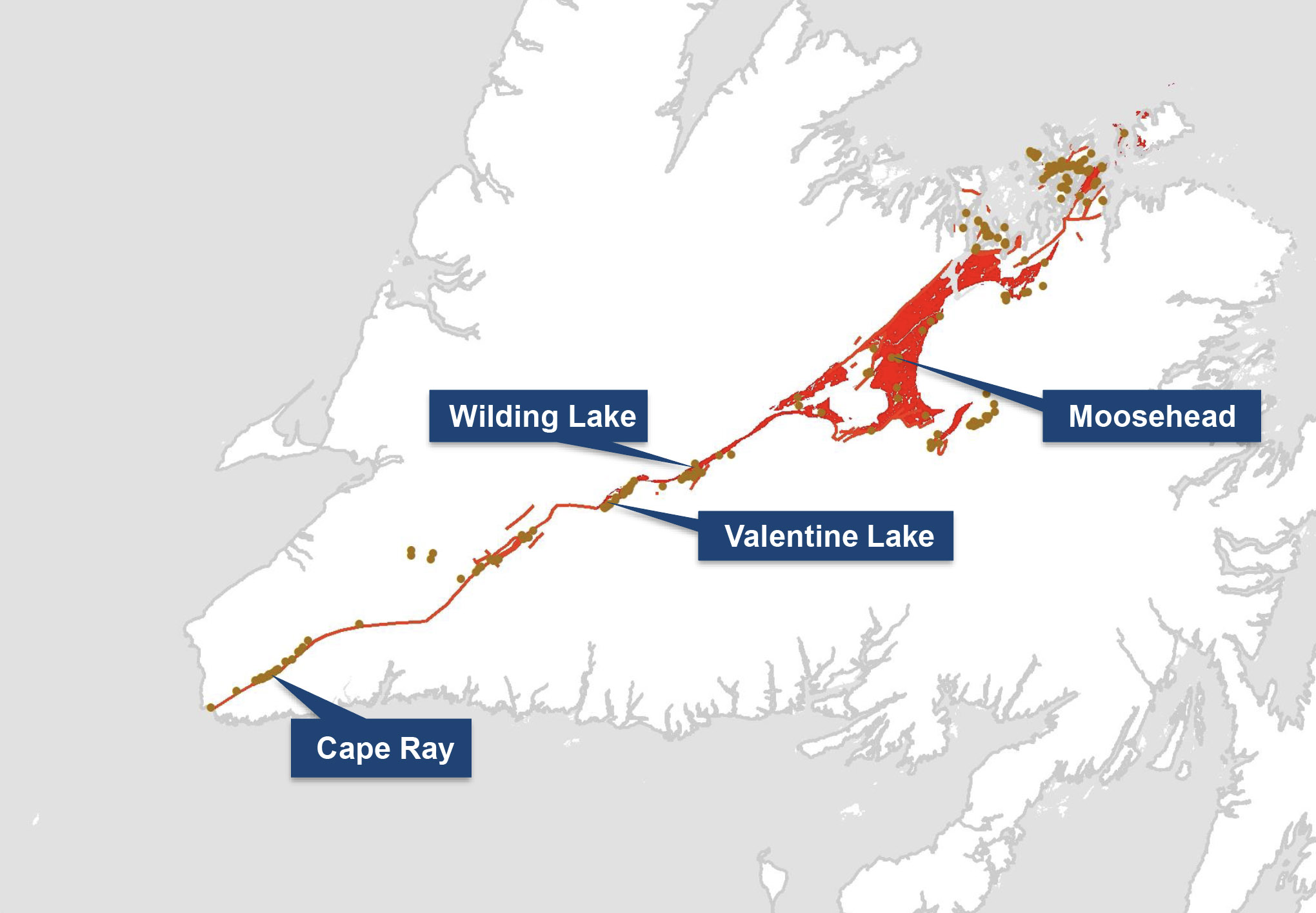

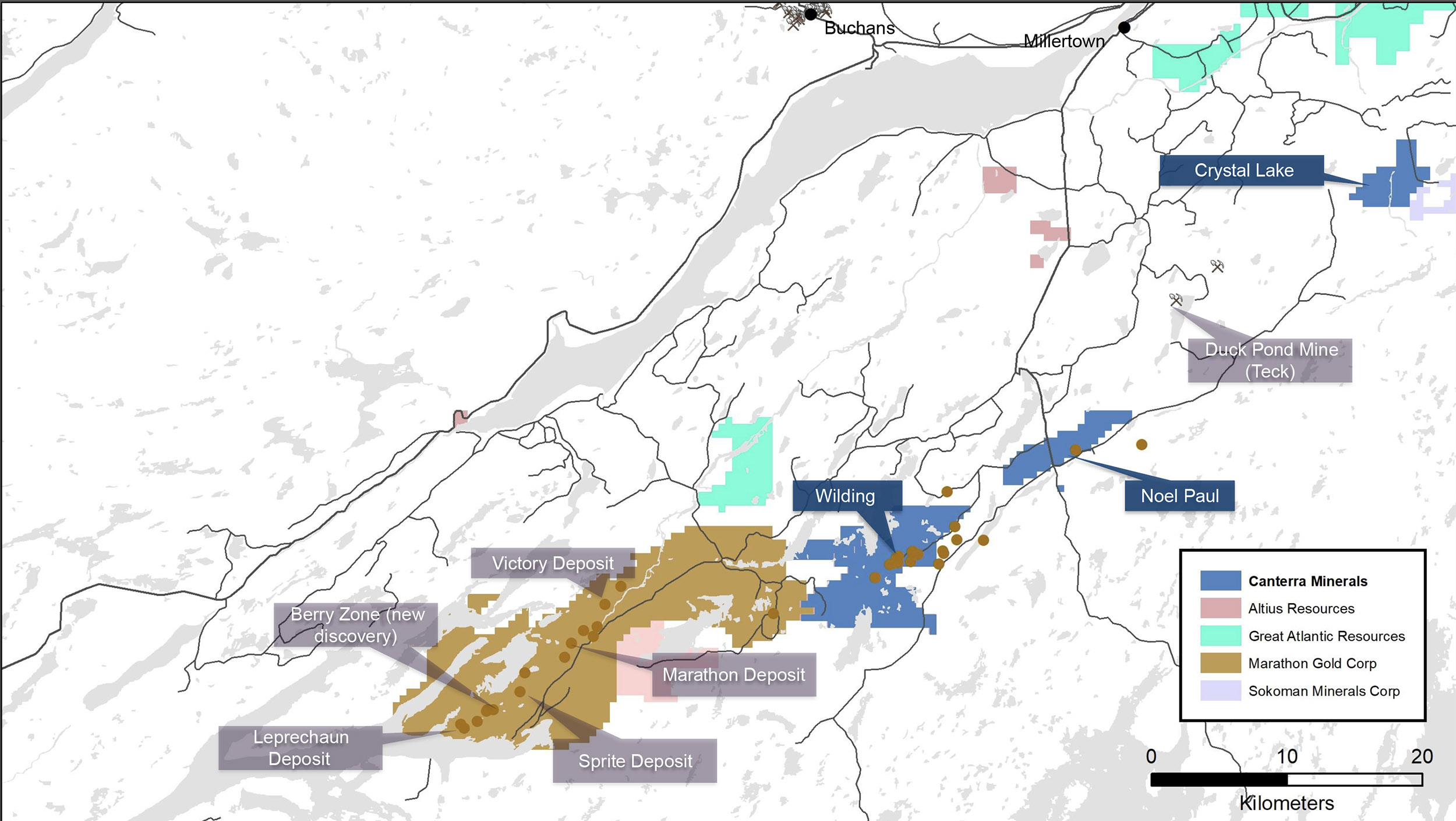

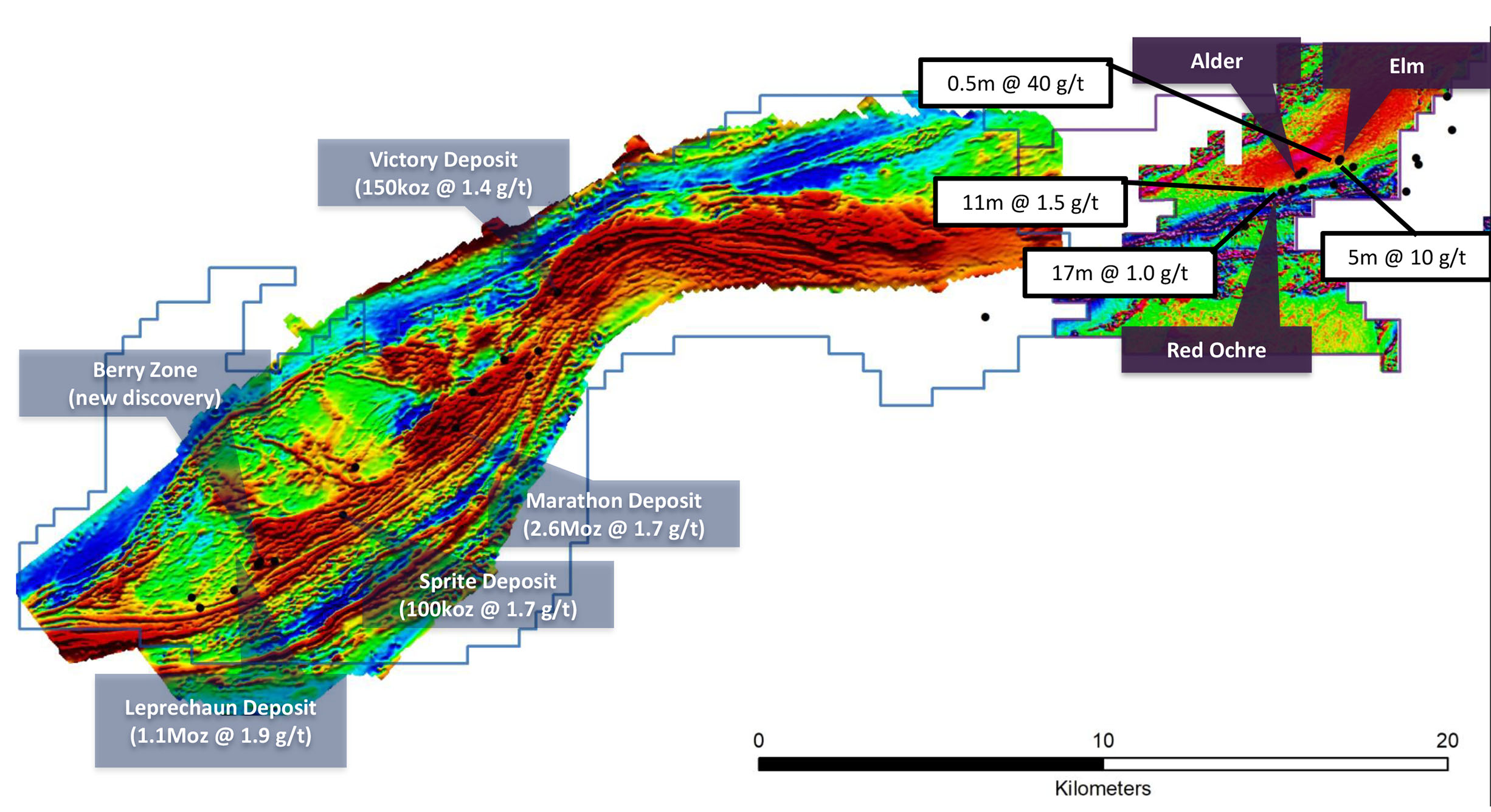

Just a few weeks ago, Canterra Minerals (CTM.V) completed the acquisition of privately held Teton Opportunities. Teton’s assets consist of 104 square kilometers split into 3 project blocks with the main project being Wilding. Combined, the projects cover 30 kilometers strike length of the Rogerson Lake structural corridor in central Newfoundland, one of the new hotspots for gold exploration in Canada. The Wilding land package also is on strike with the Valentine Lake project owned by Marathon Gold (MOZ.TO) which currently contains in excess of 4 million ounces of gold with a positive pre-feasibility study outlining a 12-year mine life. Needless to say, Teton’s (now Canterra’s) Wilding project is in the right location.

As Newfoundland appears to be a new ‘hotspot’ for gold exploration and Canterra is a new player in the game, we wanted to catch up with CEO Chris Pennimpede to pick his brain on Newfoundland and finding gold there.

Sitting down with CEO Chris Pennimpede

About Newfoundland & the project acquisition

Until recently, Newfoundland actually hasn’t been very popular as a gold exploration destination. Marathon Gold has been working in the area for a long time, but it looks like the rekindled interest in Newfoundland only started this year. What changed? What made Newfoundland suddenly pop up on the radar screens?

