Canterra Minerals (CTM.V) is now fully focusing on its base metals (and gold) projects in Newfoundland as the company just announced the sale of its diamonds property to Star Diamond (DIAM.TO). The latter will issue 17.5 million shares to Canterra Minerals for a total consideration of C$1.13M. This implies a deemed price of just under C$0.065 per share of Star Diamond. Canterra will also receive a 1% NSR on the property.

All 17.5M shares are subject to a four-month hold period, while about half are subject to a twelve-month lock-up period.

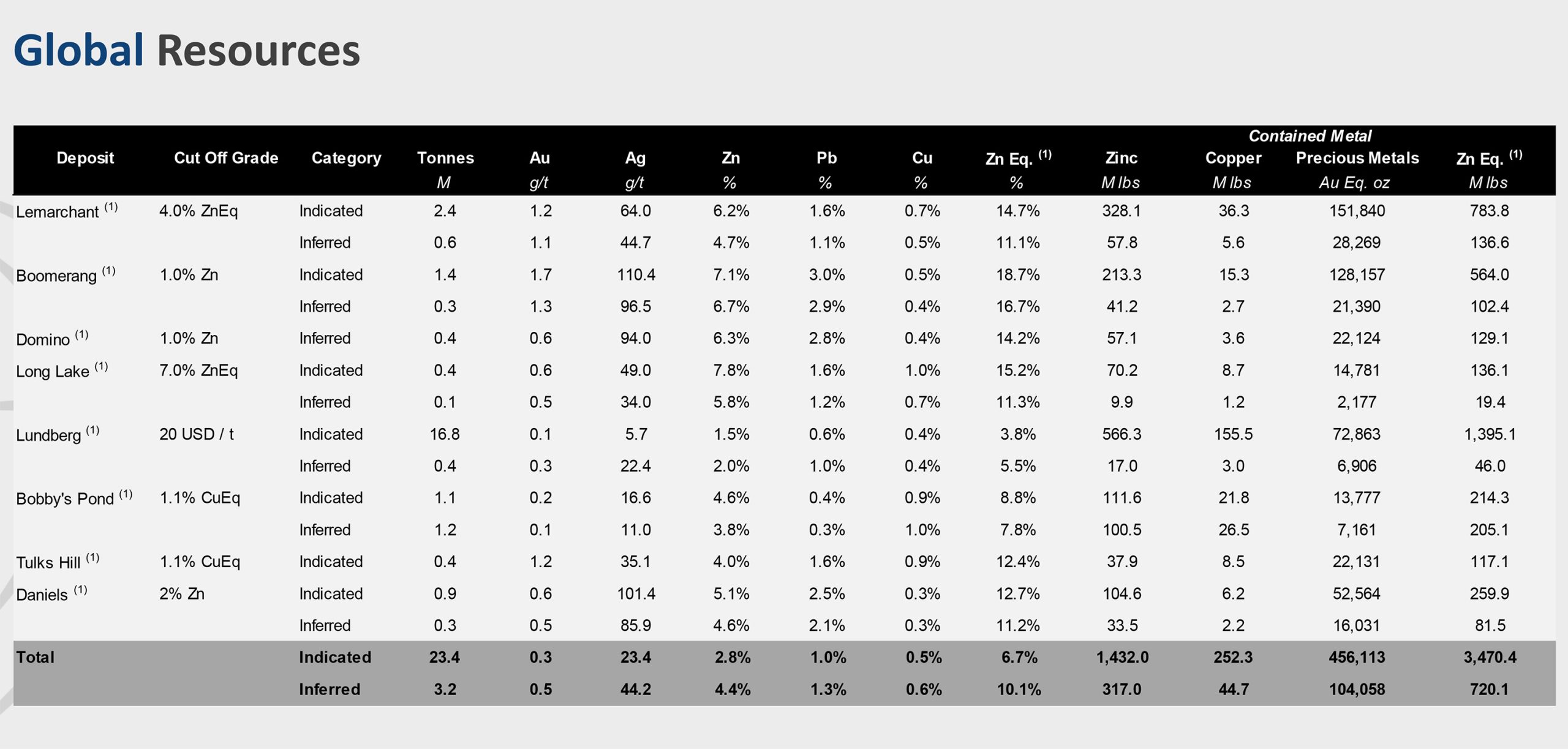

The sale of the Alberta diamond project will allow Canterra to refocus its efforts on Newfoundland where it has a global resource of almost 27 million tonnes of rock in the indicated and inferred resource categories with a total of 1.75 billion pounds of zinc as well as almost 300 million pounds of copper (with the vast majority in the indicated resource category, as shown below.

The existing resource in Newfoundland provides an excellent starting point for further exploration, and the sale of the Albertan assets creates a good opportunity to catch up with CEO Chris Pennimpede on the most recent developments.

