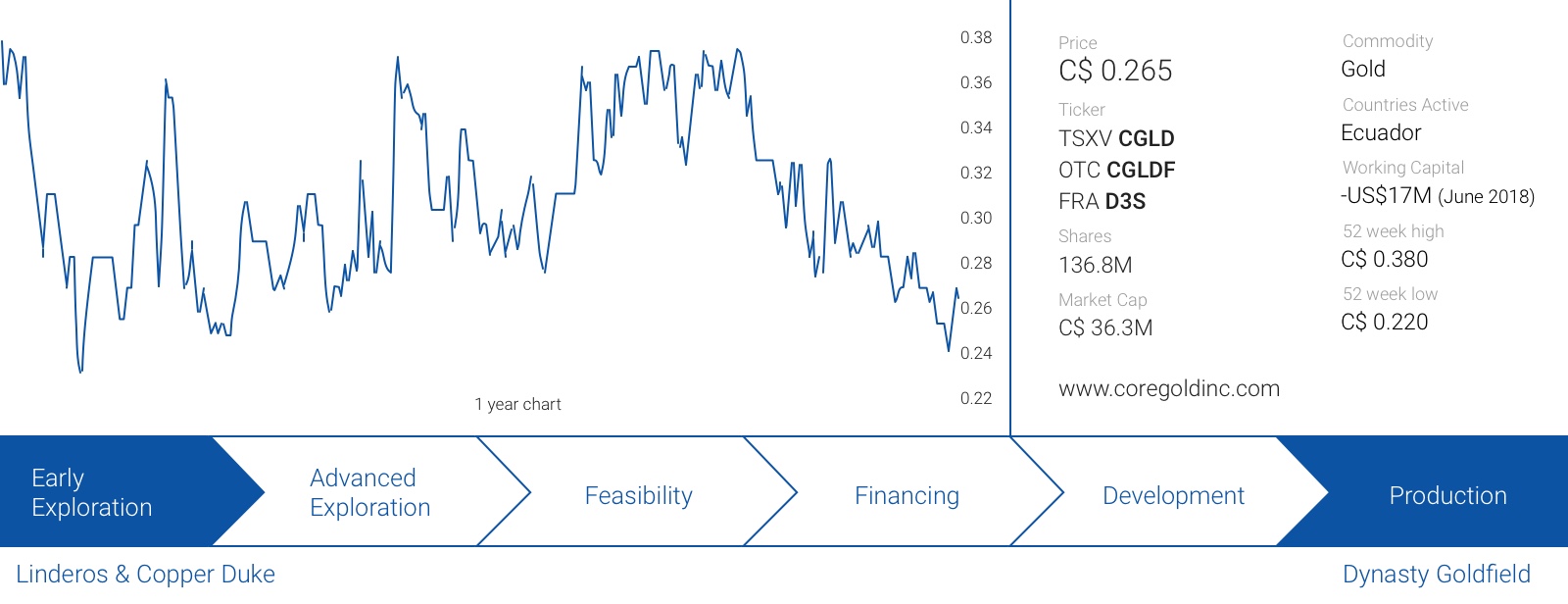

Core Gold’s (CGLD.V) share price has been moving sideways for the past few months as the market was waiting for the company to complete its planned US$15M credit facility. On top of that, Core Gold has started a drill program at the Linderos project, and we can imagine the market is anxiously awaiting to see if Core Gold was successful in following up on its very strong sampling and trenching results.

Elipe is no longer in liquidation

Last month, Core Gold released an extremely important update on its Ecuadorian operations. The debt-ridden subsidiary, Elipe, has been very successful in applying its operating cash flow and free cash flow towards reducing the net debt of the operating subsidiary.

That’s why the government of Ecuador has ‘re-activated’ Elipe, and removed it from the list of failing companies that were ‘in liquidation’. This is undeniable proof of Core Gold’s ‘hands on approach’ to tackle all historic issues that were and are associated with the company.

The market didn’t seem to care, but we would like to emphasize the importance of removing Elipe SA from liquidation and ensuring the company is deemed to be in good standing. First of all, returning to a ‘good standing’ status releases Core Gold from the payment plan which required the company to make cash payments on a monthly basis (US$712,000 per month) to ensure the subsidiary would be able to meet its commitments. Less than 2 years after completing the remediation between the company and its creditors, Core Gold’s management team is definitely allowed to put this feather on its hat for a job well done.