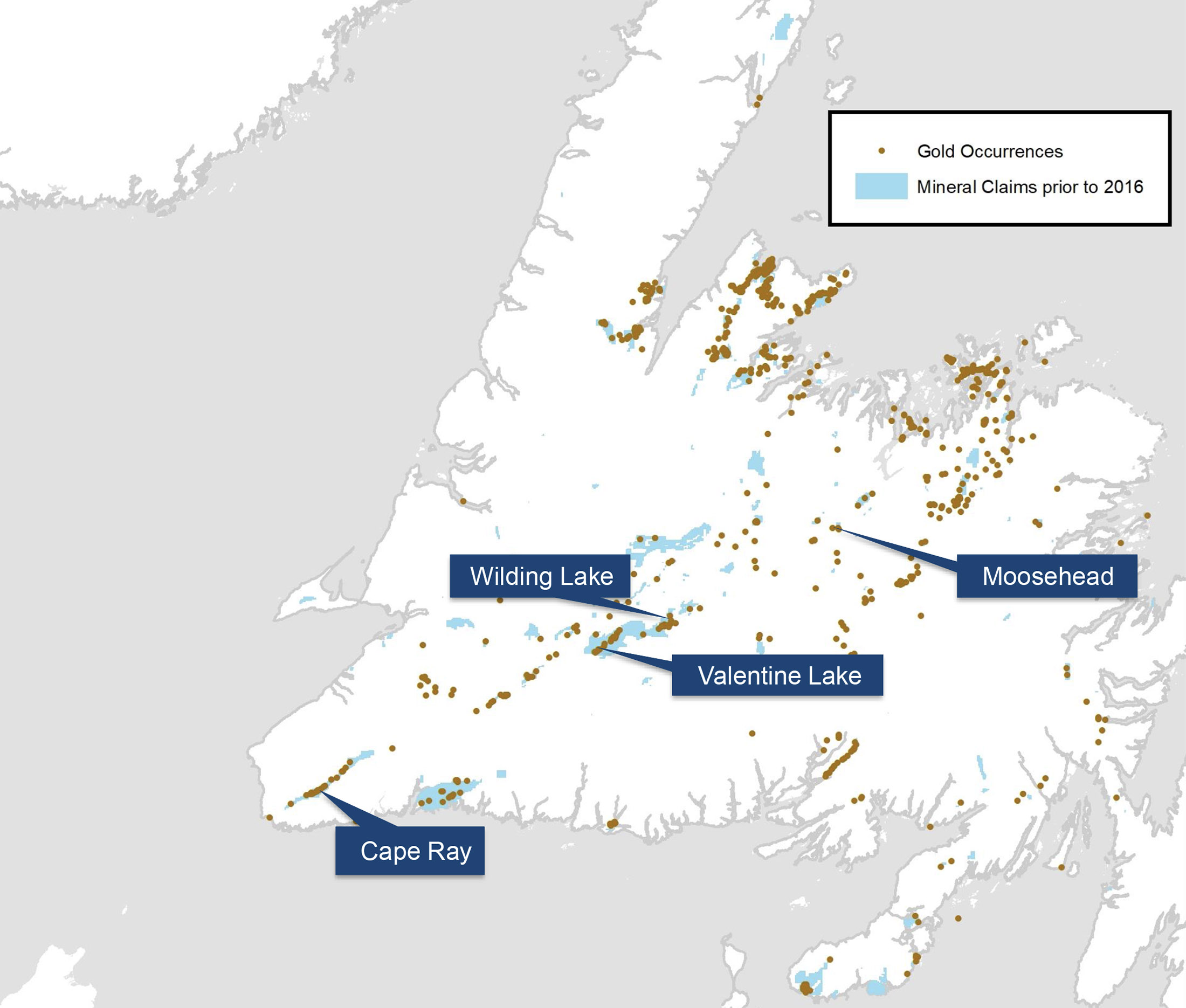

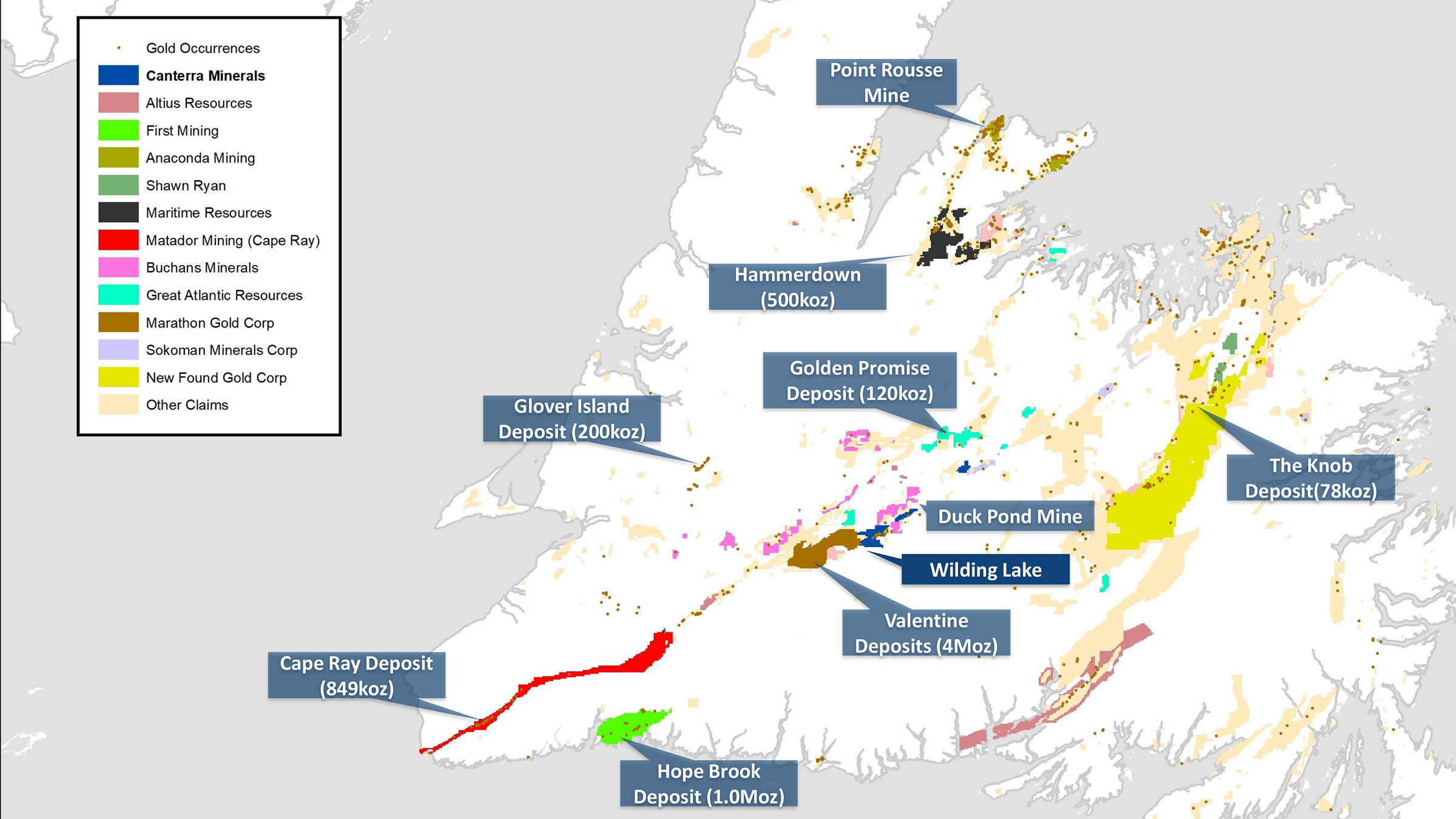

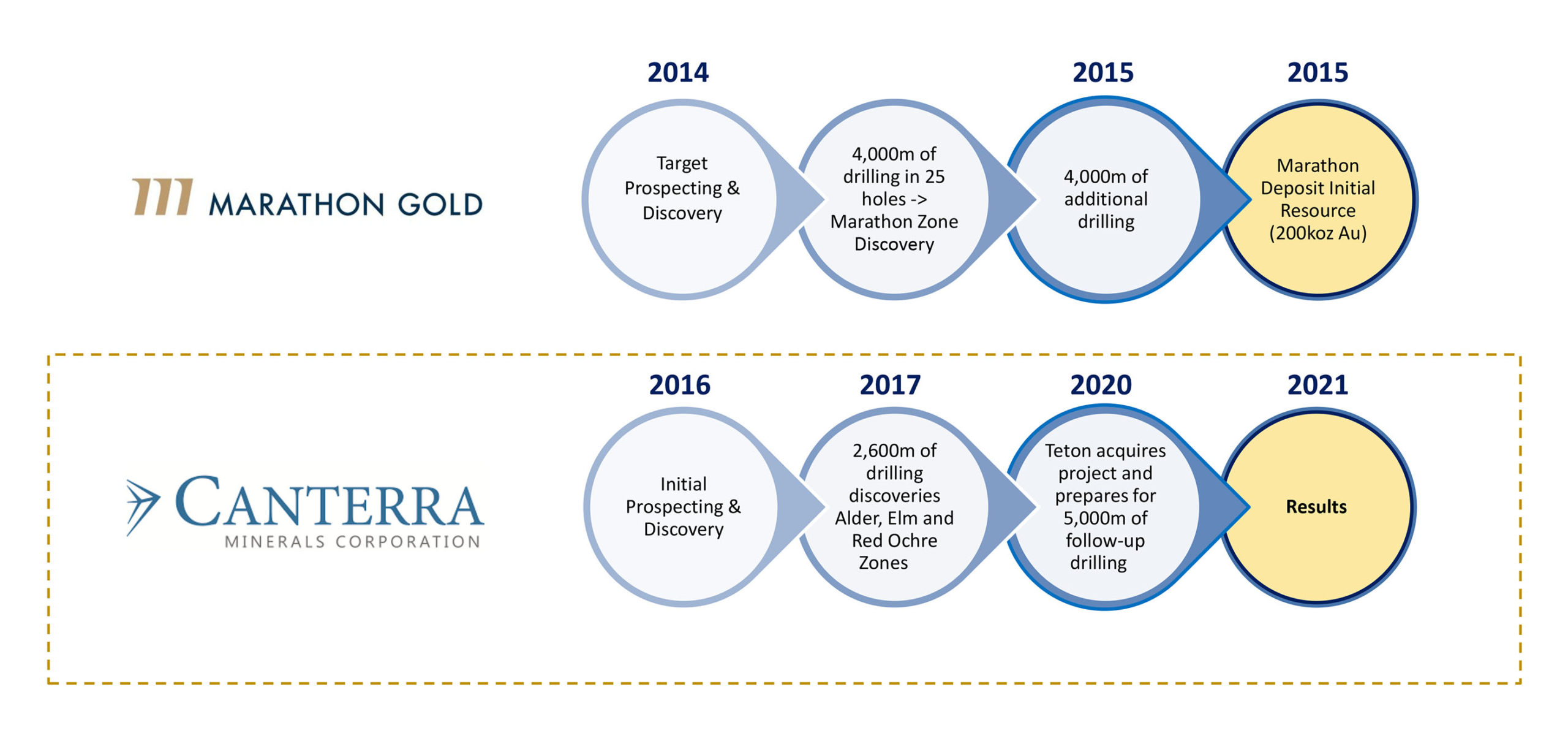

I would argue the real interest started in 2015. At that time, Marathon had put its first resource on the marathon deposit out at approx. 200koz putting their project on the map as having the potential to host large orebodies and proving that the Dunnage-Exploits region could host significant sized gold deposits. Following on that discovery, rumor had got around that Shawn Ryan, of the Yukon gold rush fame of last metals cycle, had staked half of the Island, including swaths of land near Marathon, with some ex-Newmont folks (Torq Resources). That certainly helped get other peoples attention, which lead to other companies such as Newfound Gold staking large portions of the Appleton Fault. Ultimately, having an explorer get to $500M market cap helps a lot, but I think the fundamentals behind the mineral potential of the Island, particularly in gold, are valid and I expect we will see a bunch of new discoveries on the back of this renewed gold rush.

Certainly the resource growth at Marathon has brought more attention to the Island, but I think a lot of explorers saw an opportunity in a friendly mining jurisdiction with a modern staking process to get in and make discoveries relatively easily. We saw the same thing with Yukon from 2008 on where large parts of the Territory were poorly understood and all it took was one Company to have success to spur a staking rush that resulted in many more discoveries, buyouts and major partnerships.

