Callinex Mines (CNX.V) has made a lot of progress in the past few quarters, and in this update we’d like to look back at what the company has accomplished and to look forward to what we might expect in the near future.

The past year was packed with action

After having announced a great interval of in excess of 44 meters at an average grade of 4% CuEq, Callinex Mines popped up on a lot of radar screens. It took the company a few weeks but by the end of July 2015 Callinex was able to close an oversubscribed private placement and have warrants exercised, raising C$4.1M in the process. This placement was mainly intended to accommodate Resource Capital Funds which now owns an 18% stake in the company.

That’s an extremely important vote of confidence. RCF is a well-respected party in the resource sector and unlike other funds that just throw cash around, RCF has a well-thought plan as the fund’s intention is to back the right management teams. So the 18% stake in the company (excluding the warrants owned by RCF as part of the private placement) should be seen as a thumbs up for CEO Max Porterfield and his technical team.

There are quite a few things we like about Callinex Mines, but what we admire the most is the company’s no-nonsense approach. Indeed, when Callinex was raising the C$4.1M last summer, it said it would spend the cash on drilling and additional exploration activities. These weren’t hollow words as the company already spent almost C$600,000 on exploration activities in the final quarter of the calendar year 2015 and we expect this amount to increase in the current quarter considering the company only kicked off its winter drill campaign in January.

As Callinex was aiming to complete 7,300 meters of drilling in 12 holes at Flin Flon, we would expect to see the company spend approximately C$2M on the winter drill campaign. However, the program is only expected to cost C$1M in hard dollars due to a previously negotiated agreement with the drilling company and government grants (which is another reason why Manitoba is a great place to work). This winter campaign was designed to follow up on what could be considered to be a successful summer drill program wherein the company completed in excess of 3,100 meters of drilling and tested new targets with potential for large deposits.

How should you interpret the new VMS discovery and how important is it?

Callinex Mines has been focusing on the Pine Bay project and last year’s intercept of 44 meters at 4% CuEq was just ‘scratching the surface’ as Callinex has now discovered another new VMS-zone during the current drill program.

