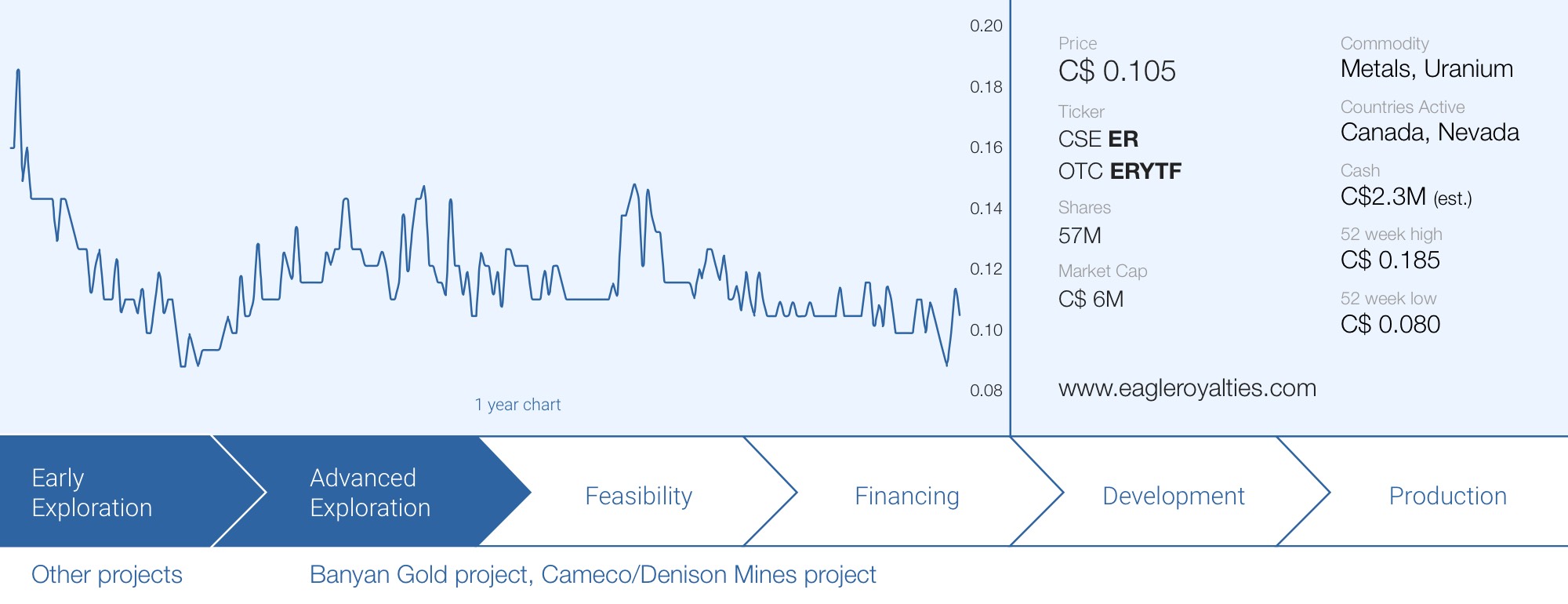

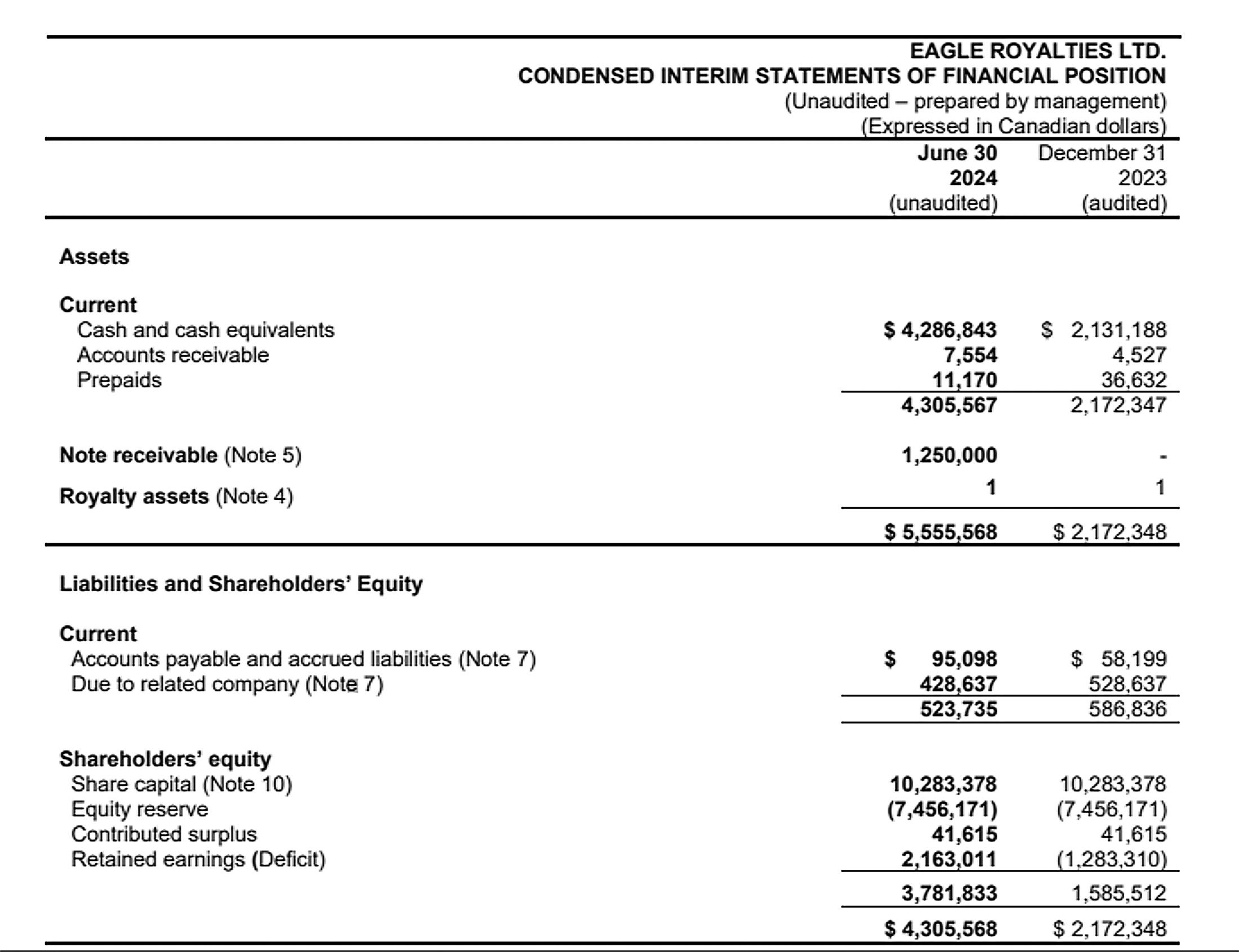

Eagle Royalties (ER.C) has seen its share price slide by roughly two thirds since completing its IPO at C$0.30 per share just over one year ago. Although royalty companies are usually well-received, Eagle Royalties almost immediately came under pressure, up to the point it is getting quasi-ridiculous. At the current share price of around C$0.10, the company is valued at C$5.7M while the balance sheet contains C$3.8M in working capital and there is a C$1.25M note receivable that is due in December 2025. Adding that to the working capital would result in a value of C$5M, or just under C$0.09 per share.

This means that at the current share price of C$0.10, any new investor is paying just C$0.01 per share for the actual royalties. Not only would we argue the royalty on portions of Banyan Gold’s (BYN.V) AurMac project is worth substantially more than that, let’s not forget the management knows how to transact. Earlier this year, it sold a portfolio of uranium royalties for C$3.75M (of which C$2.5M has already been received). While a non-revenue generating royalty company is always trickier than a revenue generating company, we would like to argue there shouldn’t be any doubt the asset portfolio is worth more than a few hundred thousand dollars.

