Last week, District Metals (DMX.V) released the assay results from the first three holes drilled on the Tomtebo polymetallic property in Sweden. The company had put a rush on the samples so it didn’t really come as a surprise to see excellent grades given the decision to rush the samples and considering the company uses XRF handguns at its core shack.

Hot on the heels of releasing one good and one phenomenal hole confirming the mineralization encountered in hole TOM21-001 seems to continue at depth to a vertical depth of about 200 meters, District took the wise decision to cash up as it didn’t want the market to start speculating against the company and its balance sheet. By proactively raising cash, District Metals is nipping that potential issue in the bud.

Hole 25 was a barn burner hole

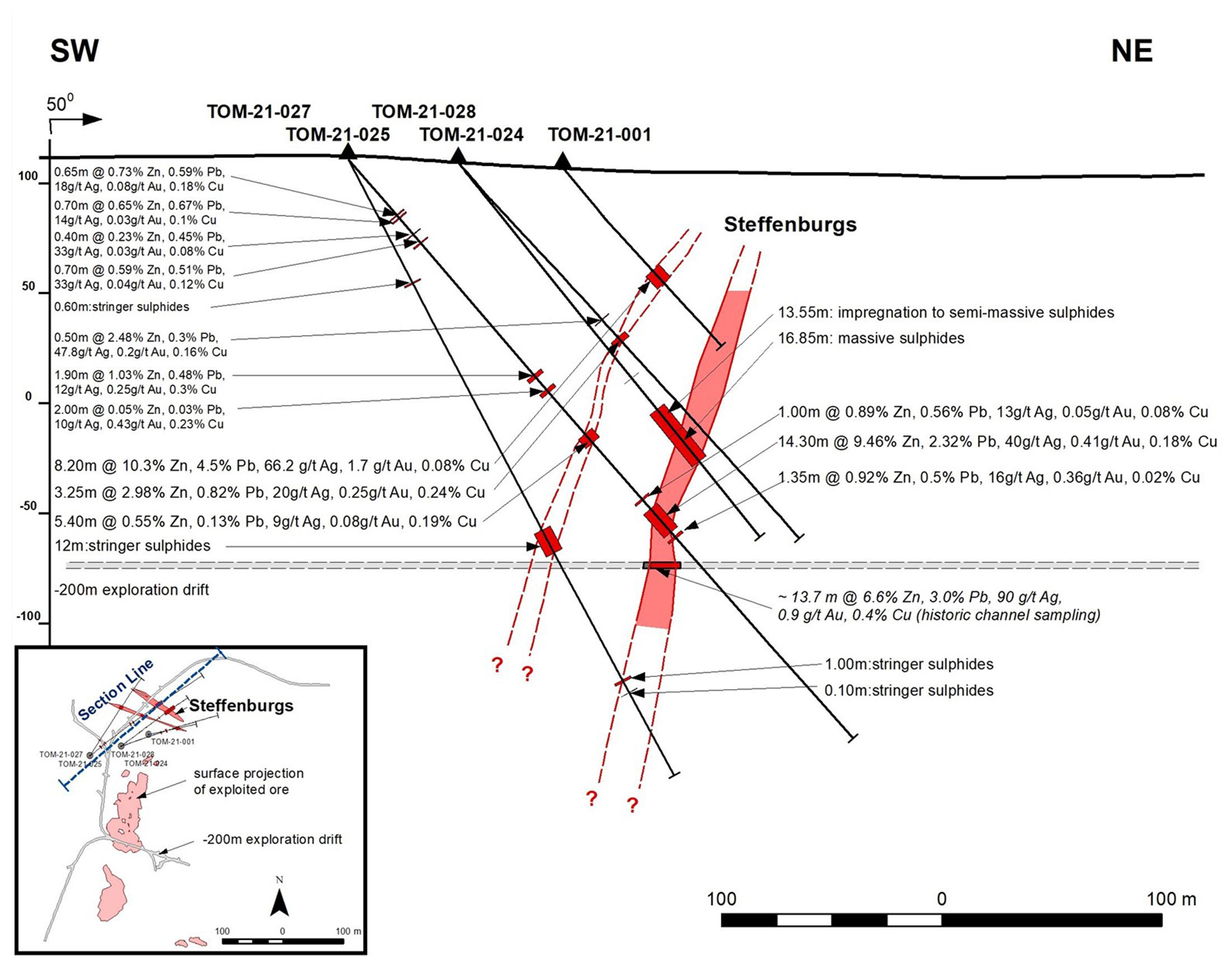

The very first hole that was drilled was indeed a disappointment as no mineralization was detected. Too bad, but that’s exploration. The two holes drilled on the Steffenburgs Zone were much more important as these holes were successful in following up on the good result from hole TOM21-001.

