Bravada Gold (BVA.V) has been relatively quiet in the past six months as the company had to wait for the lab to release the assay results of its four hole Wind Mountain drill program, which was conducted in the fall of last year. The results are now in and although gold and silver values were detected, the drill program failed to intersect the high-grade feeder system mineralization it was hoping to intersect.

We caught up with CEO Joe Kizis to discuss the assay results of the four-hole drill program and the implications for the 2021 plans.

Wind Mountain

You recently released assay results from your four hole drill program at Wind Mountain where you were trying for find the feeder zone to the existing low-grade resource estimate. Could you elaborate on the drill program and how you targeted the four holes?

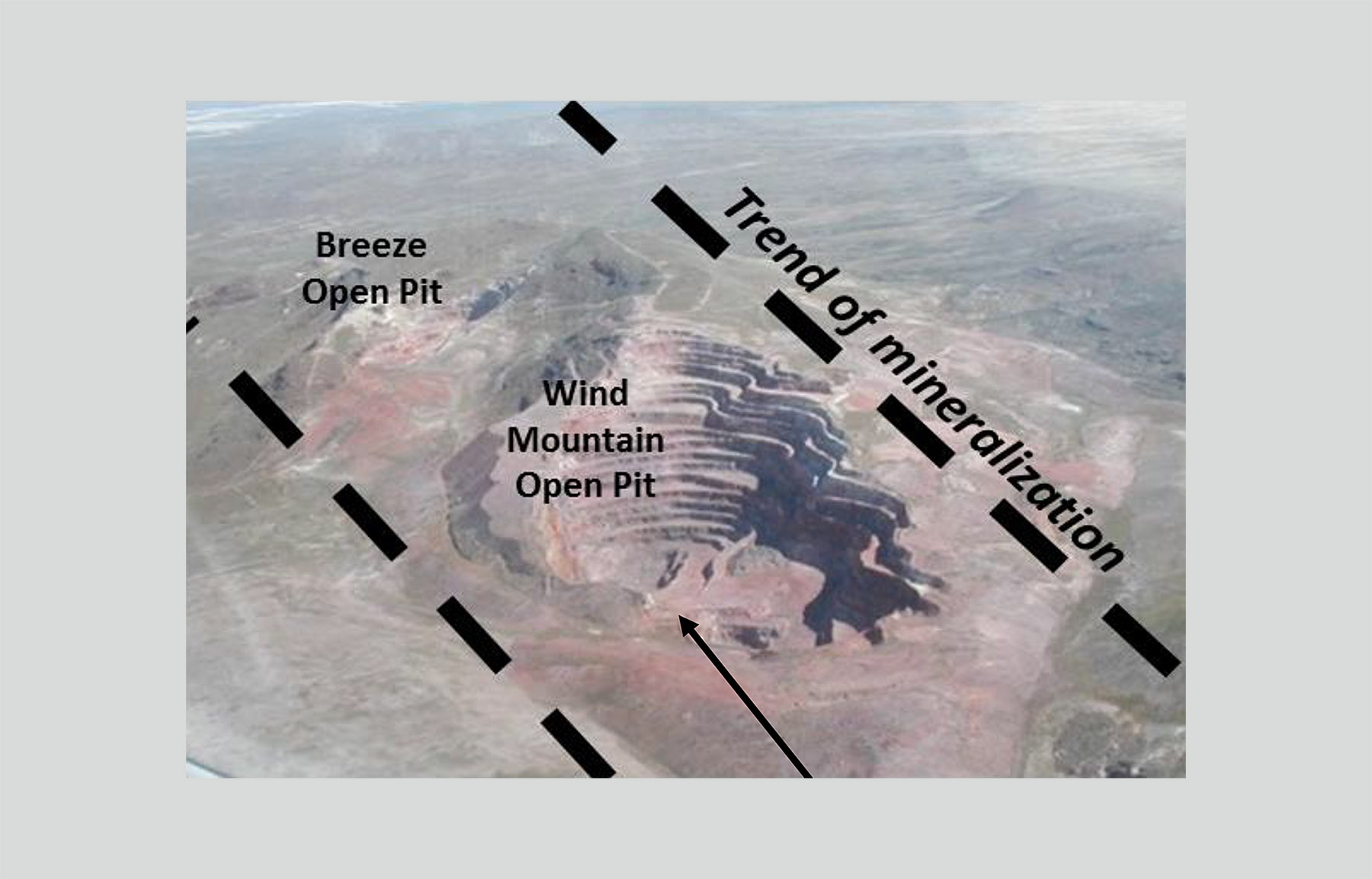

The Wind Mountain disseminated, and oxidized, gold deposit has long been understood to be the very top of a Low-sulfidation system, but previous property owners only focused on the bulk-mineable mineralization, which Amax Gold partially mined in the 1990’s as an open pit/heap leach operation. I recommended the acquisition of the property from then owner Agnico Eagle in 2016 because I saw that the possibility of a high-grade gold/silver feeder zone had not been tested. During our early drilling for the feeder, we discovered that the disseminated gold mineralization was much more widespread than originally delineated, so we pursued a dual approach of developing shallow disseminated mineralization while we searched for deeper feeder-type mineralization.