And despite the weak share price, the management and board of Eagle Royalties appears to be doing the ‘right thing’. The company recently issued 3.7 million options but rather than using the share price at the moment the options were issued, all newly issued options have an exercise price of C$0.30. It’s not a coincidence that also is the IPO price of Eagle Royalties.

Cashed up after selling a portfolio of uranium royalties

Before the summer, Eagle Royalties announced it has closed an agreement with a private company (‘Royal Uranium’) to sell twelve uranium royalties to the PrivateCo for a total amount of C$3.75M. An initial payment of C$2.5M was paid immediately while the remaining C$1.25M is covered by a promissory note issued by the buyer, secured by the royalty assets (which means that if the C$1.25M doesn’t get paid, Eagle Royalties can just repossess the royalties – and keep the C$2.5M that was initially received). That note will mature on December 14th 2025 at the latest but could be accelerated upon a default of PrivateCo or PrivateCo obtaining a listing on an exchange.

Upon the maturity date, the final C$1.25M will have to be settled by C$0.5M in cash and C$0.75M in cash or shares, at the buyer’s discretion.

This appears to be an excellent deal for Eagle Royalties as the twelve royalties are non-cash flowing (and likely won’t be generating any substantial cash flow within the next decade). The initial cash payment of C$2.5M represents approximately C$0.044 per share or 40% of the market cap of Eagle Royalties upon announcing the deal. The total deal value represents almost C$0.066 per share while Eagle Royalties could potentially retain exposure (and thus upside potential) to Royal Uranium if it receives the final payment in shares.

A good deal for what we essentially thought are ‘Tier 2’ royalties. And the timing couldn’t have been better as the investor interest in uranium stories is definitely taking a backseat these days. Well-executed, and more importantly, it provides the company with extra cash to deploy for the acquisition of additional quality royalty assets.

