After focusing on the Cobalt camp in 2018, Brixton Metals (BBB.V) is shifting gears and will spend most of its time and effort on the Atlin Goldfields project with a lesser extend on its Thorn project, both located in Northwestern British Columbia. After successfully assembling a contiguous land package allowing Brixton to secure ownership of almost the entire Atlin gold camp, Brixton is gearing up for its summer exploration campaign in the Atlin region. The Company has at least C$2M to spend this spring/summer after completing a financing in December 2018.

2019 will be the year for the Atlin Gold Camp

Brixton Metals has been carefully putting its land position in the Atlin Goldfields together since 2016 and is now sitting on a total land package of in excess of 1,000 square kilometers. Brixton Metals is the first company that has been able to consolidate almost the entire gold camp under one umbrella (there still are some small claims owned by third parties in the district, but Brixton Metals clearly is the dominant player).

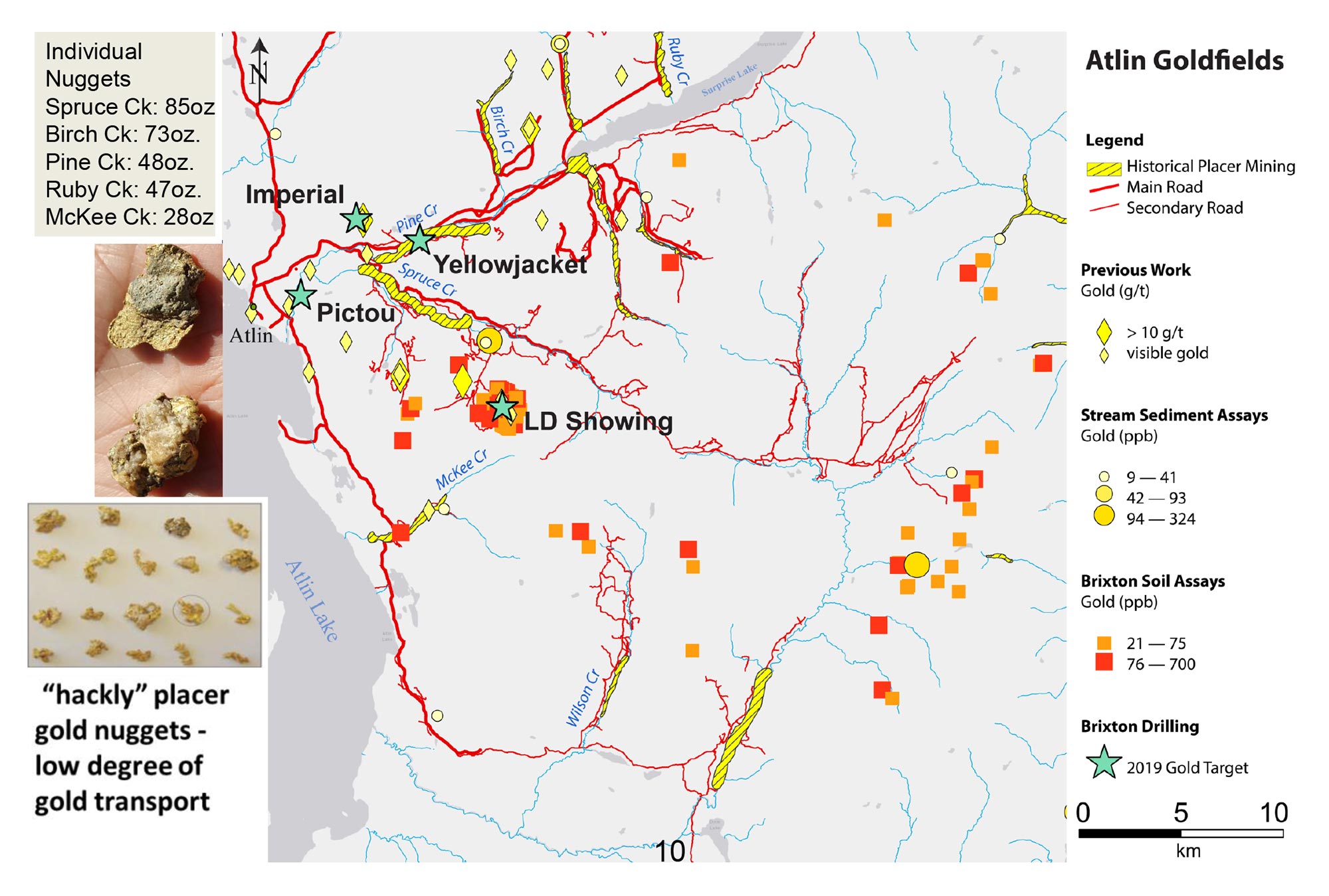

The Atlin project is particularly interesting because of its very rich history: data indicate placer mining has been ongoing for in excess of a century, and some of Canada’s largest gold nuggets were actually discovered in this camp. In fact, the largest nugget ever found on Canadian soil weighed 85 ounces and was found here, in the Atlin gold camp. Plenty of reason for an exploration company to have a closer look at Atlin as modern exploration techniques could help Brixton to target the feeder zones. After all, the gold nuggets and placer gold had to come from somewhere…