The Atlantic Gold buyout by St Barbara for in excess of C$700M helped bring attention to the Maritime provinces for gold exploration and development in general. I think we have just seen a progression from Nova Scotia and New Brunswick exploration up to Newfoundland.

About half a dozen companies have since entered the Newfoundland gold exploration scene. How did you bump into the Wilding gold project, and how did you convince Altius to option it out to you?

Altius had shopped the opportunity in early 2020 coinciding with Antler selling the project back to Altius. Altius reached out to the Teton team and some of us had past work relationships with Altius and they were comfortable with our technical expertise. We met at PDAC to get familiar with the project and the reasons for Antler moving on. The pandemic slowed discussions down after that, but we kept the ball rolling eventually finishing the Agreement in late August. It really came down to our team and past relationships with Altius that we were able to secure Wilding.

Could you elaborate on the acquisition terms of the project? What’s still required to acquire full ownership?

Teton came to an agreement with Altius to acquire Wilding, Noel Paul and Crystal Lake claim blocks for a percentage of Teton. A Share Exchange Agreement was entered into by Canterra and Teton where by Altius acquired ownership and control over 4,398,750 common shares and 2,199,375 share purchase warrants

In addition to the share position in CTM, exploration expenditures of C$1M in are required to achieve 100% ownership of the projects.