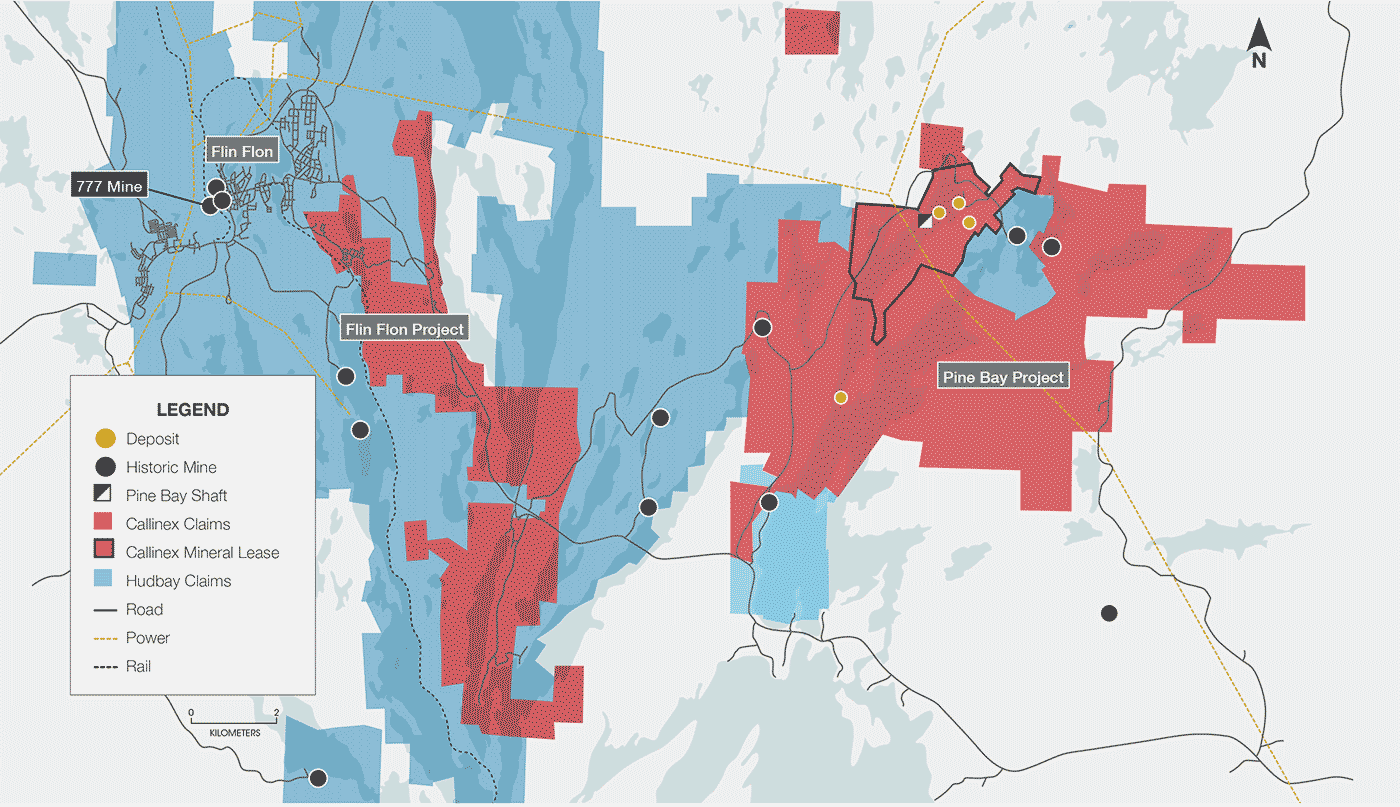

The company owns 100% of this property, which is subject to a 1% NSR and a 5.12% NPI. This project is located approximately 15 kilometers to the east of the town of Flin Flon, and what’s exciting is the fact there are some past-producing zones on the property and approximately 760 meters of underground development has already been completed at Pine Bay around a historic shaft which has reached a vertical depth of in excess of 200 meters.

Pine Bay isn’t a new project and has been explored by several larger companies and for instance Placer Dome’s geologists had an exploration target of 30 million tonnes before the head office decided to pull the plug before the geo’s could make their case. There’s plenty of stuff to be excited about, and Callinex Mines is the first company that has been able to put everything together in one large continuous land package.

During 2015, Callinex drilled in excess of 4,500 meters at Pine Bay whilst it also completed approximately 80 kilometers of ground geophysics to generate additional drill targets for the winter drill program which was in full swing during the most recent quarter.

And once again it has been proven that if you do your homework right, the chances to be successful are so much higher. The drill program wasn’t even one month old when Callinex Mines already released it had discovered a new massive sulphide zone at Pine Bay. The drill bit intercepted 4 meters of chalcopyrite, an indication of a VMS mineralization.

The market was waiting for the assay results, and indeed, the assays didn’t disappoint. The lab report showed the 3.25 meter interval contained a copper value of 3.24% with some traces of zinc and gold as well (after all 0.03% zinc and 0.07 g/t gold isn’t really exciting just yet), confirming the previously announced VMS discovery. On top of that, just below this zone (literally one meter deeper) the drill bit intersected almost 6 meters of 2.2% zinc as well!

Right after receiving these drill results, Callinex Mines decided to drill more holes in the current winter drill program to chase additional mineralization over a strike length of approximately 200 meters. 200 meters might not sound like a big deal, but this size is completely in line with the historical exploration successes in the Flin Flon VMS camp. What are the chances of success? Unfortunately we don’t have a crystal ball but almost all VMS deposits in the Flin Flon Greenstone belt have been discovered in felsic volcanic rocks, and that’s exactly the type of rock which hosted the mineralization in the discovery hole. Furthermore, the extent of alteration within these felsic rocks indicates a heat source was present to accumulate significant metal deposits.

We expect to see more drill results in the next few weeks and we’re pretty sure HudBay Minerals (HBM.TO, NYSE:HBM) is watching all developments very closely. After all, the company has admitted it doesn’t see a future at its 777 mine beyond 2020, at which point its large concentrator becomes a liability if HudBay is unable to source additional ore to be processed there. And as the Pine Bay zone is just a short drive away from this concentrator, the discovery of additional mineralization could be an important ‘trigger event’ for HudBay.