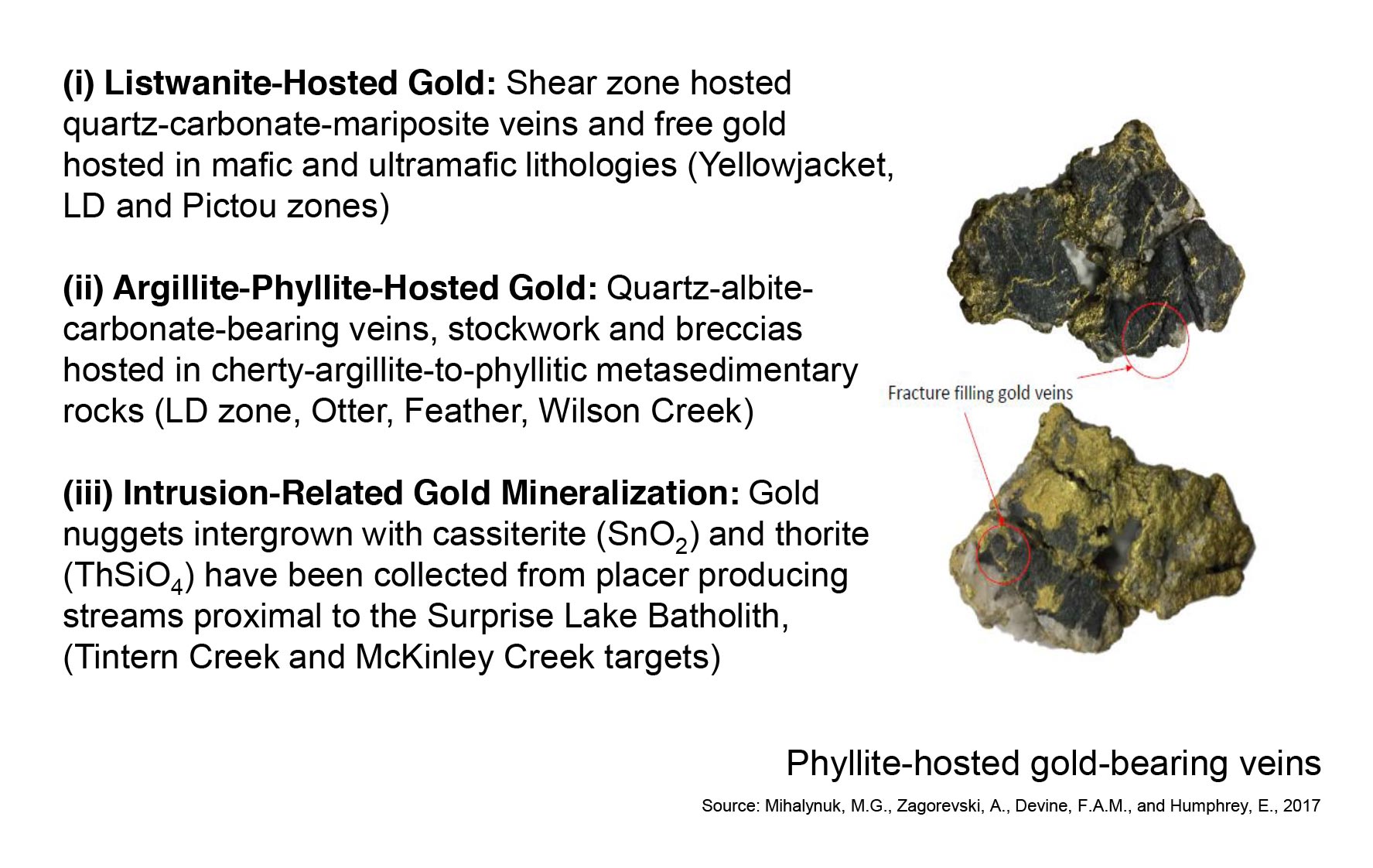

This doesn’t mean Brixton can just go in, drill a few holes and find gold all over the place, that’s not how it works. Let’s first take a step back to have a look at the bigger picture, as Atlin Goldfields seems to host three different rock types.