It’s still early days, but how do you see the Newfoundland exploration landscape evolve? Do you expect M&A activity to pick up the next few years whereby just a few dominant exploration companies will remain standing? There obviously is a lot to be said for consolidating several assets further down the road? Or are most relevant properties just too far away from each other to make sense?

I’m going to refer back to Yukon and other hot jurisdictions that have come and gone. You’d always expect M&A to pickup, but it never seems to straight away since all of the explorers tend to have a lot of cash when there is a lot of excitement in an area. However, if you look at the landscape of the White Gold District and other areas of focus in Yukon 10 years on from the peak of excitement to as it stands now you had a ton of consolidation during the downturn leaving just a few main players with large land positions in the major mineral endowed regions. So I guess yes is the answer to the question!

I would expect something similar to happen in NL as some explorers will be successful and others won’t so there will be some consolidation. And you would expect some M&A to justify all of that consolidation and land holding. I would expect a mining company to take an interest in exploring and developing a particular region of the island. For example if you look at the Rogerson Lake corridor you have approximately 5Moz and counting between two companies (Marathon Gold and Matador Mining) with discoveries from two more companies in Sokoman Minerals and their Moosehead discovery and Wilding which is of course now owned by Canterra . Although the distances are over 100km from Matador to Sokoman the deposits are so far all very similar and may have similar processing requirements. Consolidating something like that would make sense to me. You see that on the Carlin Trend, in the greenstone belts in Nunavut and in Red Lake where a major mining company gets comfortable exploring and developing similar deposits in the same region.

Could you walk us through the legal framework in the Newfoundland exploration sector? How easy is it to get drill permits and, further down the road, try to get permits for a production scenario? Is it in any way different from for instance BC and ON?

In order to drill you apply for an exploration permit and you outline the sites to be drilled/trenched/soil sampled etc. It is pretty straight forward and has much better turn around than the other provinces you mentioned. Additionally, you apply for a water permit on the back of the exploration permit to facilitate drilling. The process is quite straight forward as well and refreshingly quick. For production the new rules in Canada give the Federal government some decision making as part of the environmental assessment part but basically you go from the pre-feasibility study to the environmental impact study, feasibility study and the environmental approval and then you are good to go mining. Given NL’s long and still active mining history the local population understand mining and welcome the job creation and other benefits that come from developments.

Newfoundland and Labrador’s claim system is unique relative to other Provinces and Territories in Canada. You have escalating holding costs and work commitments as the claims age. Though other parts of Canada have similar systems where NL differs is the claims are batched into licenses so you cannot extend exploration expenditures beyond the licence. Therefore, you have to come to a conclusion on whether to hold ground or not within the first 5 years or you will be stuck spending on ground that may not be prospective to keep it. I think this system will continue to create opportunities especially given some of the Explorers that have giant land positions and will likely have to let go of some parcels of land in the next few years.

Is the Duck Pond mine still in place or has it been dismantled? If we remember correctly, this was predominantly a base metals facility. Do you think the interest in base metal exploration in Newfoundland could resurrect as well, or is it really all about gold right now?

It closed in 2015 and has been undergoing remediation since. It is a VMS deposit, dominantly Copper but with lead, zinc and gold. This part of central Newfoundland has been focused on VMS and other base metal deposit exploration and mining since the 1800s with Buchans, one of the towns closest to Wilding, as one of the centers for lead-Zinc mining. We are already seeing base metal exploration increase in central NL. Buchans’ Minerals has a large holding in the belt and is actively exploring for more Duck Pond style deposits. Teck actually left the lower zone of Duck Pond in place since they didn’t think the grade was good enough to chase that deep down so I would expect that will probably see another go round sometime in the future. So to answer the question more directly, gold is going to dominate at the moment but there are players already consolidating past base metal districts looking to re-evaluate and identify opportunities.

Exploration plans

Certain investors may remember Antler Gold, which was the previous optionee of the project. Why do you reckon Antler dropped the project, and what/how will you do it different/better?

