Callinex Mines (CNX.V) has continuously updated the market on its exploration efforts over the past 18 months as it has been actively exploring for VMS systems in Manitoba’s Flin Flon Belt. The market reacted disappointed when Callinex published an intermediate exploration update, but the company will very likely publish the results of additional holes in the next few weeks.

On top of that, Callinex will also start to drill its Nash Creek and Superjack zinc projects next month before returning to the Flin Flon Belt. These projects were acquired at true fire-sale prices, and now the zinc price has increased by approximately 70% since buying the assets, the time is right to increase the resources and create shareholder value.

Callinex will release more assay results in the next few weeks

Since the company’s last update, an additional 3,500 meters were drilled, of which several samples have been sent to the lab for analysis. The assay results from some of these holes will be published within the next few weeks and will provide the company with more insight of the geological situation on its Sourdough and Pine Bay areas of the project. Two of the holes were drilled at Sourdough, whilst Pine Bay was subject to an additional three holes.

A sixth hole was drilled on a newly acquired piece of land based on geophysical indications, so it will be interesting to see if there’s another indication of a VMS system. According to CEO Max Porterfield, the geological situation at the new land position is ‘very favorable’ and this once again emphasizes the unique approach of Callinex’ exploration team. Keep in mind all key people have been working in the Flin Flon area for several decades, so they already have a pretty good understanding of the region and how to deal with exploring these systems. Also, a VMS system is obviously much more complex than your average gold and silver projects and it’s really not uncommon to encounter disappointing holes as well.

Callinex Mines has now completed its winter drill program at Pine Bay after having drilled eight holes. Of these holes, three have successfully intersected the Pine Bay VMS horizon over a total strike length of approximately 520 meters and will continue to focus on this zone in its upcoming summer exploration program.

What’s really interesting is that some core samples effectively did contain massive sulphides, but these zones didn’t respond to the previous borehole EM survey. Callinex is now mulling over its options and will very likely do additional borehole geophysical testing, combined with an airborne ZTEM survey to nail down the priority drill targets for a summer drill campaign (which will very likely consist of an additional 5,000 meters of drilling).

