Although there’s absolutely no excitement whatsoever on the uranium markets, we wanted to have another look at Blue Sky Uranium (BSK.V) which published the results of its Preliminary Economic Assessment right before PDAC. The full report has been filed and now the Vanadium hype seems to have faded away, we felt it to be an excellent moment to have another look at the economics of the Ivana deposit on Blue Sky’s Amarillo Grande uranium project in Argentina.

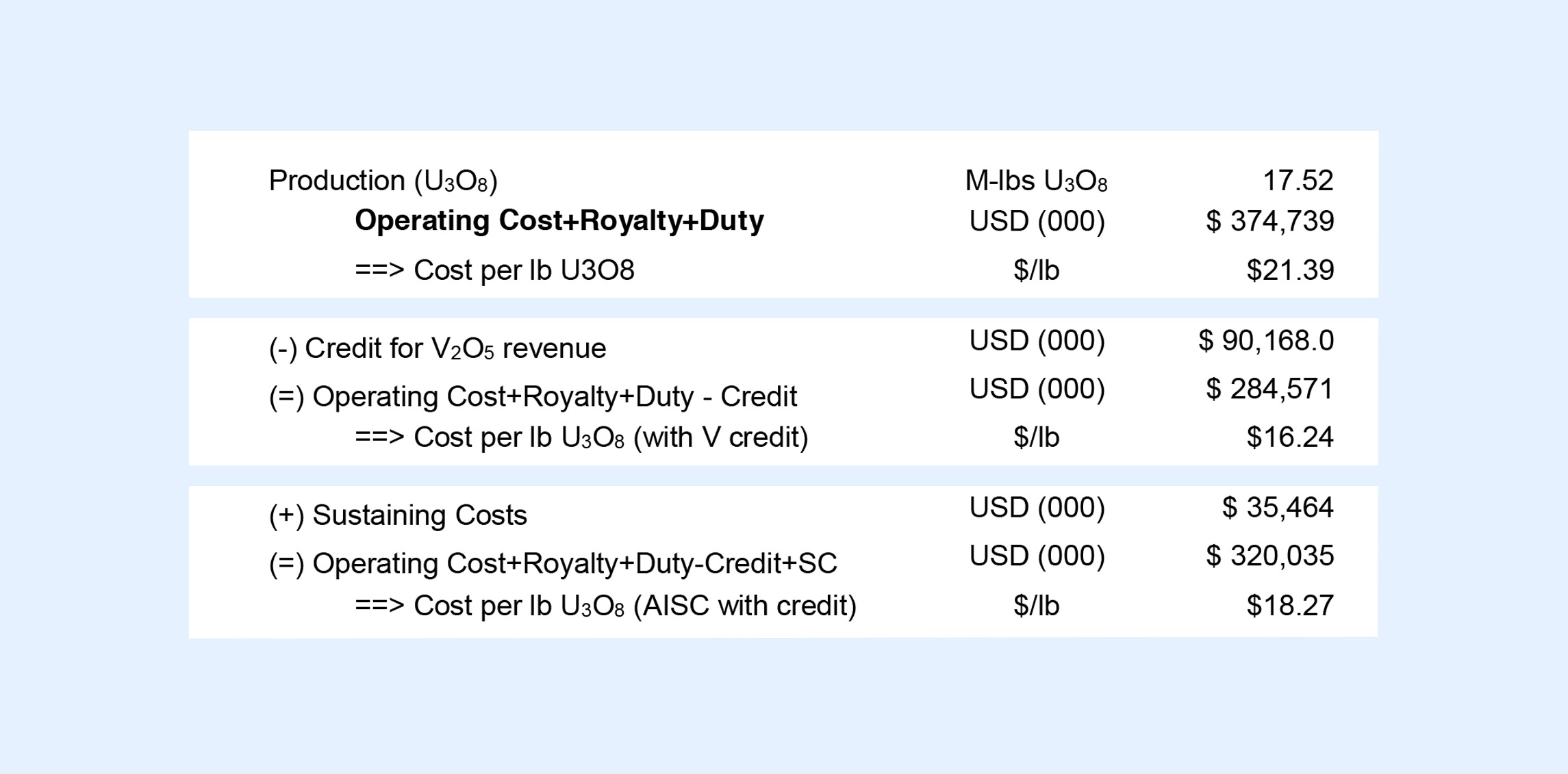

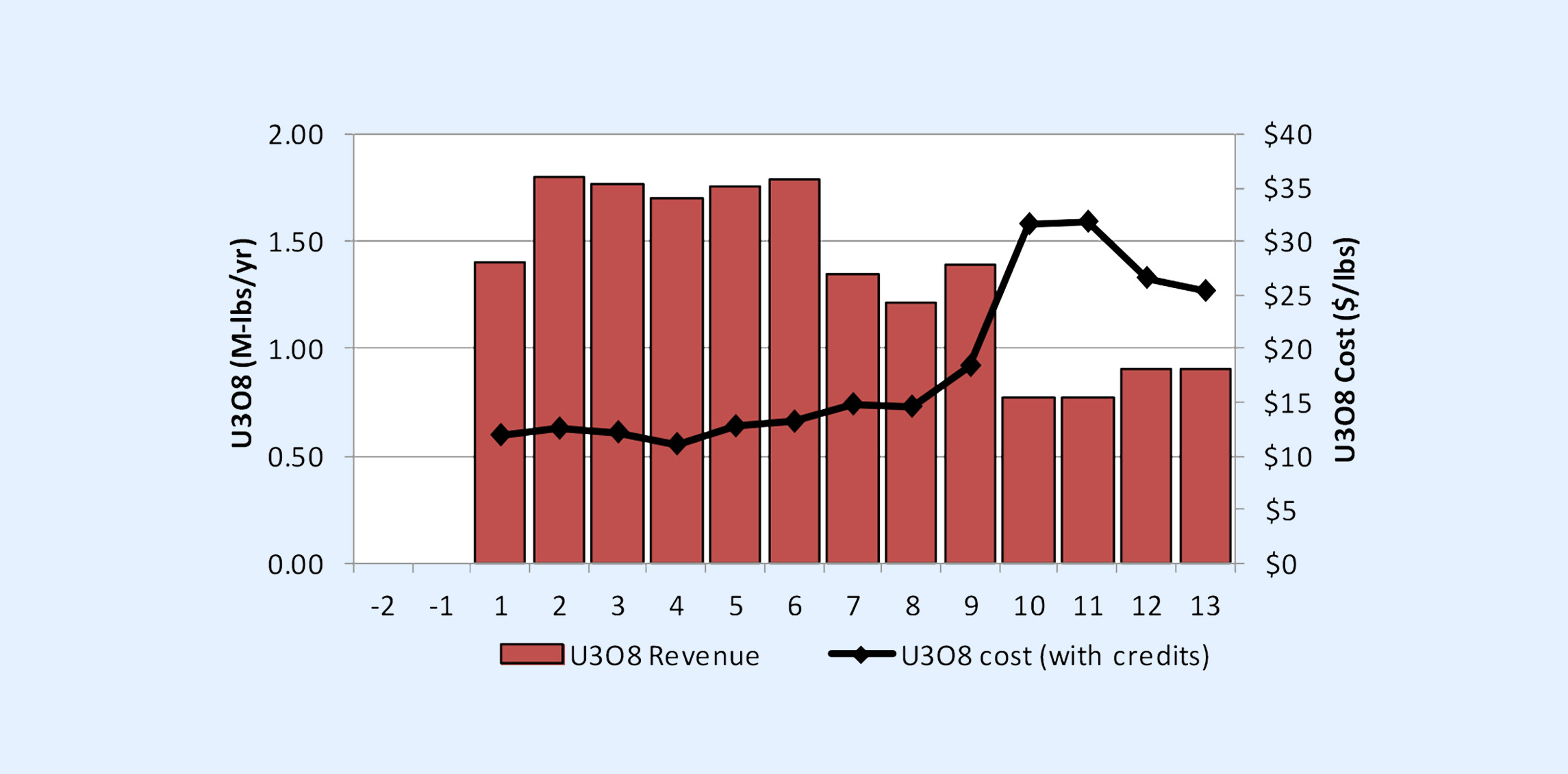

According to the proposed mine plan, Ivana would be a real cash cow in the first few years of its