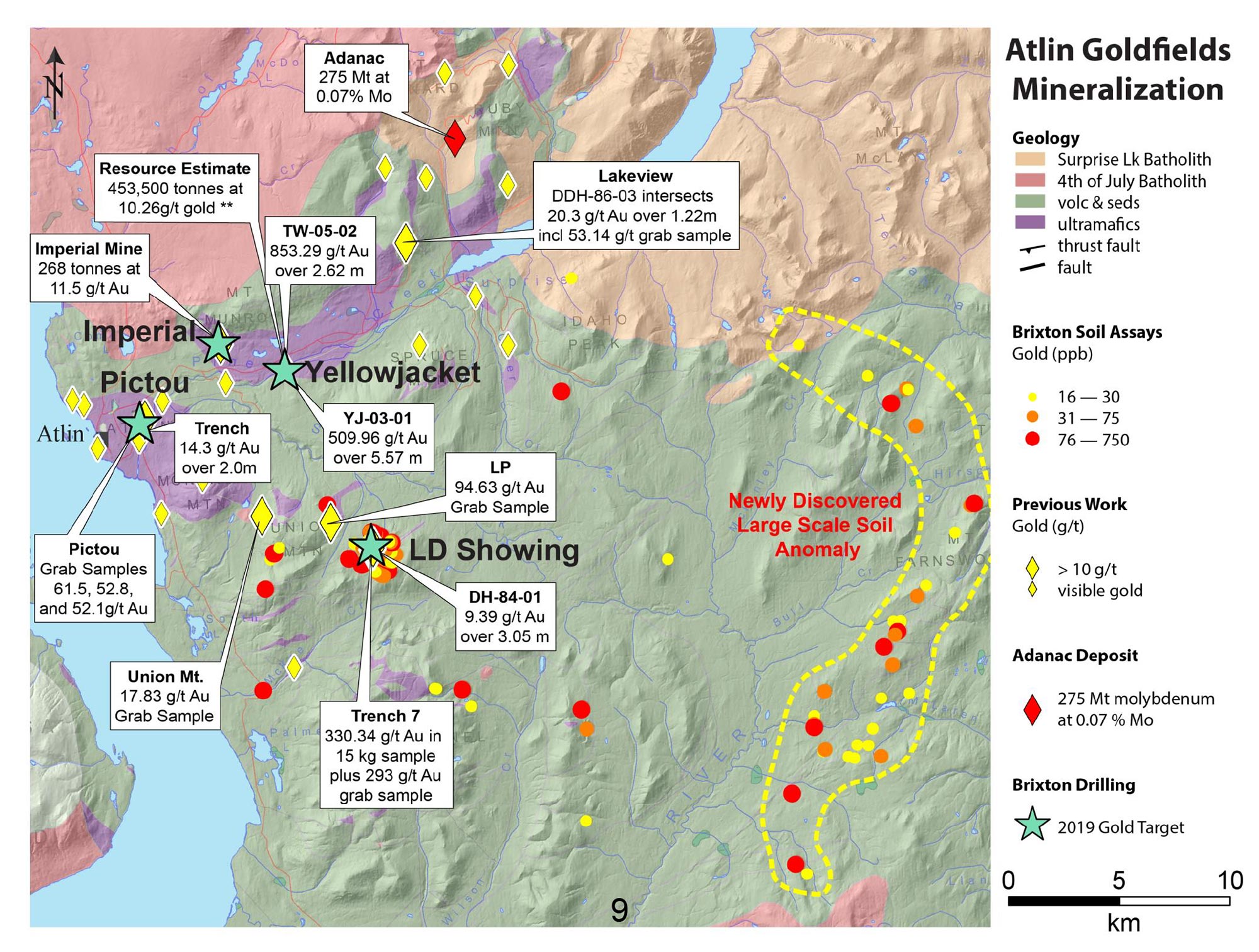

The Yellowjacket zone was mined before (and a valid mining permit for up to 200 tonnes per day remains in place) and currently still hosts a historical resource estimate (non-NI-43-101 compliant) of almost half a million tonnes at an average grade of just over 10 g/t gold. That’s a good start, but we also shouldn’t discard the historical drill intervals at Yellowjacket where the previous operators encountered for instance 3 meters of almost 48 g/t gold, 5.6 meters of in excess of 500 g/t gold and in excess of 2.5 meters at 853 g/t gold.

Of course, these intervals containing grades of in excess of 100 g/t gold will always remain the exception, but it does indicate the system is very prospective and prolific. The plan would be to identify new zones near here or tie this to a new trend.

Other high-priority targets would be the LD showing which is located just 10 kilometers southeast of Yellowjacket, and the Imperial and Pictou zones.

Brixton will apply a methodological exploration program which will include additional soil and rock sampling and mapping programs to further refine its drill targets on the 8 ‘areas of interest’ before effectively drilling the ones that stand out.

