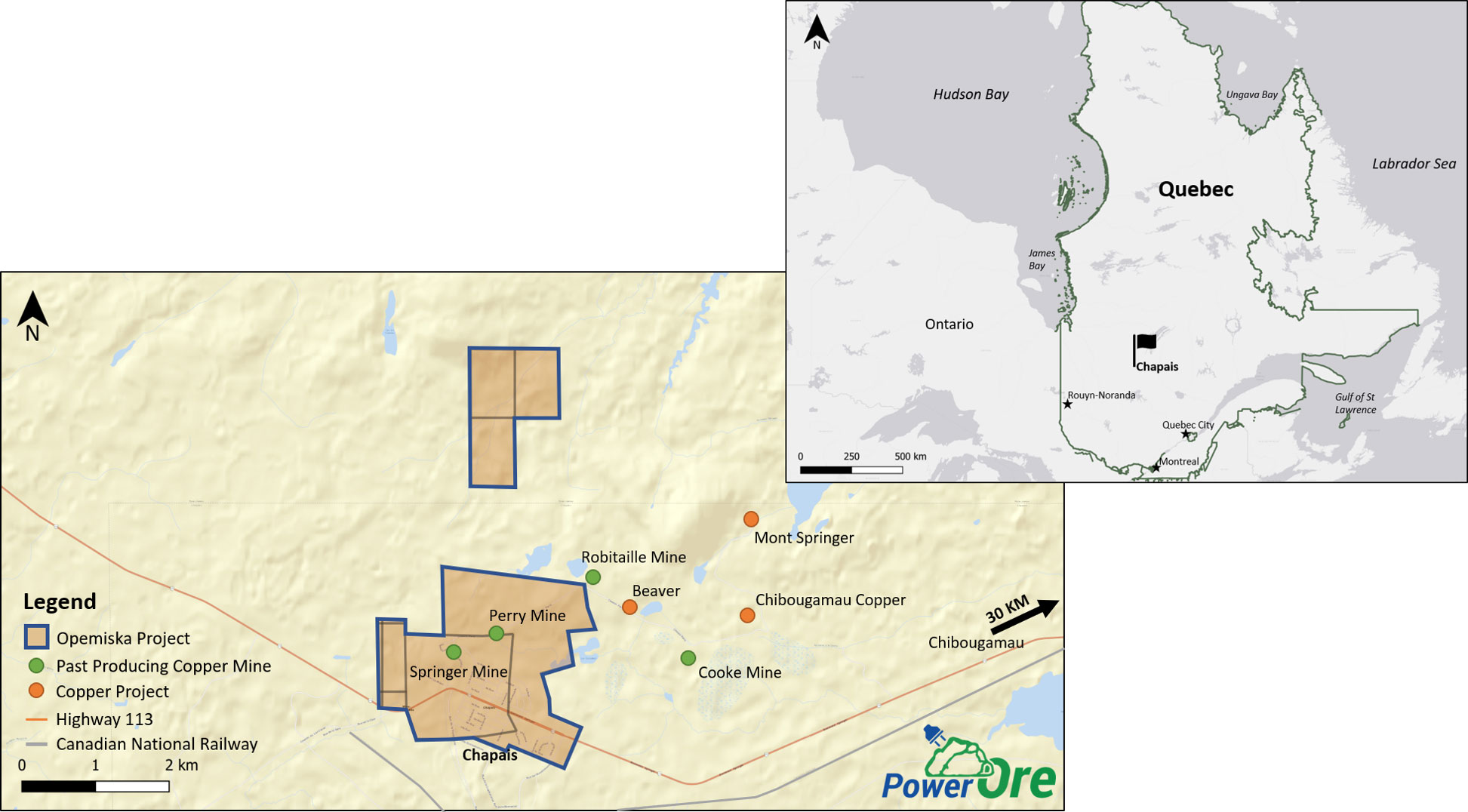

About a year ago, PowerOre (PORE.V) was spun out off Orefinders Resources (ORX.V) that wanted to focus on its gold assets in Canada. Although the somewhat generic name ‘PowerOre’ sounds cheesy, we were impressed with the company’s ability to secure an earn-in deal on the Opemiska Copper Complex in Québec’s Chibougamau region which hosts two past producing mines. As the company has continuously published excellent drill results and is gearing up for a maiden resource estimate followed by a Preliminary Economic Assessment, we sat down with Stephen Stewart, CEO of both PowerOre and Orefinders, to catch up.

