2018 is almost over and it wasn’t a great year for the natural resources sector. Some metals did very well, but this didn’t mean the share price of the companies moved along with the commodity price increases. Gold appears to be ending the year on a (relatively) strong note, but the gold equities remain weak. Silver and oil seem to have found a bottom but the equity markets still appear to be a bit cautious.

The tax loss selling season is almost over, and we think that whoever wanted to sell, has already sold by now, which could indicate the share prices may stabilize from here on and could benefit from investors taking new positions. UBS has recently released its precious metals outlook for 2019, and it’s interesting to see the Swiss bank is now expecting the gold price to average $1300/oz in 2019. That would be a great result for most gold miners and developers, but the UBS report doesn’t really provide any support for the silver sector. The bank has slashed its 2019 silver price forecast from $17/oz to just $15.8/oz, and it looks like we will see some more mine closures in 2019 as some miners can no longer justify keeping some of their mines open due to selling their silver at a loss.

Caesars Report is able to exist thanks to the companies sponsoring our mining portal. In this special exploration outlook report we are highlighting our sponsoring companies and have asked them the same three questions; how was 2018, what do you expect for 2019 and what are your projections for the commodity you focus on? All answers were provided by the companies and we pulled the other data (share count and cash position) from the company’s most recent presentations.

Enjoy the read, and happy holidays!

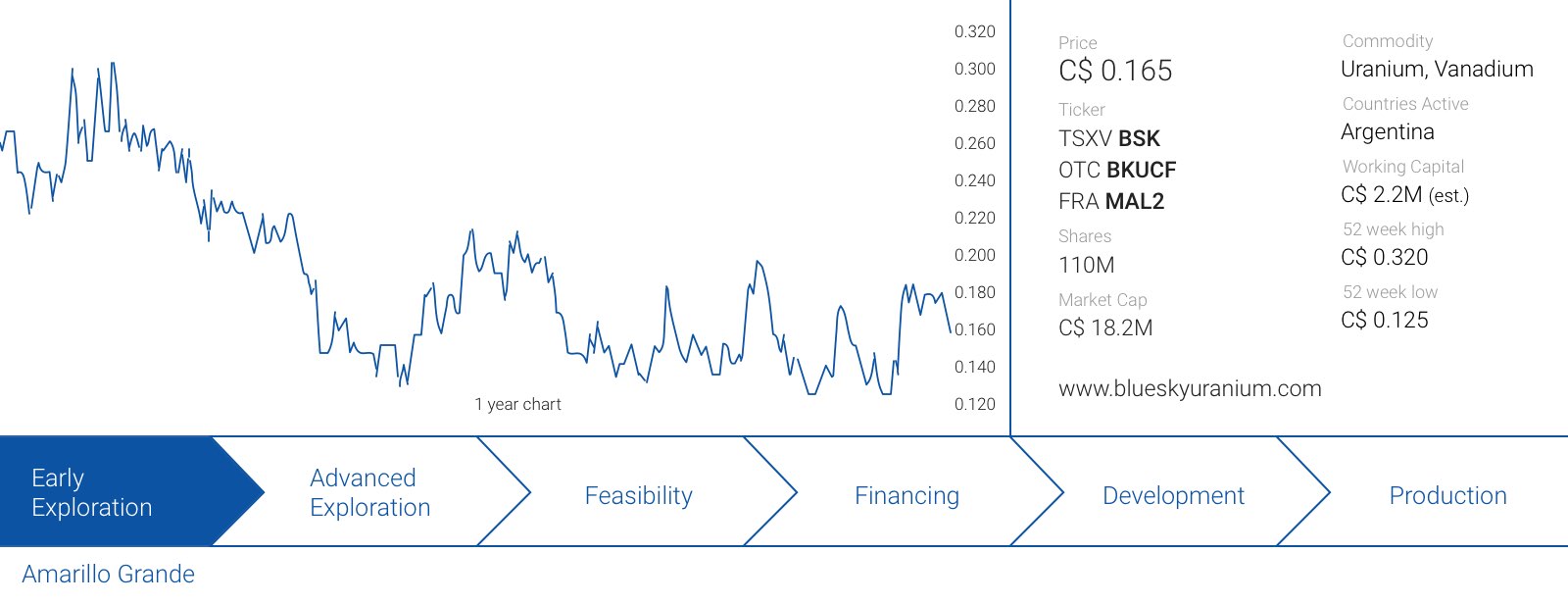

We expect 2019 to be an important year for the uranium market and the companies focusing on this commodity. The tendering activity from US utilities should start to pick up next year and especially now Cameco has become a net buyer on the spot market to meet their contractual obligations, we think the oversupply on the spot market is going down really fast which will result in higher spot prices which, in turn, should cause the longer term contract price to increase as well.