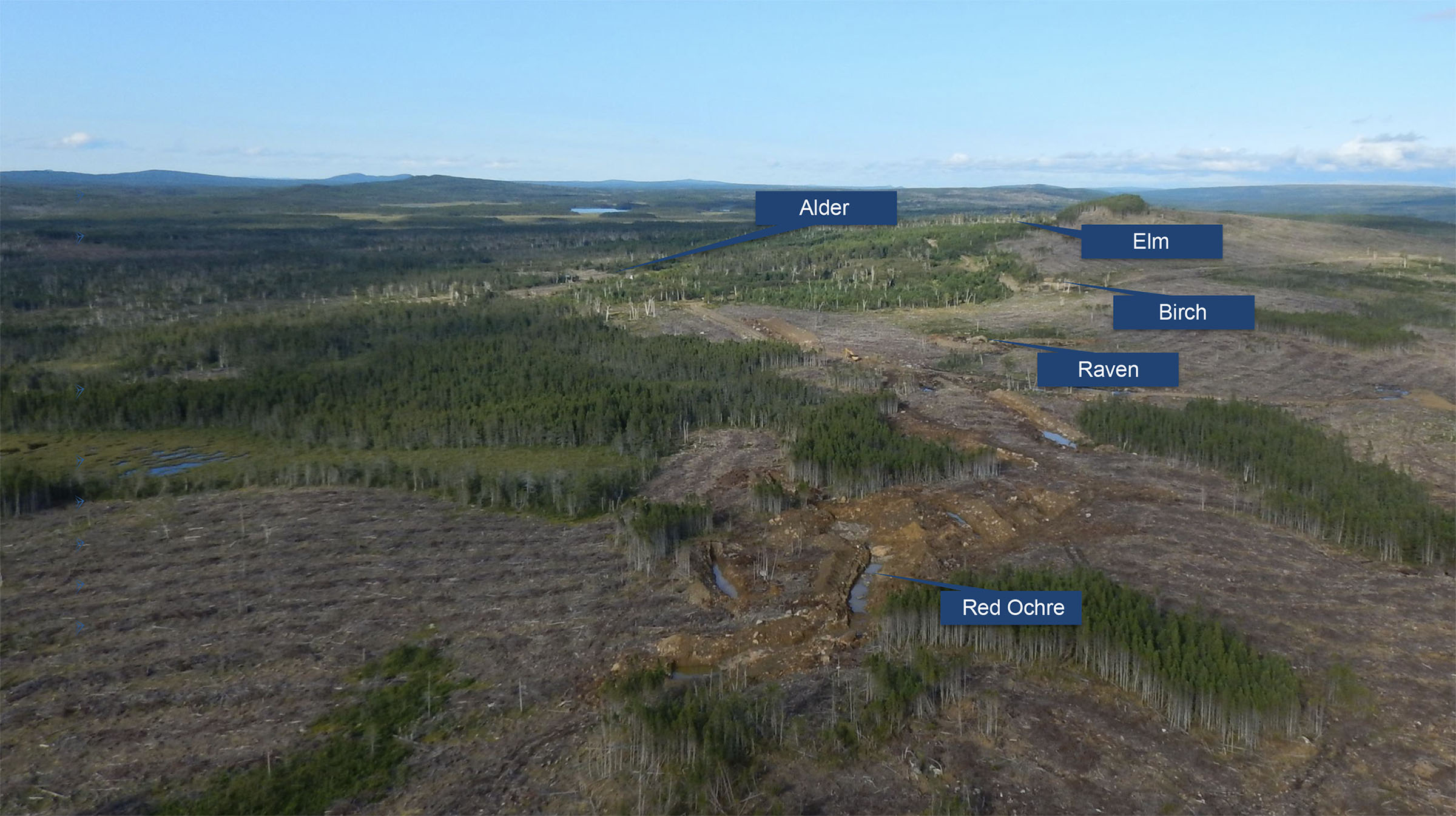

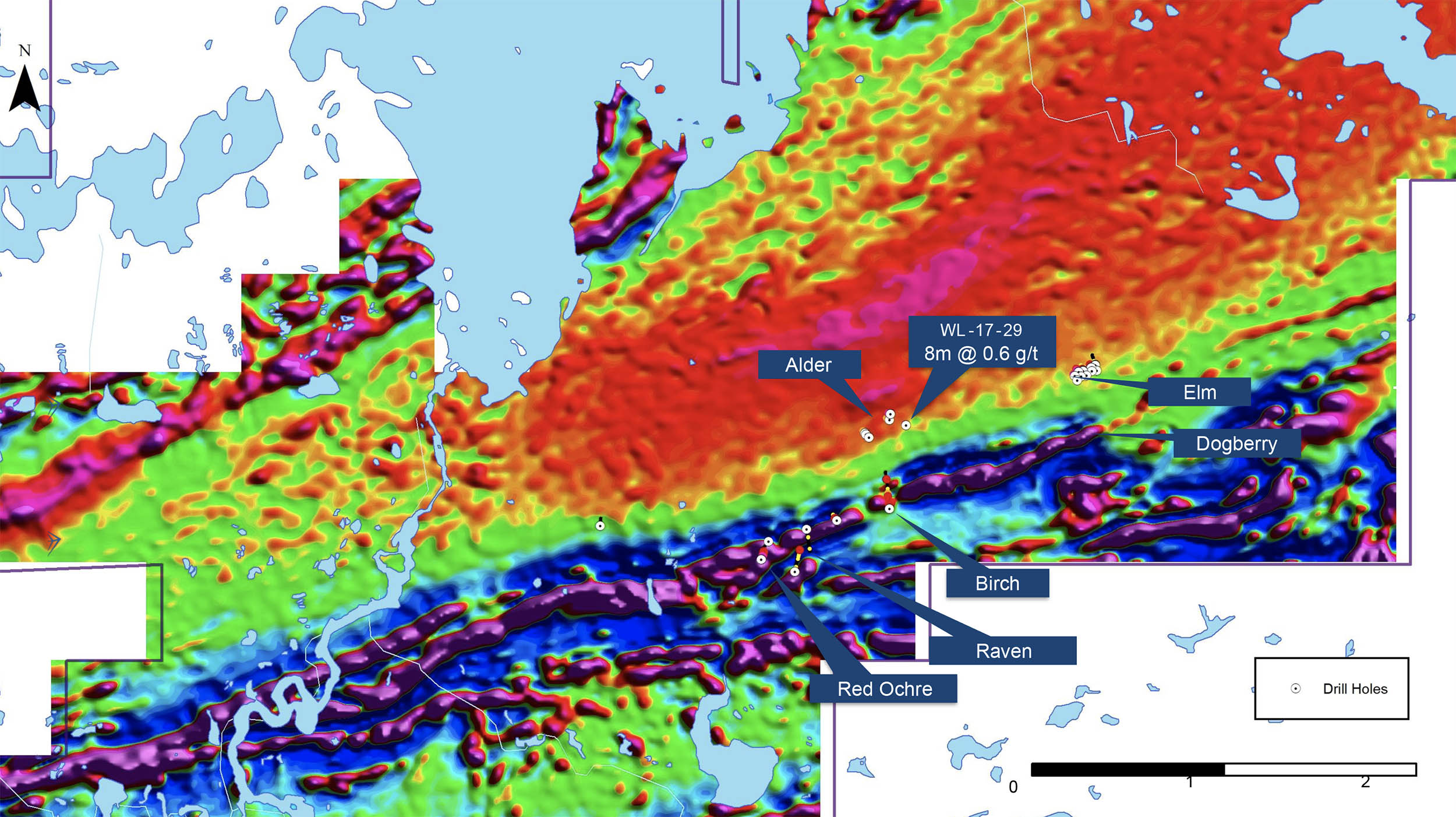

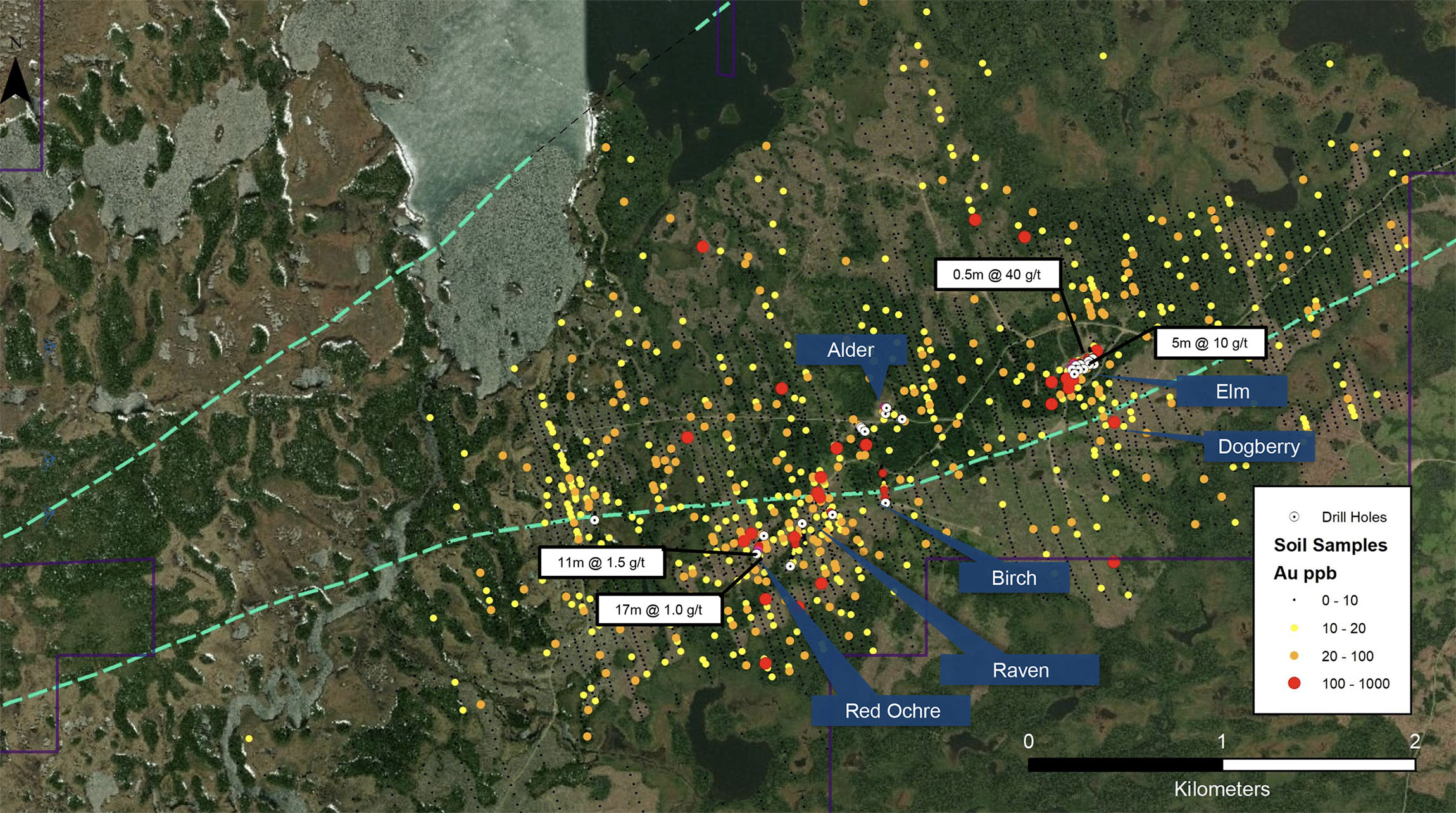

It is an interesting question. By all accounts Altius and Antler were very successful in the year and a half of exploration that was conducted. Its not very often you go from true virgin exploration ground to multiple drill discoveries across several zones and rock types in just one year. I think timing was not on their side with all the drill results coming out in December of 2017, which was a tough year for gold explorers. They did more generative work in 2018 but