Sitting down with Chris Pennimpede, CEO

Diamonds

Chris, you announced the sale of your diamond property in Alberta last week. That’s a clear signal you are fully focusing on the Newfoundland assets. Were you actively marketing your Alberta diamond asset, or did Star Diamond find you?

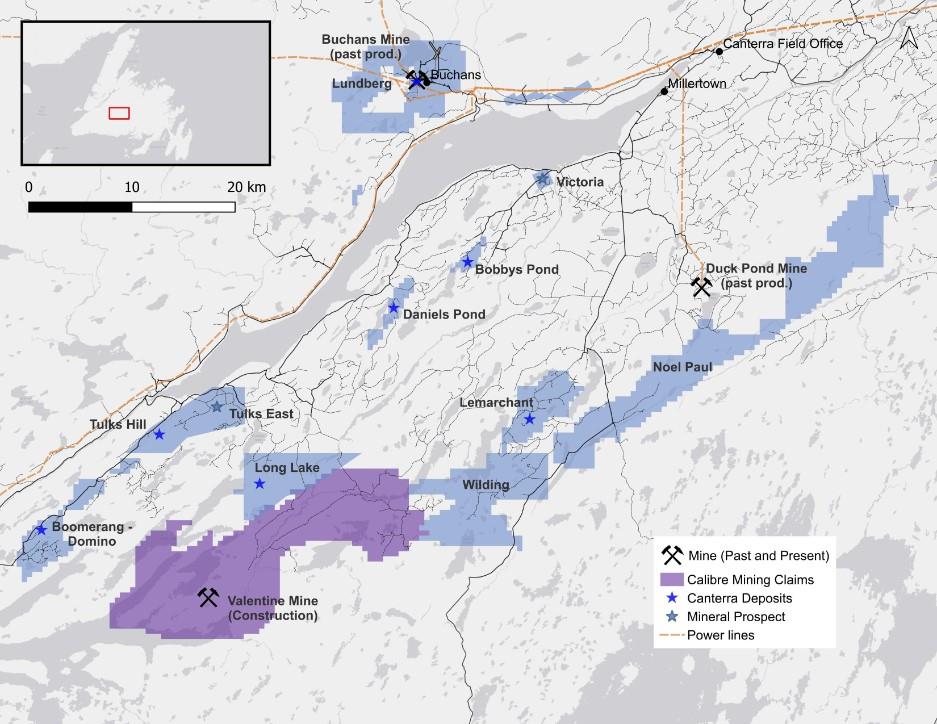

We’ve been actively marketing Buffalo Hills since I became CEO in 2020 when we brought in the original suite of Newfoundland gold assets. Given it was held within a JV with Star Diamond and we were operator, the list of potential buyers was short so it ultimately became a question of timing that was right for both companies. Since amassing the next 60 km of the Valentine Lake Shear zone in central Newfoundland in 2020 and 2021 we were firmly committed to exploring the potential of the central Newfoundland Mining District. Since then, we have ultimately realized that vision by making four acquisitions within the district thereafter ultimately going from green fields explorer to resource stage consolidator by consolidating the entire district outside calibre’s new Valentine mine.

