When access to capital remains scarce, it’s important to keep an eye on the financial statements of the companies you are planning to invest in. Where is the money going? Into someone’s pockets as salary and bonus, or into the ground in an attempt to create value for shareholders?

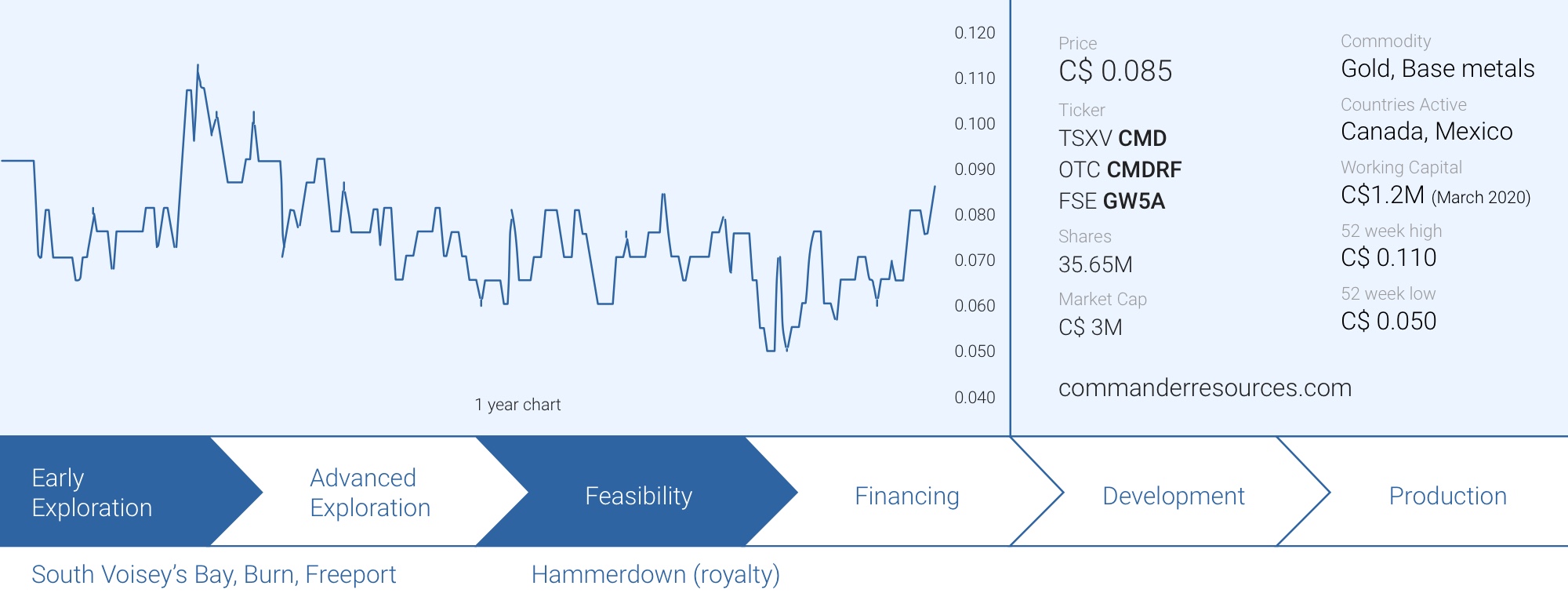

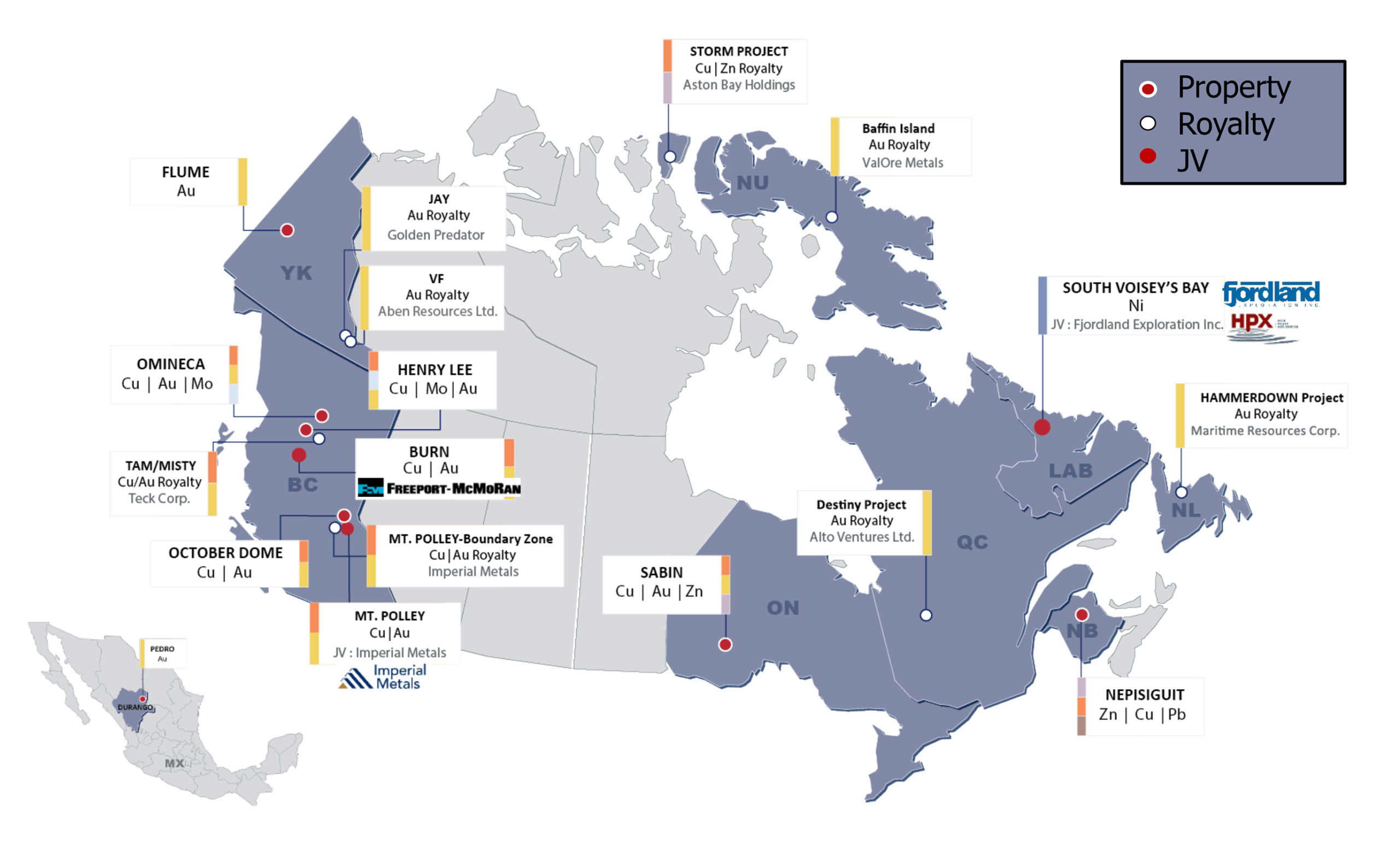

These questions are becoming even more important the lower you go on the food chain to companies that aren’t generating any revenue and are working on earlier stage projects. Commander Resources (CMD.V) could best be described as a prospect generator. With CEO Rob Cameron at the helm of the company, Commander is focusing on a dozen early-stage exploration projects in North America with the aim to advance those projects to attract joint venture partners.

Commander’s business model

Commander Resources is a Canadian exploration company following the prospect generator model. At its core, the prospect generating model allows a company to focus on early-stage exploration projects (usually grassroots or greenfields) by bringing those projects to a more advanced stage by doing some early groundwork while figuring out of there’s something beneath the surface that could warrant additional (larger) exploration programs.

Once a project has been sufficiently advanced and brought to a level where there is some initial excitement about making a potential discovery, Commander Resources tries to bring in joint venture partners that could earn a majority stake in the projects by making payments to Commander Resources in cash and stock, while there usually also is a minimum exploration commitment to advance the project.

This has a triple positive effect for Commander: the incoming cash payments are helping the company to minimize dilution while the share payments could either be retained by the company to gain exposure to the optionee’s performance while the work commitments are even more important to bring the projects to the next level. Those work commitments are typically around a few million dollars which is usually sufficient for an optionee to decide whether they want to continue to move ahead with a project, or drop it to move on to greener pastures. If an optionee decides to continue to move ahead with a project, Commander Resources will usually end up with a Net Smelter Royalty which could be worth something, further down the road.

The key asset right now probably is the 2% NSR on the Hammerdown gold project

Although Commander’s asset base mainly consists of (very) early-stage projects and there’s no guarantee the company will ever be able to unlock value for its shareholders, one element of the company’s asset base clearly does seem to have value. Commander owns a 2% Net Smelter Royalty on the Hammerdown project in Newfoundland.