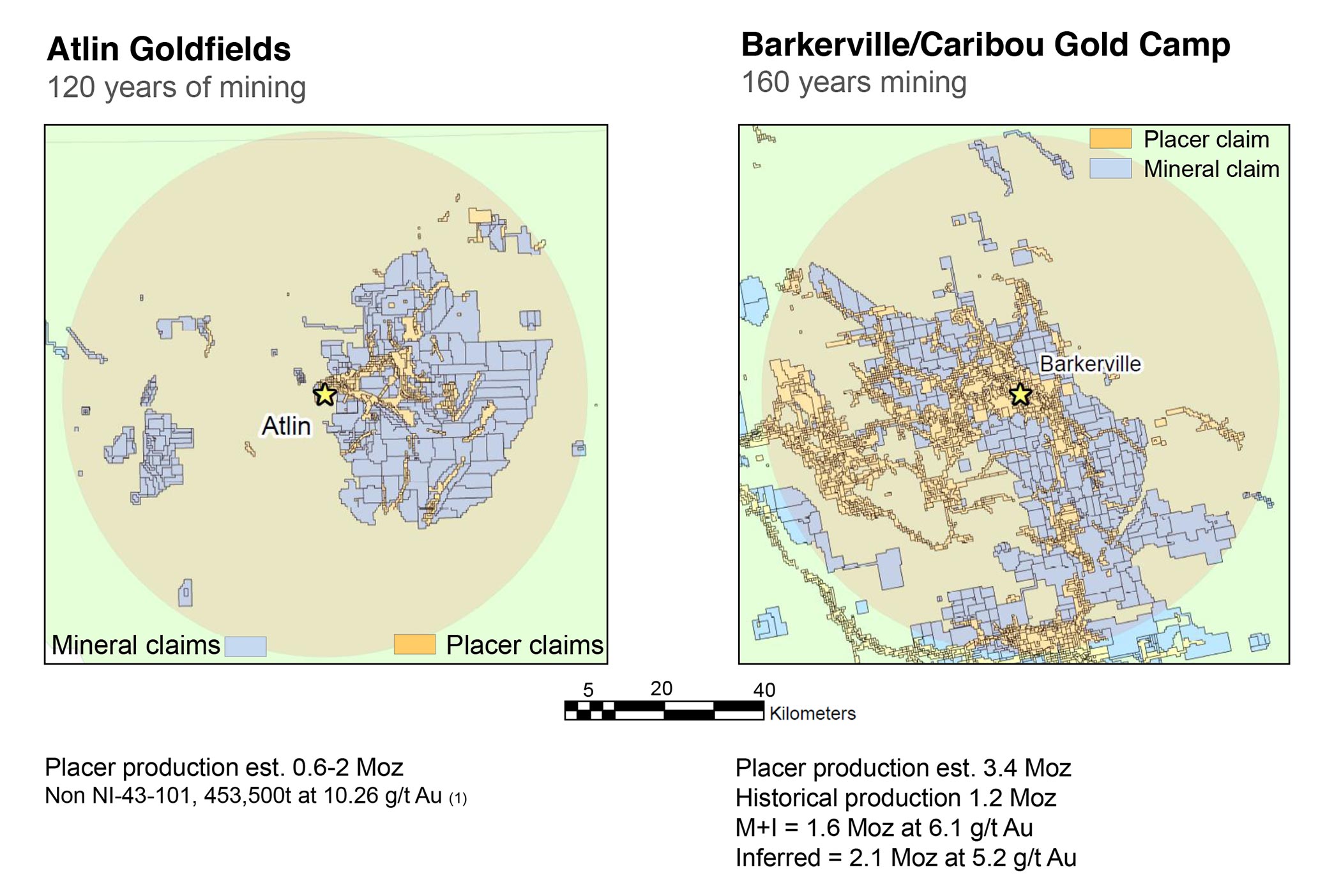

Brixton Metals compares its Atlin Gold Camp with the Barkerville/Caribou gold camp, also in British Columbia. Some companies use comparable projects/districts that could be considered a stretch, but we feel Brixton’s comparison does make sense. In both districts there has been a rich history of in excess of 100 years of placer mining with a cumulative gold production of millions of ounces of gold. The total production at Barkerville/Caribou (3.4 million ounces from placer activities and 1.2 million ounces from historical mining activities) is better documented than the total gold production at Atlin, but based on historical data and documents, Brixton estimates the Atlin Gold Camp was responsible for up to 2 million ounces recovered from placer operations.

The Barkerville system is more mature than the Atlin Gold Camp as the feeder gold zone at Atlin hasn’t been discovered yet, but that’s exactly the challenge Brixton Metals plans to prove.

The other projects won’t be neglected

We have now discussed the Atlin Gold camp in depth, but this doesn’t mean we don’t care about the other projects. Unfortunately the reality for most exploration companies is that they have to be very selective to ensure they get the biggest bang for their buck in terms of exploration results, but also measured in how much the market will appreciate/care about the exploration results.

