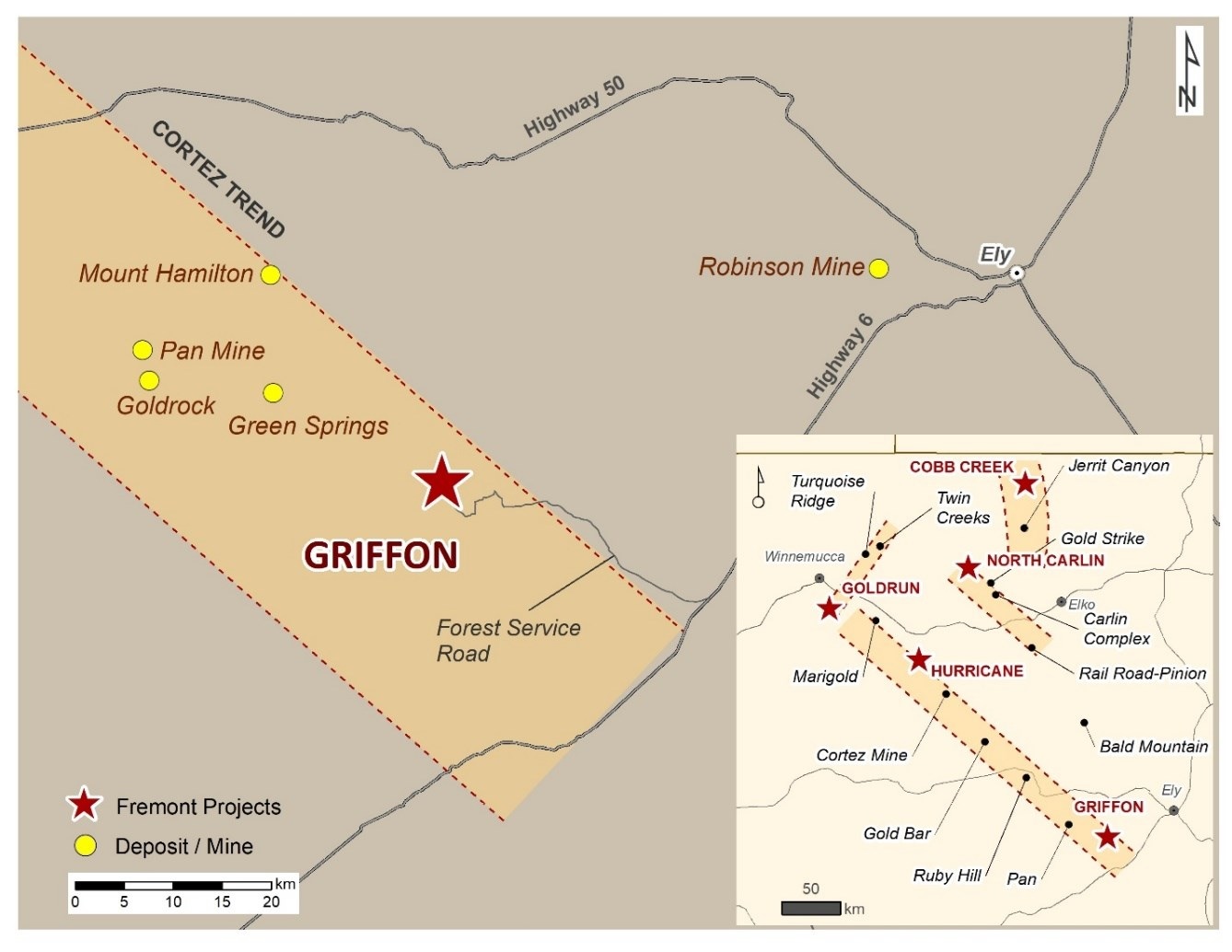

Sometimes drill programs don’t yield the desired results. After an encouraging start, subsequent drill results from Fremont Gold’s (FRE.V) Griffon gold project failed to impress as they returned gold mineralization that was uneconomic.