PowerOre

The recent exploration results are very intriguing. You are combining long intervals with acceptable copper-equivalent grades with shorter intervals containing much higher-grade zones such as 1.9 meters containing north of 15% copper and 10.2 meters containing almost 4% copper and 1 g/t gold. This was followed by 162 meters containing just over 1% Copper-Equivalent starting at surface. Could you elaborate on the geological model for Opemiska?

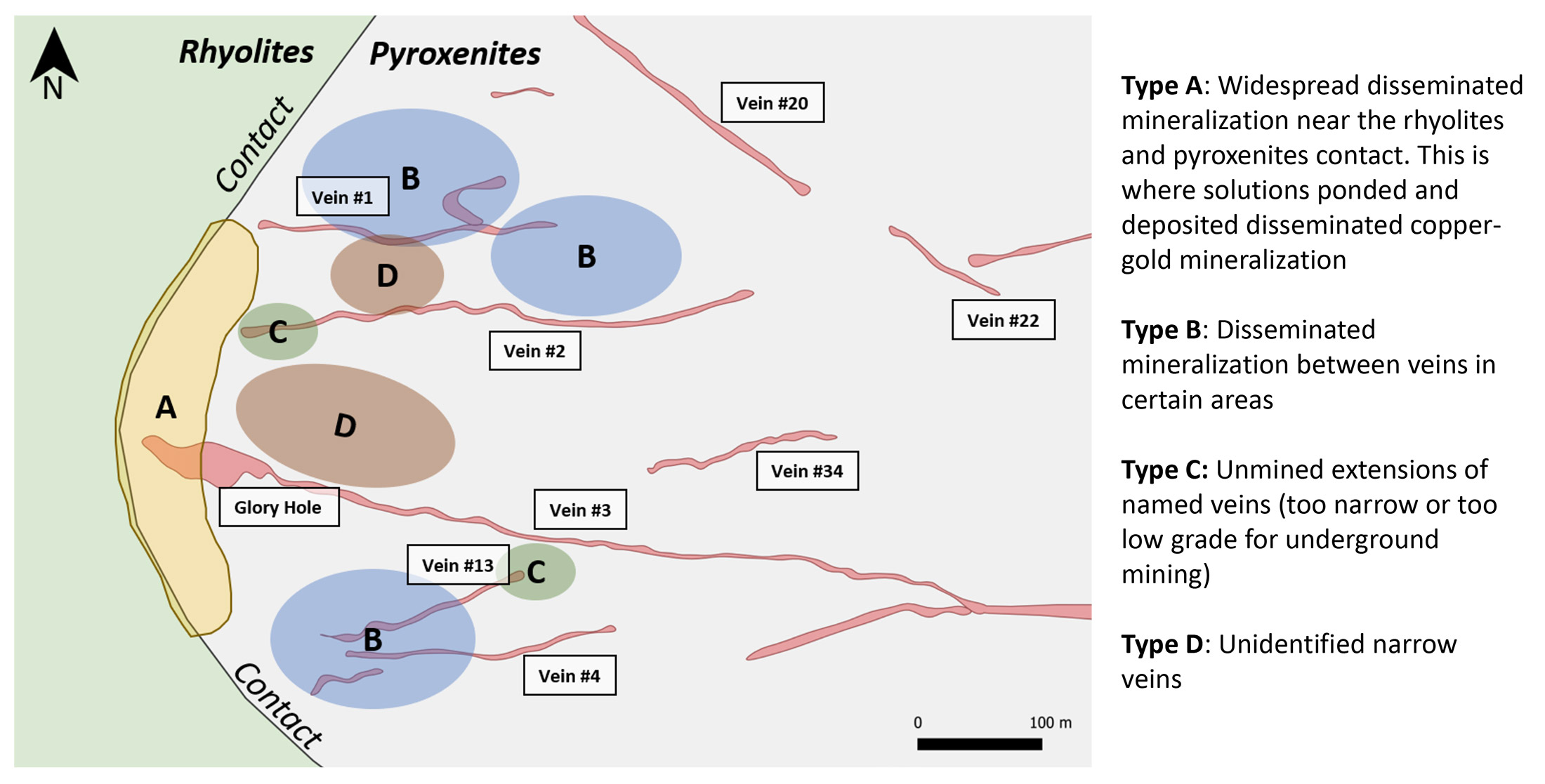

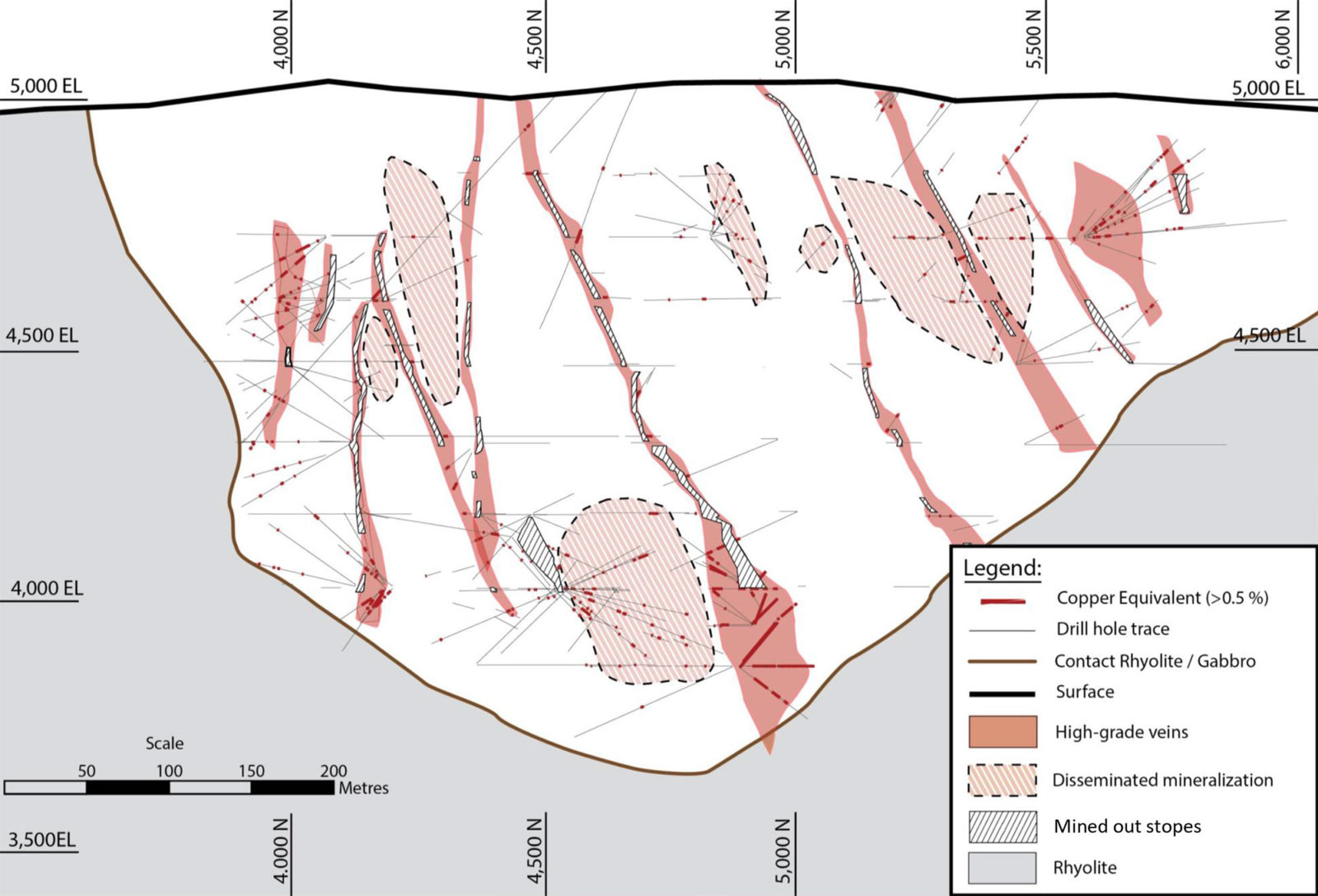

Stephen Stewart: Our results are intriguing, and we are certainly excited about the potential they demonstrate. The known high-grade veins were what drew us to this project, as you rarely see such rich copper intersections, especially being right near surface. The second factor that drew us in was the amount of data which was available which allowed us to come up with the view that Opemiska offered substantial mineralization outside of the high-grade veins – material that would boost the tonnes and grade under an open pit scenario.

Furthermore, these newly interpreted zones were near surface. Our recent drill program is meant to confirm our hypothesis and to define near surface disseminated material within an open pit context. With intersections such as 1% copper equivalent over 160 metres, 0.3% over 296 metres and 1.4% over 58 metres, this clearly demonstrates what we envision.

Simply put, we are not just re-envisioning the Opemiska in terms of a new metal price, this is a completely new interpretation of the geology.

Once this reinterpretation of the geology is fully understood, the Opemiska has a leg up on any competitor given the infrastructure it offers. A rail line runs right to the property, as does a paved highway and grid power is already on site. Very few base metal projects at our stage offer these infrastructure advantages.

