NV Gold Corp (NVX.V) has been around for a while and the Company’s focus has always been on Nevada, which obviously explains the Company’s name. Surprisingly, NV Gold announced the acquisition of an early-stage exploration gold project in British Columbia. We sat down with Peter Ball, President & CEO, to discuss these new developments.

Q&A with Peter Ball

Corporate structure

Despite your company name ‘NV Gold’ and having your assets in Nevada, you decided to pursue an acquisition in British Columbia. Can you elaborate on how this transaction fell into place?

The project was introduced to NVX accidentally at PDAC when a geologist wandering the floor was looking for a much bigger name and company than us (recommended to him by some industry colleagues ), and we asked to review his project, hence he never made it to the “bigger name”.

After discussing the project internally for 3-4 months and reviewing various options on how to move forward, the structure of earning in over 3 years to reach 51%, and subsequent option to increase to 85% ownership was decided to minimize any early dilution and provide opportunity to understand the project further. Of note, the first 6 months NVX is only required only issue 250,000 shares and issue $30,000 (which is the only cash payment required over 5 years of the full earn in to 85%, as the rest is in shares.) By the end of the 6 months, we likely will have completed a drill program and have enough information (or further geological due diligence) to be comfortable in next tranche of shares, which is 750,000 at the six (6) month mark.

The project was discussed internally with Dr. Odie Christensen, Dr. Quinton Hennigh, John Watson and Alf Stewart, all solid technical guys.

We were looking for a gold project with “flagship potential”, and hence Exodus met the requirements of grade, size, location, and initial positive indications of something scalable and accretive for the Company. After the project being worked privately for 3 years, it became ready for some elevated exploration and capital deployed. We will look to complete a property wide High-Resolution Mag geophysical program, modelling, and a subsequent potential drill program to be deployed to see what may be beneath the surface. The Exodus project can also be accessed year round with direct road access, is close to the city of Prince George, and with potential access to Flow-Through capital, and a 30% pine beetle exploration credit to help offset any capital dedicated to the project, it could provide the opportunity to be advanced fairly quickly into 2021. All of the above greatly assisted and attracted our team to the project and in making the decision to push forward on the option agreement.

Does this mean flow-through funding will be part of your future financing solutions, going forward?

Yes, we will look to raise some flowthrough capital at some point, as we push forward to ensure we can fully fund the project, and ensuring we can minimize dilution.

Can we expect more acquisitions to further advance your portfolio? Will you continue to look outside of Nevada?

We are not looking or reviewing any new assets as we have a very full plate with the new Exodus Gold Project, and the potential two programs in Nevada (Slumber and Sandy Gold Projects).

We are currently in the process of looking at opportunities to sell/JV/lease other projects within our portfolio to raise additional capital, along with selling our Swiss gold asset (Surselva).

The New BC Asset

Let’s take a moment to discuss your new Exodus project. The property was only staked in 2017. What led the original exploration team to look at that area of BC, and what were the main reasons to stake exactly that property?

The project was discovered by a local rancher, who found some interesting rocks on a brand new logging road cut by the local first nations corporation. The rancher shared the rock with a geologist friend, and it was reviewed, assayed and came back at 7.2 g/t gold. Not a bad start for the first rock!