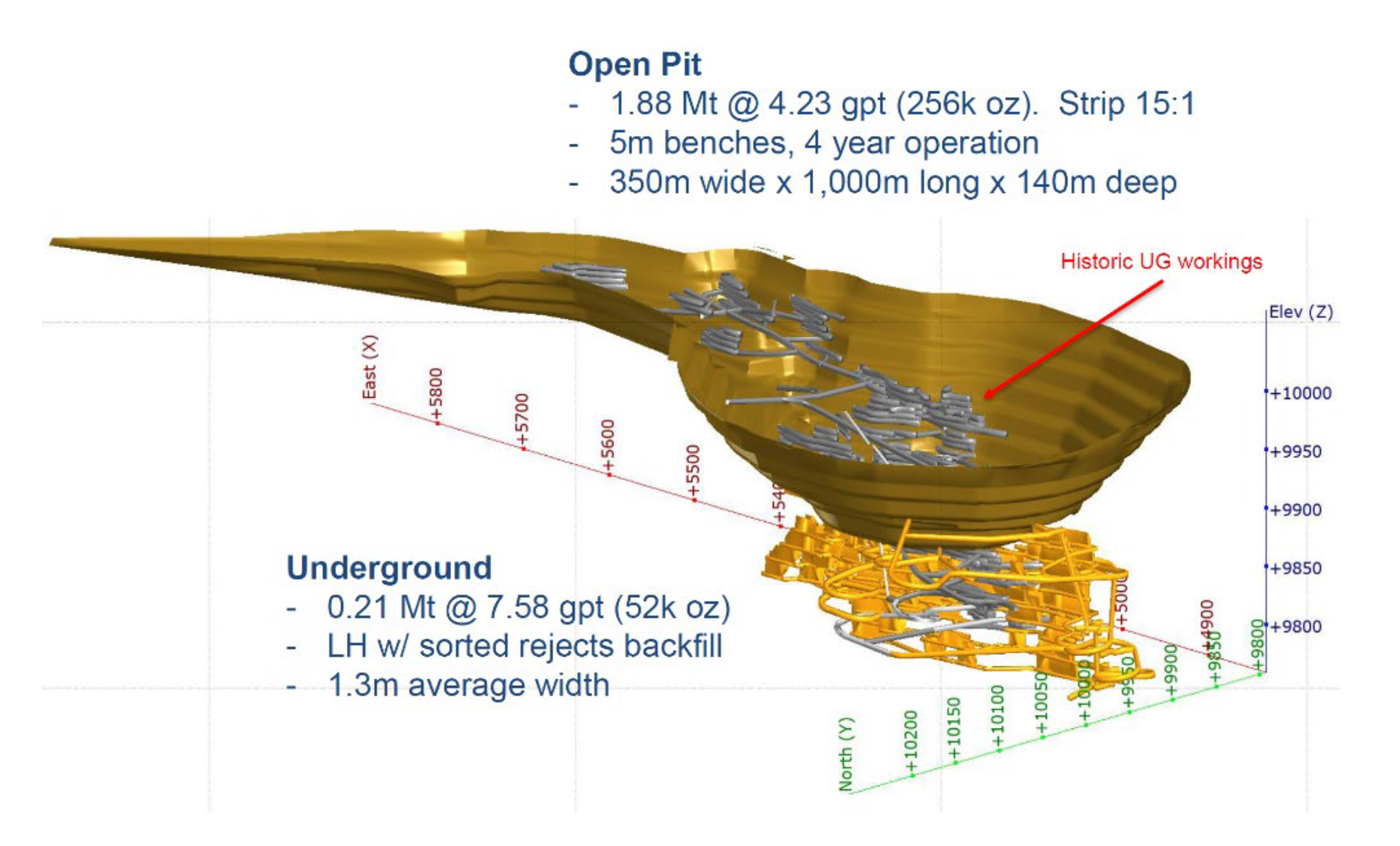

Hammerdown is owned by Maritime Resource (MAE.V) which completed a Preliminary Economic Assessment on Hammerdown in March.

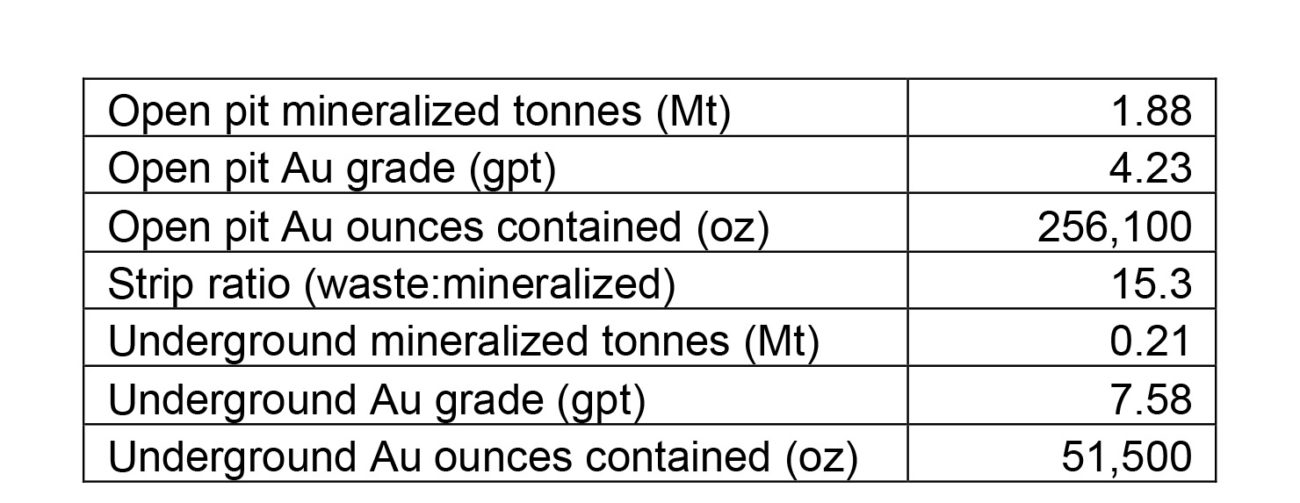

The project will produce a total of 521,500 ounces of gold based on the current mine plan, with an average output of 69,500 ounces of gold per year and almost 58,000 ounces of gold per year over the total life of mine. Considering the AISC is estimated to be just below $940/oz, Maritime may be looking to quickly advance the project and bring it to production. Extra bonus: the initial capex is estimated at just over C$57M as the rock will be shipped to the nearby Nugget Pond mill for processing.

Hammerdown is important for Commander as it owns a 2% NSR on the Hammerdown project (excluding the Orion zone) of which 1% could be repurchased by Maritime for C$1M. This should allow us to calculate an NPV for the remaining 1% but the mine plan doesn’t show a breakdown of rock coming from the Hammerdown zone (where Commander’s 1% NSR will apply) and the Orion zone (where Commander is not entitled to receiving a NSR).

This complicated our lives, and our attempt to calculate a DCF valuation of the 1% Net Smelter Royalty is even more on a ‘back of the envelope’ basis than ever, and we urge you to use caution as our assumptions may be a bit off.

According to the mine plan, a total of 308,000 ounces of gold will be mined at Hammerdown (in a combination of open pit and underground) while the remaining 260,000 ounces will be mined at Orion (where the underground component is much more important).

This means that on average, 85% of the open pit ounces but less than 20% of the underground ounces will be mined at Hammerdown and we will use that ratio to determine the attributable gold production subject to the NSR. Keep in mind that because no exact breakdown has been provided in the Maritime Resources PEA but it looks like the Hammerdown open pit will be mined first, and the Orion zone (which predominantly is an underground resource) will be mined in the second phase from Y3 on as an initial open pit with a short mine life, followed by going underground.