If we understand it correctly, about 8.875M shares will be free tradeable after an initial four month hold period when the transaction closes, with an additional 8.875M shares becoming free tradeable after one year, is that correct?

Yes that’s correct. This will allow Canterra to continue to focus on its advanced stage copper and gold exploration in the central Newfoundland Mining District. We look forward to maintaining our exposure to the Project as a Star Diamond shareholder and will be watching developments with much interest as our equity participation in Star Diamond provides our Company with exposure to future success.

You are getting a 1% NSR out of the deal. May we assume you would be interested in selling that royalty to a diversified royalty company looking to boost its portfolio?

Ultimately, we are interested in maintaining our exposure in the project and the royalty is a great way to do that. However, looking forward, Canterra has an incredible pipeline of projects and Greenfields data in the Ring of Fire, NWT and Newfoundland and Labrador. Expect us to continue to be transactional in monetizing our pipeline of projects (such as we’ve done with Buffalo hills) to generate royalties while maintaining our exposure to the exploration upside of each project. If a diversified royalty company is interested in making a play for those royalties then I think we have shown we are a very transactional company.

When do you expect the deal to close?

Closing is scheduled sometime in August with approval required from both the TSX venture for CTM and the TSX for Star diamond.

Corporate

You recently closed C$1.5M in financings, including C$1.23M in hard dollars and C$0.3M in flow-through. As you are still quite active on the exploration front, is there a specific reason you kept the flow-through portion of the financing limited? We noticed the share price fell quite sharply after your previous (predominantly flow-through) placement became tradeable in August April; did that leave a bitter aftertaste?

The priority for this raise was hard dollars. As you pointed out, the previous raise in December 2023 was all flow-through dollars which covered our exploration plans for 2024. I would have certainly come to the same conclusion as you have with the share price reaction after those flow-through shares became free-trading. However, it was unrelated. A long-standing shareholder decided to get off its position. I have been quite impressed with the flow-through subscribers holding their positions.

So yes, I would’ve expected a bitter aftertaste, but I left the experience with a renewed respect for flow-through investors in working with the issuers to place blocks and ultimately be fair in their selling when they are required to do so. A single subscriber wanted some flow-through during our most recent financing and we needed a little bit more runway for our maiden drill program on the former Buchans mine that is scheduled to commence late summer. It made sense to pull the trigger to facilitate the drill program. Buchans is a world-class asset and where we believe the next tier 1 discovery going to be made within the central Newfoundland Mining District.

Newfoundland

Can you elaborate on this summer’s plans in Newfoundland?