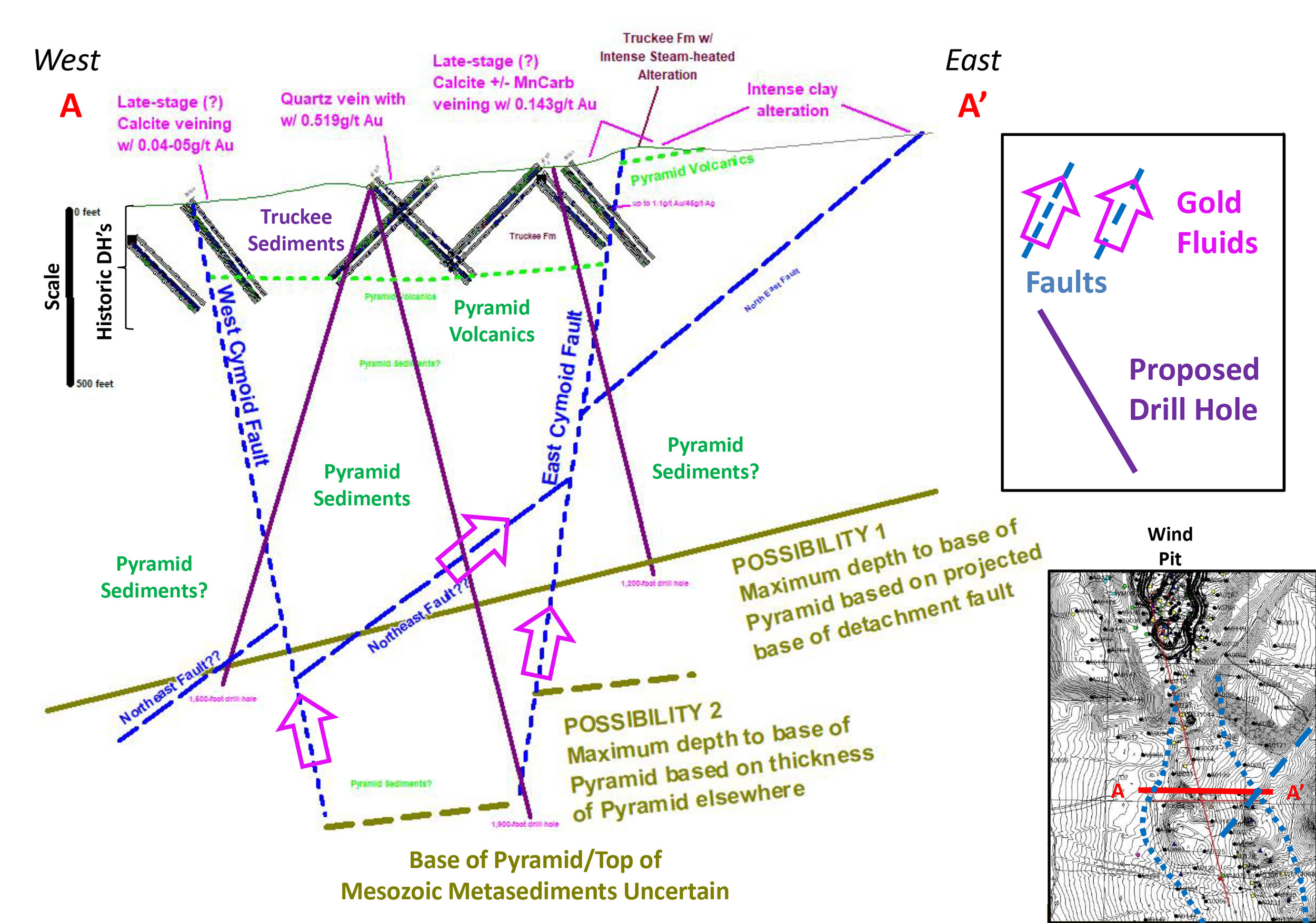

In late 2017/early 2018 we drilled two deep holes in search of feeder-style vein mineralization, one near the southern end of our property and one from the bottom of the Wind open pit. In the drill hole from the bottom of the open pit we drilled through resources blocks into increasingly fresh rocks below. In the hole at the southern end of the property, we drilled about 300 meters of highly clay-altered rock with strongly anomalous gold values. These are the same rocks that were fresh in our other hole. That provided us with a vector to the likely feeder zone being between the two holes.

That is still a fairly large target area to contain a fairly small feeder zone, being about 1.5km between the two 2017/18 holes. We conducted mapping and sampling in the area, although much of the area is covered by gravel or mine waste from Amax’s original mining operation. Our mapping and sampling confirmed a favorable structural setting. We recognized a specific type of alteration, called “steam-heated”, indicating that boiling of ore-bearing fluids occurred at depth in the area. Boiling is typically when significant gold and silver are deposited in these types of systems, and steam-heated alteration may occur several hundred meters above where gold is deposited due to that boiling.

Although most of the target area is covered, there are several historic “condemnation” drill holes in this area. The holes are shallow, only testing to 100-150m below surface, but do contain strongly anomalous silver and less anomalous gold, a feature often found in the upper parts of these systems. We drilled four holes in December 2020 to test several structures that we either identified or projected from our mapping as potential feeder structures.

How will the recent results help you to further refine your target to find the feeder zone?