In our simplified calculation, we are assuming the open pit rock in the first two years is 100% coming from the Hammerdown open pit, in Years 3-9 we will be using a blend based on the remaining ratio of rock to be mined (997,000 tonnes will be mined from Hammerdown in the first two years resulting in a remaining mineable resource of 1.46 million tonnes (2.46 million tonnes in the mine plan – 997k tonnes from Hammerdown = 1.463M tonnes to be mined from the open pits in Y3-9) which we will then assume will come from Hammerdown (60%) and Orion (40%). This ratio is based on the fact that 580,000 of the remaining 1.46 million tonnes in years 3-9 will be mined at Orion. The actual mining schedule obviously won’t be an exact 60/40 ratio and it is absolutely certain there will be grade variation as well, but this will be as close as it gets and we would like to emphasize again there is a considerable margin of error and this calculation should only be seen as some sort of ‘theoretical exercise’.

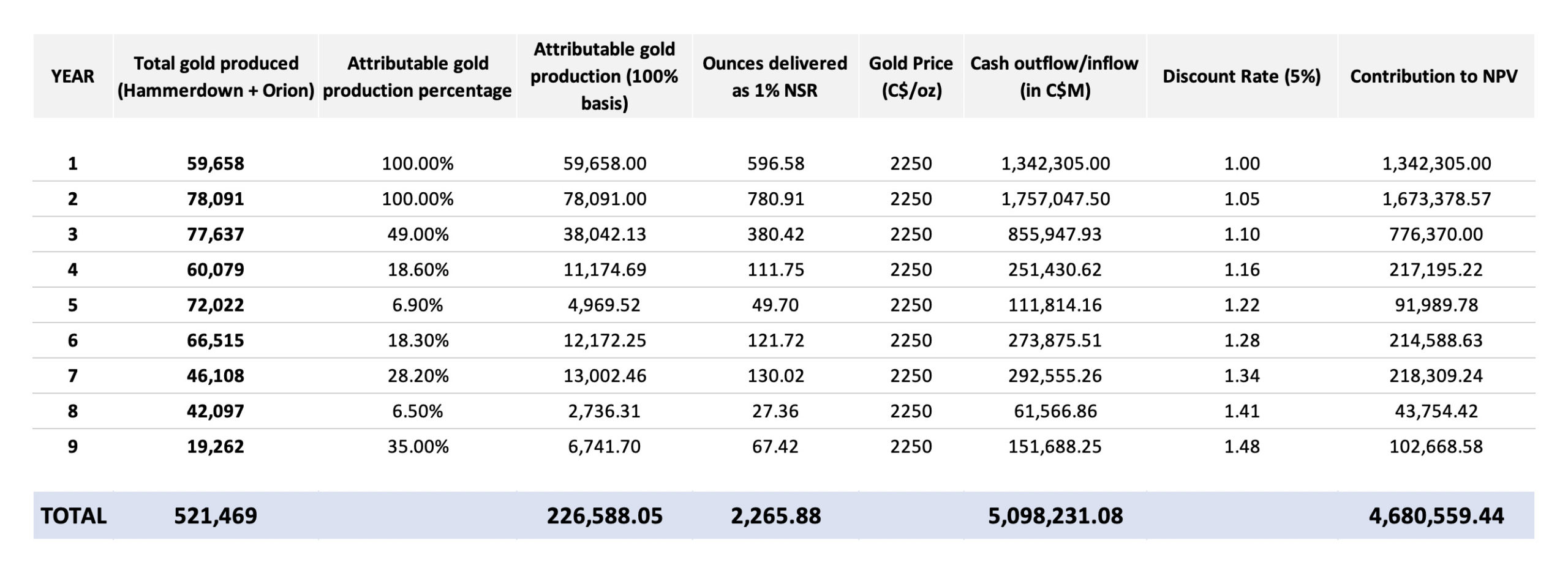

At this point, we are also leaving the underground ounces (51,500 ounces in situ, 50,000 ounces recoverable) at Hammerdown out of the picture, those can act as an additional layer of safety. The production schedule is based on table 22.8 in the NI43-101 compliant PEA of Maritime Resources. The net received gold price in the scenario here below is C$2250/oz (+-US$1600).

Using a net received gold price of C$2250/oz, the undiscounted pre-tax NPV appears to be C$5.1M for the 1% NSR (assuming Maritime will indeed repurchase the first percent for C$1M in cash). Discounting the cash flows by 5% results in a NPV of around C$4.7M.