mine life, producing north of 1.5 million pounds of uranium per year at an all-in sustaining cost of less than US$15 per pound (after deducting the contribution of the Vanadium by-product credits).

And as always, please note that all assumptions and interpretations in this report are our own and do not reflect the company’s points of view.

A brief recap on the Amarillo Grande project

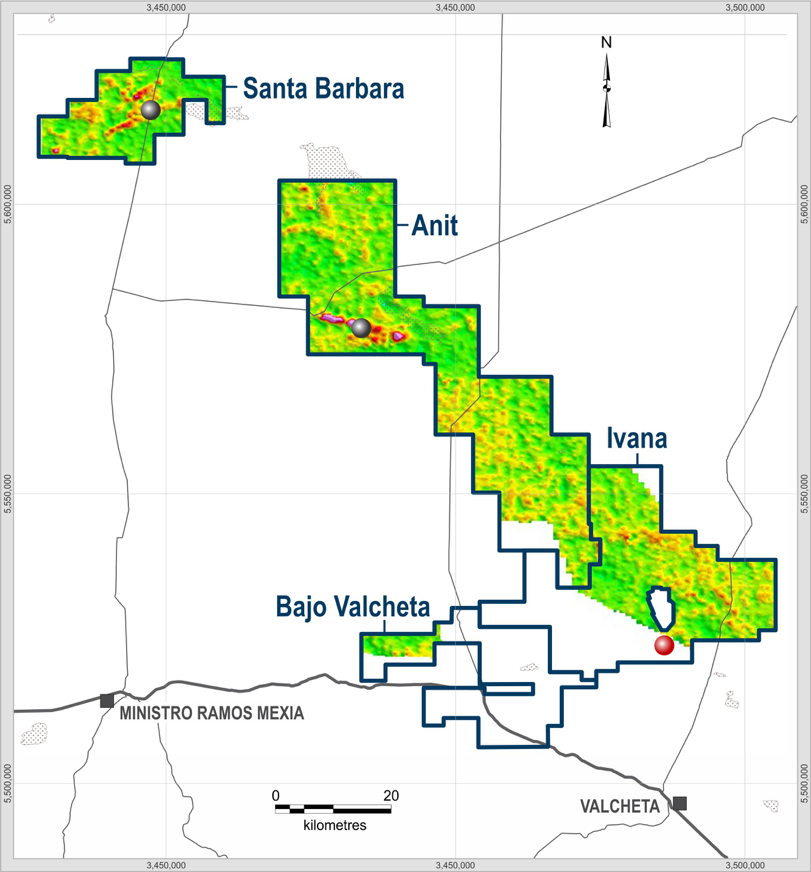

Blue Sky’s flagship project is the Amarillo Grande project in Argentina’s Rio Negro province, which consists of the Anit, Ivana and Santa Barbara zones for a total land package of approximately 287,000 hectares.