We expect 2019 to be an important year for the uranium market and the companies focusing on this commodity. The tendering activity from US utilities should start to pick up next year and especially now Cameco has become a net buyer on the spot market to meet their contractual obligations, we think the oversupply on the spot market is going down really fast which will result in higher spot prices which, in turn, should cause the longer term contract price to increase as well.

Blue Sky Uranium (BSK.V) released its maiden resource estimate on the Amarillo Grande uranium-vanadium project earlier this year, and the recent exploration updates have been very encouraging as the company continues to encounter mineralization outside of the current resource. We asked Blue Sky Uranium the same three questions.

Could you review 2018 for us? What did you work on, and what did the company achieve in the past 12 months?

Blue Sky Uranium Corp. is a leader in uranium discovery in Argentina. The Company’s objective is to deliver exceptional returns to shareholders by rapidly advancing a portfolio of surficial uranium deposits into low-cost producers. Blue Sky holds the exclusive right to properties in two provinces in Argentina. The Company’s flagship Amarillo Grande Project was an in-house discovery of a new district that has the potential to be both a leading domestic supplier of uranium to the growing Argentine market and a new international market supplier.

The Ivana uranium-vanadium deposit is the largest discovery in Argentina in the last 50 years and the districtwide potential makes Amarillo Grande one of the most significant uranium discoveries in the world. The company filed the maiden NI 43-101 Technical Report supporting disclosure of the initial independent mineral resource estimate for the Ivana Deposit at the Company’s 100% owned Amarillo Grande Uranium-Vanadium Project in Rio Negro Province, Argentina, as reported on March 5th, 2018.

The Ivana mineral resource estimate is the first for the Amarillo Grande Project. The deposit is situated within five properties of less than 7,000 hectares in total, covering the southern portion of the 140-km uranium-vanadium exploration trend, within which Blue Sky Uranium controls over 280,000 hectares of mineral exploration rights.

Through additional drilling and exploration work, the company recently reported high grades of uranium and vanadium in initial pit samples located a kilometre west of the Ivana Uranium-Vanadium deposit over 1% U3O8 and 0.1% V205. This clearly supports that the deposit is open to expansion potential.

Guillermo Pensado, Vice President of Exploration, received the “Explorer of the Year” Nivaldo Rojas Award at the 2018 Argentina Mining conference for the Uranium/Vanadium discovery and maiden resource. Nominees for the award are put forth and voted on by members of the exploration and mining community attending the annual conference, which is the premium international event of the Argentinean mining sector.

What will 2019 bring? What will you be working on and what budget do you have in mind?

Blue Sky will continue work to expand the resource with an aggressive work program. The Company will be announcing the metallurgical test results and the Preliminary Economic assessment in the first part of the New Year with of a focus of moving toward to production.

We will have funding requirements in the New Year so your readership should stay tuned in case they would be interested to participate in a financing.

What’s your near-term and longer-term outlook for Uranium (and the Argentinean uranium market)?

Argentina is a natural market with an existing nuclear power plant fleet that is currently under expansion and yet no domestic mine production of uranium. Argentina remains pro-mining.

Blue Sky expects to be the first supplier to feed the country’s current uranium requirements and be there for the near term expansion. Blue Sky Uranium is the ideal uranium development story in Argentina. The company’s main assets are in a pro-mining province and at some distance from any substantial settlement (Rio Negro province).

As expected the unmet demand will be just less than one billion pounds of U3O8 in the coming 10 years. At the same time, over 70% of the expected reactor needs are not contractually secured. For a little traded commodity like uranium this return to more “normal” long term contracts could put tremendous pressure on the long-term prices as well as on the spot prices. The international plant operators are showing buying signals.

We expect world demand will increase sharply due to the construction of several hundred new nuclear reactors so that the market price will benefit twofold as well as the investor who has recognized that trend in time.

Could you review 2018 for us? What did you work on, and what did the company achieve in the past 12 months?

Could you review 2018 for us? What did you work on, and what did the company achieve in the past 12 months?

In 2018, Brixton was active on all four of its wholly-owned projects. We spent about $4M in the ground across our projects with a decreasing spend starting from Langis, Hog Heaven, Atlin Goldfields and Thorn. The Brixton team grew to twelve (mostly geologists) and strengthened its Board by adding a new Board of Director’s member, mine builder Randall Thompson.

For 2019 Brixton plans to focus on the Atlin Goldfields project and seek JV partners of its other projects if an attractive deal can be reached. However, the wholly owned assets have low to no holding costs and are drill ready with major upside potential so the company is not in a desperate situation to do just any deal.

Brixton conducted the most work at its Langis and Hudson Bay silver-cobalt properties in Cobalt, Ontario. The program exceeded its original objective, which was to drill in and around the historical past producing mine workings to test for high grade silver-cobalt mineralization as an extension of the workings. Several intercepts of multi-kilogram silver and multiple percent cobalt were encountered like 6m of 4719 g/t silver plus 0.33% cobalt and one hole retuned 3.55% cobalt over 1 meter.

