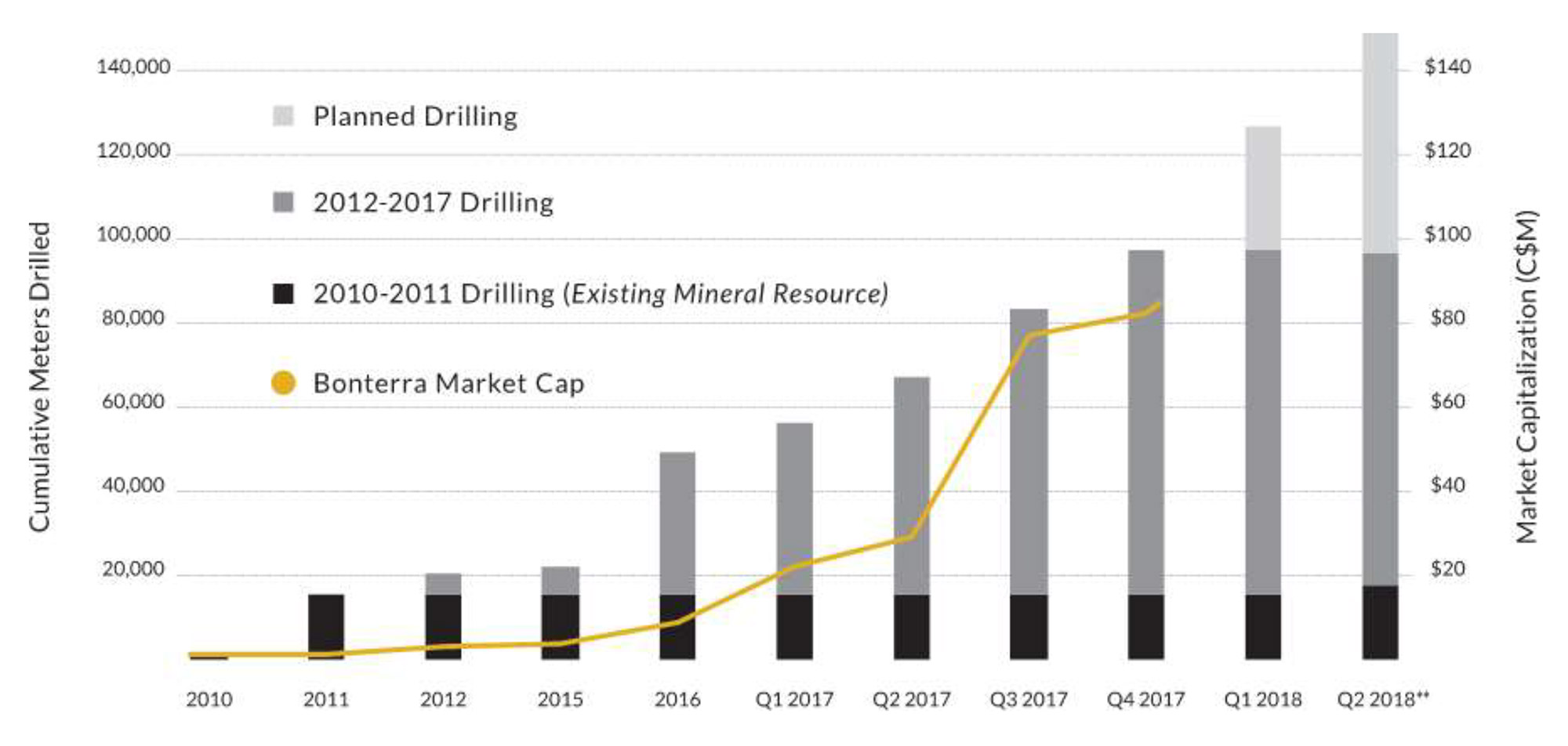

BonTerra Resources (BTR.V) is taking advantage of the strong capital markets and its exceptional exploration results of the past few years, and the company has now raised enough cash to complete a 70,000 meter drill program on its Gladiator gold project in Québec’s Urban-Barry gold camp.

