A while ago, we highlighted Clean Teq Holdings (ASX:CLQ) as an advanced stage Scandium play, but as it’s taking longer than expected to see Scandium being widely used for new purposes, Clean Teq decided to re-brand the Syerston project as a nickel-cobalt project, which indeed makes more sense.

The company has published a pre-feasibility study in the final quarter of last year, and in this article we’ll have a closer look at the economics of Syerston, as we do expect this company to benefit tremendously from an expected demand increase for cobalt.

The economics of the Syerston nickel-cobalt project

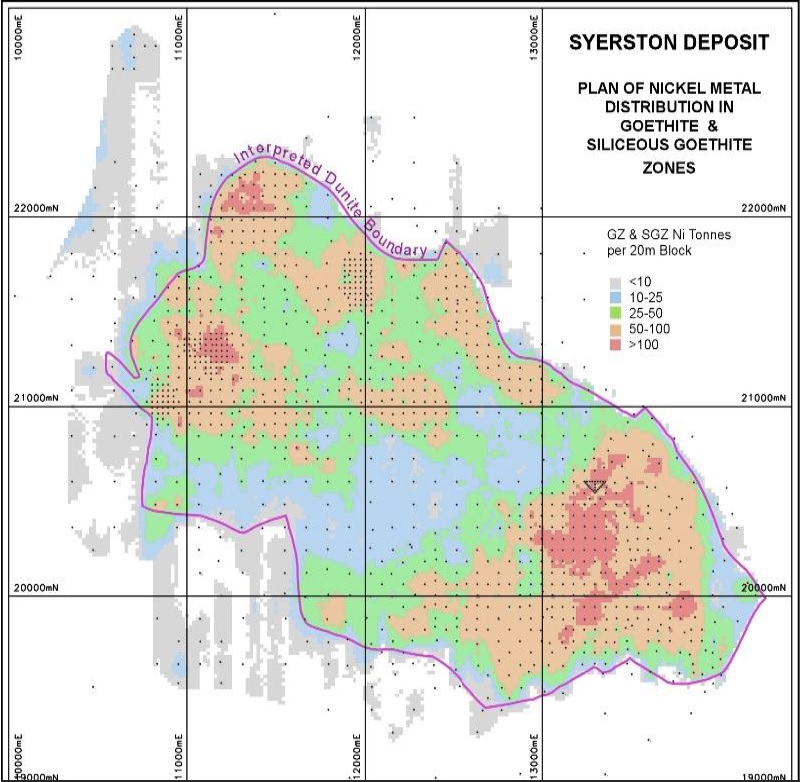

The Syerston project is pretty large, with an estimated 101 million tonnes of rock in the measured and indicated categories, at an average grade of 0.65% nickel and 0.10% cobalt. The in-situ M&I resource thus contains 660,000 t onnes of nickel, but perhaps even more important, 106,000 tonnes of cobalt. Of these 101 million tonnes, 96.2 million tonnes were deemed to be sufficiently reliable to be classified as ‘reserves’.