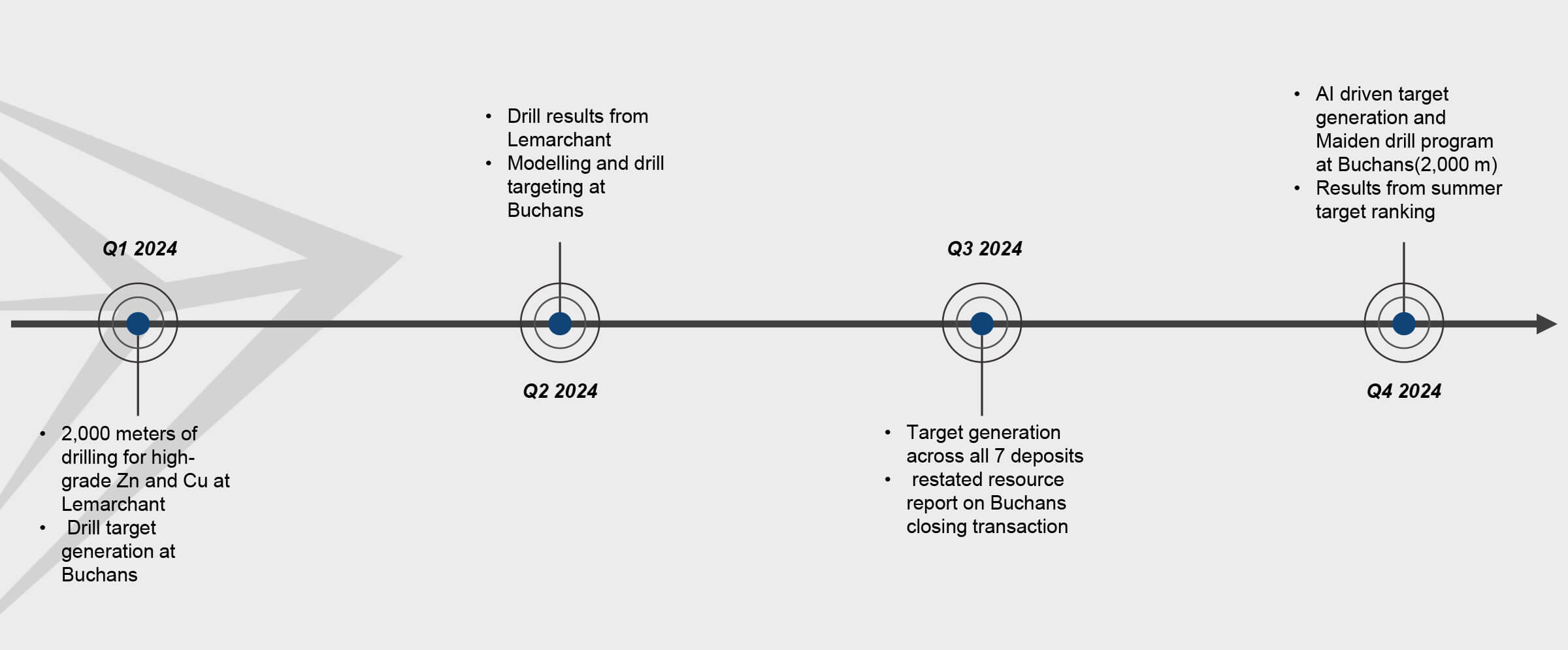

Having finally completed the entire central Newfoundland Mining District consolidation we now have 6 resource stage projects and the next 60 km of the Valentine Lake Shear zone, which hosts all of the orogenic gold mineralization and deposits (totaling approximately 6 Moz and counting between AuMega Metals and Calibre Mining). So our 1st priority was to spend time on the resource staged projects to determine which has the greatest potential to get bigger and/or to yield a new discovery. Essentially a target ranking exercise.