Rio Negro has been the subject of uranium exploration before, as approximately 50 years ago, a national commission for atomic energy initiated a first exploration program in the province. Unfortunately, no historical data has been made public by the Argentinean government, and the results of the exploration program in the Sixties and Seventies remain unknown. The properties remained dormant until 2006 and 2008 when Blue Sky Uranium acquired a 100% interest in the Anit and Santa Barbara properties in two separate steps.

Blue Sky Uranium started with a surface sampling program at Santa Barbara which is part of a regional uranium-vanadium system. It was remarkable to see how even surface grabs sampled in excess of 10,000 ppm uranium which is absolutely stunning. This confirmed Blue Sky’s suspicions about a potentially sizeable uranium exploration target right under the shallow overburden.

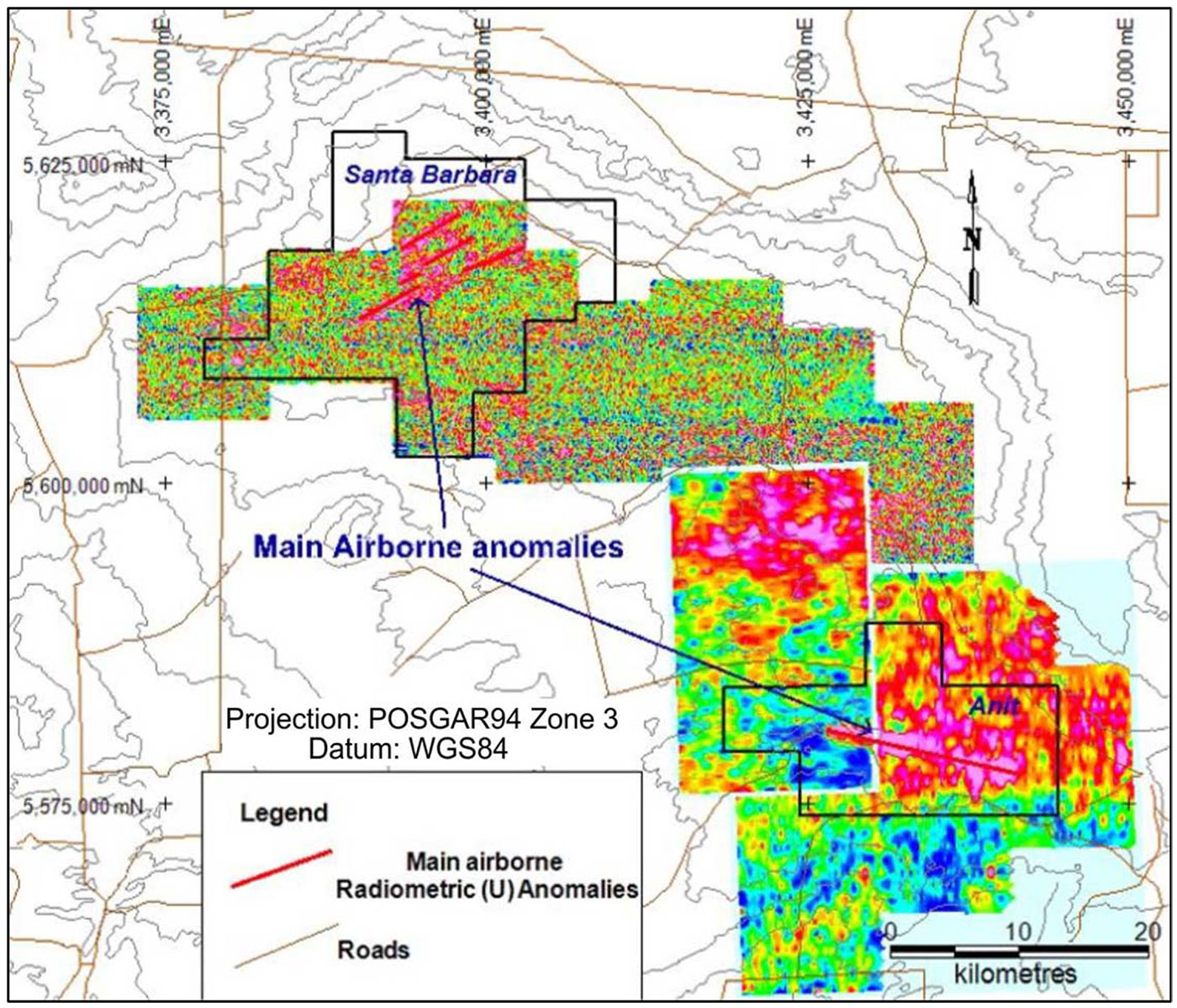

The next step undertaken by Blue Sky (as part of its original earn-in schedule to acquire a 75% stake in the properties) was an airborne survey (the three properties have been subject to almost 40,000 kilometers of airborne surveys). This was a good approach to follow up on previously identified uranium anomalies on the Anit and Santa Barabara zones. The airborne survey discovered 4 anomalies; one at Anit and three large ones at Santa Barbara of which the largest was up to 11 kilometers long and 1.5 kilometers wide. If you look at the next map, you don’t even have to be a geophysicist or geologist to see the ‘hot spots’ pop up on the map.