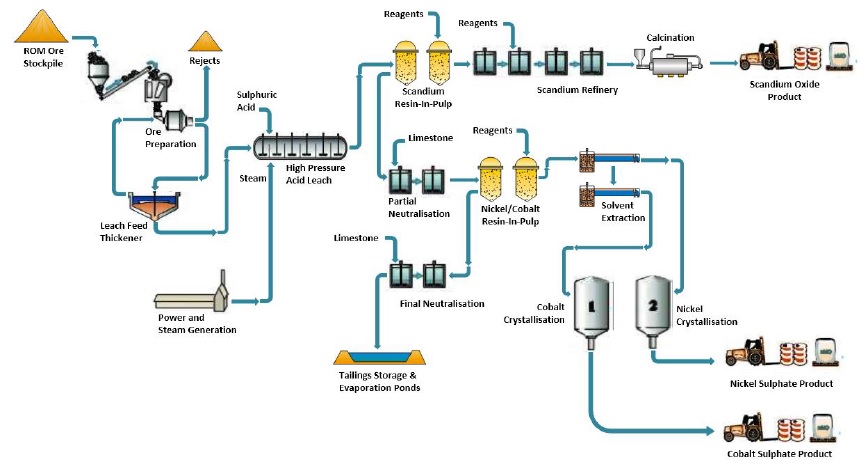

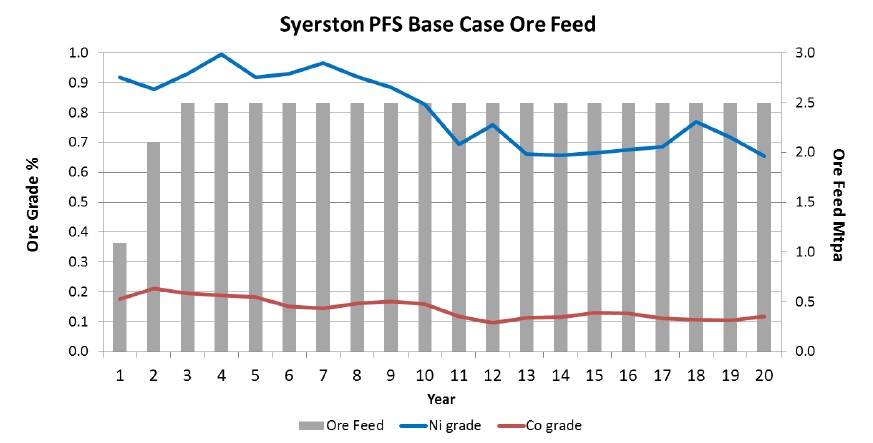

The entire reserve estimate (excluding the additional 8 million tonnes in the inferred resource category, which wouldn’t move the needle anyway) was used in the mine plan in the pre-feasibility study which has outlined a 40 year mine life at an average processing rate of 2.5 million tonnes of rock per year. The flow sheet consists of a milling circuit followed by acid leach and a Resin in Pulp process where after the sulphate solution is refined through a solvent extraction phase. After this final step, the Syerston output will consist of nickel sulphate and cobalt sulphate. The average recovery rate is expected to be 94% for nickel and 93% for cobalt, which actually is really good.

Clean Teq will need two years to get the processing rate up to the 2.5 million tonnes per year, where after it has designed an initial 20 year mine plan (which is approximately half of the expected 39-40 year mine life). It looks like the mine plan calls for the higher grade zones to be mined first, as the average grade in the first 18 years of the full production stage is approximately 0.84% nickel and 0.14% cobalt which is substantially higher than the reserve grade.

That’s not a bad decision as A) the higher grade will reduce the production costs per produced pound of nickel and cobalt and thus reduce the payback period, and B) the impact on the Net Present Value will obviously be much higher if the higher grade rock is processed first.

Using a cobalt price of $12/lb, the C1 cash cost of the nickel production will be approximately US$0.89 per pound, making it one of the lowest cost nickel producers in the world. However, we would like to make an important remark here. The after-tax NPV8% of US$891M is quite optimistic, as the company uses a base case nickel price of $7.5 per pound, which is almost 90% higher than the current spot price. Should you use a more acceptable $5/lb, the annual pre-tax cash flow would fall by approximately $100M per year to just US$160M (in full production mode). As the initial capex is estimated at US$680M, the lower nickel price will very likely cause the Internal Rate of Return to fall to less than 20%.

That’s below our minimum requirements, but there are two additional factors we need to take into consideration. The first factor is the abundance of scandium on the property. As you might remember, Syerston used to be a Scandium-focused project, but the pre-feasibility study has excluded all potential revenues from Scandium, and adding scandium to the equation as an additional by-product credit could have a substantial positive impact on the annual cash flow (see later).

Secondly, even though the nickel price is quite optimistic, we do have the impression Clean Teq has been quite conservative with its cobalt price assumptions. The company used a base case cobalt price of $12 per pound, whilst the current price for cobalt on the London Metals Exchange is approximately $17/lbs. Since January 1st last year, the cobalt price has actually increased by more than 50%, and using $12/lbs is way too conservative.

If we would use today’s spot price, the total revenue from the sale of cobalt would increase by US$25M per year (assuming a payability rate of 70%). At an assumed cobalt price of $20/lbs, the cash cost for the nickel would be exactly zero, improving the economics of the project even at a nickel price of 5 dollar per pound.

The potential revenue from selling the Scandium is NOT included in the cash flows and NPV

Even though Syerston used to be marketed as a scandium project, the pre-feasibility study is completely ignoring the potential scandium sales as an additional source of revenue. According to the study, CleanTeq can build a plant to recover the scandium at an additional cost of just $15M, which would produce up to 50 tonnes of scandium oxide per year.

Of course, as the current world market for scandium is just 10-12 tonnes per year, ‘dumping’ 50 tonnes per year on the market could have devastating effects on the scandium price. That being said, thanks to the low additional cost, it could make a lot of sense for CleanTeq just to build the scandium plant, stockpile the scandium oxide and sell it on opportunistic moments. And if scandium really takes off in 5 or 10 years from here, CleanTeq will have a large inventory of finished product.