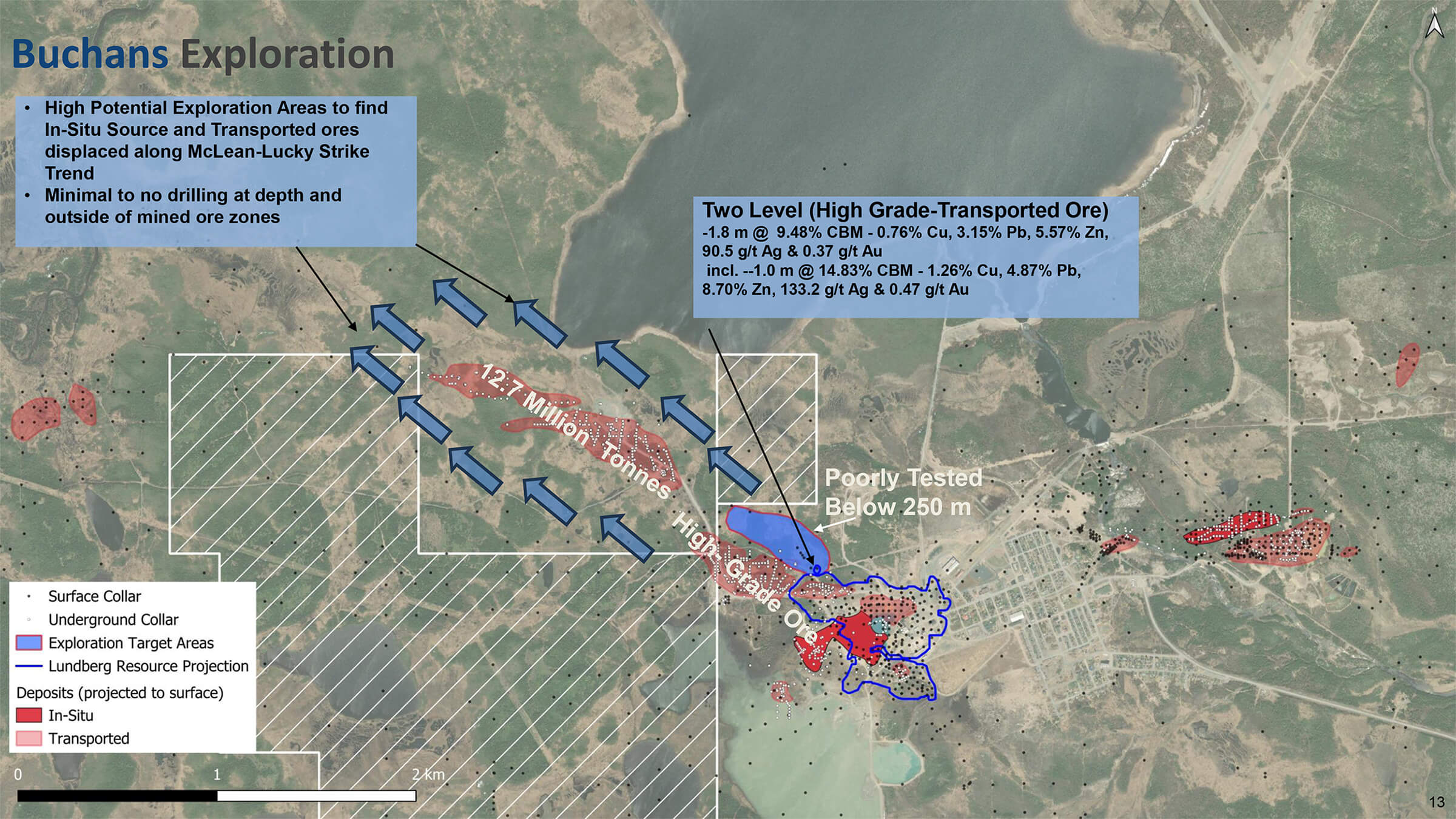

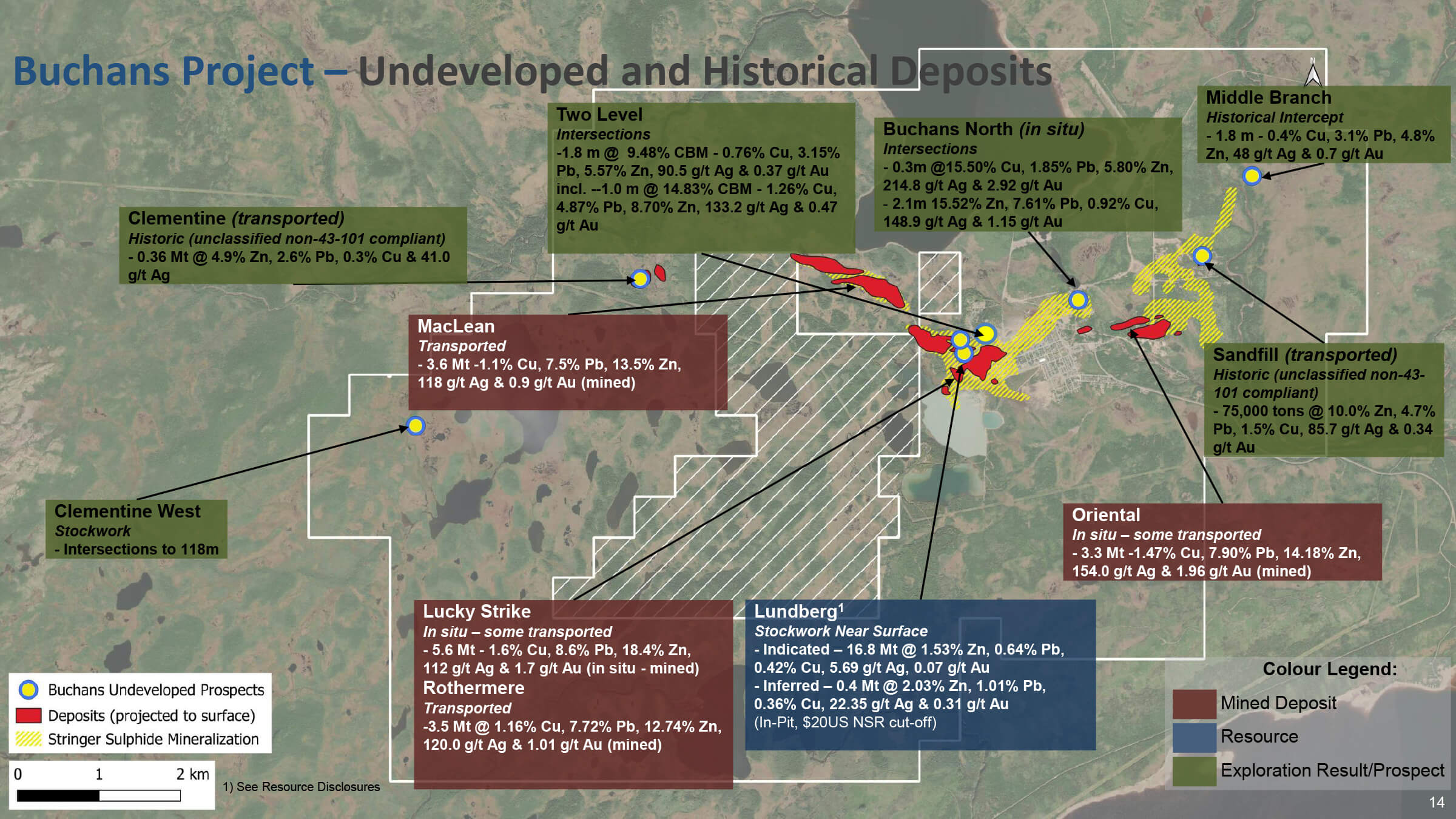

Secondly, Buchans is certainly the cornerstone asset going forward and given it’s almost 100 years of data it’s a prime candidate for AI – machine learning to crunch all that data and generate new exploration ideas. So, we’ve begun to explore how to best apply those techniques. Your readers can stay tuned for advancements on that front.

I think it’s really the future of exploration, but as is always a challenge with our business, it comes down to data quality. The Newfoundland and Labrador government has meticulously stored all the previous mining and exploration data, which gives us a huge advantage and its basic the perfect data set to use data-driven techniques to generate exploration targets.

Ultimately for this summer’s drill program, we are looking at the past work that was done by Buchans resources Limited and the Boliden cooperation agreement, which generated a lot of drill targets. We are now ranking them and the top ranked targets will be drilled by the end of summer.

The goal of this drill program is to demonstrate the incredibly high- grade base metal nature of the Buchans project which produced 16 Mt at 1% Cu, 20% Zn, 10% Pb 100g/t Ag and 1 g/t Au by hopefully making new high-grade discoveries within the Brownfields while also proving the existing 16 Mt bulk tonnage resource can be substantially expanded especially in the current metal price environment (the resource was completed at 2019 prices most notably $3 copper).

Conclusion

Now the sale of the Albertan diamond project will be completed in the next few weeks, Canterra can focus on its already sizeable base metals project in Newfoundland. After having consolidated the Buchans district, Canterra has transformed itself from a gold exploration company to one of the go-to names in Atlantic Canada for base metals exploration. The company doesn’t have to start from scratch as it already has in excess of 20 million tonnes in the indicated resource category and that is an excellent base to continue to build tonnage, pounds and even ounces as we shouldn’t ignore the almost half a million ounces of gold-equivalent in the indicated resource category.

Disclosure: Canterra Minerals is a sponsor of the website. The author has a long position in Canterra Minerals. Please read our disclaimer.