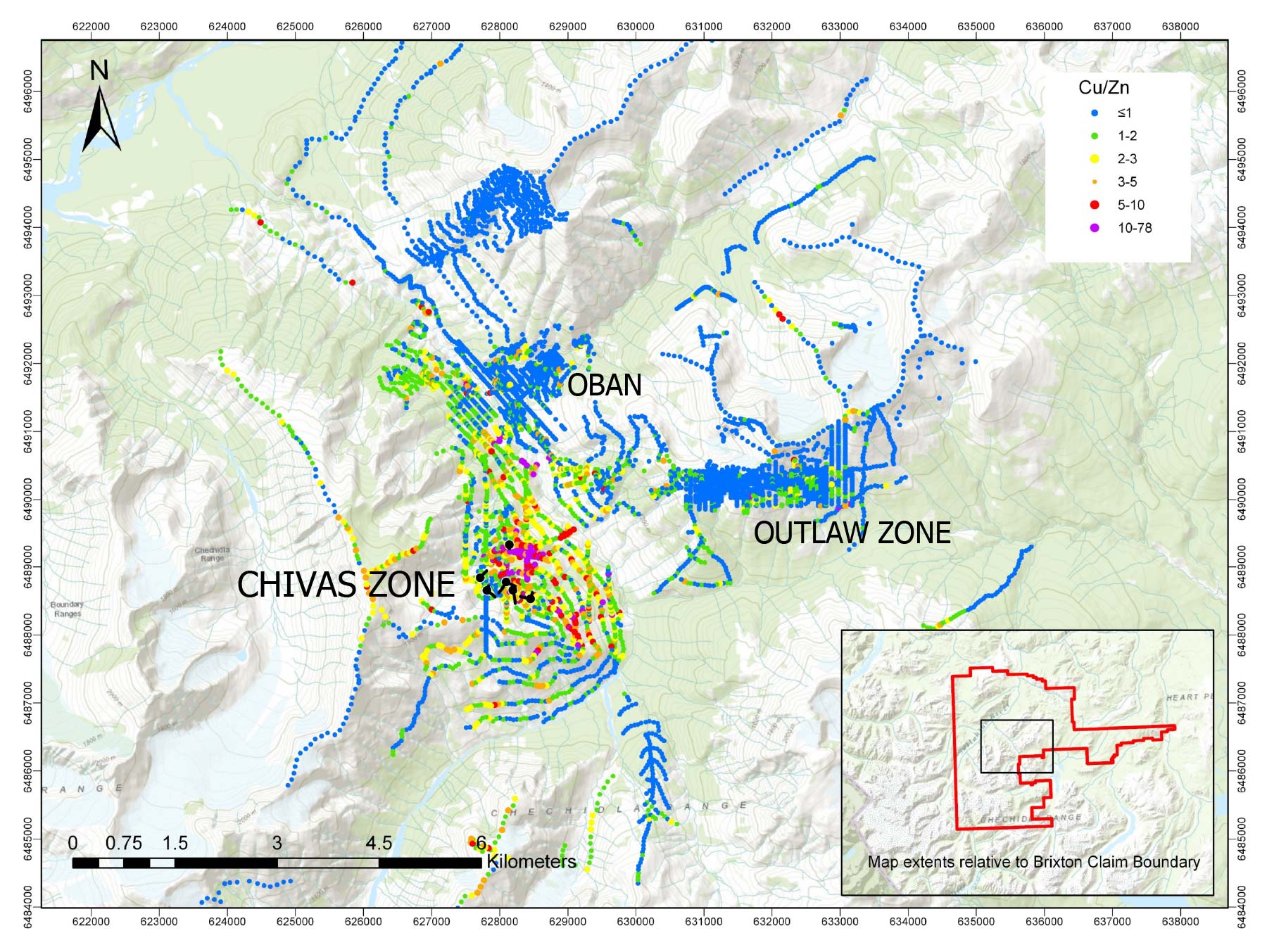

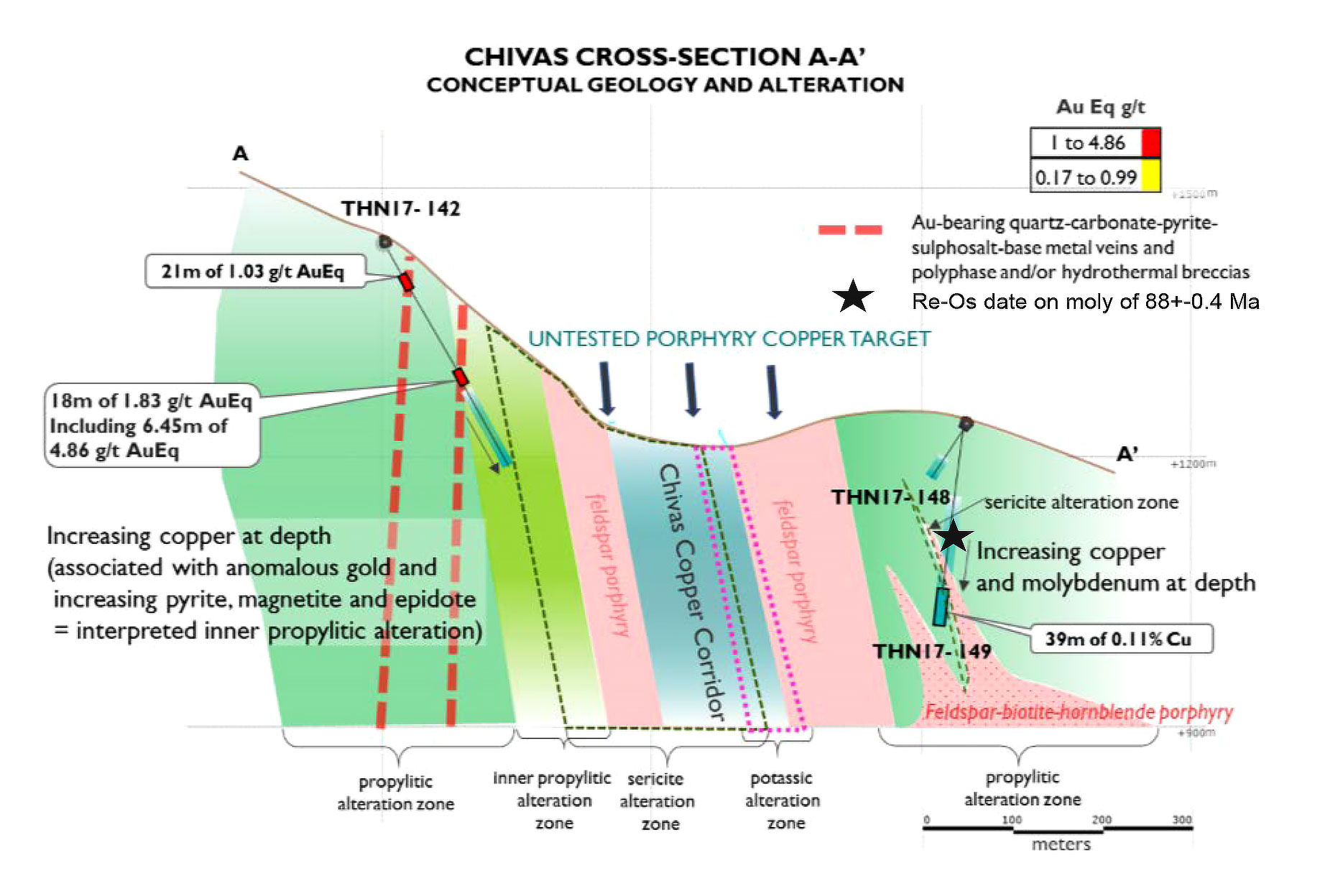

Thorn, for instance, is a district scale mineralized system with an existing resource estimate of in excess of 21 million silver-equivalent ounces. Subsequent exploration programs identified a high-priority copper-gold porphyry exploration target at the Chivas zone that should be drilled. It appears that the project has several high potential targets. In 2019 Brixton plans to refine the Chivas target for drilling and possibly drill one deep hole at the Oban Breccia zone with the objective of reaching a porphyry target at depth. The deepest hold at the Oban zone ended in 0.56% copper at 383m and the closest hole retuned 30m of 1.18% copper from 264m depth.

In 2018, most of the efforts and money was spent in the Cobalt Camp where Brixton Metals owns the past producing Langis and Hudson Bay mines. Both mines produced a cumulative 17 million ounces of silver and in excess of half a million pounds of cobalt. The cobalt hype appears to be over but with cobalt trading at a more realistic long-term price of $13-15 per pound it could still be an attractive by-product to a potential silver mining operation. Brixton isn’t close to putting a resource together in the Cobalt Camp and the project needs more drilling to figure out the structures and size, but the whole approach changed in Q3 last year when Brixton discovered a kimberlite zone…

This was completely unexpected as the area isn’t known for kimberlite occurrences and Brixton has commissioned additional test work to figure out what it’s sitting on. Unfortunately diamond exploration takes much longer than assaying rocks for cobalt or silver, so it will take another few months before Brixton will have a detailed view on its kimberlite discovery and if there’s potential to find diamonds. We agree with the slow and detailed approach as it’s better to think this through before allocating more exploration funds to the Cobalt Camp without a clear plan forward as long as the potential of the kimberlite discovery remains unclear.