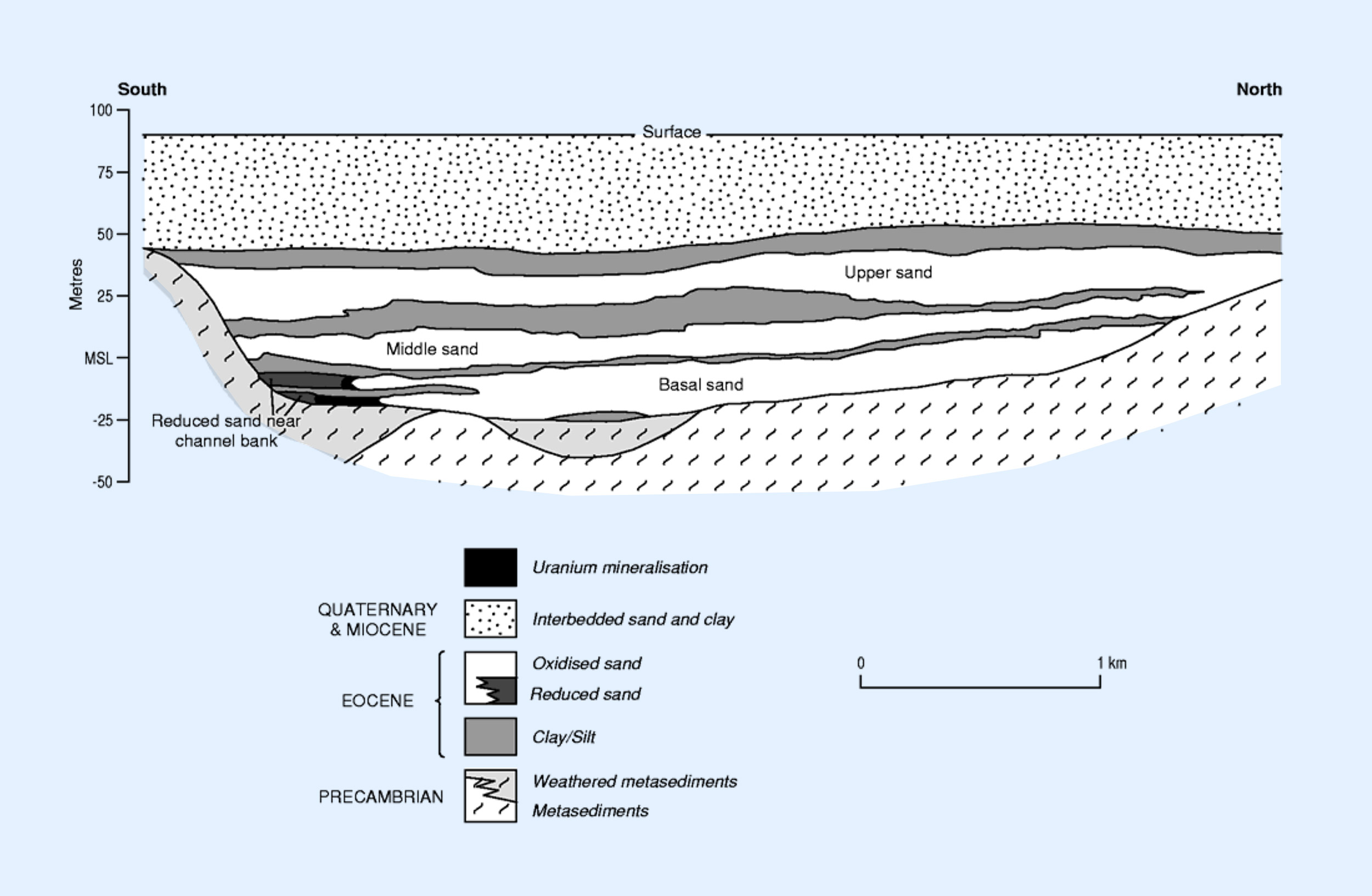

Keep in mind that the Amarillo project is a so-called surficial deposit. Unlike the underground uranium deposits you might be more familiar with, sandstone type deposits are usually several kilometers long, relatively wide (1-1.5 kilometers) but usually aren’t thicker than just a few meters. And these sandstone type deposits are the main source of uranium production worldwide. So exploring and developing the uranium resource at Ivana shouldn’t be rocket science.

Having access to existing infrastructure is a key element to ensure the potential mining operations will be as cheap and efficient as possible. Having the town of Valcheta (5,000 inhabitants) within commuting distance (25 kilometers, which is the approximate distance between downtown Vancouver and Coquitlam) and an existing powerline just 30 kilometers away are very important factors to keep the initial capex and ongoing opex as low as possible. Although the project doesn’t disturb any locals, the Ivana zone is close enough to all relevant infrastructure.