In addition, while drilling for cobalt-silver, Brixton discovered a diamond bearing kimberlite zone (Several kimberlites are known to occur in the region). Since this unique kimberlite discovery, Brixton has drilled 11 (100-200m deep) holes hitting kimberlite in 10 of the 11 holes over a 20 hectare area, so we are pretty excited about this. The kimberlite material is currently being processed and results shall be released upon receipt which will likely take some time given the large volume of material.

At Brixton’s Hog Heaven silver-gold-copper project in NW Montana, we completed the historical assay data entry of 57,498 meters of drilling from 722 drill holes and built our 3D model. Brixton completed 724 line kilometers of VTEM Plus and 60 square kilometers of LiDAR. Through this review process we identified some of the previous holes encountered high grades gold and copper in additional to the silver. As an example: hole AFR-79-5 intersected 18.29m of 4.46% Cu, 4.51 g/t Au, 745.71 Ag and hole AFR-81-38A intersected 67.06m of 2.65 g/t Au, 339.94 g/t Ag and base metals we not analyzed. And AWFR-79-33 returned 3.05m of 26.06 g/t Au, 265.71 Ag and base metals were not analyzed. The project is permitted and drill ready. The Company is seeking a JV partners to advance the project. A historical non-Ni-43-101 compliant resource estimates sits at about 47Moz Ag and 0.23Moz Au and base metals were discounted.

At our Atlin gold project in Atlin, BC, Brixton consolidated the camp (12 deals over 2 years) and now controls 1004 square kilometers of district-scale, Barkerville-style land package. The project is road accessible with the potential to drill year round. During 2018 Brixton collected about 2500 soil samples, conducted geological mapping and re-logged core and are currently working up drill targets for 2019. There are 4 known prospects (Yellowjacket, Imperial, LD and Pictou) that we plan to drill test in 2019.

The Yellowjacket zone has a historic non-compliant-NI-43-101 estimate of 150,000oz Au at about 10 g/t Au. The best historic drill hole at the Yellowjacket zone was 5.5m of 509 g/t Au (16oz/t Au). The Imperial vein which is near the Yellowjacket zone was mined near surface (245 tons at grades between 5 and 14 g/t Au). The LD showing returned up to 293 g/t Au for Brixton in 2017 and historical trenching returned up to 330 g/t Au and limited drilled returned up to 3m of 9.4 g/t Au. The Pictou showing returned 10 g/t Au from a one ton bulk sample, 14 g/t over 2m from trenching and grab samples up to 52 g/t Au. During the 2018 program a large gold-in-soil anomaly was identified at the eastern portion of the property which will be followed up on during 2019. Drilling is planned for early May 2019 at the Atlin project.

At Brixton’s Thorn project in the Golden Triangle of BC, in collaboration with the Mineral Deposit Research Unit and porphyry specialist, Brock Riedell, we completed a program of core re-logging, geological mapping and sample collection for whole rock lithogeochemical analysis combined with short-wave infrared spectroscopy (SWIR). This is a cost-effective method to vector for copper-gold porphyry targets. Final results are pending.

What will 2019 bring? What will you be working on and what budget do you have in mind?

In 2019, Brixton plans to focus the majority of its resources on its high-grade Atlin Goldfields project. Past results of 5.5m of 509 g/t (16 oz/t) gold have been drilled near surface, and we feel this will prove to be the greatest value driver for the company. The market is very hungry for new discoveries, and the share price of companies announcing high-grade discoveries did very well this year.

The project is near the town of Atlin with road access, has low-cost drilling, and is in a very stable jurisdiction. We draw a strong comparison between Atlin and the historic Barkerville gold camp which now has 1.6Moz gold in the M&I and 2.1Moz Au in the Inferred categories.

We are planning to enter 2019 with a drilling budget of $2.5-$3M. This will give Brixton enough horsepower to drill our intended targets, develop new targets and with the potential for new discoveries as well. One of the objectives we have set for ourselves at Atlin is to sort out the structural controls for the gold mineralization; we are looking to “crack the code” on the geology.

What’s your near-term and longer-term outlook for your main commodity?

While the Company does have some multi-commodities optionality in its portfolio, like diamonds, silver and copper. We believe that many factors are contributing to a positive near-term outlook for gold.

Political instability and a falling US dollar should lead to a favorable gold market in the short to medium-term. Major producers are in search of quality projects in friendly jurisdictions and companies like Brixton Metals with wholly-owned projects such as these will be in an advantageous position. If you can develop a high grade gold resource in a place like Canada, you will not only have lots of potential buyers but you will garner a premium price for the asset.