Now Core Gold’s main subsidiary has returned to the ‘good standing’ status, the way is paved to complete the US$15M credit facility with Accendo Banco (the new name of Investa Bank). This credit facility has been negotiated quite a while ago, but as the bank (understandably) wanted to have a first lien on the operating assets of the company as collateral, the credit agreement could not be executed as long as Elipe SA was in liquidation mode.

Now this issue has been resolved, we would expect the credit facility to be approved and executed within the next few weeks.

The day-to-day operations in Ecuador are going well

Core Gold has already produced (and sold) in excess of 10,000 ounces of gold, putting the company on track to meet its own guidance of 22,000-26,000 ounces of gold to be produced in 2018. But Core Gold will indeed have to step up its operating performance in the second half of the year to at least meet the lower end of the guidance.

In the first six months of the year, Core Gold reported a net loss of US$3.7M which was relatively benign considering the mining activities resulted in a loss of US$887,000. However, when we have a closer look at the US$13.25M in operating expenses, there are some things that have been expensed that might be hiding the profitability of the operations.

We expect the ‘and others’ to have contained the monthly payments to the creditors of Elipe. The 33% decrease of the mining, processing and other expenses in the second quarter of the year compared to the first quarter coincides well with Core Gold’s re-negotiation of the payments. In Q1 2018, Core Gold paid US$1.95M as part of its payment plan, while it paid just US$400,000 in June 2018. This US$1.55M difference is almost identical to the US$1.46M decrease of ‘mining, processing and other’ expenses in the second quarter.

Now the Elipe subsidiary has returned to a good standing status, we expect Core Gold’s net income and free cash flow results to be substantially better from the fourth quarter on (Core still paid US$800,000 as part of the payment plan in July and August, so the Q3 results will still be impacted by these payments).

Core Gold is topping up its treasury with a C$2.8M equity raise

Once the Elipe-issue had been resolved, Core Gold immediately went back to the market and announced a C$2M placement which was subsequently upsized to C$2.78M, issuing 9.27M units at C$0.30 per unit (which is a double digit percentage premium to the share price). Each unit consists of one common share as well as half a warrant priced at C$0.45 (just like the vast majority of the warrants that are currently outstanding – see later). Core Gold expects to close the placement by the end of this month and the C$2.8M cash inflow will be a welcome addition to reduce the working capital deficit on the balance sheet.

As of the end of June, the working capital deficit was approximately US$17M (down from US$19.3M at the end of 2017). We aren’t too worried about this deficit, as we expect the company to convert the majority of the current liabilities into a long-term liability by using a big chunk of the Accendo Banco cash to pay off some of the payables on the balance sheet. We expect the working capital deficit to have been cut by almost 50% by the end of this year on the back of a healthy net operating cash flow and refinancing the current liabilities with a longer-term credit facility.

An additional 3 million warrants with an exercise price of C$0.15 expired on September 15th, and assuming all warrants were exercised, an additional C$0.45M will have been added to Core Gold’s treasury. All other warrants are currently out of the money, and the remaining 24 million warrants have an average exercise price of just over C$0.44. In an ideal world, these warrants will be exercised throughout 2019, allowing Core Gold to add cash to its treasury from the operating activities as well as the warrant exercises. This could put the company in an enviable position as it would be able to reduce the size of its credit facility or to aggressively expand its exploration plans.

Conclusion

The market might not reward Core Gold for it, but the company has done and is still doing everything right. It’s tackling the historic issues first, and the simple fact that the Elipe subsidiary is back in good standing is not only an amazing achievement, it’s also an incredibly important milestone.

Returning the subsidiary to good standing means Core Gold will now finally gain access to a US$15M credit facility which will be used to upgrade the plant and to pay some overdue bills. Upgrading the Portovelo plant will subsequently result in higher gold production rates and higher operating and free cash flows. Removing the Elipe subsidiary from liquidation was the first piece of the puzzle, and all other pieces could fall into place pretty fast.

Now Core Gold will have the financial flexibility to do what it has been wanting to do for the past two years, the management can finally start executing on its plans. We think Core Gold in 12-18 months from now will be a very different company than what it is today.

Disclosure: Core Gold is a sponsor of this website, we have a long position. Please read the disclaimer