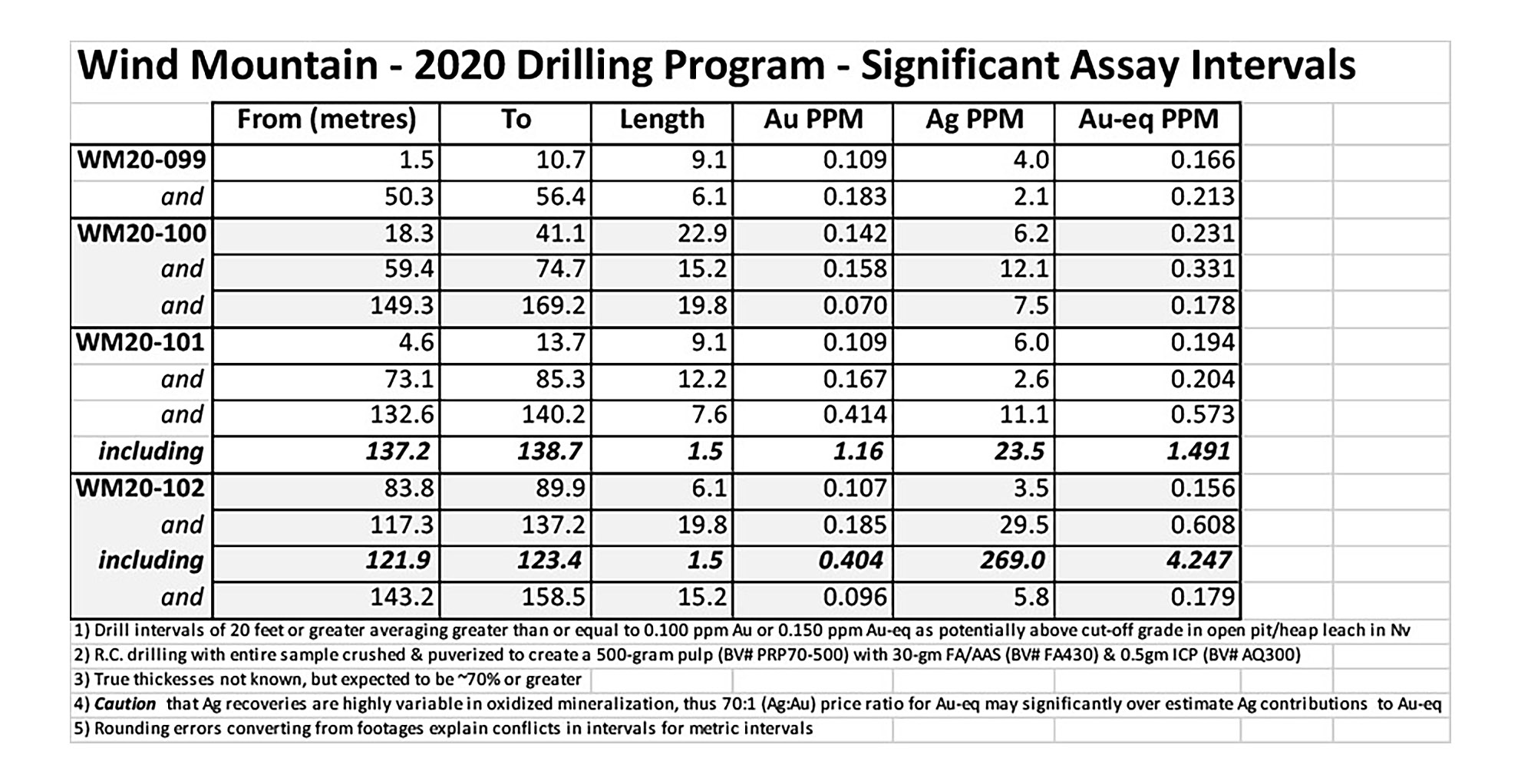

Our drilling intersected widespread anomalous gold in the hosting sediments, indicating they were very permeable to the mineralizing fluids. That unfortunately meant that the metals generally were not concentrated into economic values, although some relatively thick zones may be above cut-off grades if mined as part of a pit designed for higher grades nearby. So where is the feeder zone?

We don’t see many true quartz veins within the disseminated gold/silver mineralization at Wind Mtn, probably because the hosting sediments were so permeable, so the vein zone that we did intersect cutting sediments in hole WM20-102 is very encouraging… especially with the high Ag assay (269g/t Ag with 0.404 g/t Au, or 4.25g/t Au-eq over 1.5m). We looked at the chips under a binocular microscope and that interval has a lot of very fine-grained, silvery gray sulfide, so it is not enriched in silver due to supergene (weathering) upgrading. The mineral is difficult to identify with certainty, but with low values of arsenic, the mineral is probably a silver sulfide or perhaps a selenium/silver sulfide.

From modeling of our recent drill data, the hole WM20-102 vein zone appears to be near the bottom of the sediments, and also probably near the northern margin of a metamorphosed basement high that we discovered in our recent drilling, so testing the vein zone below the WM20-102 intercept into the boiling zone could discover a nice high-grade vein. I think that is a good risk/reward target, worth a couple of deeper drill holes considering how shallow this vein is below the paleosurface. The silver-rich vein zone includes possible hydrothermal breccia (quartz vein material surrounding breccia fragments), which indicates periods of explosive upwelling possibly related to boiling below, but none of the textures that would indicate boiling occur in this intercept of WM20-102. The depth of this vein intersect is less than 150 metres below the estimated paleosurface, based on steam-heated alteration in nearby hills, and the high silver to gold ratio is consistent with this interval being in the upper portion of vein mineralization, which could overlie much higher gold grades, particularly in the more brittle rocks that lie beneath the sediments.

You mention you are planning to start drilling again in Q2 2021. Will you still try to detect the feeder zone, or will the drilling be focusing on the low-grade gold and silver resource zone?