Contact Gold (C.V) has made a lot of progress on its Pony Creek gold project in Nevada. The company spent millions of dollars on drilling the property and has now confirmed there seems to be a widespread ‘blanket’ of gold mineralization that seems to be the extension of the gold zones on the neighboring properties owned by Gold Standard Ventures (GSV.TO, GSV).

We talked to Chris Pennimpede who takes care of Contact Gold’s Corporate Development to discuss the achievements of Contact Gold and his expectations for the gold sector.

Could you review 2018 for us? What did you work on, and what did the company achieve in the past 12 months?

2018 was a year of discovery for Contact Gold. The company’s two most significant accomplishments were: expanding the oxide gold footprint (at 100 gram meters) through step-out drilling at the Bowl Zone; proving the historic resource could be expanded, and the subsequent development and discovery of the West Zone.

The West Zone started the year as a 2km long gold-in-soil anomaly. It’s very unusual for a soil anomaly to deliver across its entire length, but Contact has now identified more than 2.3 km of oxide gold extending from surface in every drill hole at the West Zone; including the discovery hole (PC18-18)33m @ 0.42 g/t Au, followed by (PC18-22) 10m @ 0.7 g/t Au in late summer. The final holes from the West Zone, released in late November (PC18-49 to 51), were particularly interesting as they were thick (93 @ 0.33 g/t Au) oxide gold intercepts from surface at the northern most section of the soil anomaly.

The next steps for Contact at the West Zone will be going back to increase the drill density and hopefully find higher grade pods that are typical in these Carlin-type gold systems. By succeeding in making new discoveries at Pony Creek, Contact is now in a position to further advance these new discoveries to deposits in 2019.

What will 2019 bring? What will you be working on and what budget do you have in mind?

2019 will be a very busy and critical year for Contact Gold. We will be focused on aggressively pushing forward exploration and drilling at Pony Creek. The successes we’ve had – identifying new, large Carlin-type gold systems over the last 1.5 years – mean that we now have to focus on drill density to prove up these discoveries into new gold resources on the property.

To accomplish this, we have to look to increasing drill density at our recent discoveries, and testing virgin targets as well. The drilling budget for 2019 will be determined early in the new year once all the results from this year have been received and reviewed.

What’s your near-term and longer-term outlook for your main commodity?

The current economic climate for junior gold explorers certainly illustrates the need for projects to be in safe, mining-friendly, and low-cost jurisdictions where miners can operate and make a profit at $1100-1200 gold.

When we started Contact Gold we were focused on “Tier-1” jurisdictions (Nevada, Ontario, Quebec). Tier-1 jurisdictions survive downturns and depressed metal prices because the infrastructure is already in place, and the regulatory framework offer a safe, reliable and streamlined path to production. During the last downturn all gold majors focused in on their key low-cost producing mines/jurisdictions and Nevada proved to be critically important for Newmont Mining (NEM.TO, NEM), Barrick Gold (ABX, ABX.TO) and others.

Additionally, all of these producers are now seeing their production profiles decline, with some of them steeply declining. They will need to add deposits in these Tier-1 jurisdictions, which puts Contact in a good position. Overall, all of these factors should be good for gold.

The gold price (and the exploration industry) slowly increased from 2002 – 2008 after the tech bubble. I think the expectation that gold would go right back to the frothy 2011 $1,900/oz level was unrealistic coming out of the downturn in 2016. I would prefer to see a slow, steady increase in gold price with some healthy dips coinciding with the bursting of the “Everything Bubble” and further decline of the FAANG stocks.

These events are already starting to take place and I expect gold will be seen as a safe haven as investors look for security. The gold price should benefit from market turmoil and we expect gold prices to incrementally rise over the coming years.

Blaine Monaghan recently moved from a Vice-President position at Allegiant Gold (AUAU.V) to become CEO at Fremont Gold (FRE.V), a gold exploration company exploring the tenements directly adjacent to McEwen Mining’s (MUX.TO, MUX) Gold Bar development project in Nevada. Monaghan didn’t waste any time and recently closed an oversubscribed placement, raising C$1.23M which will go a long way towards a new drill program at Gold Bar and Gold Canyon in 2019.

Could you review 2018 for us? What did you work on, and what did the company achieve in the past 12 months?

On the exploration and the corporate front, 2018 was a busy year for us. On the exploration front, we drilled both Gold Bar and Gold Canyon, with good results. We also carried out some earlier stage exploration work at North Carlin, which identified some excellent drill targets. On the corporate side, I was named the new CEO of Fremont Gold, replacing Dennis Moore, who remains as President, so he can focus on what he does best, which is making new discoveries.

We’ve also had great success in building out our advisory board. We named Derek White to it this past summer and we recently appointed Douglas Hurst, who was the executive chairman of Northern Empire when it was acquired by Coeur Mining. In addition, we just closed an over subscribed financing. No small feat in the current market environment. I believe this speaks to the quality of our team and of our projects.