The PEA met our expectations

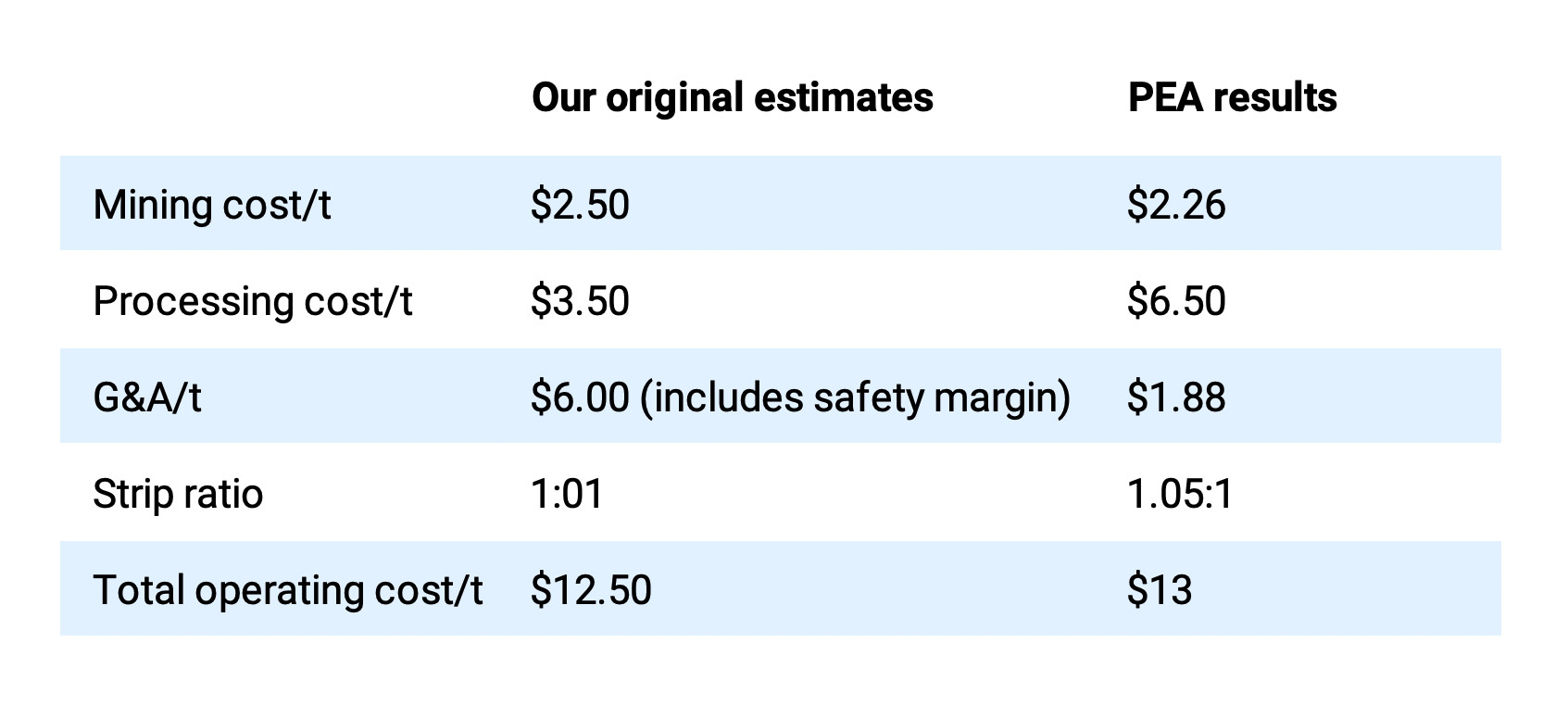

Before the results of the PEA were published, we already ran our back-of-the-envelope model on Amarillo Grande, and we were happy to see we were almost spot on with our estimated production cost of $12.5 per processed tonne (although we did underestimate the processing cost per tonne that effectively gets processed). The next table provides our own expectations compared to the result of the PEA.

The Preliminary Economic Assessment confirms the superior economics of this sandstone-hosted uranium deposit. The initial capital expenditures were estimated at just US$128M, which already includes a very robust $28M contingency allowance and the expenses related to pre-stripping the deposit while the plant is being built. While most companies try to get away with a contingency of just 10 or 15% on the PEA level, Blue Sky’s consultants are immediately trying to make the economics as robust as possible by applying a 28% contingency. And even on the sustaining capex (estimated at $35.5M), in excess of $7M is categorized as contingency.