This year will be full of catalysts; the substantial drill program will result in a continuous news flow with exploration results from the drill program and these results will subsequently be used in a resource update. And this will be the very first resource update since 2012 incorporating in excess of 100,000 meters of additional drilling…

The flagship project: Gladiator

The Gladiator project (previously called ‘Eastern Extension’) is located in Québec’s Chibougamau mining district, and right on a southern lobe of the Abitibi greenstone belt. This is a very prolific area and whilst the exploration activities in the greater Abitibi region were scaled back during the more difficult years for the mining sector, this now is one of the most active exploration regions in the world. Osisko Mining (OSK.TO) was the first company to announce huge drill programs, but BonTerra immediatey followed suit with a 70,000 meter drill program for 2018.

And there’s a very good reason for this region to heat up. The existing infrastructure in this part of Québec is pretty good, and the Gladiator property is located just 100 kilometers east of Lebel-sur-Quevillion (which has a small airfield) and is just a 4-hour drive from Val D’Or. And whilst the powerlines are a little bit further away, there’s plenty of (cheap) power available. Much better than the logistical nightmare other exploration projects around the world have to deal with.

Back in 2012, the company engaged Snowden to complete a maiden resource estimate on the project. The expectations and hopes weren’t very high as BonTerra was just getting started on the property and very little work had been completed by then. Just to give you an idea: the first resource estimate was based on a total of 15,000 meters of drilling on the quartz-carbonate vein system on the property.

Since the resource estimate in 2012, BonTerra has completed tens of thousands of meters of drilling, and it would be an understatement to say drilling was just ‘successful’. Every other few weeks or so, BonTerra announces assay results from new drill holes, and even now, almost 6 years after that first resource estimate, BonTerra is still figuring out where the mineralization is actually ending as the Gladiator project is still open in all directions and at depth.

That’s why BonTerra embarked on a very aggressive drill program this year, and the first assay results are expected any day now!

The mineralization at Gladiator could best be described as a set of veins, running pretty much parallel to each other. Right now, 5 veins (with a ‘mineable’ width) have been identified and drilled over a total (horizontal) length of 1,200 meters. BonTerra was also smart enough to drill a few deep holes to figure out the total extent of the mineralization, but even at depths of in excess of 1,000 meters the mineralization seems to be continuing. That’s not a huge surprise as the gold deposits in Québec are notorious for their depths, and in several cases in the province, gold was traced until a depth of 1,500-2,000 meters. We’re not saying the gold will be economical at depth (it could be), but we hope it’s clear the potential at depth could be enormous. Time will tell!

The metallurgical test work (Q2) and the updated resource estimate (H2) should draw some attention

Unfortunately the 2012 technical report does not contain any information on the anticipated recovery rate of the gold from the Gladiator ore. BonTerra is conducting some metallurgical testing activities as we speak, and the company plans to release the results of its test work sometime in the second quarter of this year.

A positive outcome would be an incredibly important step forward for BonTerra as the viability of the project will depend on the recovery rate of the gold as well. Fortunately most of the other gold projects in the belt have pretty good metallurgical recovery rates so we don’t anticipate BonTerra to run into any issues on this front. But it will be nice to have some official numbers to rely on!

The current resource estimate of less than 300,000 ounces of gold is actually meaningless as it’s based on just 15,000 meters of drilling. This is obviously a negligible amount of drilling for a project of this size. BonTerra hasn’t updated this resource yet, but is planning to do so by the end of this year, and this new resource estimate will incorporate well over 100,000 meters of ‘new’ drill data on the property.

As approximately 25% of the total amount of new drilling will only be completed in the first semester of this year, it’s still too early to put an exploration target together for the updated resource estimate. You should also keep in mind the resource will be calculated based on the zones closer to surface. As only a very few holes were drilled really deep, we expect the updated resource estimate to show additional exploration potential.

Larder Lake as horse number 2 in the stable

Elsewhere in Canada, BonTerra also owns the Larder Lake gold project in Ontario, literally within a 30-minute walking distance from the border with Québec. Despite an existing resource estimate confirming in excess of 950,000 ounces of gold at an average grade of approximately 5.5 g/t, BonTerra was able to purchase the property for a cash payment of C$1.15M (completed) and issuing 10 million shares (for a total pro forma value of C$3.8M) to Kerr Mines (KER.TO).