What will 2019 bring? What will you be working on and what budget do you have in mind?

We are currently permitting Gold Bar and Gold Canyon for another round of drilling and expect to be drilling early in 2019. However, unlike last year’s drilling programs, this program will be focused on finding additional mineralization along strike and at depth.

At Gold Bar, we believe we may have discovered a possible extension to the historic Gold Bar mine. We’ll be testing a coincident gold and mercury soil anomaly to the south east of the historic Gold Bar mine in an area that hasn’t seen any drilling. We’ll be testing this anomaly with four 300-metre holes.

At Gold Canyon, we are looking to further define a mineralized horizon that we intercepted in last year’s program. We plan to drill four 200-metre holes at Gold Canyon. I’d also like to drill test North Carlin sometime in the second half of 2019, so we are gearing up for a very busy 2019 on several fronts.

What’s your near-term and longer-term outlook for your main commodity?

I think there are a lot of reasons to be bullish about gold. However, in the short term, I believe a weaker US dollar will lead to an improved gold environment. It would appear that the Fed has blinked and is no longer as hawkish as it once was regarding the pace of rate increases.

Integra Resources (ITR.V) had a very busy 2018 as it started a 20,000 meter drill program on the DeLamar and Florida Mountain projects right after announcing a maiden resource estimate of 871,000 gold-equivalent ounces at Florida Mountain. This pushed the combined resource to 3.54 million gold-equivalent ounces (2.27Moz gold and 108.5 million ounces silver) at an average grade of 0.71 g/t AuEq.

And the assay results from this drill program have been impressive. The company has been stepping out from the currently known inferred resource estimate and continues to hit gold mineralization, paving the way to lift the gold-equivalent resource to 5 million ounces. CEO George Salamis answered the same three questions.

Could you review 2018 for us? What did you work on, and what did the company achieve in the past 12 months?

The last 12 months were a whirlwind for Integra. Since November 2017, Integra acquired the past producing DeLamar and Florida Mountain deposits, released two NI-43-101 Resource Estimates outlining 3.5 million ounces AuEq, drilled 20,000 meters on the project (the first major drill program at DeLamar since the 1990s), significantly increased our land package to include more than 6 km of highly prospective ground, and identified multiple new targets and zones of mineralization below and around DeLamar.

Perhaps one of the most important milestones in the last year was the discovery of Sullivan Gulch. Located on the edge of the existing resource envelope at the DeLamar Deposit, Sullivan Gulch returned a strong IP anomaly that when drilled revealed significant, undiscovered gold mineralization. Over a 500m strike length, Integra drilled fences spaced at 100 m that returned gold over widths of 100 m and 200 m at 1.25+ to 2.0+ g/t AuEq. Sullivan Gulch, not explored by previous operators, has the potential to grow the resource substantially.

The drill bit and field reconnaissance also identified high-grade targets west of DeLamar, including Henrietta (1,080.00 g/t Ag over 4.57 m (13.00 g/t AuEq over 4.57 m)) and Milestone (to be drilled in early 2019).

What will 2019 bring? What will you be working on and what budget do you have in mind?

After our recent financing, we plan on hitting the ground running in 2019. The drills will take a short holiday hiatus before ramping up again in mid-January and peaking during the summer. While budgets are still being finalized, we expect to drill another 20,000+ m at DeLamar in 2019. In addition to drilling Florida Mountain and DeLamar, we will also use the drill to test some high-grade targets on recently staked, highly prospective ground near DeLamar.

In addition to the drill program, Integra also plans to update the resource estimate on the project in Q1 2019 and feed that into a Preliminary Economic Assessment in H12019. This PEA will be an option study on the project, outlining multiple processing scenarios at DeLamar – heap leach, heap leach plus mill, mill as a standalone. Based on the 20 year history of milling at DeLamar, the Company knows how a mill works…well. To understand how mineralized material would heap leach, we’ve engaged McClelland Labs in Reno to undertake metallurgical testing on core samples from all around the DeLamar and Florida Mountain Deposits. This test work is already underway and will be completed in Q1 2019 as well.

What’s your near-term and longer-term outlook for gold?

Based on sector research, including research from major banks who are bullish on gold and commodities for the first time in years, it is hard not to get excited about the potential for a decent gold market. However, during the Integra Gold days, arguably some of the darkest days for the yellow metal, we stuck to the mantra, control what you can control.

At Integra Resources, we’ve stuck to that mantra. Integra can’t control the price of gold…but we can de-risk the project, grow the resource, and work with inputs to ensure the economics of this project work in an uncertain gold market. In our opinion, advancing the project is the only way to create greater value for our shareholder, both in the short and long term.