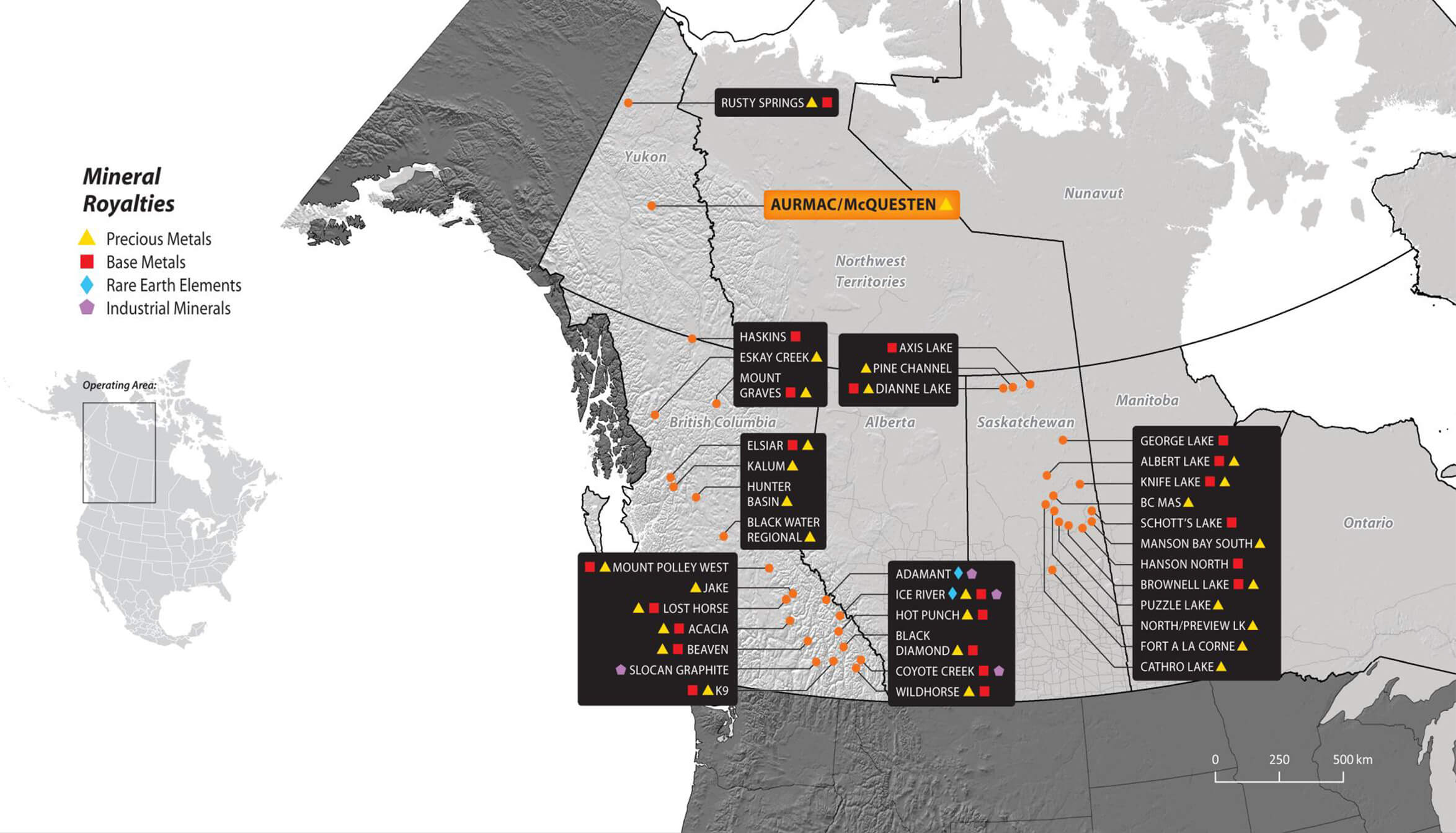

Eagle Royalties recently acquired a royalty in Nevada, expanding its geographical exposure

A small portion of the cash was put to work in August when Eagle Royalties announced it had entered into an agreement with Silver Range Resources (SNG.V) to acquire a 1% Net Smelter Royalty on its East Goldfield property for C$25,000. A negligible cash amount (and no other cash or stock payments are due, the 1% NSR has effectively been established) adding a royalty in a safe jurisdiction to the pool of ‘optionality’.

The East Goldfield project is directly adjacent to the Goldfield project, owned by Centerra Gold (CG.TO, CGAU) which acquired the asset from Waterton for in excess of US$200M, just over two years ago. Centerra Gold is pretty active at Goldfield as it plans to drill approximately 21,000 meters of which almost 80% was completed in the first half of the year. In its Q2 2024 Management Discussion & Analysis report, Centerra Gold mentioned it continues to focus on the oxide and transition zones at Goldfield as it wants to publish a maiden resource calculation by the end of this year.

Silver Range obtained the East Goldfield property through staking and has mapped over 75 workings on its tenements indicating the merits of the asset. It optioned the asset to ATAC Resources in 2020 and ATAC’s surface sampling program which encountered 3 meters of almost 8 g/t in a chip sampling program was encouraging. A subsequent drill program didn’t yield the desired results for ATAC (the highlight was 82.3 meters containing 0.31 g/t gold including 9.15 meters of 1.03 g/t gold), and the company walked away, resulting in Silver Range maintaining full ownership of the property. All this happened before Centerra entered the district with the acquisition of the Goldfield project from Waterton.

On Silver Range’s website, the project is still listed as ‘available for option’, so hopefully Silver Range Resources can attract a new partner to further advance the asset.