You have now completed a 23 hole drill program, and the assay results of 18 of those holes have already been published. It appears to be your intention to immediately publish a resource estimate and use that as the basis for a PEA. May we interpret that as you being confident in already reaching the needed critical mass after just this first round of drilling? A weak PEA will do more harm than good.

SS: Given the abundance of data we have, which includes >800,000 metres of drilling, 300,000 assays and >3,000 maps and sections, all of which have since been digitized, we are able to fast track development after only a fairly modest drill program. That being said, this drill program has been an eye opener as we are seeing results which not only confirms our hypothesis of there being disseminated mineralization outside of the veins, but expands the potential of it.

We were pleasantly surprised to see mineralization in areas which we originally considered barren, specifically the rhyolite surrounding the pyroxenite/gabbro on the western side of the property. This tells us that there’s more to discover at Opemiska, and that any preconceptions of the project and that traditional thinking was too constrained around the veins. These new zones possibly extend the envelop for which any resource can be considered.

For now we are focused on receiving the last of our drill holes and incorporating this data into our internal model. Only then will we be ready to make the best decision in terms of what is next. Until then all options are on the table.

Lastly, I’ll point out that our work to date, in terms of drilling and data compilation, has only been focused on the Springer zone, which is the open pitable portion of Opemiska. We’ve yet to model or drill the Perry zone which appears to have even higher copper grades but at depth, suggesting an additional potential underground scenario. These two zones collectively comprise the Opemiska Copper Complex, so there is still plenty of work to be done.

There are exploration targets of 14.5-30 million (metric tonnes) at 1-1.4% copper (and 0.37-0.62 g/t gold) for the Springer Zone and two targets at Perry (including an underground target of 2.5-10M tonnes at 1.5-2.5% copper). These exploration targets were originally published in 2013 and 2014. Do you see a realistic chance to expand the Opemiska beyond these initial exploration targets?

SS: There has been over 8,000 metres of drilling since the publication of those RPA reports. As we learn more about the deposit and consider the fact that mineralization is not just limited to the veins (and those exploration targets appear to be solely focusing on the veins), we believe there is opportunity to expand the resource. We’ve taken the work that RPA did and recreated it ourselves to be comfortable with the work, and we believe it is of quality. But we’ve also spent substantially more time, resources and care in creating our own model based of all available data. So, given what we know and what we are learning there is substantial opportunity for resource growth.

Could you elaborate on the existing (regional) infrastructure you would be able to use? The Opemiska complex does host some past-producing areas, but one of the key elements to bring a relatively small mine into production will be the processing plant. Is there any spare capacity within trucking distance from the project site? Who owns the Copper Rand mill now, and would that be an option?

SS: As mentioned, the infrastructure available to Opemiska is exceptional given the rail, road and power on site. The Chibougamau district is also undergoing a bit of a renaissance with quite a few groups spending money in the area. Many are searching for new deposits in this well-established copper – gold camp, which is great news. And I do think there’s good potential for a consolidation of operations in the district.

However, the ultimate goal at Opemiska is to develop a project that supports its own mill. Any other mills in the area are simply too small to be considered for what we are looking to build.

We are not interested in sending our material to others but there is a scenario that they can send their ore to us. Given the proximity of other projects I do see potential for hub and spoke milling but it only makes sense for the largest project to host the facilities.

As of the end of April, you had a working capital position of around C$1M but you have also completed just over 3,000 meters of drilling since then. Do you have sufficient cash on hand to complete the resource estimate (and PEA)?

SS: The simple answer is yes and we have capital available to use from different sources when the time comes.

As you have an excellent working relationship with the Osisko Group at Orefinders, your other company, would the Opemiska complex be something one of the Osisko companies (for instance Osisko Metals (OM.V), which is currently focusing on zinc) could be interested in? It would certainly be nice to have a strong group backing and co-funding your future exploration and development plans.

SS: I have a good deal of respect for the founding members of Osisko and for the team they’ve built throughout the entire Osisko group of companies. Osisko Gold Royalties is one of the largest shareholders of Orefinders, which in turn is the largest shareholder of Power Ore. So there’s some overlap between these groups, however as it stands today Osisko has no direct affiliation with Power Ore.

But when the time is right I would be happy for that to change. Their team is smart and understands cyclicality and the opportunities available in mining, but they’re not the only group that would have an interest in Power Ore. While the retail market in the copper/base metal space over the past 12 years has been soft, those are who are truly interested in copper, meaning those who mine and supply the commodity, have taken notice of Power Ore and its drill results. There are systematic issues with the future supply of copper with few replacement deposits in the pipeline. Those with interesting deposits, especially within a top tier jurisdiction, should expect to get a lot of attention from this crowd.