The Larder Lake property (which consists of a 9-kilometer-long land package on the Cadillac Larder break) actually contains a past producing mine and two shafts are ‘silent witnesses’ of the heydays in the district. The entire Cadillac-Larder trend produced a total of 13 million ounces of gold, with the majority coming from the Kerr Addison mine, that produced in excess of 10 million ounces of gold.

It’s also interesting to mention that Gold Fields (GFI) worked for three years on the property as part of a 60% earn-in deal (which required Gold Fields to spend $40M on exploration and development activities) but cancelled the earn-in a few years ago. Gold Fields was quite aggressive as the company completed approximately 25,000 meters of drilling in 59 holes and all data has been handed over to BonTerra as part of the property acquisition deal.

The Ministry of Northern Development and Mines of the province of Ontario has actually made a historic report on the Larder Lake and nearby Kerr Addison mines available for consultation (find it here).

Besides completing a 3D model at Larder Lake, BonTerra hasn’t done much work on the property since it was acquired in the summer of 2016.

Whilst we obviously understand the company’s main focus is the Gladiator deposit as it’s aggressively expanding the existing resource, we do hope BonTerra will spend some money on the Larder gold project as well.

The cash position, share structure and management

After raising C$21.5M by issuing 13.3 million super flow through shares at C$0.75 and 19.2 million ‘normal’ flow-through shares at C$0.60 per share, the current share count has increased to approximately 226.6M shares. We expect the share count to gradually increase as warrant holders will be exercising their in-the-money warrants.

Using the current share price of C$0.50, this represents a total market capitalization of C$113M resulting in an enterprise value of C$83M after deducting an estimated C$30M in net cash. This is our own estimate based on the cash position at the end of November (C$18.5M), the slightly higher share count after warrant exercises, the net proceeds of the C$21.5M financing and the expected incurred exploration expenditures in the past four months.

Some people were surprised to see BonTerra raising more money, but our view is pretty clear: if you’re being offered money at decent terms (in this case: a good flow-through premium and no warrants) as an exploration company, you should ALWAYS take it.

We would expect BonTerra’s treasury to remain very healthy as a bunch of warrants will be expiring within the next 12 months. The next table provides you with an overview of the amount of warrants and strike prices but please note, the amount of warrants is the situation as of November 30th, and some of those warrants have already been exercised.

As you can see, C$0.50 is the key level. Should the warrant holders exercise their C$0.50 warrants by July and August, BonTerra will be able to raise an additional C$4.4M. In case this doesn’t happen, the remaining (cheaper) warrants will allow BonTerra to add C$1.6M to the treasury by issuing 5.2 million new shares.

There are some big names represented in the company’s share capital as for instance ETF issuer Van Eck and Kirkland Lake Gold (KL, KL.TO) have substantial positions in BonTerra Resources. Kirkland Lake Gold already has a huge presence in the greater area and is probably keeping tabs on BonTerra’s exploration program.

Nav Dhaliwal – President & CEO

20 years of leadership and entrepreneurial experience, as well as in corporate and business development. Successful startup and financing expert in numerous active junior resource companies.

Dale Ginn – VP Exploration & Director

Geologist with 30 years of experience in exploration and mining. Led and participated in numerous discoveries and startups. Senior positions with Sprott Mining, Jerritt Canyon, San Gold, Harmony Gold, Hudbay, Westmin, Goldcorp.

Richard Boulay – Director

Conclusion

BonTerra is aggressively drilling and expanding its Gladiator deposit and we are anticipating a substantial increase in the gold resources when the new resource estimate will be published in the second half of this year. We expect the total gold resource to increase to well in excess of 1 million ounces, and we will particularly focus on the grade (which will very likely decrease compared to the previous resource estimate) and the potential viability of the project.

Drilling is ongoing and shareholders could expect a steady news flow throughout the next two quarters which will ultimately result in an updated resource estimate in the second half of this year.

The author has no position in BonTerra Resources. BonTerra is not a sponsor of the website, but we were compensated by a third party. Please read the disclaimer