The impact of the Victoria Gold issues on Eagle Royalties

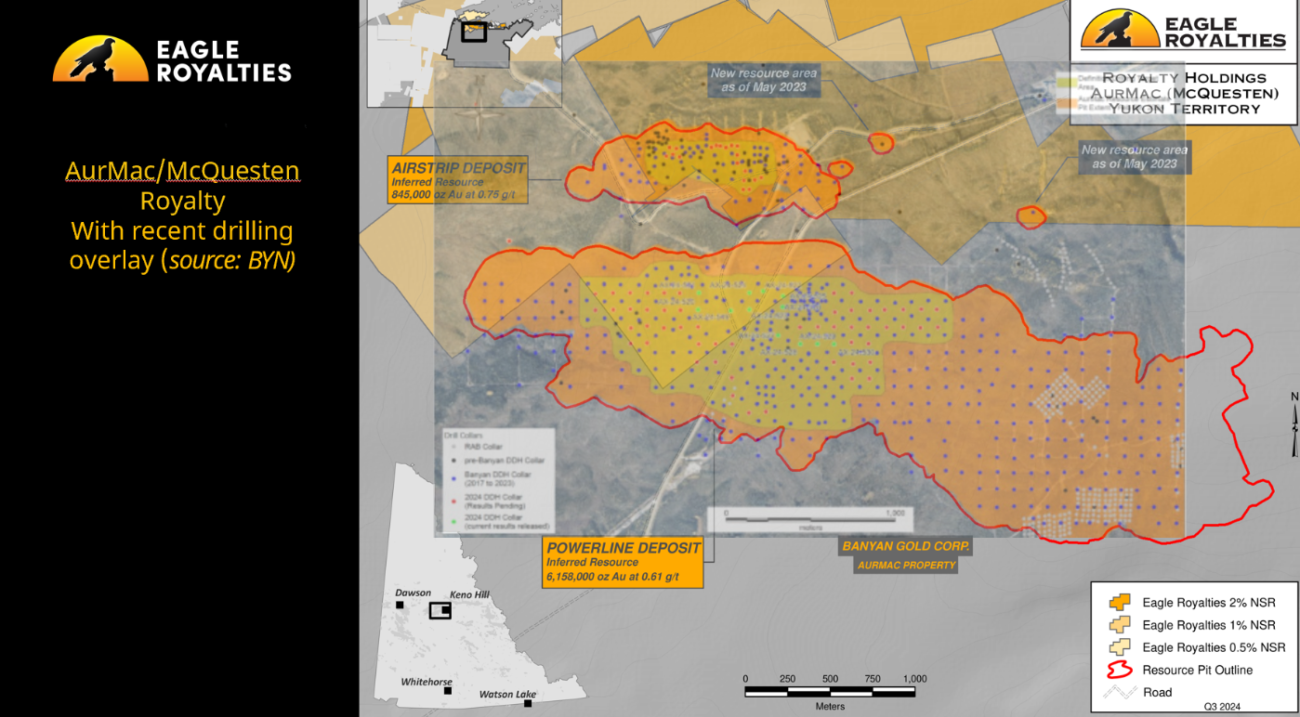

We think one of the reasons why Eagle Royalties’ share price has been performing pretty poorly is related to the issues at the Eagle Mine in the Yukon Territory, where operator Victoria Gold has been pushed into bankruptcy by the Territory’s government. As Eagle Royalties’ most important royalty (in our opinion) is the 0.5-2% Net Smelter Royalty on certain claims of Banyan Gold’s (BYN.V) AurMac project, there is some secondary fallout here. Not only were most people we talked to expecting ‘something’ to happen with Victoria Gold and Banyan (and then not necessarily Victoria acquiring Banyan, but one larger gold company trying to consolidate the entire area) and as Victoria Gold went belly-up, Banyan’s share price took a hit as well.

Additionally, the environmental impact of the Eagle Mine heap leach pad failure also worried investors as one could imagine permitting processes would become much stricter due to the Eagle Mine landslide.