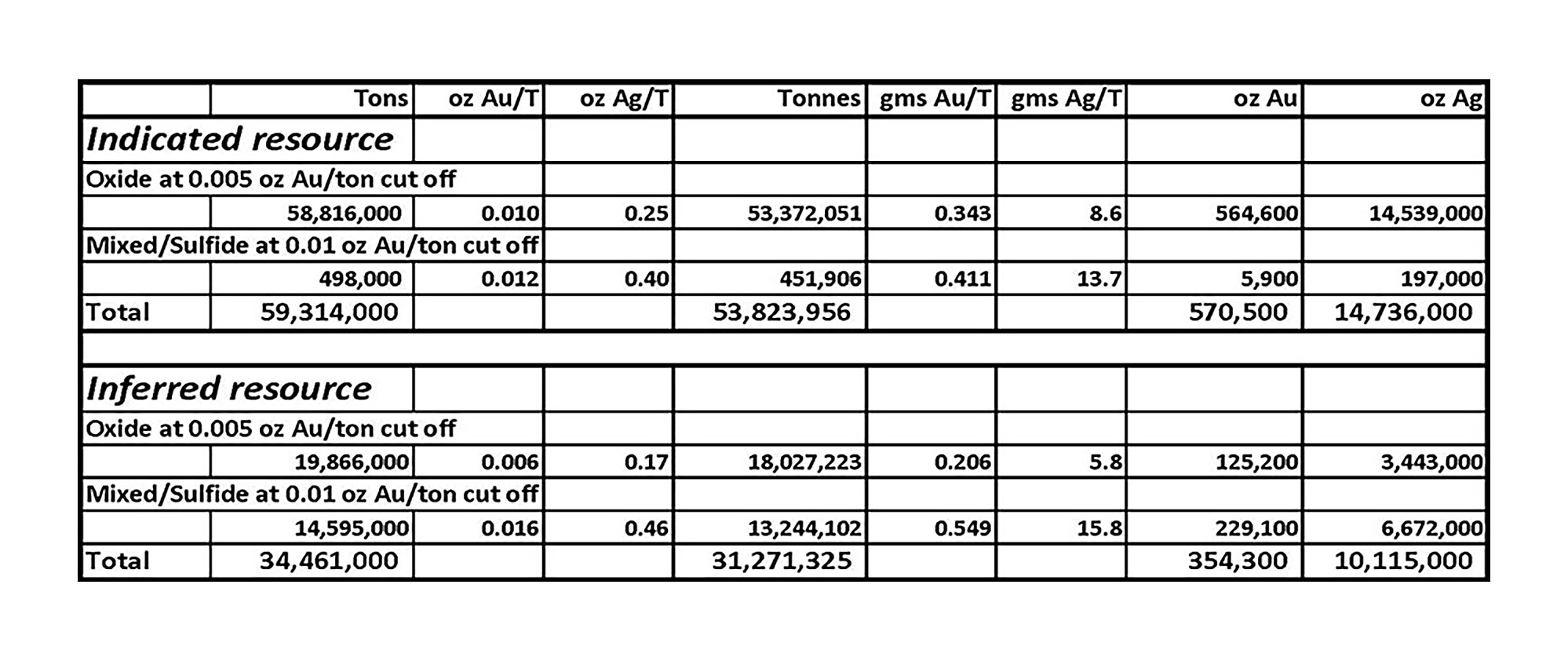

We will drill 2 or 3 holes to test beneath the WM20-102 vein intercept, as I discussed above. However, with the increase in gold and silver prices, we believe a re-assessment of the shallow and oxidized, disseminated gold and silver resources on the Wind Mountain property is justified. We have identified several areas within and directly adjacent to resource blocks that could inexpensively add to the resource base, particularly focusing on higher-grade zones averaging around 1g/t Au that are not adequately drilled. These areas have been permitted and bonded, and drilling will be completed prior to updating the resource and then updating our positive 2012 Preliminary Economic Assessment (PEA). As a reminder, in 2012 Bravada commissioned an independent resource estimate and Preliminary Economic Assessment (PEA) for Wind Mountain by Mine Development Associates of Reno, resulting in:

• 570,000 ounces of gold and 14.7 million ounces of silver in the Indicated category, and

• 354,000 ounces of gold and 10.1 million ounces of silver in the Inferred category.

Drilling is scheduled to begin in April, with the goal of completing an update to the resource base and PEA by Q1 2022.

It’s great to see you’ll restart your focus on the oxide zone at Wind Mountain again, as we have always seen this as an excellent call option on the gold price. At $1700 gold, even the low-grade resource at Wind Mountain could be viable. Could you elaborate on what your next steps are at the existing resource? You mention a drill program, how many meters would you like to drill?

I am proposing about 2,000 meters of reverse-circulation drilling, with 2/3 of that as in-fill drilling on the disseminated mineralization and 1/3 of that as further testing of the feeder target. After we receive the results from the in-fill drilling, we will have an independent engineering group recalculate the resource and update the 2012 PEA.

You mention you aim to have a new resource and PEA by Q1 2022, is there any chance this could be sped up?

Possibly, although Covid-19 protocols have slowed assaying significantly. However, we were fortunate enough to reserve a drilling company, and we previously permitted and bonded the holes we need to drill, anticipating this program. The resource update and PEA may be slower than usual due to the heavy backlog of such work by now well-funded companies. Q1 2022 is a conservative estimate for completing the update.

Wind Mountain Open Pit

Wind Mountain

The other projects in the portfolio

With Nevada being a Tier-1 mining jurisdiction and the gold price remaining strong, do you see more inbound interest in other projects from potential joint venture partners?