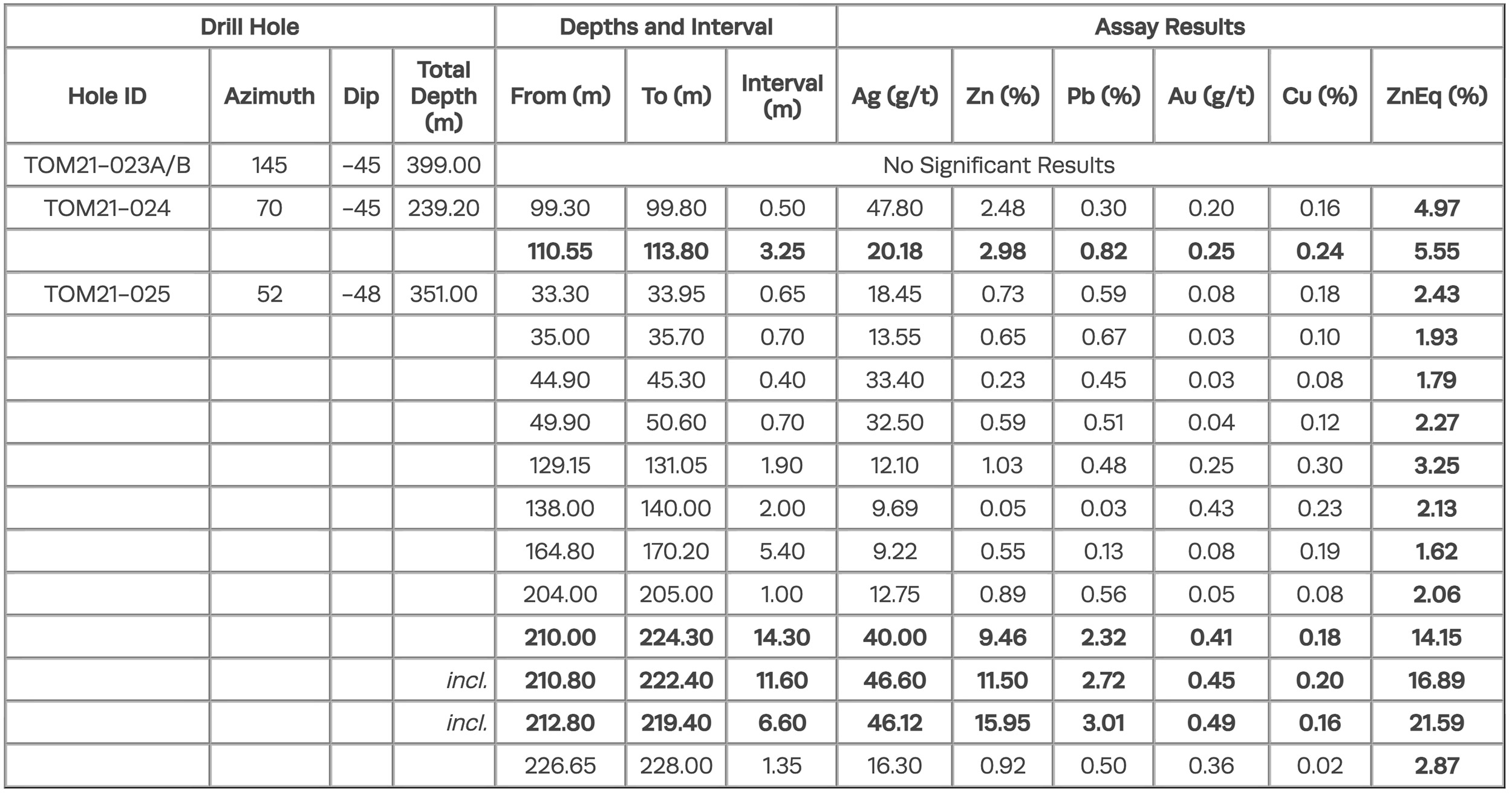

Hole 24 was drilled approximately 40 meters down plunge from the massive sulphides encountered in hole 1, and successfully intercepted the mineralized structure. There was a narrow 0.5 meter interval of just under 5% ZnEq followed by a thicker interval of 3.25 meters with an average grade of 5.55% ZnEq (of which 2.98% was actually zinc). That’s a positive achievement, but hole 25 definitely was the hole that fully validated the exploration theory.