If we would assume annual scandium sales of 6,000 kilogram per year and a scandium price of $2000/kg (the current price is approximately $4000/kg), the annual cash flow could increase by an additional $10M per year, further boosting the economics of the Syerston project. Even if just 1/10th of the scandium could be sold, it would still make sense to include the $15M scandium recovery plant in the business plan.

Cobalt might be THE commodity of 2017

Even though CleanTeq is marketing the project as a nickel project with a cobalt by-product (which is the correct way to do considering the nickel revenue will be approximately twice as high as the revenue from the cobalt sales), the potential power of the cobalt production should not be underestimated.

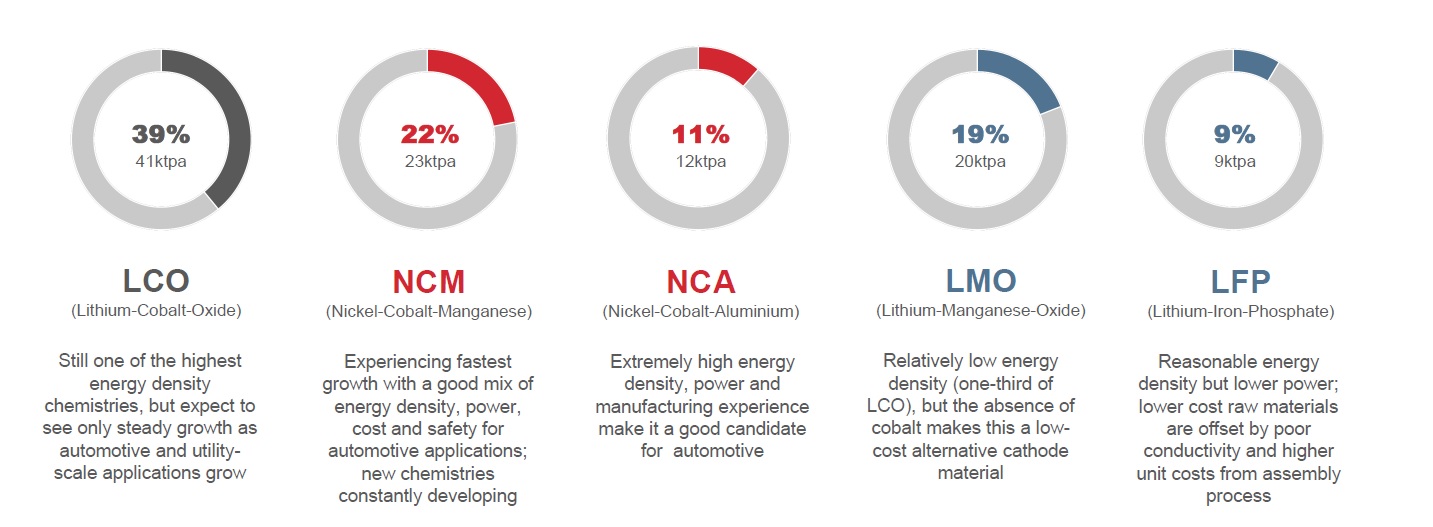

The entire world seems to be focusing on lithium right now, but the market seems to be forgetting cobalt actually is an important part of the battery market as well. 72% of all batteries in the EV market now contain cobalt and cannot be replaced. Cobalt really is the ‘forgotten’ metal of the past decade, and virtually nobody has been investing in cobalt exploration in the past years. This resulted in the dangerous situation the world is depending on ‘unstable’ regions (such as the DRC) for their cobalt needs. According to the United States Geological Survey, 63% of the cobalt is produced in countries that we consider to be ‘unreliable’ predominantly for political reasons. And THAT will be the main risk for the global cobalt supply.

It’s also the main reason why we expect cobalt to enjoy much more attention in the coming years, as the investing world will suddenly start to wake up after the recent lithium boom, realizing if lithium batteries really take off, the world will need to develop new cobalt projects as well. It’s not a coincidence the European Commission has placed cobalt on the list of critical raw materials.

Conclusion

And that’s where Clean Teq’s Syerston project comes in. The anticipated cobalt production rate isn’t too high (at just 3,200 tonnes of cobalt per year), it would produce approximately 3% of the total world demand. We would expect some of the cobalt end-buyers to seriously consider diversifying their sources for cobalt as it would make so much more sense for them to get involved with an Australian project with an initial mine life of 20 years, rather than hoping for two decades of no social unrest in the DRC (which seems extremely unlikely).

The author has no position in Clean Teq Holdings. Please read the disclaimer