There have been a lot of new cobalt stories popping up in the past 18 months or so, but M2 Cobalt (MC.V) is the only company trying to go elephant hunting through grassroots exploration in Uganda. Following a sound exploration theory which expects the cobalt-rich mineralization from the DRC to extend onto the Ugandan territory, it acquired a dominating land position in the country.

Following an extensive sampling and trenching program, M2 Cobalt is currently drilling some high-priority prospects on its claims and the assay results should be out in the next few weeks or so. CEO Simon Clarke answered our questions.

Could you review 2018 for us? What did you work on, and what did the company achieve in the past 12 months?

M2 Cobalt had a strong year despite challenging stock market conditions in the second half of the year. We started the year with the acquisition of a very large land package of highly prospective acreage in Uganda and we raised $8.5 million on the back of that transaction. We have spent approximately $5M directly on our projects in Uganda to date and have discovered numerous, cobalt, copper and nickel targets across 3 different styles of mineralization. We are now in the process of conducting a small initial drill program to further test and progress 2-3 of our key initial targets.

Critically we have also cemented our position as first mover for cobalt in Uganda and we have built a strong local team headed by Dr. Jennifer Hinton who has been based in Uganda for 13 years and who is a key figure in the mining community locally. Through Jennifer and her team, we are very well positioned in the country. The new technologies we have introduced to the country have been very well received.

The geological potential of Uganda with the same underlying geology and many shared mineral trends as the DRC (where 70% of global cobalt production will originate this year) is, to my mind, now without question. Our goal very much remains to discover and develop world-class cobalt (and related minerals) assets with the potential for large scale production to help meet the looming supply shortages many commentators predict for the early 2020s.

What will 2019 bring? What will you be working on and what budget do you have in mind?

We will conclude our initial drill programs currently underway and our current plan is to commence resource drilling on at least one of our key targets with the goal of maiden resource numbers in H2 next year and moving into PEA phase thereafter. Our asset package is very large with large-scale potential and this also offers the potential to bring in appropriate partners as we advance our projects.

Budgets will depend on capital markets, but at this point we envisage at least a further $3-$5m in drilling next year with the potential for significantly higher drilling budgets. We will also look to launch geophysical and geochemical programs across the exploration licenses we acquired in our recent strategic asset acquisition.

What’s your near-term and longer-term outlook for your main commodity?

I believe there is a large disconnect between the huge surge in electric vehicle sales (especially with so many new models coming online from next year onwards) and the growth in the overall storage markets and the share prices of the underlying companies especially at the junior end. The run up in the price of cobalt earlier in the year was, in my view, somewhat overdone and the price is now at what is still a historically high, yet more sustainable longer-term level. However, I also believe that the lack of new sources of large-scale cobalt supply will become more and more apparent especially without appropriate investment at the exploration end and I believe prices in the medium-long term will trend significantly higher.

I also believe the decline in nickel and copper prices has been over-done and we will see better pricing next year. I also believe that the whole growth in electric vehicles / storage side of things will be positive for both of these commodities – especially nickel sulphides!