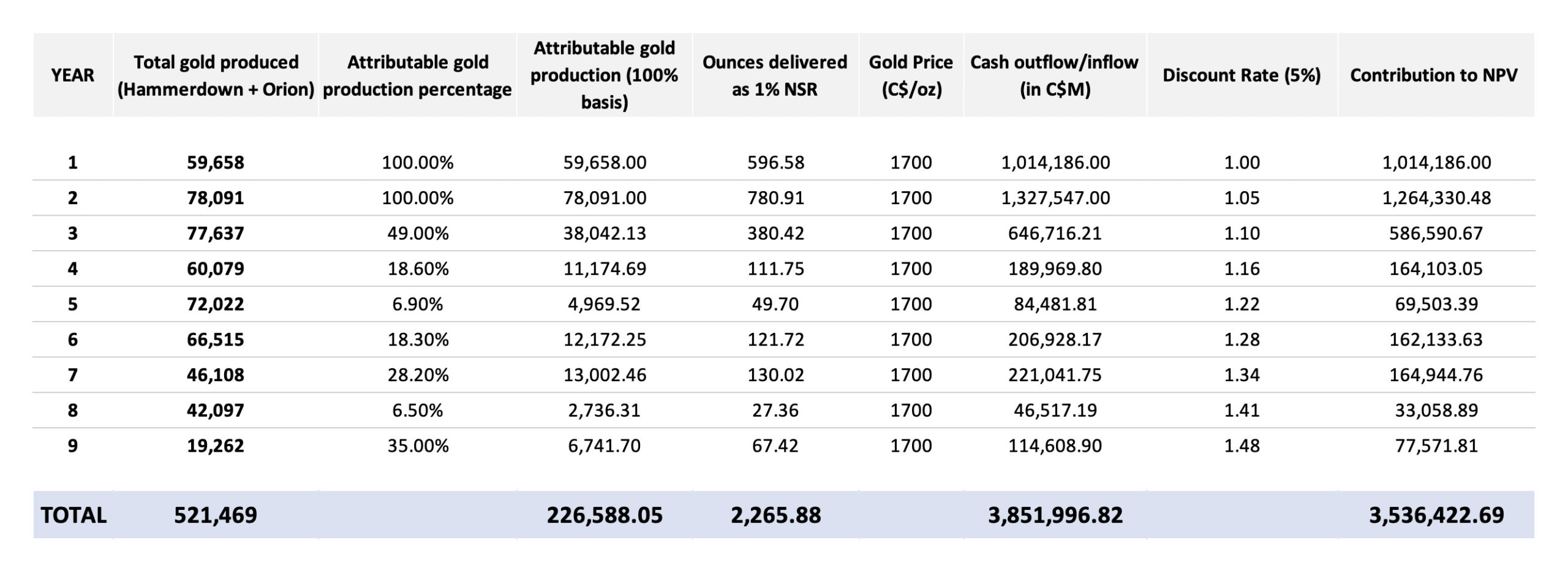

In a second scenario, we used a net received gold price of C$1700/oz (+- US$1210/oz).

So although Maritime has the option to repurchase half of the 2% NSR, even at a lower gold price the remaining 1% NSR certainly has some value to Commander Resources. And remember, this still excludes the net attributable gold from the small Hammerdown underground resource which should add 500 ounces and approximately C$0.85-1.1M to the undiscounted cumulative cash flow.

And finally, an interesting fact: included in the C$57M initial capex to build the Hammerdown mine is a C$1.3M allocation to repurchase 1% of the NSR so it appears to be likely to see Commander end up with C$1M and a 1% NSR which could subsequently be monetized as well. Also important: considering the balance sheet of Commander Resources indicates a cumulative deficit of almost C$38M, it appears to be likely the company won’t have to pay any taxes on the potential royalty income assuming the Hammerdown mine gets built: it can just apply historic losses against any taxable income. Keep in mind that not the entire C$38M can be applied against taxable income, but we are assuming Commander will retain a 1% NSR and recovering 300,000 ounces from the Hammerdown zone, the 3,000 attributable ounces have a current pre-tax undiscounted value of US$5.1M and in excess of C$7M which is just about a fifth of the total deficit on the balance sheet.

A few other highlighted assets

The (positive) problem with Commander Resources, and by extension the ‘problem’ most prospect generators have is the abundance of projects and we can’t discuss them all here. We won’t bore you with a detailed breakdown of every single asset but would like to briefly discuss the three projects that are currently optioned to joint venture partners to show how the joint venture agreements typically work. We will briefly discuss these three projects in more depth and with a more technical angle in an interview with Commander CEO Rob Cameron as we don’t want to overload you with information.

South Voisey’s Bay, JV with Fjordland Exploration

The company’s best-known exploration project very likely is the South Voisey’s Bay nickel-cobalt project in Labrador, approximately 80 kilometers south of the Voisey’s Bay mine, owned and operated by VALE (VALE).