did nothing in 2019. It reads to me like they needed a new deal to revitalize the story. The work and the results Antler did were excellent and provide a great point to start from and get back drilling the identified zones and drilling some of the untested targets.

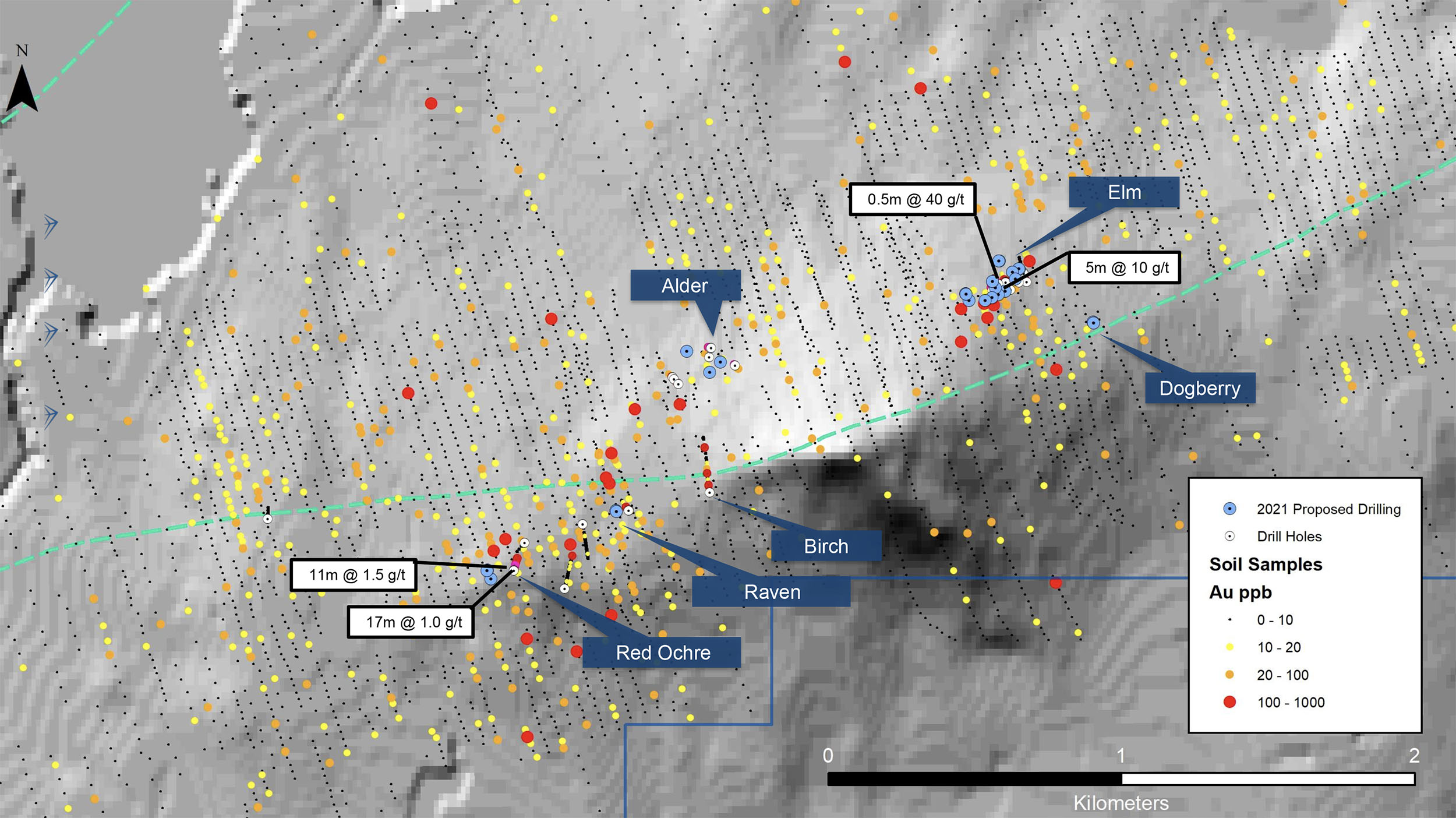

Although Canterra is just coming out of the gates as a company, Wilding actually is a pretty advanced exploration project and you will start drilling in 2021 as you are aiming to complete 5,000 meters of drilling in about 40 holes. How have you (or will you) determine your drill targets?