I am spending quite a bit of time fielding calls from companies looking for projects at various stages. We have 10 projects at various stages in Nevada, and we expect to find some matches for our projects. Highland and Baxter seem to be attracting the most attention at this time, but other projects are being evaluated as well. I feel there are too many groups trying to replicate the Joint-venture model, and that is generally reducing the quality of JV deals for the companies applying this model. I think a lot of companies will waste a lot of time trying to filter through all of the projects being offered by these newly minted companies. Most of our projects have been advanced to the drill stage, so I’m willing to be patient and wait for the right partner with the right terms, and meanwhile conduct judicious drilling on a few of our properties that can enhance their value.

OceanaGold dropped its earn-in option on the Highland gold project at the end of last year. What made them decide to return the project? Were they looking for a bigger size project? Higher grade?

Neither really. Their mining operation in the Philippines did not receive a mining extension by the government, causing one of their most profitable operations to shut down while at the same time additional development work was necessary during a planned shut down at one of their New Zealand operations. Exploration budgets were slashed, and they closed their Reno office early in 2020. They asked Bravada to conduct a minimum program at Highland to maintain the earn-in option, but drilling costs were higher than expected and the program was suspended halfway down the second core hole. Drilling on a second target, the Geyser target, was permitted and bonded, but was postponed for drilling until 2021. By the end of the year, however, OceanaGold decided to only fund exploration on their existing operations for the foreseeable future and dropped our Highland option.

You were originally planning to drill the Big Hammer target at Highland this summer. Are you still planning on drilling the target yourselves, or are you hoping to have secured a new joint venture partner by then?