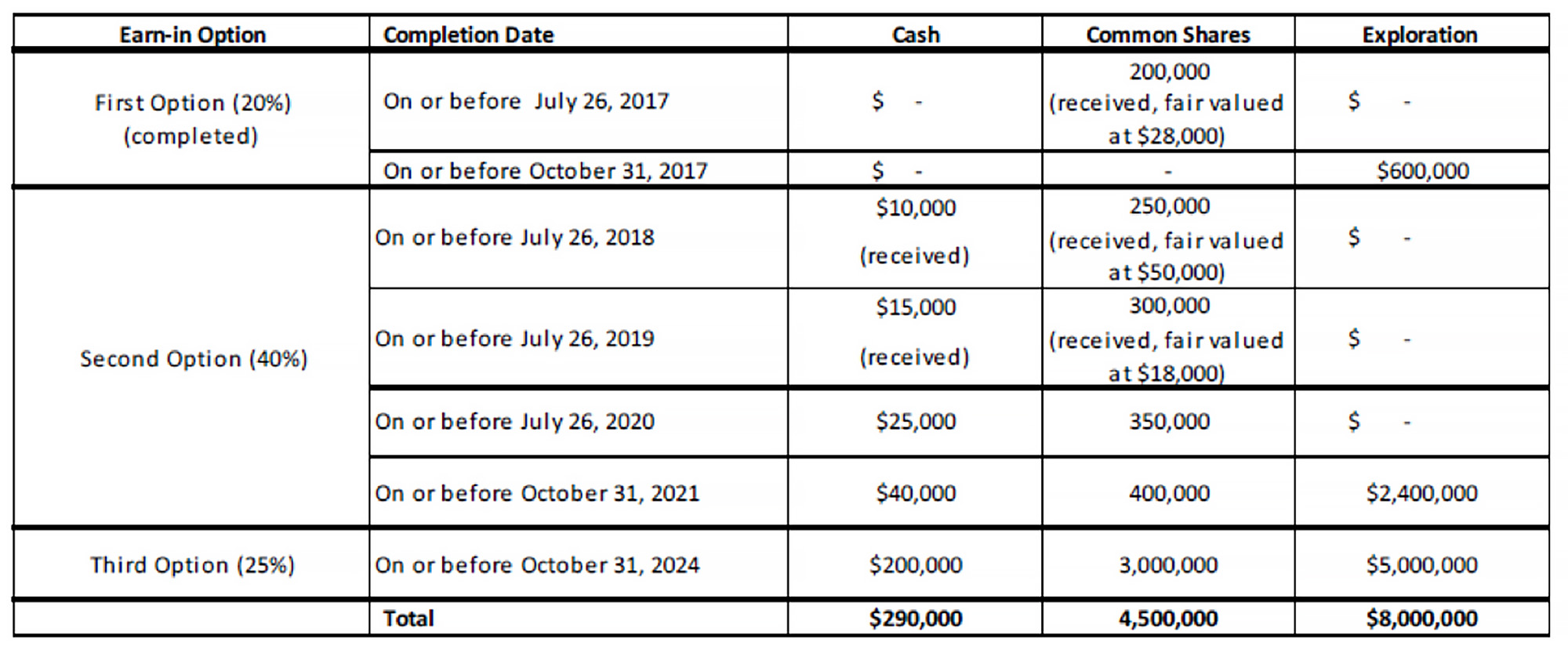

Fjordland Exploration (FEX.V) is currently in the second stage of its earn-in program to obtain full ownership of SVB after having completed a first step to earning a 35% stake. Under the current agreement, Fjordland can boost its stake to 75% by making cash payments totaling C$90,000, issuing 1.3 million shares, and completing C$2.4M in exploration expenditures by the end of October 2021. The final 25% can subsequently be obtained by completing an additional C$5M in exploration expenditures and making C$200,000 in cash payments as well as issuing 3 million shares while a 2% NSR will be issued to Commander Resources as well.

Fjordland subsequently attracted High Power Exploration (‘HPX’, a Robert Friedland company) as second joint venture partner that can subsequently earn a 65% stake in South Voisey’s Bay once Fjordland completes its earn-in but hasn’t drilled SVB since 2018 when it completed just over 1,250 meters of drilling in 11 holes. Notable intercepts were 10 meters containing 0.116% copper, 0.14% nickel and 0.013% cobalt and 4.35 meters containing 0.16% copper, 0.33% nickel and 0.07% cobalt.

While none of these results are real barnburner results, it is clear there is copper-nickel-cobalt mineralization present and more exploration will be needed to figure out if there is a viable and mineable resource hiding on the SVB property. An interesting project which we will soon discuss with Rob Cameron (who also acts as a technical advisor to Fjordland Exploration).