Going back to the identified zones is a great starting point as all the zones were left open and anytime you can chase 10m @ 5 g/t down dip and along strike you start there. From there drilling some of the untested targets is the next priority to continue that discovery success. Once summer comes around we will have time to develop some more drill targets for parts of the project that have not yet been explored, so stay tuned.

Dividing 5,000 meters by the roughly 40 holes indicates an average depth of just 125 meters per hole. Is this sufficient?

In some cases yes in other cases no. For most of the zones identified to date they are shallow and follow up drilling to expand those zones do not need to be pushed deep at this point. Same with the untested targets. Short quick drill holes will give us the data we need to make that decision as to whether the zones can continue to be expanded. For the deeper mag target that was successfully drilled by Antler the holes will be just over 200m in depth targeting that Valentine like intrusive at dept

Corporate

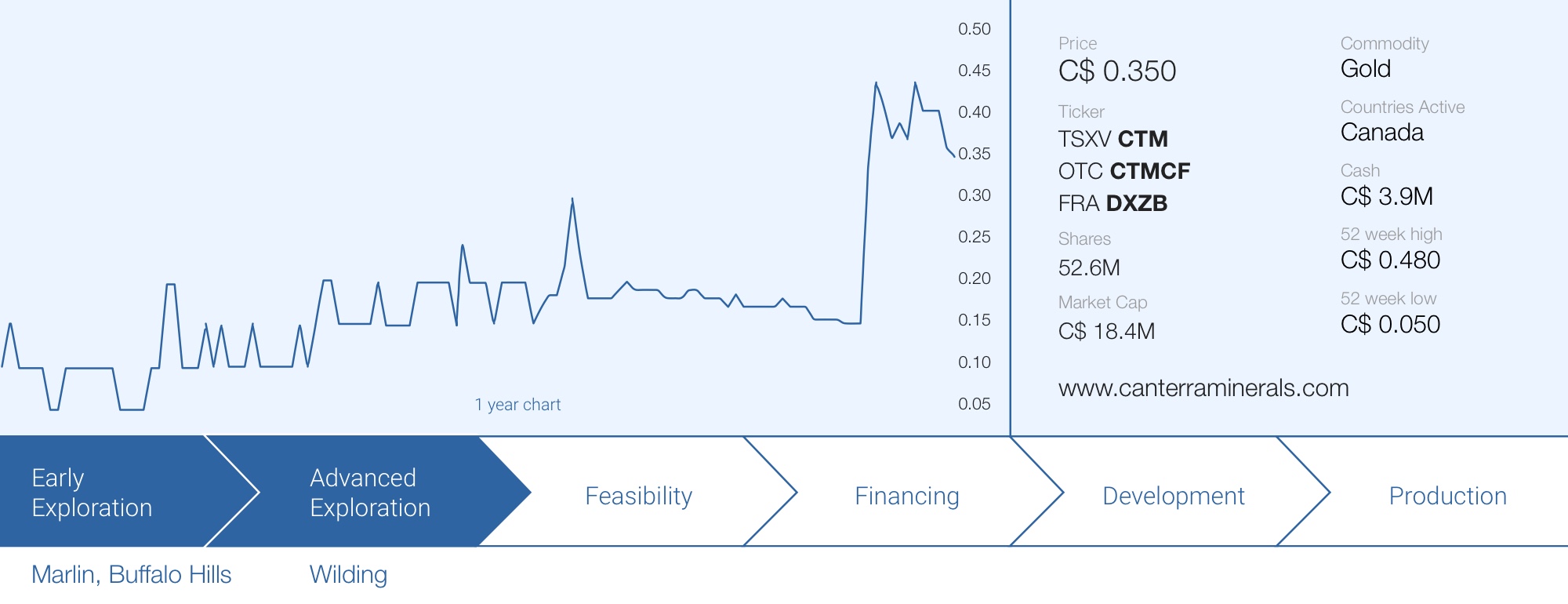

Now everything is said and done, you have just over 52 million shares outstanding, which gives you a market capitalization of C$18.4M. You recently successfully raised C$3.9M and that also is your current approximate cash position. About C$2.7M was raised in flow-through funds at C$0.13 and we noticed the flow-through placement was priced just one cent higher than the hard dollar financing. Was there a reason for this merely symbolic higher price?

At the end of a wild year it was apparent that demand for flow through might be somewhat higher than a unit offering. Therefore, balancing the demand we decided that it would make sense to offer FT slightly higher to provide a bit of a decision point as to whether buyers wanted the FT benefits or the optionality of a unit. It worked out great.

People may know you as the VP Corporate Development at Contact Gold. Exploring for gold in Newfoundland is obviously very different from Nevada-based oxide gold deposits. Do you have relevant experience on these types of deposits, or are you jumping in the deep here?

Actually this is back to my comfort zone in terms of hunting for gold deposits! The first decade of my career was spent looking for gold in glaciated terranes and in the case of most of my Yukon work, in areas of heavy overburden (cover). It was actually shocking to go to Nevada and be able to see (or not see in the case of Carlin-type mineralization) all of our targets in outcrop!

My degree was focused on surficial geology and because of my experience in Nunavut, Alaska, BC and Yukon among others I became very comfortable exploring for gold in previously glaciated environments just like we have here at Wilding. From a deposit point of view, the Marathon deposits and others in the same belt (Matador and Sokoman) are orogenic style gold deposits, which are similar in style though not age to those found in the greenstone belts in Nunavut, Ontario and Quebec.

What are the next few catalysts for the company?

We are aiming to start drilling at Wilding in Q1 2021. This will be a smaller winter campaign leaving much of the meterage for summer 2021.

There were 1,400 soil samples that were never analyzed from the previous operator that we will be submitting to the lab for analysis in Q1. We are also looking to bolster our property position in the region and will be looking at staking opportunities as they come available.

And of course, we will be looking to increase our listing exposure to allow for other markets to easily invest as well.

Conclusion

The Wilding Gold Project isn’t just ‘virgin ground’. The project was subject of a 30 hole drill campaign in 2017 (way before Newfoundland was a ‘hot’ area for gold exploration) and some of the intercepts highlighted in the press release are 5.3 meters of 10 g/t gold, 5.1 meters of 1.44 g/t gold and a thicker interval of 17 meters containing 0.98 g/t gold.

With a drill program expected later this quarter targeting some pre-defined targets thanks to the work of previous operators, Canterra Minerals seems to be ready to hit the ground running and the current market cap of C$18.4M is still very reasonable.

Disclosure: The company is not a sponsor of the website. The author has a long position and was a shareholder of the private company. Please read our disclaimer.