Hole 25 was designed to step out 118 meters down plunge from the massive sulphides in hole 1, and as such, basically drilled almost 80 meters further down plunge than hole 24. Hole 25 encountered several narrow but decently graded intervals in the first 200 meters but what really mattered was obviously the zone where the strong mineralization was projected.

And hole 25 didn’t disappoint at all. At a depth of 210 meters downhole (which really is less than 200 meters from surface), the drill bit intersected 14.3 meters of 14.15% zinc-equivalent, of which 9.46% was actually zinc. The table below shows the high-grade nature of that specific interval with 12% ZnPb and in excess of one ounce of silver per tonne of rock.

The 14.3 meters contains some higher-grade intervals with for instance 6.6 meters containing 21.59% ZnEq. This definitely doesn’t mean the company was ‘smearing’: even if you would remove that very high-grade 6.60 from the 14.30 meter zone, the residual 7.7 meters would still have an average grade of just under 7.8% zinc-equivalent, which would clearly still be above the economic cut-off grade for a project.

An excellent result and this could bode well for holes 27 and 28, which were also completed at the Steffenburgs zone. The initial indications of hole 28 (drilled 60 meters up plunge from hole 25 which provides proof of the continuity) returned 30.4 meters of sulphide mineralization including almost 17 meters of massive sulphides. This further confirms the interpretation that hole 24 hit a parallel sulphide lens and holes 1, 25 and 28 have been hitting the main target.

Again, even though we expect all samples to have been subject to XRF screening before sending the samples off to the lab, keep in mind XRF is a useful tool but not the holy grail. And unlike other companies which proudly release XRF results in press releases, we are happy District uses it as the tool it really is: getting a quick and good feeling about the core that has been pulled out of the ground before sending it to the lab. Anything else would be a bit too much ‘arm waving’ for us as the only thing that really matters are the lab results.

District Metals is raising funds on the heels of the new discovery

The day after releasing these positive drill results, District Metals announced it had engaged Haywood Securities as sole lead agent to raise C$3M on a commercially reasonable efforts base. The private placement was priced at C$0.25 with each unit consisting of one common share of District Metals as well as half a warrant with each full warrant allowing the warrant holder to acquire an additional share of District Metals for a period of 24 months after closing, at a fixed price of C$0.35/share.

District Metals had and still has enough cash on hand to complete the current drill program but it is likely smart to just take the money whenever it’s available. The C$3M cash injection will be very useful because by January or February, the market could have started to bet against District Metals, knowing very well the company would have to raise cash.

By immediately raising money on the back of good drill results, District Metals is avoiding being taken hostage by a market that could potentially smell blood in the water.

The C$3M will bring the treasury back to a healthy position while additional assay results will roll in. The second batch of samples have been shipped to the lab and results are expected in January 2022.

Conclusion

The riskiest thing for an exploration stage company (other than not finding anything) is running out of funding. Sometimes the market can be a pool full of sharks and when blood can be smelled (i.e. a balance sheet showing a company is running on fumes), it’s not that difficult to see the share price spiral down as existing investors are unwinding positions in anticipation of a financing. District Metals avoided this potential issue. Although we didn’t expect a raise before January, we also hadn’t expected the company to rush the samples to and through the lab so it does make perfect sense to raise money on the back of the first very good drill results from the Tomtebo project.

The recently released assay results from the two Steffenburgs Zone holes are good (hole 24) to absolutely excellent (hole 25) as the two main boxes (grades and widths) have now been ticked. We are also hopeful to see the next few assay results show high-grade material (we would assume the core wouldn’t have been rushed either) but as per the securities law, District Metals cannot publish material news during a financing. So we expect the financing to close first with the assay results from the next batch of holes to follow in January 2022. We are very curious to see the assay results of hole 28 as that will allow District to build up tonnage.

Additional news related to the airborne geophysical surveys and rock sampling at the recently acquired Gruvberget and Svärdsjö Properties will also be released in early-2022. The Tomtebo drill program is definitely off to a good start (unfortunately that northeastern anomaly didn’t turn out to be anything of interest) and with a few additional million dollars in the bank, District is in a good shape.

Disclosure: The author has a long position in District Metals. District Metals is a sponsor of the website. Please read our disclaimer.