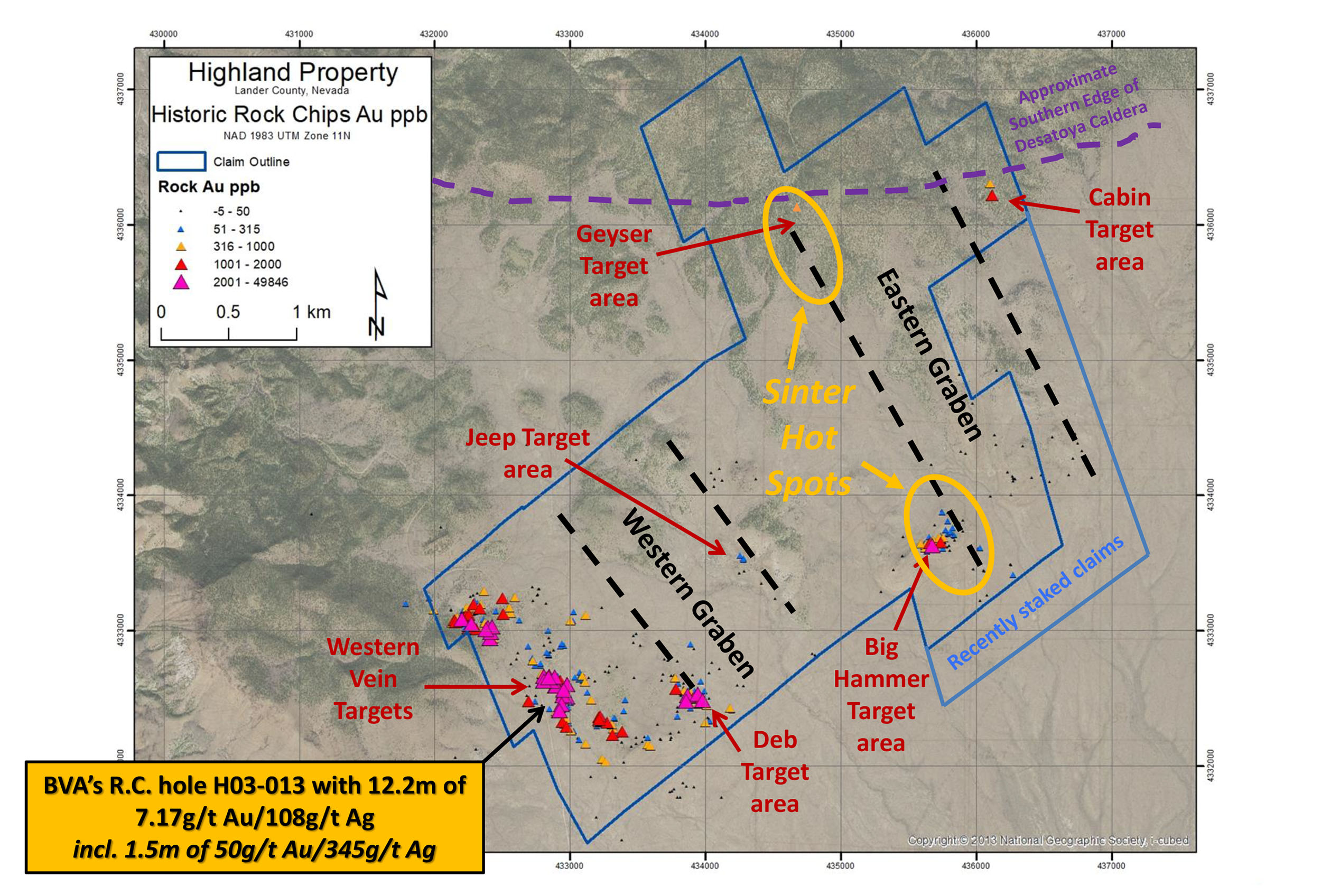

As I mentioned above, there is strong interest in Highland because we have new targets that haven’t been drill tested in the eastern portion of the property where OceanaGold’s efforts were focused. But we have as well untested drill targets that we previously identified in the western portion of the property. In 2013 the Company drilled our best hole in the western area, being H03-013 with 12.2m of 7.17g/t Au/108g/t Ag, including 1.5m of 50g/t Au and 345g/t Ag. Subsequent drilling showed that this zone is relatively restricted, but such impressive intercepts indicate a robust low-sulfidation gold/silver system. Finding areas where economic concentrations occurred becomes the challenge; however, all the best low-sulfidation gold/silver mines have such teaser zones.

Could you perhaps briefly elaborate on why you’re so keen on testing the Big Hammer target? What makes the target so interesting to you?

The Highland low-sulfidation system is very large, covering an area of about 20 square kilometers, and drill intercepts like we received in drill hole H03-013 indicate that the system has the potential for several important, high-grade deposits. I have examined the preserved tops of several high-grade low-sulfidation deposits that are in production, and the tops are either barren or unimpressive. Well known examples include El Penon in Chile, and Midas, Sleeper, and Fire Creek in Nevada.