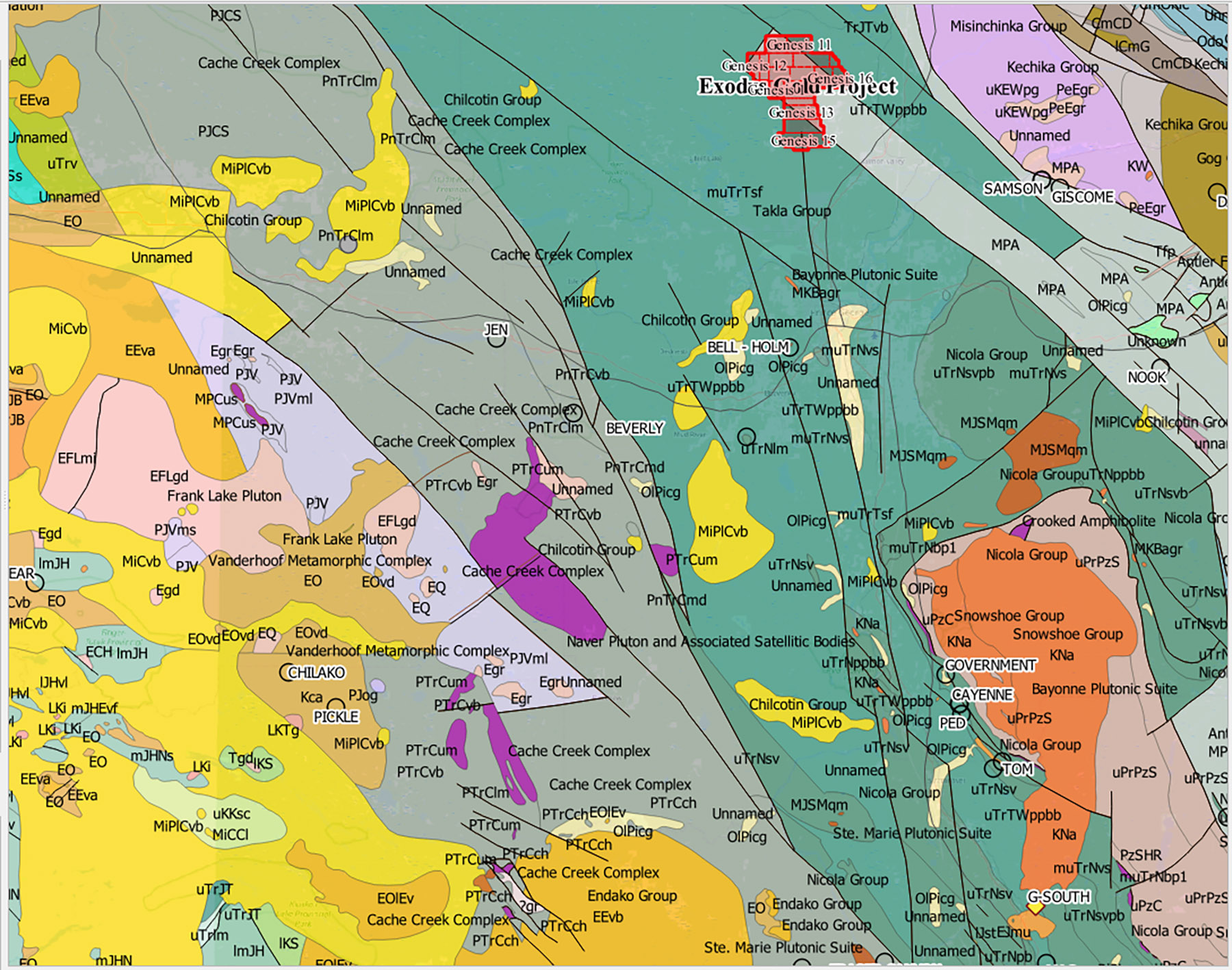

After exploring the area, it was discovered that GeoScience BC (QUEST survey) completed some work over the area and a mag low was identified to be coincident with what they call the Antler/Takla Group rock formation that was directly over the area. Prior to this the local area was sampled extensively by the geologist and rancher, and multiple veins were discovered, with widespread gold and arsenic geochemical signatures in the host rocks, and quartz veining and soils.

In addition, other key pathfinders including strong antimony correlation was found. These are what most explorationists look for in tracing or reviewing gold projects. Further review of the localized geology found key structural breaks and an interpreted deformation zone existed directed on top and cutting through the project. All the right indicators that something may exist at depth. Also, the project is situated directly between two porphyries drilled in the past by two major mining companies further indicating that we are in the right area for such a mineralized system to exist. Glencore and Xstrata both drilled porphyry targets immediately to the east and west, and having the Exodus project situated between two potential porphyry targets always means you are in the right area.

What’s the near-term work program in BC? The property comes with trenching and exploration permits, so we would assume that would be your starting point?