The acquisition of Tara Lake fits the bill

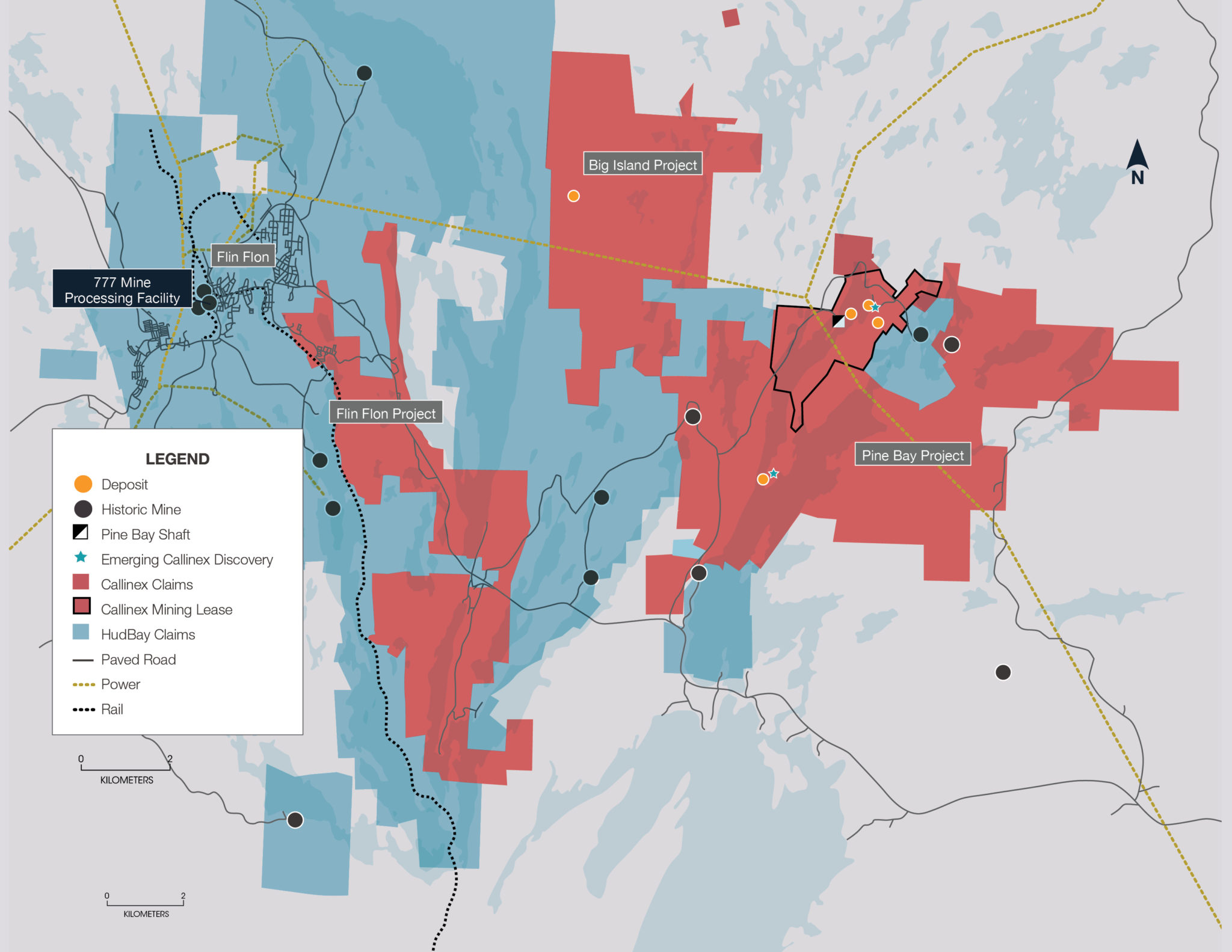

Callinex Mines is obviously very serious in its attempts to prove there’s more VMS ore to be found in the Flin Flon area, and the company has now also acquired the Big Island project. This project is located pretty much right in between the Pine Bay project and HudBay Minerals’ prime ‘hunting grounds’, as you can see on the next map.

The Big Island project contains the Tara Lake deposit which was explored in the late 80’s but hasn’t seen any modern exploration in the past 25 years. That’s intriguing, considering the previous operator at Tara Lake successfully intersected some ultra high-grade zinc zones with 12.4 meters at 33.9% ZnEq (22.4% zinc) and 19.6 meters containing 23.8% Zinc-Equivalent (14.6% zinc).

Although these results don’t necessarily have to indicate a large mineralized system (we also saw the same type of mineralization and grade at the Pine Bay discovery holes, but it will obviously take more time and efforts to really understand the system), it definitely makes the Tara Lake deposit very interesting.

Callinex’ initial focus will indeed be aimed at the historical high-grade mineralization as the previous owner/operator didn’t follow up on this discovery. We all know the exploration methods have changed tremendously over the past 25 years, and we expect Callinex Mines to come up with an exploration plan and punch a few holes in the ground at Tara Lake as part of the summer drill program.

And Callinex doesn’t really have much to lose. If it walks away in the first two years of the agreement, it would only have paid a total of C$100,000 and issued 200,000 shares for the option. Should the company like what it sees and make a move to acquire 100% of the property, it would cost Callinex just C$265,000 in cash, 750,000 shares and a 1% NSR which can be repurchased for C$1M. That’s a really good deal, and there are no work commitments as the project has enough exploration credits to remain in good standing for the next decade.

The company has big plans for Nash Creek (and Superjack)

In the spring of last year, Callinex Mines acquires some zinc projects when the zinc price was trading much lower. Now zinc is trading at approximately of C$1.5 per pound (US$1.2/lbs), it makes a lot of sense to start working on those projects as well.