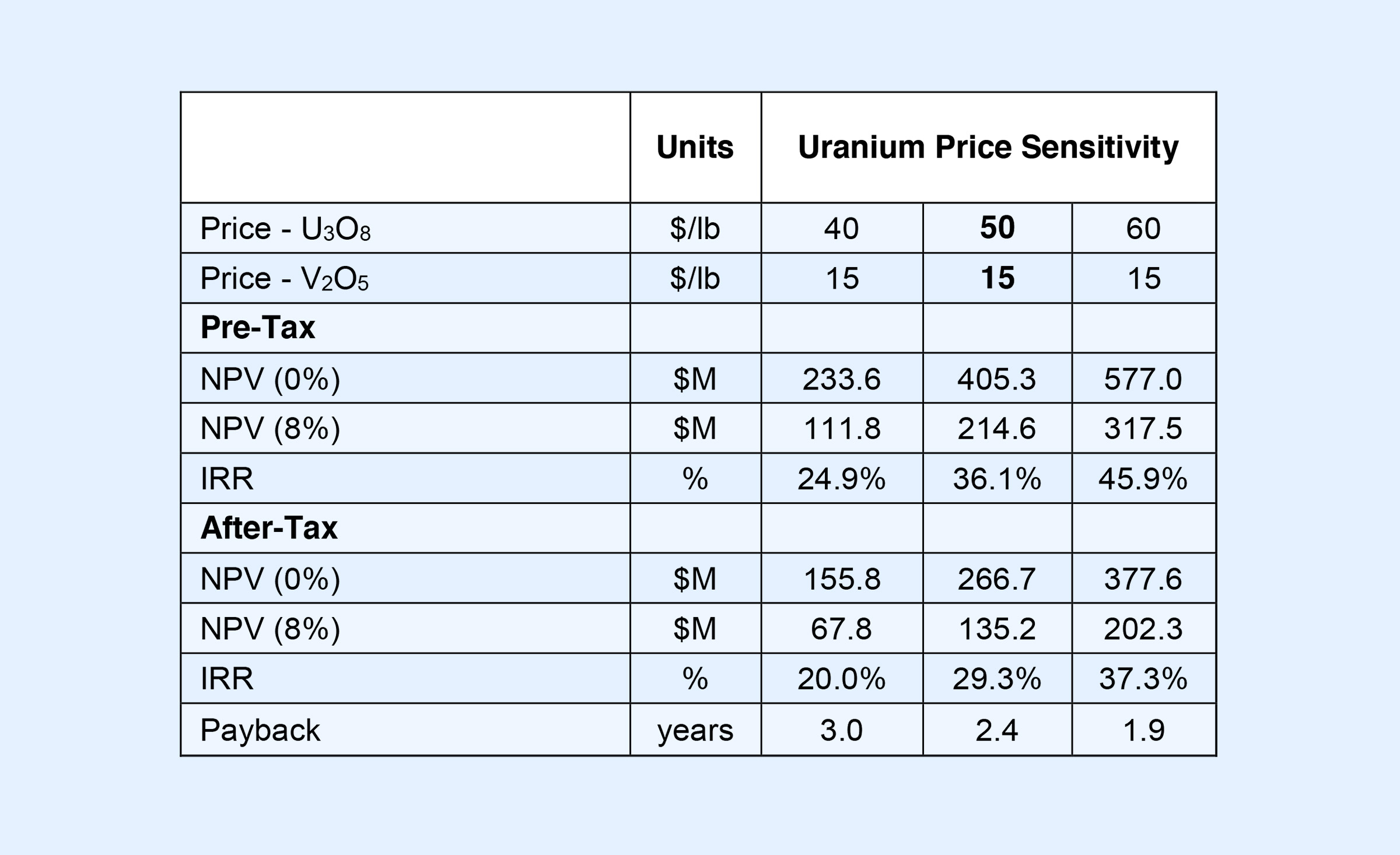

Despite these contingency allowances, the economics look pretty good, even at $40 uranium:

While a base case scenario using an uranium price of $50 per pound is definitely realistic (we still feel $50 is an acceptable long-term price) and an after-tax NPV8% of US$135M and an IRR of 29% is excellent. It’s a positive surprise to see an IRR of 20% at $40 uranium. The NPV8% at $40 uranium isn’t that great, but at least the project remains viable with an undiscounted net after-tax cash flow of US$156M.