Orefinders

You are also the CEO of Orefinders, a gold-focused exploration and development property. Could you elaborate on what the company has achieved in the past 12 months?

SS: Orefinders has been very busy over the last 12 months, however not in the traditional “junior way” of raising expensive money, only to release results to an inanimate market. Power Ore is an example of how Orefinders differentiates itself, having been a spin off company to create shareholder value from non core assets to provide Orefinders shareholders with a share-based dividend of Power Ore. This allowed everyone to participate in the upside of the new vehicle. We’ve also made other recent acquisitions, including Knight, McGarry, Mistango, Pacific Precious which I view as counter cyclical and opportunistic given what the market was presenting.

Orefinders’ business model has been about changing the dynamic of juniors and taking advantage of market fundamentals. We’ve done this by acquiring assets and real data at a fraction of their replacement costs. By doing this, Orefinders was able to consolidate its portfolio of assets within two major districts: 1) in Kirkland Lake along the Cadillac-Larder Lake break, and 2) 70km to the west in the Shining Tree district, which itself remains underexplored and is starved for drilling. The goal of each of these districts is to achieve critical mass within a rising gold price environment so that our cost of capital is low and the results delivered are valued. Those are ideal conditions for exploration in the large gold systems that we operate in.

Orefinders’ objective is about being smart in its exploration to give us the best risk-adjusted chances of finding that elusive billion dollar drill hole. That’s why were in this business – to drill our own billion dollar drill hole, while caring very much about how that’s financed and mitigating as much risk as possible.

Gold is still trading firmly above $1400/oz and even breached the $1500/oz mark; how does this change Orefinders’ approach for the next 6-12 months?

SS: I don’t think a single price should change anyone’s approach, not immediately anyways. A $1400 gold price itself doesn’t offer the juniors any direct advantages in the short term. Should these elevated gold prices hold for a longer period, capital will flow back to the juniors – and this is what will ultimately change our approach. Should this be the paradigm shift that Orefinders has been preparing for then yes, our approach will certainly change in that accretive acquisitions will cease to exist and successful drill results will be valued thereby lower our cost of capital. The basis of our rationale is acquisition capital is best deployed in a bear market and exploration capital is best raised and used in a bull market.

Your push to consolidate assets in the Abitibi greenstone belt seems to be paying off and the cluster of projects that are within trucking distance from each other (McGarry and Mirado) appear to be a solid move. Given this, it made a lot of sense to also have a closer look at the Omega mine, owned by Mistango River Resources (MIS:CSE). You currently own 31% of the Mistango River shares and have been pushing for some changes there. Could you elaborate on what’s going on and what you are aiming to achieve?

SS: We are very happy with our position on the Ontario side of the Cadillac Break. We’ve built the most substantive position on this trend, which extends from the 12 million ounce producer Kerr Addison on our east side, Kirkland Lake Gold’s Macassa to our west and Agnico Eagle’s Upper Beaver to our north. This also is the same rocks/geology that exists on the Quebec side of the Cadillac Break which is Rouyn-Noranda and Val D’Or and all the mines which exist there. All things considered, we see this trend as part of the top two gold-hosting trends in the world.

The Omega project, which is owned by Mistango wherein Orefinders owns a control block, is just one more piece of the puzzle. Fundamentally, we believe in consolidation, achieving critical mass and putting all of the data to triage our targets. That’s what we’ve been doing with Orefinders, that’s what the entire industry should be doing. I believe M&A is inevitable and we’re putting ourselves ahead of the curve.

We have the same philosophy with our Knight project which was a consolidation itself and which sits atop a 4 million ounce gold project owned by Pan American Silver. We see these two projects as needing each other for the same reasons I note above. I see further consolidation as merely a function of time and given Orefinders owns its assets outright with patented claims and no debt, we look forward to having a few seats at the table when the tide comes in.

Conclusion

It looks like PowerOre was able to land quite a deal with the agreement to acquire full ownership of the Opemiska copper complex. Not only is the project located in a safe region, its status as past-producing mine and existing infrastructure (rail, power, access,…) make this a very intriguing project for a junior exploration company.

PowerOre is still flying under the radar as the current market capitalization of C$3.2M (based on a share price of 8 cents) doesn’t seem to be fair considering the recent excellent drill results and the upcoming catalysts with a first NI43-101 compliant resource estimate followed by a Preliminary Economic Assessment.

Disclosure: PowerOre and Orefinders are not sponsoring companies. The author has no position in PowerOre or Orefinders.

Pingback: #29 Weekly Update on TFSA Stock Picks for 2019 – Aug 12 | TFSA Investment Letter