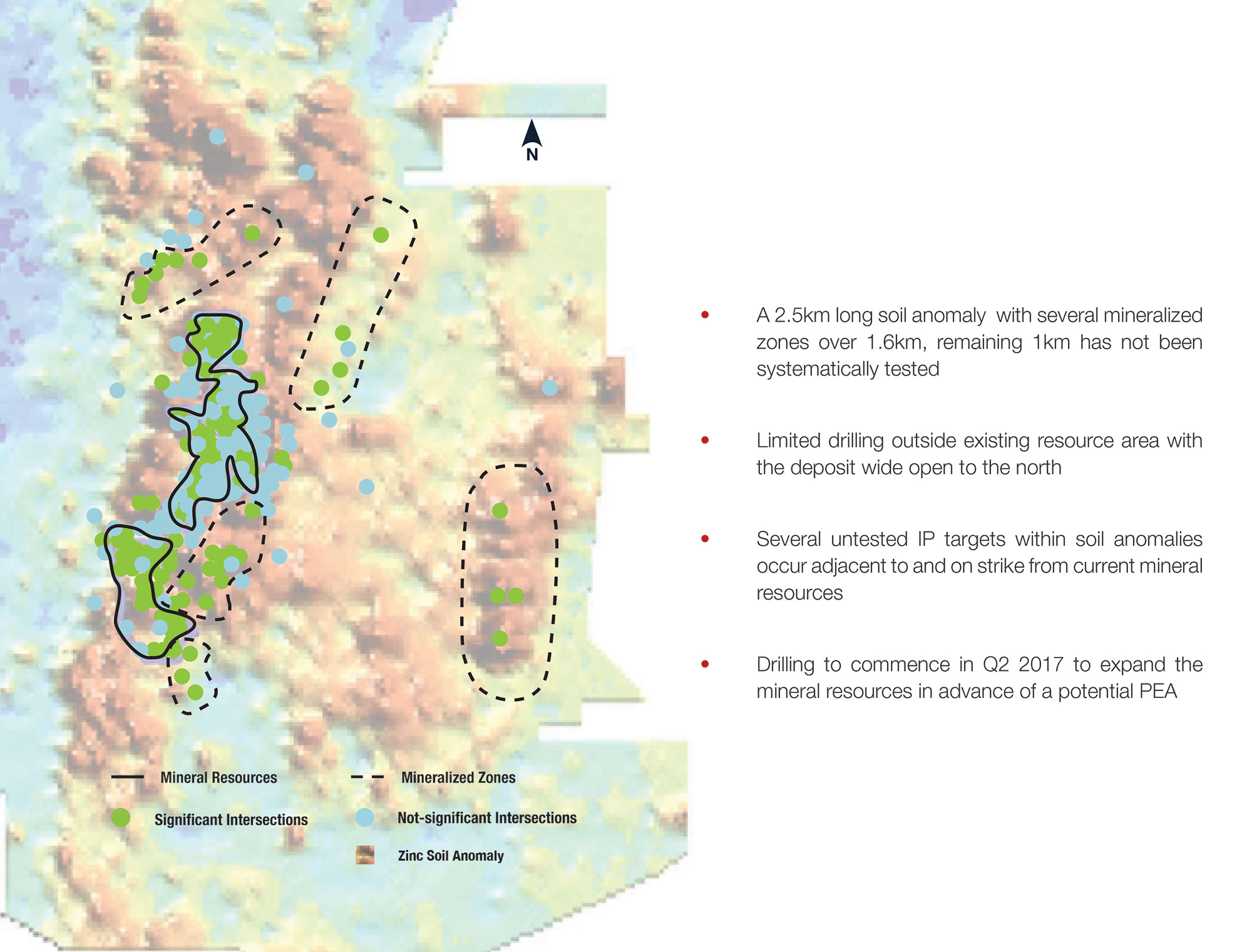

In our call with CEO Porterfield it became clear that the main focus this summer will be on the Nash Creek project where an existing resource estimate contains approximately 10 million tonnes of mineralized rock of which roughly 90% is located in the indicated resource category.

Yes, an average zinc-equivalent grade of 3.6% is low and whilst the project didn’t make any sense at all at $0.75 zinc (which is why Callinex was able to acquire the property at a bargain price), the situation does change now zinc is trading almost 70% higher. Using the current metal prices and a recovery rate of 90.5% for zinc, 81.5% for lead and 50% for silver, we estimate the rock value at approximately US$77/t based on $1.1 zinc, $1 lead and $18 silver.

But the economics could improve, as Callinex plans to use Dense Media Separation (‘DMS’) to increase the head grade of the ore before it is processed in a plant. It’s anticipated the DMS step could increase the head grade by 80-90%, which would result to a feed grade of almost 7% ZnEq. This would substantially improve the economics of Nash Creek, but of course, more testing will be needed to confirm our expectations.

There is some low-hanging fruit left at Nash Creek, as the previous operator has identified a large target just north of the existing resource. The lack of funds (due to the general lack of interest in zinc stories earlier this decade) prevented the previous owner to execute a planned exploration program, but this zone seems to be one of Callinex’ high priority zones as it should be relatively easy to add a few million tonnes to the current resource estimate. It really was a lack of funds which prevented the previous owner to drill it out and Callinex will very likely drill some stepout holes.

Callinex is indeed aiming to add 3-5 million tonnes to the Nash Creek resource estimate before moving towards a Preliminary Economic Assessment, which is expected before the end of this year. Even though there are some processing plants in the neighborhood, the PEA will be focused on a standalone operation, which would make sense using a 13-15 million tonne resource estimate and the inclusion of a DMS circuit to increase the head grade to the mill.

In a later stage, Callinex will also drill-test the mineralized structures at Superjack at depth, as it does look like all zones are connected at a depth of 700-1000 meters. Drilling 1,000 meter deep holes is obviously very expensive, but it definitely is a theory which will be drill-tested in a later stage. They also plan to follow-up on high-grade mineralization at depth which is still open and appears to be increasing in grade up to 10-17% Zn. Eq.

The exploration programs at both Nash Creek and Superjack are obviously aimed at increasing the currently known resources.

There still is plenty of cash on the balance sheet

As of at the end of December, Callinex Mines had a working capital position of almost C$10M after closing a C$5M placement with Sprott, and accelerating the expiration date of the in-the-money warrants.

Using the current share price of C$0.295 and the total amount of shares outstanding (77.5M), the enterprise value is just C$15M, and this does seem to be quite low for a company with several horses in its stable. Even though Callinex hasn’t been able to replicate the discovery hole on the Flin Flon land package, you should definitely keep in mind the company also owns three zinc projects in Canada, of which the Nash Creek and Superjack projects have access to existing infrastructure, and are located in an existing (zinc) mining camp.

These two projects by themselves should already be worth C$20M (especially as it looks like it will be relatively easy to increase the resource estimate at Nash Creek), and we do have the impression the market is giving too much attention to Pine Bay/Sourdough, whilst ignoring the zinc assets in the portfolio.

Granted, a head grade of 3.6% ZnEq at Nash Creek isn’t impressive, but adding a DMS circuit could boost the grade to somewhere around the 6-7% mark and this would make a standalone scenario with the associated infrastructure and processing plant capex feasible. Once Callinex will get its boots on the ground at Nash Creek (and Superjack), we would expect the market to pay more attention to the zinc-side of the Callinex Mines story.

Disclosure: Callinex Mines is a sponsoring company, we have a long position. Please read the disclaimer