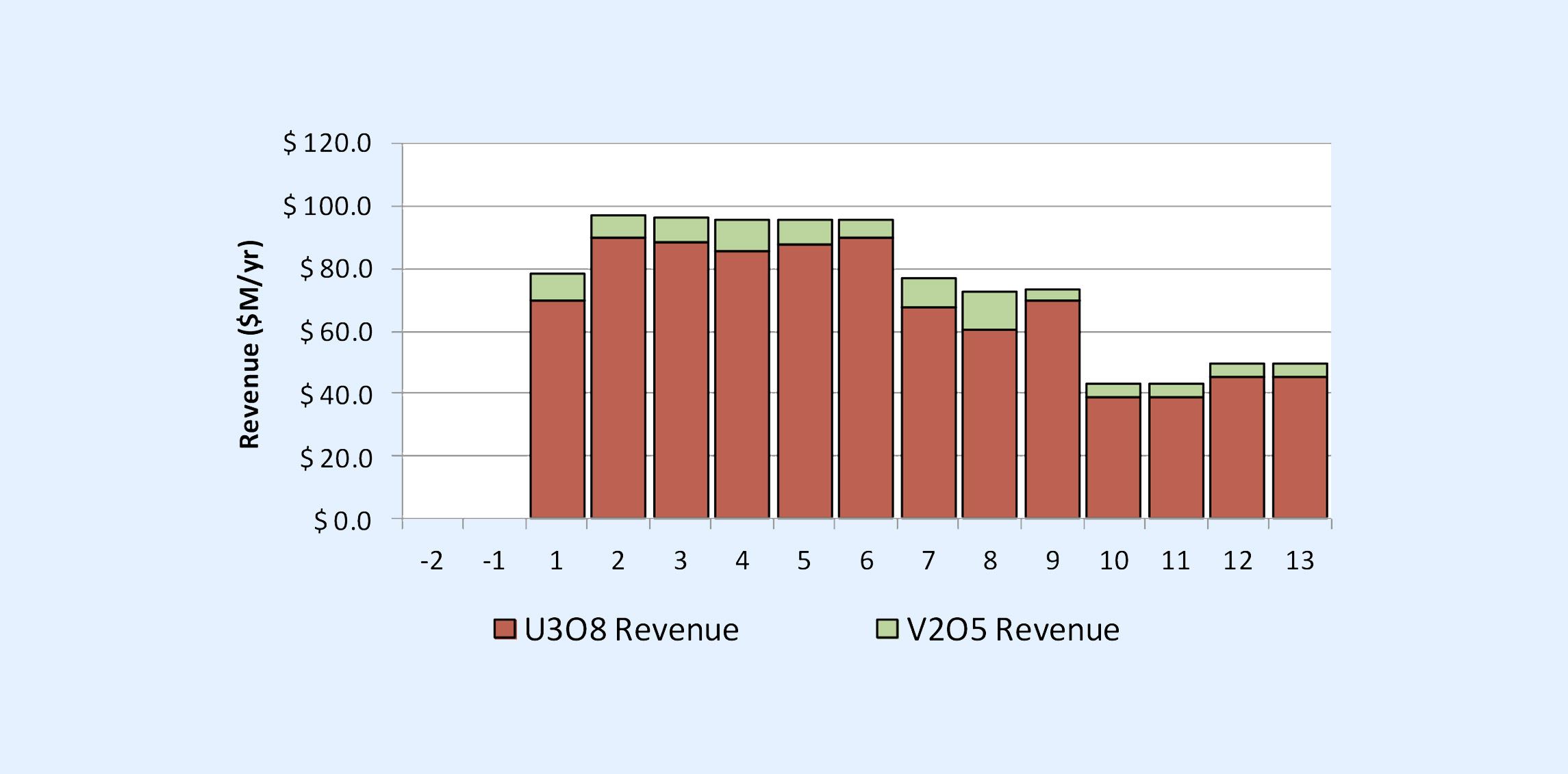

And as expected, the vanadium offers a nice ‘extra touch’ but won’t move the needle at the current recovery rates and assumed pricing of US$15 per pound.

It’s definitely helpful (as it provides a by-product credit of around US$5 per produced pound of uranium), but it’s clear Ivana (and Amarillo Grande as a whole) predominantly is an uranium project.

We are also positively surprised by the relatively high Internal Rate of Return for Ivana, and it looks like the IRR was boosted by A) the higher grade uranium mineralization in the first five years of the mine life while B) the higher average V2O5 production in those initial years also helps to boost the by-product credit. As you can see on the next chart, the production cost of the uranium in the first six years will be closer to $12-13 per pound on an annual production of in excess of 1.5 million pounds per year (we would estimate the AISC to be around $15-16 during these first few years of the mine life). This indicates the mine sequencing plays an important role at Blue Sky, and the company is lucky to be able to process the highest grade zones first as this will be a tremendous help to secure a short payback period.

In an ideal scenario, Blue Sky Uranium should try to find additional higher grade mineralization which could then be processed from the 7th year on as that would help preventing the uranium production rate fall off a cliff while the operating expenses per pound of Uranium are expected to increase to in excess of 30 dollar per pound in years 10 and 11 due to a lower average head grade and a lower contribution from by-product credits.

And that’s exactly what the current exploration program will try to do…

The PEA is only the start

Blue Sky didn’t waste any time and immediately continued to explore the Ivana tenements (keep in mind that Blue Sky’s total land package is approximately 287,000 hectares and that the current resource at the Ivana zone covers just a fraction of the total land position).

Blue Sky Uranium is planning to complete an additional 321 auger holes, and this drill program has already started right after the publication of the PEA. Using auger drilling is an easy and cheap way to figure out if zones with no or weak superficial radiometric results could host uranium mineralization before bringing in the bigger (and more expensive) Reverse Circulation (RC) drill rigs.

Auger holes are quite shallow and are drilled to a total depth of just 10 meters where after the field geologists survey the hole by dropping a radiometric probe to detect radiation. Considering the vast majority of the uranium mineralization at Ivana appears to be running from surface to a maximum depth of around 20-25 meters, auger drilling provides the company a lot of bang for its buck as it’s a very efficient way to define high-priority drill targets before embarking on a 4,500 meter RC drill program. According to the NI43-101 compliant technical report on Ivana, the 488 RC holes drilled on the property reached an average depth of just over 15 meters, so these are really inexpensive holes to drill.

Just to give you an idea. Assuming one hole could be extrapolated to 12 meters in each direction and assuming an average thickness of 6 meters, every hole adds almost 4,000 tonnes to the resources (using a density of 1.45 tonnes per cubic meter). Applying the average grade of 367 ppm, every drill hole has the potential to add at least 3,000 pounds of uranium to the equation. Note that our 12 meter radius is quite conservative as the current resource is based on 100 meter drill spacing. If we would expand the radius to 25 meters while keeping all other parameters unchanged, every hole would add around 17,000 tonnes of rock to a resource, containing just over 13,000 pounds of uranium. Of course, this is just a theoretical explanation and any resource increases will have to be underpinned by a NI43 compliant resource estimate.

While for most companies the PEA pretty much is the end game, we feel this is just the start for Blue Sky Uranium as hundreds of thousands of acres still need to be thoroughly explored and tested for potential uranium-vanadium mineralization. The next batches of drill results will provide more details on how and where Blue Sky Uranium will be able to expand the current resource base.

Blue Sky is closing an additional private placement, boosting its cash position

The aforementioned RC drill program was subject to Blue Sky having sufficient funding in place, and that’s why the company is currently working on closing a C$1.39M placement. A first tranche has already been closed, raising just over C$370,000 by issuing 2.48 million units at C$0.15. Each unit consists of one common share and a full warrant with an exercise price of C$0.25 per warrant for a period of three years. We think the 3-year full warrant will appeal to the (potential) shareholders who are speculating on a rebounding uranium market within the next 2-3 years. Therefore we expect Blue Sky will be able to close the final tranche of its capital raise soon.

And Blue Sky is effectively spending the cash on the project. In the first quarter of the current calendar year, in excess of 50% of the cash expenses were effectively spent on the project. A good result considering Blue Sky wasn’t aggressively exploring until it had the results of its Preliminary Economic Assessment back.

Looking at the financial results of FY 2018, the percentage of the total cash outflow that was spent on the Amarillo Grande project was substantially higher (C$2.35M on a total cash expense of C$3.76M for a ratio of 63%), and we expect a similar percentage this year.