Conclusion

Callinex Mines has found exciting intercepts in the past year and this resulted in RCF becoming the company’s main shareholder, owning almost 20% of the company’s share count. The cash infusion of C$4.1M, led by by RCF and 25 other participants in the private placement that was conducted last year in July is being spent very wisely, and the 80 kilometer of ground geophysics was money well spent.

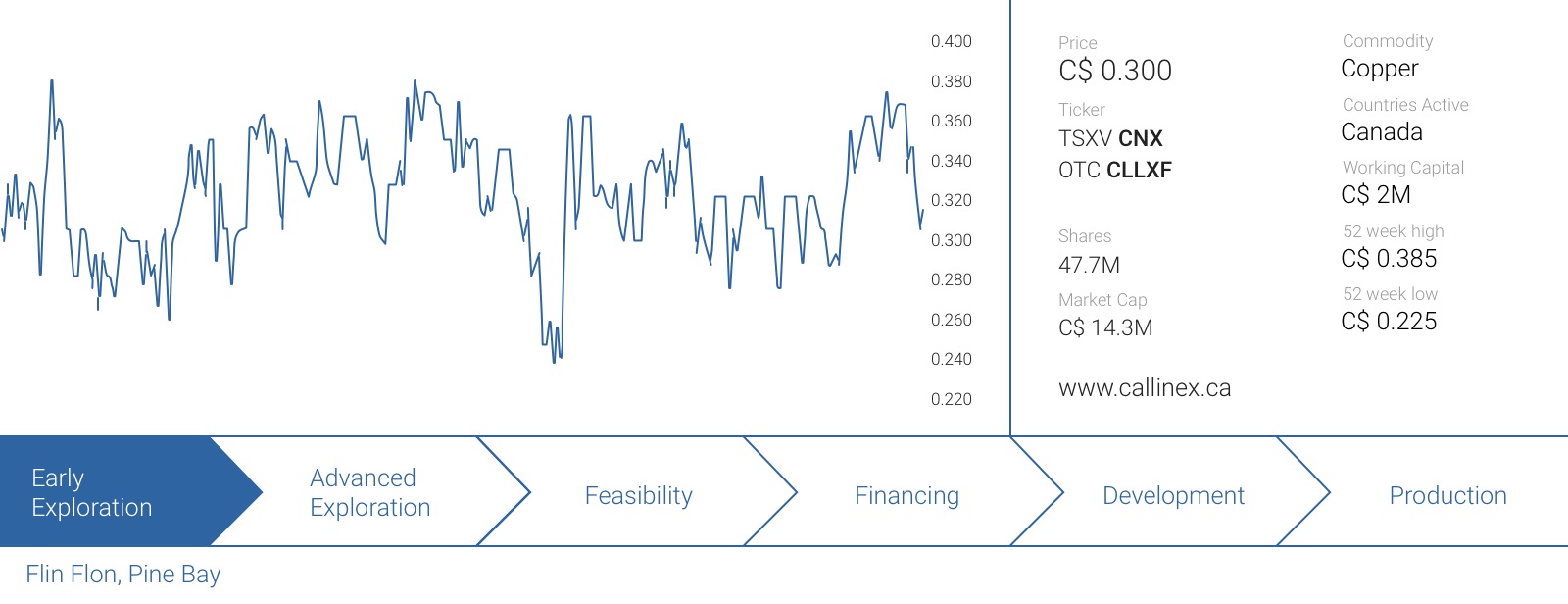

As you can see on the previous image, Callinex’ share price has performed really well and whereas the copper price lost approximately 12.5% from September 1st until now, Callinex’ share price increased by more than 10%. The total outperformance was approximately 26% and this tells you a lot about this management’s ability to create shareholder value.

In addition to upcoming exploration in the Flin Flon VMS Camp, we also expect that Callinex may seek to acquire additional projects in established VMS camps as hinted at in previous news releases which was confirmed during our recent discussions with the management team. The acquisition of advanced stage VMS properties may be another catalyst for the stock and an opportunity for the Company’s technical team to leverage its expertise.

We are certainly watching CNX closely and anticipate the management team to continue their aggressive, no-nonsense approach to build a strong portfolio of assets.

Disclosure: Callinex Mines is a sponsoring company, we hold a long position. Please read the disclaimer