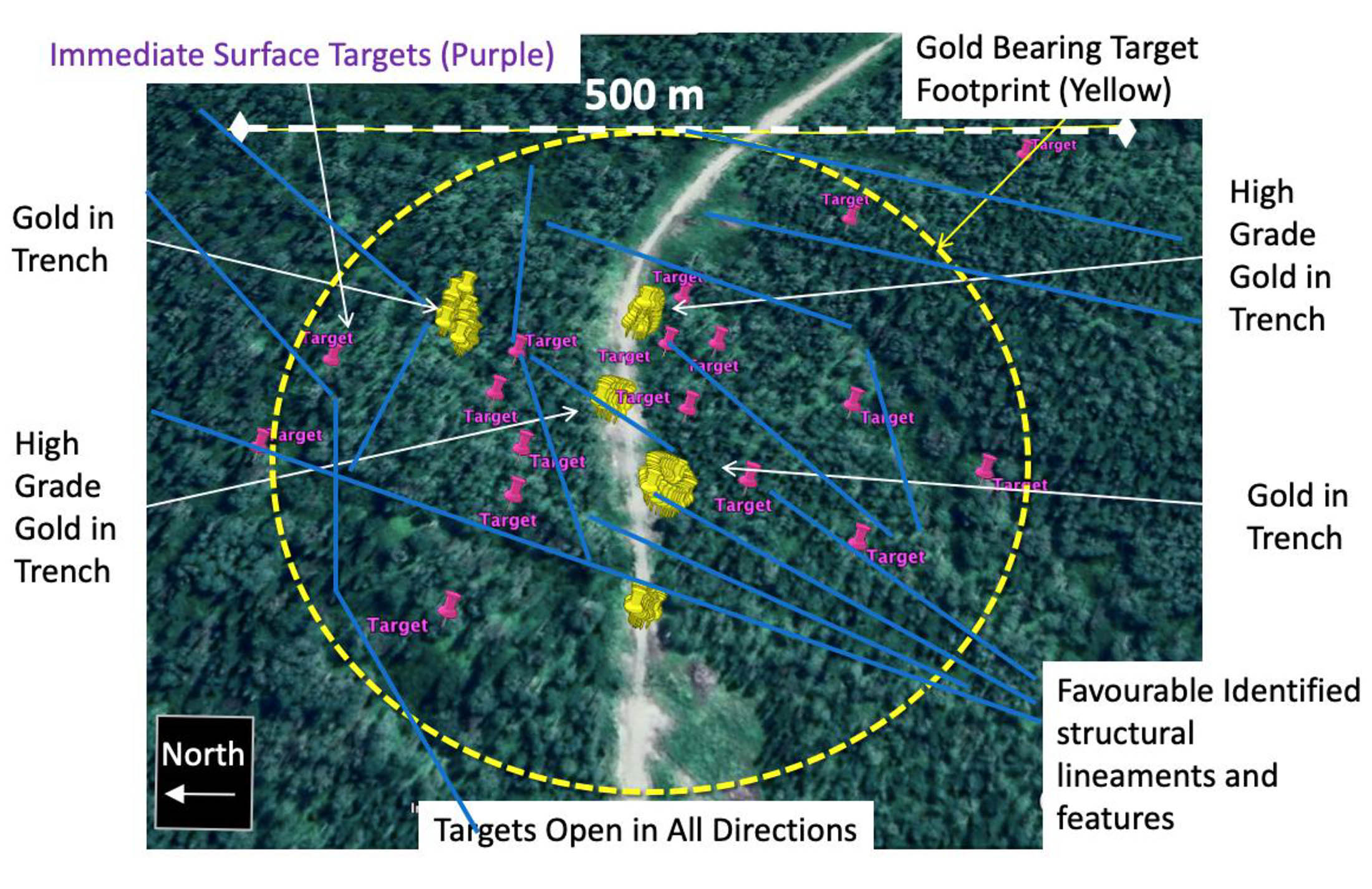

With trenching, soils and sampling completed over the past 3 summers and identifying what seems to be an initial area of interest in the center of the project, additional work was completed to lightly step out and produced positive results with similar mineralization discovered approximately one kilometer away.

Near term work program will initially include a property wide High-Res Mag property wide geophysical survey, to assist in identifying the localized structures, for immediate modelling and reconnaissance exercises. In addition a property wide reconnaissance sampling, a trenching program will be completed, and with extensive access through many logging roads across the project, we should be able to expand the foot print of the interpreted gold system. At this project, with excellent access, you could drive into town for lunch, noting it is only a few kilometers from the main power grid that extends north along the highway, and the highway and the community of Prince George. Of note the new logging road, which was further expanded a few kms this past year, was named Mine Road, with signage by the local supportive First Nations team.

Gold mineralization in quartz veins

The licenses remain in good standing until the end of 2021. What’s the required annual amount of exploration expenditures to keep the project in good standing?

We are currently good until 2021 with work expenditures, and with the work we will complete this year, we will be good well into the future. The claims require approximately $115K per year to keep them in good standing, so by the end of this year for example, we in theory would be good for a an additional 4-5 years if we spent $500K in 2020. Another key aspect on the expenditures is the Pine Beetle Exploration Tax Credit which should return approximately 30% of the capital deployed to the project back to our treasury.

How far along are you in the drill permit process? May we assume there is no real urgency as your field work will have to define the high-priority drill targets first?

We are working with the local Mines Inspector group finalizing and reviewing our drill permit and we anticipate receiving the permit in September and embark on a drill program in October. Again, the location of this project allows us to continue to drill through the winter with road access, unlike some of the projects in the Golden Triangle.