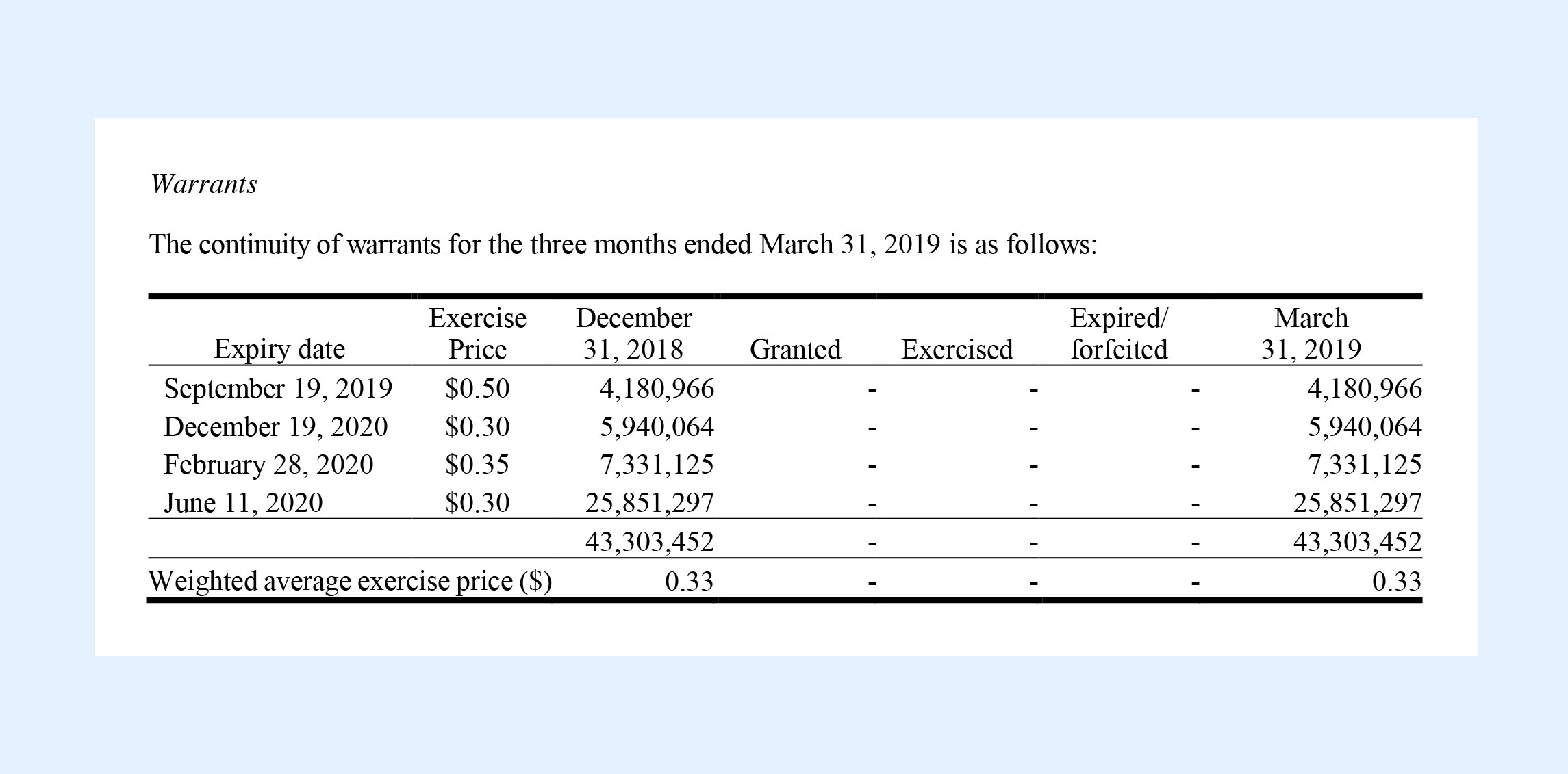

As all of Blue Sky’s warrants are out of the money (see above), the fully diluted share count should remain within limits. Although the C$0.30 and C$0.35 warrants in 2020 are definitely still in play (and would result in a total cash inflow of C$12M (!)), we aren’t holding our breath for the 4.18 million warrants with a strike price of C$0.50 and expect those to disappear in September.

Some investors complain about a sizeable overhang created by the warrants, but let’s not forget that A) all warrants have a strike price of roughly twice the current share price so before they even come into play, the share price already has to double. Additionally, B), these warrants – if exercised – will act as secondary capital raises and remove the need for Blue Sky to raise money on the open markets again. So having in excess of 50 million warrants (including the C$0.25 warrants that will be issued as part of the current capital raise) is both a curse and a blessing.

Conclusion

As originally expected, the presence of Vanadium is nice, but doesn’t really move the needle for Blue Sky Uranium. We are glad to see the company’s consultants used a V2O5 price of just $15 per pound which is quite reasonable. Finding vanadium is great, but with a recovery rate of just over 50% and after deducting the payability discount, it’s clear Blue Sky’s main focus should still be on the Uranium. The Vanadium should only be seen as a coincidental by-product credit.

The PEA appears to be quite robust with conservative pricing assumptions and relatively high contingency allowances. This paves the way for even stronger economics once additional tonnes and pounds will be added to the resources and mine plan. The after-tax NPV8% of US$135M (approximately C$175M) really is just the start for Blue Sky Uranium as it looks like Amarillo Grande (and more specifically Ivana) has much more to give, and we are hoping to see our feeling confirmed with the next sets of drill results.

Disclosure: Blue Sky Uranium is a sponsor of this website, we have a long position. Please read the disclaimer