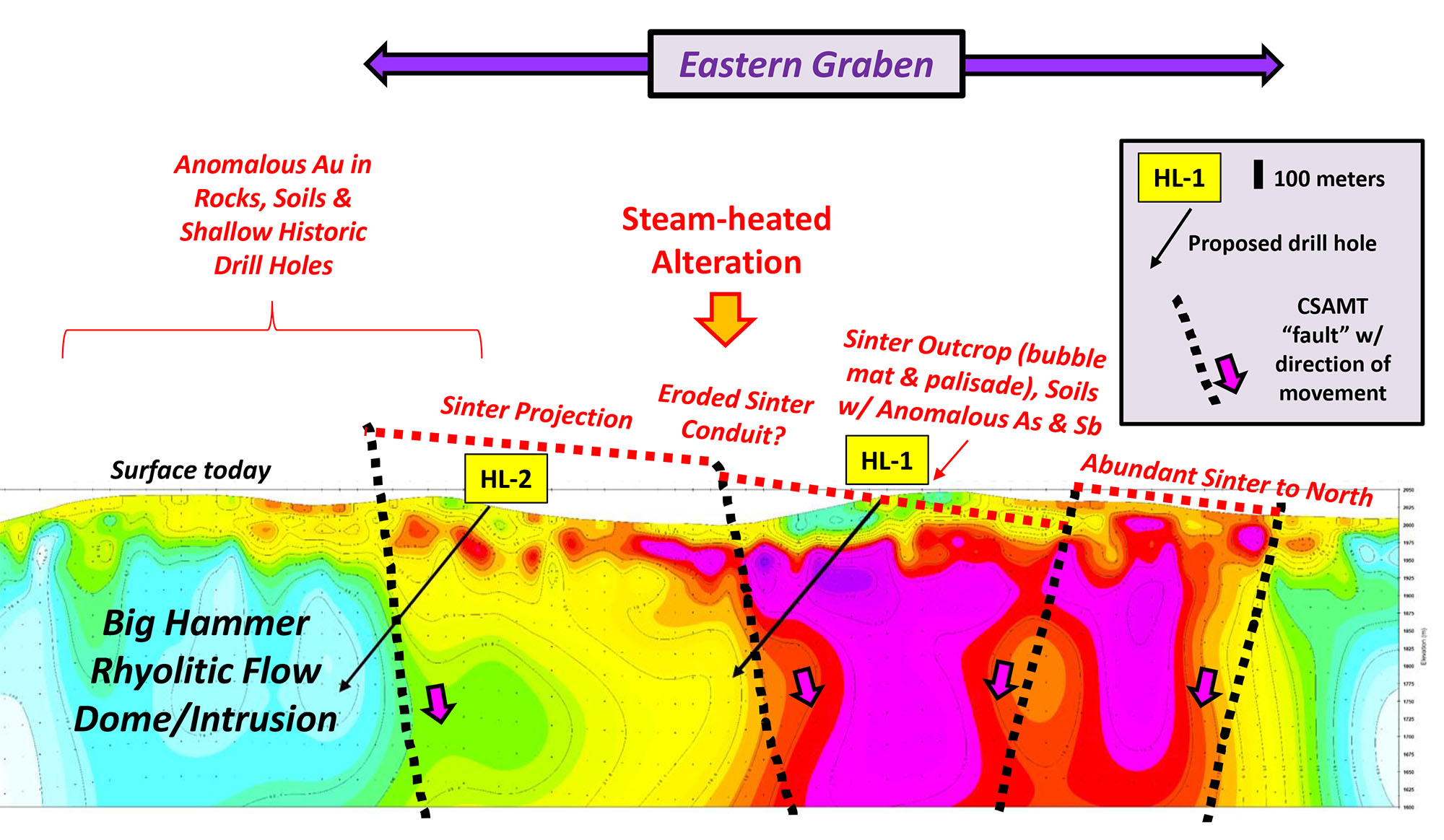

The Big Hammer target is less eroded than the targets with exposed veins on the western portion of the Highland project; thus, the entire mineralized system is preserved in the eastern portion of the property. There are extensive areas of sinter in that area, a paleo-surface rock that indicates little or no erosion below paleo-hot-springs. The Big Hammer volcanic flow dome could be an important heat source for the mineralizing fluids, and hot water flowage features are preserved at the top of the volcanic dome. Samples of altered rock around the dome contain anomalous gold, typically up to 1g/t Au, but with a high value of 15g/t Au. Shallow historic drilling has intersected anomalous gold to about 1 g/t Au in veins with textures typical of the upper portions of vein systems. We have identified two areas that have the strongest values, one was partially drilled in the second hole during 2020 and one is located approximately 500m to the south along the same fault zone.

I believe additional drilling is justified on the western portion of the Highland property as well, and we have identified several drill targets there.

Corporate

As of the end of October, Bravada had a working capital position of just over C$300,000. Did you see some warrant proceeds come in since filing that financial statement as you had a bunch of 10 cent warrants out that are expiring this and next month? Will you need to raise more money soon in anticipation of your drill programs?

