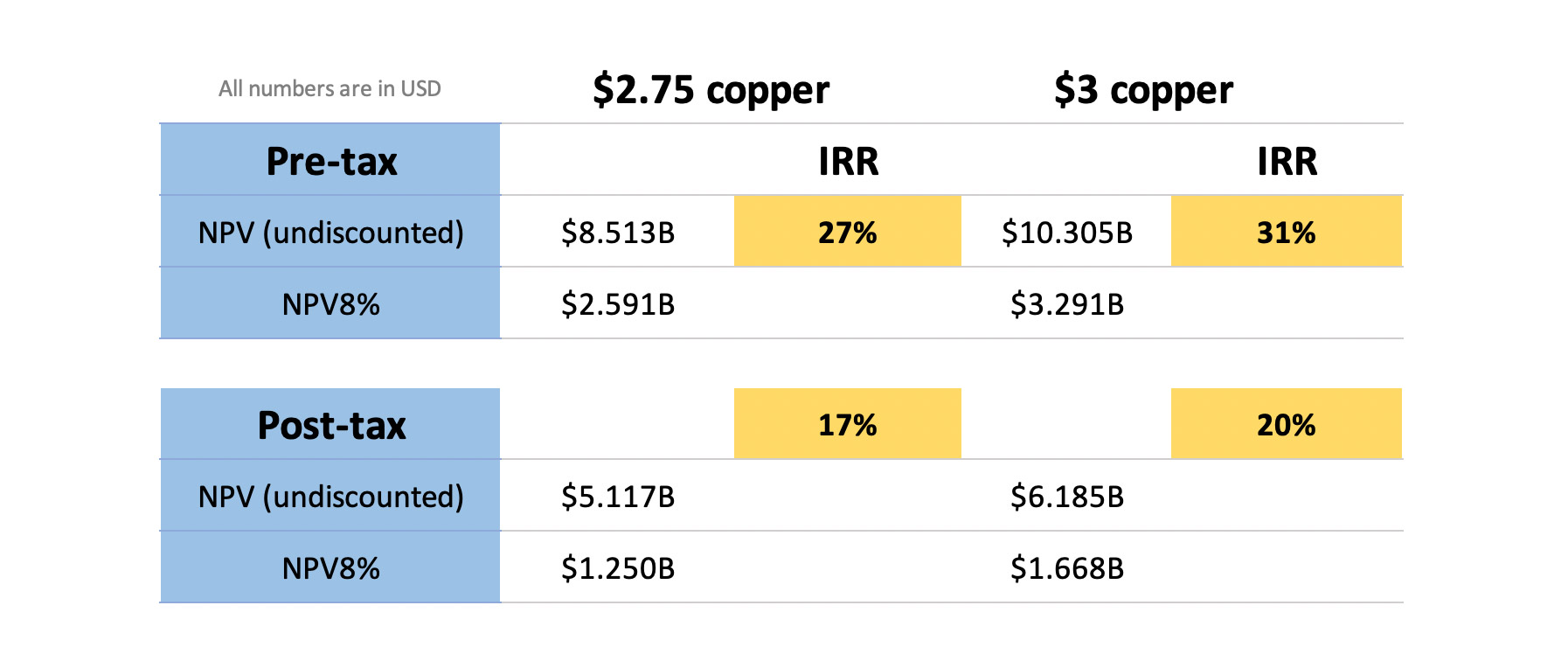

Based on the aforementioned input data, we end up with an after-tax NPV8% of US$1.67B and an undiscounted NPV of just over US$6B based on $3 copper.

The post-tax IRR comes in at around 20% and the payback period (based on the undiscounted cash flow) is estimated to be around 5 years.

We also ran the numbers using $2.75 copper. This results in the following pre-tax margins:

Y1-10: $12.29/t

Y11-25: $9.57/t

Y26-33: $5.13/t

And the subsequent post-tax margins:

Y1-10: $8.28/t

Y11-25: $6.35/t

Y26-33: $3.08/t

This results in the following DCF model:

The NPV drops to US$1.25B which still is a very respectable result for a large project. The post-tax IRR obviously decreases a bit (to 17%) but remains robust and the payback period remains a relatively modest and 5.5 years (which is relatively short considering this is just 1/6th of the anticipated mine life).

We also ran the numbers on a pre-tax basis as potential suitors may have a tax loss in Mexico that could perhaps be used to ‘shield’ the cash flows from taxation in the first few years of the mine life.

The conclusion is simple: Santo Tomas works at $2.75 copper, but ideally needs $3 copper of higher to become really appealing. And of course, keep in mind there are other important parameters here as well. We kept the mine life limited to 25 years (or 810 million tonnes) with an additional 8 years of milling low-grade material for a total of 1.07 billion tonnes of rock that are being processed. Although exploration targets are being frowned upon by the Canadian regulator, it’s perhaps worth emphasizing the older technical reports contain an exploration target of 1.5-2 billion tonnes (and perhaps even more than that as Santo Tomas still needs to be thoroughly explored).