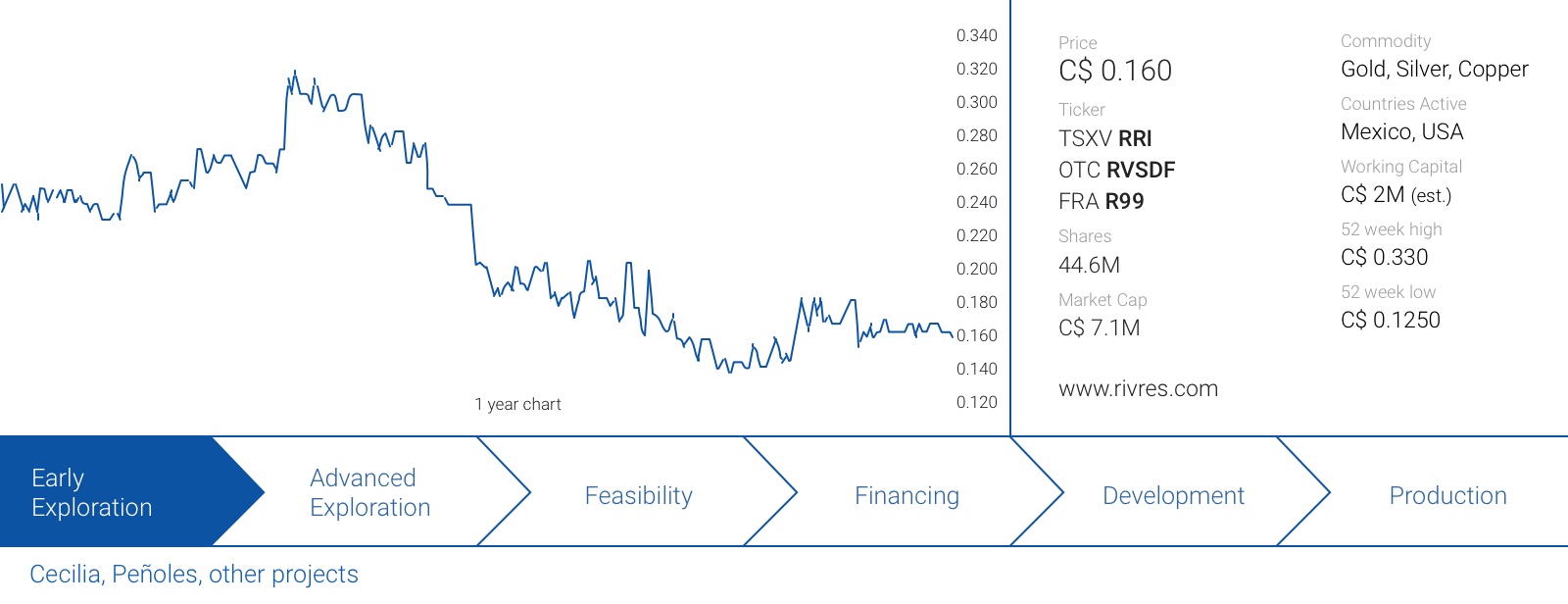

Riverside Resources (RRI.V) has completed a lot of work this year on its gold and copper exploration properties in Mexico. The Company was able to sign a joint venture agreement with Sinaloa Resources which very likely means the exciting high-grade gold-silver project will be drilled in 2019, but on top of that, it advanced several other projects to a drill-ready stage.

We talked to Raffi Elmajian (Corporate Communications) who provided the answers to our three questions.

Could you review 2018 for us? What did you work on, and what did the company achieve in the past 12 months?

Riverside had a good year with a focus on precious metals and some base metal porphyry copper work.

On the precious metals side, Riverside was happy with the positive exploration results in Sonora where the Cecilia Gold-Silver Project is located. We expanded the land package by over 500% to approximately 60 square kilometers to control the entire district and subsequently our follow up exploration work discovered four new target areas at the Project. The field work at Cecilia was positive as we encountered high grade gold results in our sampling program, sometimes exceeding one ounce of gold per ton of rock and we also found new target zones both at the main Cerro Magallanes zone as well as on the 5000 hectare surrounding ground of Cecilia 1. This sets us up very nicely for high potential results early in 2019.

At Tajitos, a second project located in Sonora, Riverside developed high-grade gold target areas that are adjacent to Fresnillo’s (FRES.L) resource and its planned Tajitos open pit mine. We are excited to own such excellent ground with portions of the mineralization that is planned to be mined, which appears to be extending onto Riverside’s ground.

In Sinaloa, the La Silla project with high grades of up to 19.9 g/t Au & 200 g/t Ag makes the project very interesting. Adjacent to our La Silla project, work done by mid-tier and major mining companies like Meridian and Yamana Gold (YRI.TO, AUY) developed resources at their own La Silla veins which extend through Riverside’s large 20 square kilometer tenure package. Partner Sinaloa Resources plans to carry out exploration work in 2019.

On the copper side, Riverside made progress on three properties including the Ariel project where a generative reconnaissance exploration program came up with new target zones. Additionally, Riverside engaged with potential major copper company partners on our Copper projects. We also worked on our two other copper assets (which are also located in Sonora) and we are looking to develop a relationship with a large copper company in 2019, which would really kick-start the exploration activities on the properties.

What will 2019 bring? What will you be working on and what budget do you have in mind?

For 2019 we are set up very well with high-grade precious metal projects including our plans to drill the Cecilia project where we will build upon the fine 2018 results. The drilling could expand the high-grades of surface channel sampling at Cerro Magallanes area and at several areas on the large tenure of the project.

During 2018 Riverside developed new zones and interpretations for the high-grades of silver at the Peñoles project and for 2019 the project will likely progress with a partner funding exploration program toward further development of high grades.

Our partner Sinaloa Resources is expected to conduct mineral exploration and drilling at the La Silla Project in Sinaloa, Mexico and we look forward to seeing some results from that project as well. We are also looking to expand beyond Mexico in 2019 as we are working towards finalizing some opportunities that presented themselves in 2018.

We will obviously also continue to progress the Prospect Generator model with partnerships and potentially a new strategic exploration alliance which could lead to immediate drilling on Riverside’s titled and permitted drill ready projects, which is very exciting.

What’s your near-term and longer-term outlook for your main commodity?

There’s a lot of uncertainty and instability in the world at the moment including interest rates, debt, China, Brexit, and super power jockeying which we see as some factors lining up for an increase in gold price in 2019.