And finally, Brixton still has the Hog Heaven silver-gold-copper project in Montana, that hosts a historic resource estimate of roughly a quarter of a million ounces of gold and just over 47 million ounces of silver. The interpreted feeder systems are drill-ready, but as Brixton Metals is obviously unable to use flow-through funds on a US-based project, Hog Heaven has been put a bit on the back burner as well. In the meantime, the Company is seeking a JV partner to advance the project.

That being said, Brixton released additional historical drill results on the Hog Heaven project from holes that were completed in 1979 and 1980 but were never reported to the market. With drill intervals of in excess of 18 meters containing 4.51 g/t gold, in excess of 20 ounces of silver per tonne and 4.5% copper and longer intervals such as 198m of 0.87 g/t gold, 0.59% copper 154 g/t silver (almost 5 oz/t silver). We fully agree with Brixton to keep the Hog Heaven project in the asset portfolio as the project does deserve more attention when more cash becomes available for exploration stage companies.

Long story short, Brixton’s portfolio contains four promising assets, but the main priority for 2019 will be on the Atlin Goldfields project.

Brixton is now fully cashed up after closing a financing in December

As of the end of September (when Brixton’s financial year ended), the company still had a working capital position of approximately C$1.35M but it preferred to ‘play it safe’ and pulled the trigger on a financing in November, which was closed in December.

Brixton raised C$2.78M of which approximately C$750,000 was raised in hard dollars by issuing 4.9 million units priced at C$0.15, and an additional C$2.04M was raised in a Flow-Through financing at C$0.17. The Units contain a full warrant allowing the warrant holders to acquire an additional share in Brixton at C$0.25 for a period of two years (until December 2020). The warrants do contain an acceleration clause which calls for an expedited expiration date should Brixton’s shares trade above C$0.50 for 20 consecutive trading days.

The annual financial results indicate excellent financial stewardship

Although the company has already reported its financial results of the first quarter of the current financial year (which ends in September), we feel it’s more important to have a look at the most recent full-year financial results. As Brixton still is a ‘pure’ exploration-stage company, the winter months where the exploration activities are usually scaled back which could provide a wrong impression of how much money effectively gets spend on the ground.

During its financial year 2018 (ending on September 30, 2018), Brixton Metals reported a total expense of C$5.15M, of which C$2.9M was spent on ‘pure’ exploration expenses. However, it’s important to note just over C$630,000 was expensed as ‘share based payments’ and should be disregarded when trying to calculate how much of the total expenses are being directed towards the projects.

The total cash expenses were approximately C$4.5M, and considering C$2.9M was spent on ‘exploration and evaluation’, it’s fair to say that of every dollar that has been spent during the financial year, 64 cents were effectively spent on the ground. Additionally, when checking the ‘related party transactions’, it appears that approximately C$134,000 of the ‘professional services’ were unrelated to the related parties and could very likely be attributed to the exploration programs throughout 2018.

Adding this C$134,000 to the project expenses would further increase the ratio of cash spent on the properties versus the full-year expenses to 67%, and that’s an excellent percentage for an exploration-stage company. Of every dollar that left the company, 67 cents was directly related to advancing the exploration properties. An excellent ratio indicating Brixton is spending its cash resources very efficient.

Conclusion

The past few years haven’t been easy for Brixton Metals, but the company has been able to raise cash and to grow its resource base and now has four quality assets. Recent exploration results at Thorn appear to be very interesting and still represents a company maker type project.

Hog Heaven remains an interesting project which warrants further work. Brixton still awaits results from its kimberlite discovery at Langis.

In 2019 the focus will be on BC, mainly the Atlin Goldfields project and Thorn project. We expect the company to announce its 2019 exploration plans soon and expect to see a high-impact drill program to determine the next steps at both Atlin and Thorn.

Stay in touch with our weekly newsletter and when we publish a report. Unsubscribe at any time.

The author has a long position in Brixton Metals. Brixton Metals is a sponsor of the website. Please read the disclaimer