In Q1, you cancelled the LOI to earn into the Silver District Project in Arizona. We notice your terms to acquire Exodus are relatively similar with a very low up-front commitment. What would you need to see in the first pass exploration program to remain committed to Exodus?

At Exodus, we will be looking to expand on the model and determine next steps based on the fall/winter drill program. Let’s see what the drill bit brings. The Silver District, based on extensive review, did not meet our needs, and we didn’t feel we could solidify or expand the historical resource without significant capital.

Nevada

How will your future ratio of efforts in Canada/Nevada be?

As mentioned earlier, we are looking to have up to 3 drill programs in 2020. I would suspect capital will be allocated 60% BC/40% NV and expanded in either location based on results.

What is your planned exploration budget for Nevada this year?

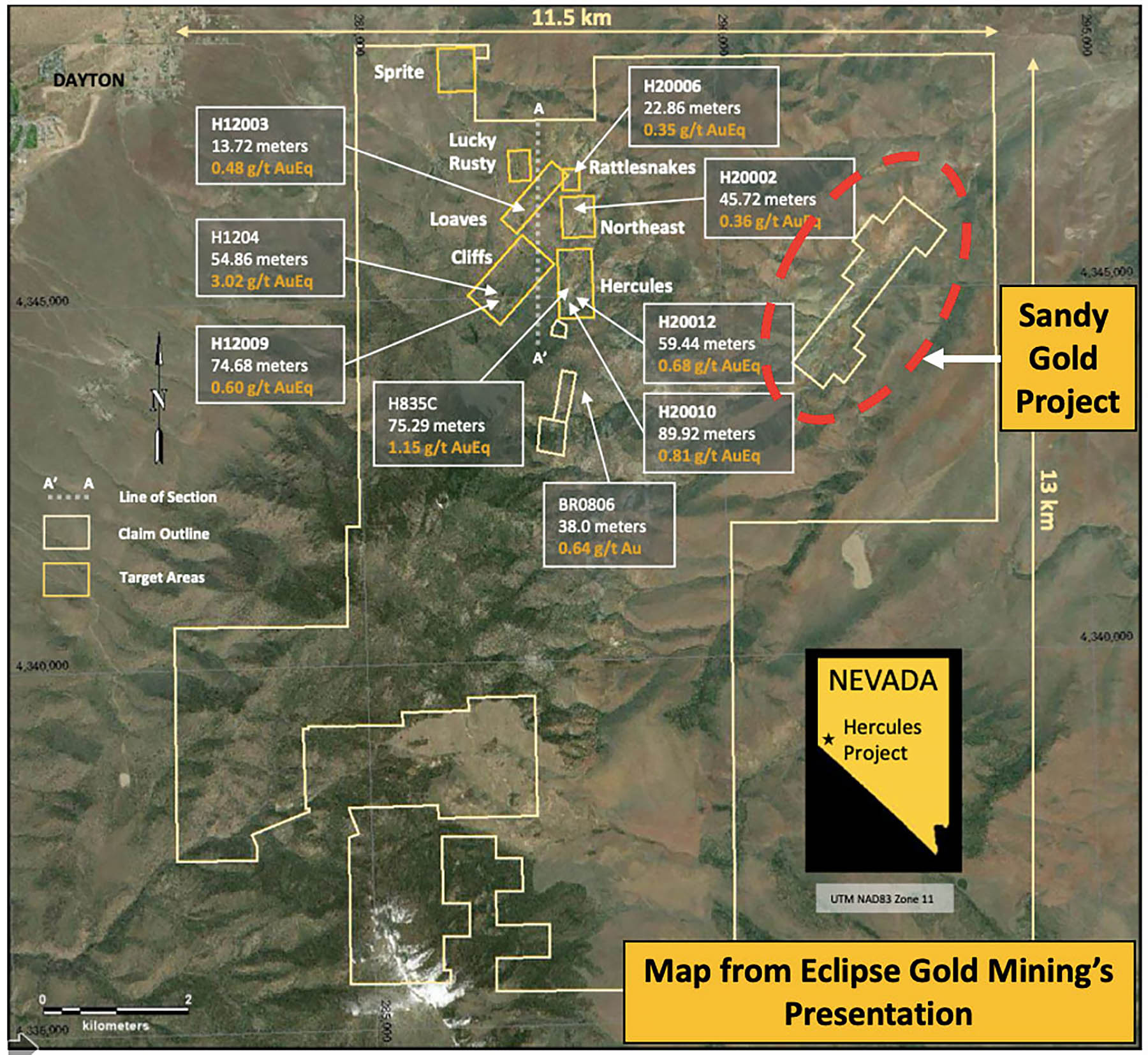

The budget for Nevada in 2020 would be approximately $300K to $350K, based on geophysics and two small drill programs to further test the Slumber and Sandy Gold Projects. Sandy is quite interesting noting its location within the Eclipse Gold Mining (EGLD.V) large land package, where they recently received positive results immediately to the west of drill holes completed at Sandy in the 1990s. Sandy was acquired for staking costs only from our database, where we discovered open ground with historical drill holes with positive intercepts, such as 30 feet grading 1.16 g/t au. Anything over 1 g/t Au in Nevada is viewed as very positive. Check our website for other results from the project.