Burn, Freeport McMoRan

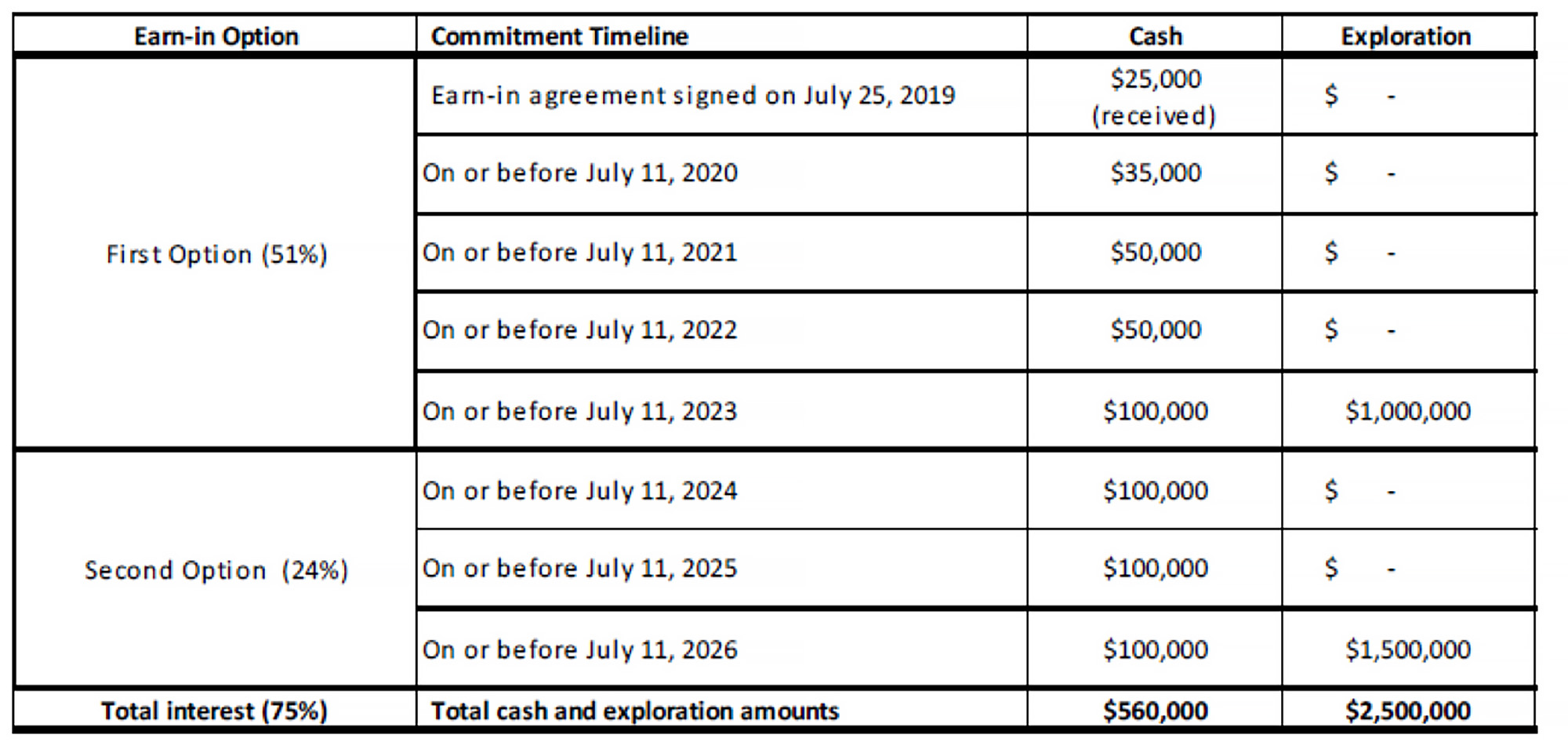

Although the Burn project in British Columbia is still in a very early stage on the exploration curve, Commander Resources was already able to attract well-respected Freeport McMoRan (FCX) as an optionee looking to earn a 75% stake in the project. Freeport can establish an initial 51% stake by making C$260,000 in cash payments and spending C$1M on the property before July 11th 2023 whereafter the company will be granted a second option to increase its stake to 75% by spending an additional C$1.5M on exploration and making a cumulative C$300,000 in cash payments to Commander Resources.

Mt Polley Extension, Imperial Metals

The Mount Polley Extension project is Commander Resources’ most recent joint venture agreement. In October 2019, Imperial Metals (III.TO) which operates the Mount Polley copper-gold mine signed an agreement with Commander Resources to earn a 100% interest in the majority of the claims of CMD’s Mount Polley project (to keep it simple we will just call Commander’s claims the Mt Polley Extension (‘MPE’).

This is a relatively cheap way for Imperial Metals to try to add more tonnage to the Mount Polley resource to keep the mill running for a few more years as Imperial can earn a 100% stake (and 90% for some areas where Commander doesn’t have full ownership of the claims) by making C$225,000 in cash payments to Commander Resources (and C$25,000 to a private partner). A first C$45,000 has already been received and the next two payments of C$90,000 to Commander are due by the end of 2021 and 2022.

In addition to those cash payments, Imperial Metals has committed to pay Commander C$1.25 per tonne of rock from the MPE property that will be mined and milled. So, as a hypothetical example; if 20 million tonnes are found, Commander can earn up to C$25M in contingent payments (subject to a 90/10 split with the private partner in some areas). If there are only 2 million tonnes on the MPE, Commander will only be entitled to C$2.5M.

An interesting caveat: Imperial Metals can repurchase half of the production royalty for C$1M at any given time, resulting in a residual royalty payment of C$0.625 per tonne of rock from the Mount Polley Extension that will be mined and milled.

Commander makes a dollar go a long way: a look at the financial results

Commander has released its annual report in March, and this provides us with a good overview of what its money was spent on. Exploration companies may often be subject to seasonal fluctuations (some seasons are better for exploration activities than others) so an annual overview which ‘smooths out’ the potential seasonal effects offers valuable insight.

The total operating expenses came in at C$1.26M but this included a C$51,000 share-based compensation expense (which is a non-cash item) but excludes a total of C$87,000 in incoming cash from advance royalty payments, interest & management fee income and the cost recoveries on exploration and evaluation assets. As such, the net cash operating expenses were approximately C$1.12M.