Riverside has been exploring and working up projects during these down markets times positioning ourselves in preparation. Throughout Riverside’s history (which included downturns in the mineral exploration sector), the company has been able to form strategic alliances with companies providing significant generative exploration funding from majors that allowed Riverside to add quality projects to the portfolio that we now own 100%. Riverside continues to build on its 75,000 location database that has significantly enhanced our entire company’s knowledge significantly.

A second key commodity for Riverside is copper, particularly looking at 2019 and 2020. The electricity boom and clean technology changes going on will drive huge demand for copper in the coming decade and we are quite positive on the outlook for the base metal. We are ready for a push on our copper project and are trying to identify potential JV partners and are looking to add more promising copper projects to our portfolio in the next 6-18 months.

Southern Silver Exploration (SSV.V) made major progress on its 40% owned Cerro Las Minitas zinc-silver project in Mexico. The company published a resource update and continued to intersect mineralized zones that should help it to increase the silver-equivalent resource, which currently stands at almost 210 million silver-equivalent ounces. It’s still very early days and Southern Silver currently has no plans to publish a Preliminary Economic Assessment on CLM, but we already made an attempt to figure out the economics of CLM, and you can re-read our report here.

Since that report was published, Southern Silver released updated and improved metallurgical test work and we will shortly update our expectations using the more recent metallurgical test work ahead of the planned resource update.

Could you review 2018 for us? What did you work on, and what did the company achieve in the past 12 months?

We:

- Published an updated mineral resource estimateof, at a 175g/t AgEq cut-off:

- Indicated – 116.1Mozs AgEq: 33.6Mozs Ag, 319Mlbs Pb and 813Mlbs Zn; and

- Inferred – 7Mozs AgEq: 20.7Mozs Ag, 131Mlbs Pb and 870Mlbs Zn

- Continued to expand the CLM West claim group to +200 sq km to bring the total property package to now 345 sq km.

- Completed a $3.0M exploration program focused on:

- the continued expansion of the mineral resources at Cerro Las Minitas; and

- the further development, through continued surface exploration and drill testing of Ag-Au epithermal vein systems in the more recently acquired CLM West claim group.

In the Area of the Cerro, the drill program was successful in expanding high-grade mineralization at the Las Victorias and North Skarn targets, several hundred metres laterally and down dip. Drilling in the Skarn Front deposit filled gaps in the current block model including a 15.3m (est. TT) intercept averaging 260g/t Ag, 0.18% Cu, 0.9% Pb and 0.1% Zn (317g/t AgEq; 8.9% ZnEq) from Drill hole 18CLM-110. Results from several additional holes are still pending and will be included in an updated Mineral Resource estimate in late Q1 2019.

Exploration in the +200 sq km CLM West claim group focused on the ‘greenfields’ discovery of Ag-Au epithermal vein systems in this largely volcanic terrane which elsewhere hosts major mineral deposits at the Avino Gold-Silver Mine and Coeur Mining’s, La Perciosa deposit. Drilling successfully intersected a strongly anomalous silver intercept averaging 168g/t Ag over 3m and thicker zones of strongly anomalous As-Sb ‘pathfinder’ elements. Drilling tested the Durazno breccia, a strongly oxidized and brecciated structural zone that can be traced discontinuously for over 1.5 kilometres on the CLM West property before plunging under gravel cover to the south. Only one hole has tested this newly identified target; more work and drill testing is planned in 2019.

Earlier metallurgical work on the Skarn Front had copper in the form of chalcopyrite report to the zinc concentrate resulting in dilution of both zinc grade and recovery. Work in 2018 successfully removed the chalcopyrite from the zinc concentrate, effectively creating three high-grade base metal concentrates (Zn, Pb, Cu) with over 84% of silver reporting to the copper and lead concentrates.

What will 2019 bring? What will you be working on and what budget do you have in mind?

Current budgets for 2019 are contemplated in the $2M to $3.5M range. Funds will be used to:

- Update a mineral resource calculation in late Q1 2019 based on the 2018 exploration results;

- Continue systematic resource expansion in the Area of the Cerro toward a near to mid-term goal of +300Mozs AgEq;

- Continue targeting of Ag-Au quartz vein systems in the CLM West claim group toward the identification of a brand new, high-grade, precious-metal-rich mineral deposit.

What’s your near-term and longer-term outlook for your main commodity?

Zinc 2019 Outlook: expected to remain in supply deficit for a third year in a row despite increasing supply with mine production up 4.6%; however, China’s environmental protection continues to pose supply risks.

Silver 2019 Outlook: forecasted to outperform gold; supply is expected to decrease in 2019 due to lack of new mines and expansions.

Lead 2019 Outlook: to remain in supply deficit supporting prolonged high lead prices.

Copper 2019 Outlook: higher demand (renewable energy, electric vehicles), modest deficit, 3% production increase will create a balanced market. Projected to hold current price levels or move slightly higher.

Disclosure: All companies mentioned are sponsors of the website, and we have a long position. Please read the disclaimer