Are you still actively looking for partners on some of your Nevada assets? Would you mind highlighting any of your property assets that appear to be very intriguing but aren’t high on NVX’ priority list?

All of our projects in Nevada have extensive work completed on them, and many are drill ready or have enough information to be pushed to drilling. A few projects stand out such as:

- In the Walker Lane trend, we have Frazier Dome which yielded 10.4 g/t Au in one drill intersection over 1.5m, and additional drilling yielded anomalous gold across a 500 ft hole from surface to the near bottom of the hole.

- Root Spring, up close to the Cortez trend, was sampled in the fall of 2019 and yielded close to 9.5 g/t Au and 1500 g/t Ag. 4000 feet of drilling was completed historically with positive results deserving a follow-up exploration program.

- Three other key projects right in the middle of the Cortez and Carlin trends, all with positive results were Cooks Creek, SW Pipe and Richmond Summit. Refer to our website for information.

- Another interesting project is Cu-Au porphyry (Oasis) that a major spent approximately $3M on and yielded good results, before they exited North America for corporate reasons.

- One last one is Seven Devils, where an extensive gold system was discovered over 2 kilometers, and assays up to 3.5 g/t. Again, that’s good grade for Nevada.

GoldSpot & the recent financing

You tried to raise money in February at C$0.12 per unit but this capital raise obviously fell through due to COVID-19 and the turmoil on the financial markets. Perhaps this was a good thing as you were subsequently able to price your May financing at C$0.14, almost 20% higher. You also welcomed GoldSpot Discoveries as a new shareholder, can you elaborate on the role Goldspot played in this financing? Were they the lead order?

The immediate rise in COVID issue and cases globally after our announcement of the February financing made us halt the raise to ensure we could get better rates later. We have supportive shareholders and a management team that is very respected in the industry, and as we are all large shareholders, managing dilution is always key. We were also subsequently contacted by GoldSpot Discoveries Corp. (SPOT.V) team who wanted to work together, specifically related to the databases we control. I know their team well, and seemed like a great fit for our databases. GoldSpot contributed $500K in the financing, out of the $1M we wished to raise, and thus yes they were the lead order amongst two other key institutional funds from the USA, and that allowed us to close an oversubscribed financing quickly totalling $1.2M.

Could you elaborate on the role GoldSpot will have going forward?

We will be working closely with respected GoldSpot team, and their proprietary artificial intelligence data mining technology, to review our extensive databases and extract what may be hidden gems or projects. This will be the first time our two databases (AngloGold and USMX) will be fully analyzed.

Will GoldSpot’s technology also be helpful in BC?

I believe that the GoldSpot team, made up of an extensive list of respected technical professionals will be key to helping our team understand any project we review. So yes we can tap into their team. As a large shareholder, GoldSpot wants any project we advance to be successful.

What is your current cash position?

We have about C$1.2M in the bank as of July 1st and about $1.8M of ($0.20) warrants currently in the money. The terms of the Warrants with half expiring in September 2021 and remaining in May 2022, allows additional funding to come into the Company, and we are seeing certain shareholders exercising the past couple weeks. Shareholders are encouraged, as we move forward to contact the Company as they wish to exercise, as additional capital will assist the Company as we move forward.

Conclusion

NV Gold already had one non-Nevada exploration project and has now added the Exodus project in British Columbia to its asset base. The deal has just been announced and NV Gold is undoubtedly still finalizing its exploration plans and we are looking forward to see if the company can book early exploration successes.

With C$1.2M in the bank and about C$1.8M worth of in-the-money warrants, NV Gold shouldn’t have to tap the equity markets anytime soon although now it has a BC property, it could make sense for the company to see if there are any (charity) flow-through funds available. With NV Gold’s shares trading above C$0.30, it shouldn’t be too difficult for the company to raise some flow-through funds at over 40 cents per share if it wants to.

We anticipate to hear more about the upcoming portfolio-wide summer exploration programs in the near future.

Disclosure: The author has a small long position and in-the-money warrants in NV Gold that could be exercised at any time. NV Gold is not a sponsor of the website.