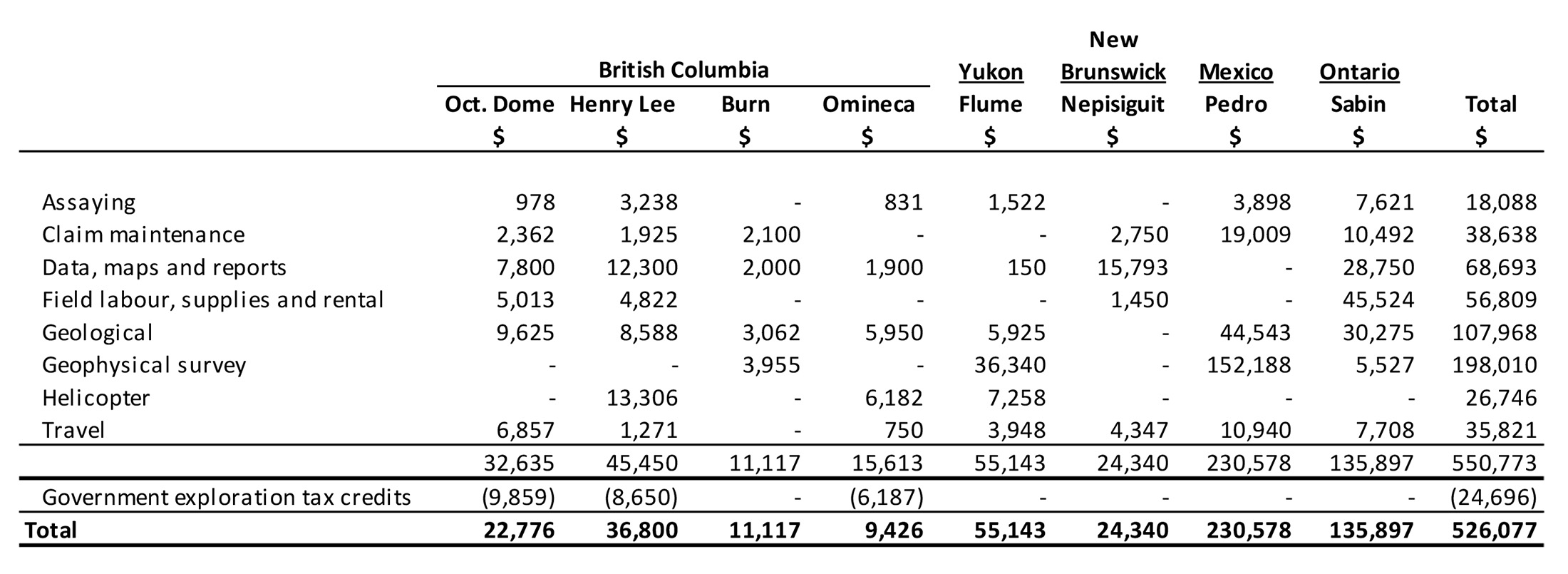

Of the C$1.12M, C$526,000 was directly spent on exploration while an additional C$102,000 in exploration efforts was capitalized as an investing cash flow. So of the total C$1.22M cash operating expenses which is approximately 52%. Commander also provides a breakdown on what the money was spent on, both on a per-project basis as well as per type of expense:

As a prospect generator, Commander Resources doesn’t just focus on one or two projects, but tries to advance several projects at the same time and the C$526,0000 was spent on eight different projects.

As of the end of 2019, Commander had just over C$700,000 in cash and a positive working capital of approximately C$1.9M. The working capital position is much higher than the cash position as Commander has C$1.24M worth of marketable securities on its balance sheet. Of course, that’s based on the share price as of the end of 2019, and the 11 million shares of Aston Bay Holdings (BAY.V) are currently worth C$605,000. The other stock positions of Commander Resources were not publicly disclosed but during 2019 it received 300,000 shares of Fjordland Exploration (FEX.V) with an additional 350,000 shares to be received this summer. The remainder of the marketable securities is probably represented by the position in Maritime Resources which currently owns the Hammerdown project. With Fjordland trading at C$0.03 this won’t have a major impact on the fair value of the marketable securities. All shares held as ‘marketable securities’ could be sold at any time to boost the cash position if needed, but Commander Resources will obviously try to not disrupt an orderly market.

This year, Commander will also receive C$25,000 in advance royalty payments on the Tam property in BC (this will be the 9th payment of a maximum of 10 advance royalty payments), C$25,000 from Fordland Exploration as part of its earn-in schedule on South Voisey’s Bay in Labrador and C$35,000 from Freeport McMoRan (FCX) which is earning an initial 51% stake in the Burn property in British Columbia. These three elements should result in C$85,000 cash proceeds to Commander Resources (compared to C$70,000 in FY 2019) which will have a mitigating impact on the net cash outflow.

Management

Robert Cameron, President & CEO

Mr. Cameron has over 30 years of international experience in the mining industry including positions as President and CEO of Valley High Ventures and Bearing Resources Ltd. as well as Vice-President and Manager of exploration for Phelps Dodge Corporation of Canada Limited (a then subsidiary of Freeport McMoRan Copper and Gold Inc.). In addition he has extensive market and finance experience including a term as mining analyst for Research Capital. He is a member of the Association of Professional Engineers and Geoscientists of British Columbia.

Stephen Wetherup, VP of Exploration

Mr. Wetherup has over 20 years of global experience including work with Phelps Dodge Corporation of Canada. He is also Vice President Geology with Caracle Creek International Consulting.

Conclusion

Commander Resources is prospect generator, aiming to ‘upgrade’ early-stage exploration projects to a stage where joint venture partners could be convinced to step in and further advance the projects. Right now, three of Commander’s properties are part of a joint venture agreement while Commander continues to work on several other projects. However, the most coveted asset in the Commander stable is the 2% NSR on the Hammerdown. One could expect Maritime to repurchase the first percent for C$1M (as the money to do so has been earmarked in the initial capex calculation) which means Commander will retain a 1% NSR. Based on the production profile in the PEA and the current gold price, the undiscounted pre-tax sum of the cash flows points at a (purely theoretical) fair value of C$4.7M.

It will take Maritime a few years before bringing Hammerdown into production and perhaps Commander can monetize its NSR before the project even goes into production as larger streaming and royalty companies could be interested in acquiring a royalty on a Canadian gold project, but Commander could also just keep the royalty and take approximately C$1M per year to the bank if Maritime’s NI43-101 compliant mine plan checks out.

It shows the value of the prospect generator model. Early-stage exploration is risky but sometimes the royalties could provide a handsome payout further down the road, and everything boils down to the quality of the technical team. In Commander’s case, we have known CEO Robert Cameron for several years now and he has never tried to pull the wool over our eyes or be overly optimistic when it wasn’t warranted. This obviously doesn’t mean an investment in Commander Resources will be a success as you never know what Mother Earth has in store for the company’s geologists, but you can at least be sure the people leading Commander mean it well.

Disclosure: The company currently is not a sponsor of the website but could become one. The author currently has no position in Commander Resources.