However, the Yukon government recently mentioned it has no intention to make mining or permitting in the Yukon Territory more difficult and although it seized the asset from Victoria Gold, it actually is looking to offload it to a reputable mining company. According to The Globe and Mail, IAMgold (IMG.TO, IAG) and Agnico Eagle Mines (AEM, AEM.TO) are among the favorites to gain control of the Eagle Mine when all the dust settles. And that would actually be a positive outcome for Banyan Gold as any operationally and financially strong neighbour could see the 7 million ounces of gold on Banyan’s ground as an attractive add-on.

Keep in mind Eagle Royalties’ NSR of 0.5-2% is only overlaying certain portions of the deposit. But as the image above (the drill grid versus the resource outline and royalty claims) shows, Banyan has brought certain areas surrounding single drill holes into the 7 million ounce resource calculation and we wouldn’t be surprised to see Banyan focusing on resource expansion there. That area also contains the higher grade zones (0.75 g/t gold in the resource estimate) versus the lower grade Powerline deposit (which carries an average grade of 0.63 g/t gold).

And perhaps a final comment on Banyan’s project: rather than the Eagle Mine which was operated as a heap leach mine, it looks like Banyan is approaching things from a different perspective and its metallurgical test work has been focusing on using a CIL/CIP process in combination with gravity recovery. And although the grade at AurMac is pretty low, the recovery rates of 90-93% are good, so the project does have a chance in a $2500 gold environment.

Eagle Royalties recently also published an excellent video with more details on its AurMac royalty.

At the current share price, the company thinks the best investment is in itself

Last week, Eagle Royalties announced it has implemented a Normal Course Issuer Bid. For the non-Canadians: this is a share buyback program which allows the company to purchase its own shares on the open market. As per the strict regulations of an on-market buyback, the company is allowed to repurchase a total of 2.85 million shares during the next twelve months, and has a strict maximum of 5,900 shares per day it can repurchase.

Although the company likely is still actively exploring the potential to add more royalties to its portfolio, it seems to think one of the best investments is to buy itself considering the current market capitalization is barely higher than the working capital + note receivable.

The balance sheet

The main reason why Eagle Royalties doesn’t deserve to be trading at the current levels is its strong cash position. At the end of June, the cutoff date of the most recent available financials, the company had a positive working capital position of C$3.8M. And once the C$1.25M note receivable will move to the current assets, we expect the company to have a working capital position of close to C$5M.

And let’s also not forget the company’s overhead is very low. In the first half of the year, the burn rate was just C$0.35M which works out to just C$0.7M per year. This could be reduced by the interest income as the company generated almost C$50,000 in interest income in the second quarter. Although interest rates are coming down, we can easily see Eagle Royalties generating north of C$0.1M per year in interest income, which will reduce the net burn rate.

Conclusion

It’s difficult to put a fair value on a royalty company without any royalty revenue. It basically means the value is what a fool wants to pay for it and this could create an opportunity for savvy investors who recognize the potential value of the royalty portfolio. But as we have seen in the numerous transactions over the past five years, larger royalty companies continue to gobble up portfolios of smaller non-producing royalties as the ‘optionality’ could turn in their favor.

In Eagle Royalties’ case, we think the royalty on a portion of the Banyan grounds is by far the most valuable royalty and despite the issues in the Yukon Territory and the current enterprise value of just over half a million Canadian Dollar is obviously not reflecting the fair value of that royalty.

We expect to see Eagle Royalties’ management to continue to build the company by opportunistically picking up additional overlooked and undervalued royalties at bargain prices as per their recent East Goldfield acquisition. Also keep in mind the modus operandi of Eagle Royalties will be the same as for any previous spin-off from Eagle Plains Resources: make the company as attractive as possible for a potential buyer. Two of Eagle Plains’ three previous spinoffs have been acquired by larger companies and we wouldn’t be surprised to see that scenario unfold for Eagle Royalties further down the road.

Disclosure: The author has a small long position in Eagle Royalties. Eagle Royalties is a sponsor of the website. Please read the disclaimer.