Adding even more tonnes and years to the mine life won’t help the NPV and IRR by too much as the compounding discount rate has a negative impact on the huge majority of the cash flows later in the mine life (in Y25 of the $2.75 copper scenario, for instance, the undiscounted cash flow is expected to be $205M, but due to the applied discount rate, only adds $30M to the NPV), but would make the project more appealing for one of the bigger boys who’s only interested in securing a sufficient feed for a smelter. 1.5 billion tonnes at a throughput of 90,000 tonnes per day would result in a 46-year mine life. And that’s exactly what some companies (BHP, Grupo Mexico, Chinese/Korean/Japanese smelters,…) are looking for.

Of course, there are so many variables that could still change between now and the construction decision. Mine plans, strip ratios, capital expenditures… could still change dramatically over the next few years so you should just treat this model for what it is: a back of the envelope calculation.

Management

Craig J. Dalziel – President and CEO

Craig Dalziel, the President and CEO. of Oroco Resource Corp., brings 35 years of financial, investment and corporate governance experience to the company, most recently as President and a Director of ATM Mining Corp., a British Columbia resource management company which founded both Oroco and US Cobalt Inc. (originally Northern Rand Resource Corp.) a TSX-listed company. During the mid-1990s, Mr. Dalziel was President and a Director of Ming Financial Corp., which financed and facilitated, as majority partner, the re-activation of the Rambler Mine and its 1000 tonne per day copper/gold processing facility in Newfoundland, Canada. Focused on the early 2000s on Asian resource opportunities, Mr. Dalziel was the founder and President of Sunda Mining Corporation, the forerunner of Southern Arc Minerals Inc., a TSX-listed mineral exploration company initially active in Indonesia, for which he was responsible for shaping much of the early business development strategy.

Stephen M. Leahy – CFO and Director

Stephen Leahy, Chairman of Oroco, has an extensive and diverse business background. Formerly the Chairman and CEO of American Tungsten Ltd., which was at one time the largest producer of tungsten concentrate outside of China. Mr. Leahy currently serves as Auracle Remote Sensing’s Executive Chairman overseeing the company’s strategic vision. He also recently led the team responsible for securing Valemount Glacier Destinations’ Master Plan approval for an international ski resort in British Columbia, Canada.

David W. Rose – Corporate Secretary

David Rose has been a practicing lawyer since 1990. After working as an agent prosecutor for the Department of Justice and as Crown Counsel for the Attorney General of BC into the mid 1990’s, Mr. Rose began working in a mix of private legal practice and venture finance. He has been providing legal and management consulting services to resource companies and venture start-ups for the last 20 years. Over the course of his career, Mr. Rose has gained significant experience and expertise in multi-jurisdictional transactions and legal matters in Mexican resource law.

Adam J.C. Smith – Corporate Finance

Adam Smith has a career of over 25 years in business and corporate finance and has been a consultant to Oroco since its formation in 2006. He is responsible for liaising with Oroco’s business partners within North America and overseas. Mr. Smith holds a BA in Philosophy from the University of British Columbia.

Conclusion

The copper price isn’t exactly cooperating at this moment, but the main advantage of Santo Tomas is its simple metallurgy, easy access to existing infrastructure and its potential to be mined for about half a century, and that could be exactly what some of the larger copper producers are looking for.

We established that based on importing the parameters used for the feasibility study of the Rosemont copper project in Arizona, the Santo Tomas project could work at $2.75 copper, predominantly thanks to the higher grade shell that could be large enough to keep the mill fed with higher-grade rock (of around 0.50% copper) for the first 10 years, an important feature for the NPV and IRR calculations considering these types of large projects can be derisked by front-loading the cash flows to ensure a payback period that’s as short as possible. We would like to emphasize that effectively being able to access the higher-grade shell early in the mine life will be extremely important for Santo Tomas.

Now it’s up to Oroco to continue to advance the asset and perhaps streamline the ownership of Santo Tomas by consolidating the current three shareholders to just one or maybe two entities. That will help to bring the message across to investors while it will make the project more appealing to potential joint venture partners as well, who rarely like to get involved in an overly complicated ownership structure where they would be the fourth member of a consortium.

The legal mess has now finally been solved and the title should be registered soon (as the conventional registry process is ongoing). Now it’s up to Oroco’s management team to continue the earn-in procedure while advancing the asset at a pace that will be determined by the copper markets and how easy it will be for Oroco to raise money at acceptable terms. We do believe the company is sitting on what could become a Tier-1 copper asset that could spark the interest of pretty much any company that’s serious about being in the copper mining business. Oroco has attracted skilled and experienced industry personnel to ensure it meets the next few milestones to reconfirm Santo Tomas as a Tier-1 asset.

Disclosure: The author holds a long position in Oroco Resource Corp. The company is not a sponsor yet, but could become one.