At the end of October, Bravada had cash of just under Cd$900,000. We currently have cash of approximately $350,000 after spending approximately $350,000 on Wind Mtn and the rest on overhead, promotion, and minor amounts on other projects. We have set to expire over the next few months approximately $867,000 in $0.10 warrants and $150,000 in $0.15 warrants. We anticipate the full program expected at Wind Mtn to cost approximately $640,000 over the next nine months, so we have sufficient funds to begin the program in April. Additional funding will be determined by how successful we are in convincing our previous investors to exercise their warrants and market conditions.

Conclusion

The assay results from the program designed to drill-test the Feeder zone at Wind Mountain have not yet yielded the results we were hoping for but as CEO Joe Kizis mentioned, the high-grade silver values (which in turn boost the gold-equivalent grade) will further help to refine the target.

While the company will continue to try to track down the high-grade feeder zone system, it looks like the low-grade oxide resource at surface will also get a fair bit of attention. That is great as the current gold price environment should be beneficial to the low-grade gold-silver deposit. As a reminder, the recovery rate for silver in heap leach oxide projects tends to be pretty low (and the 2012 PEA used a silver recovery rate of just 15%) so what really matters here are the gold grades.

It’s encouraging to see there seems to be plenty of interest in other projects in Bravada’s portfolio and hopefully the company can sign up one or two joint venture partners this year as that will help the news flow throughout the year in case other projects of the project portfolio would be drilled by their parties.

Disclosure: The author holds a long position in Bravada Gold. Bravada Gold is a sponsor of the website. Please read our disclaimer.