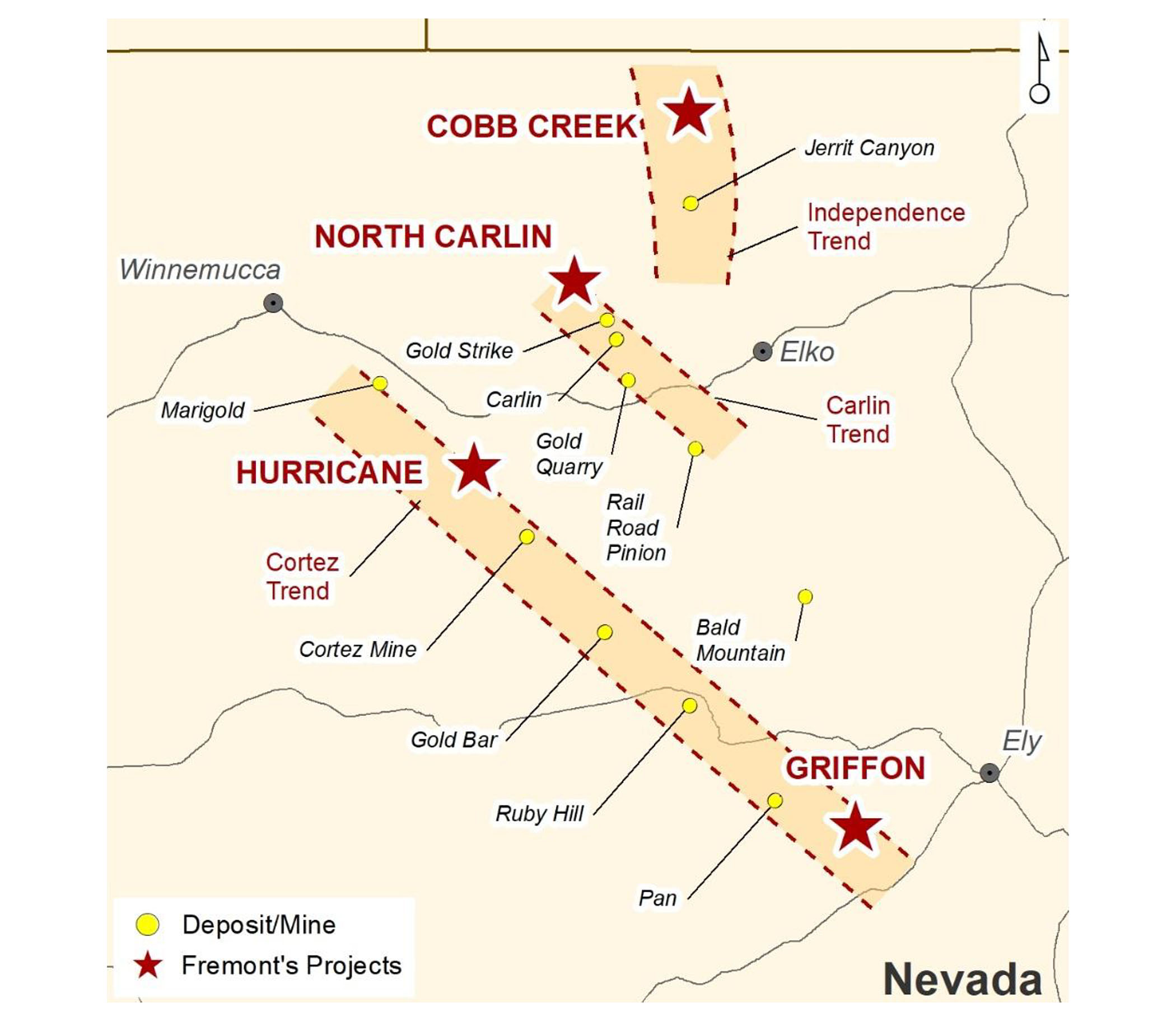

Instead of sulking, Fremont immediately changed their focus and is now working on a C$2M capital raise which will allow them to drill the North Carlin gold project next month and launch an exploration program at the Cobb Creek gold project next spring. The raise will also give the company sufficient financial breathing room as it will cover G&A for approximately a year.

The drill program at Griffon started out well but ultimately disappointed

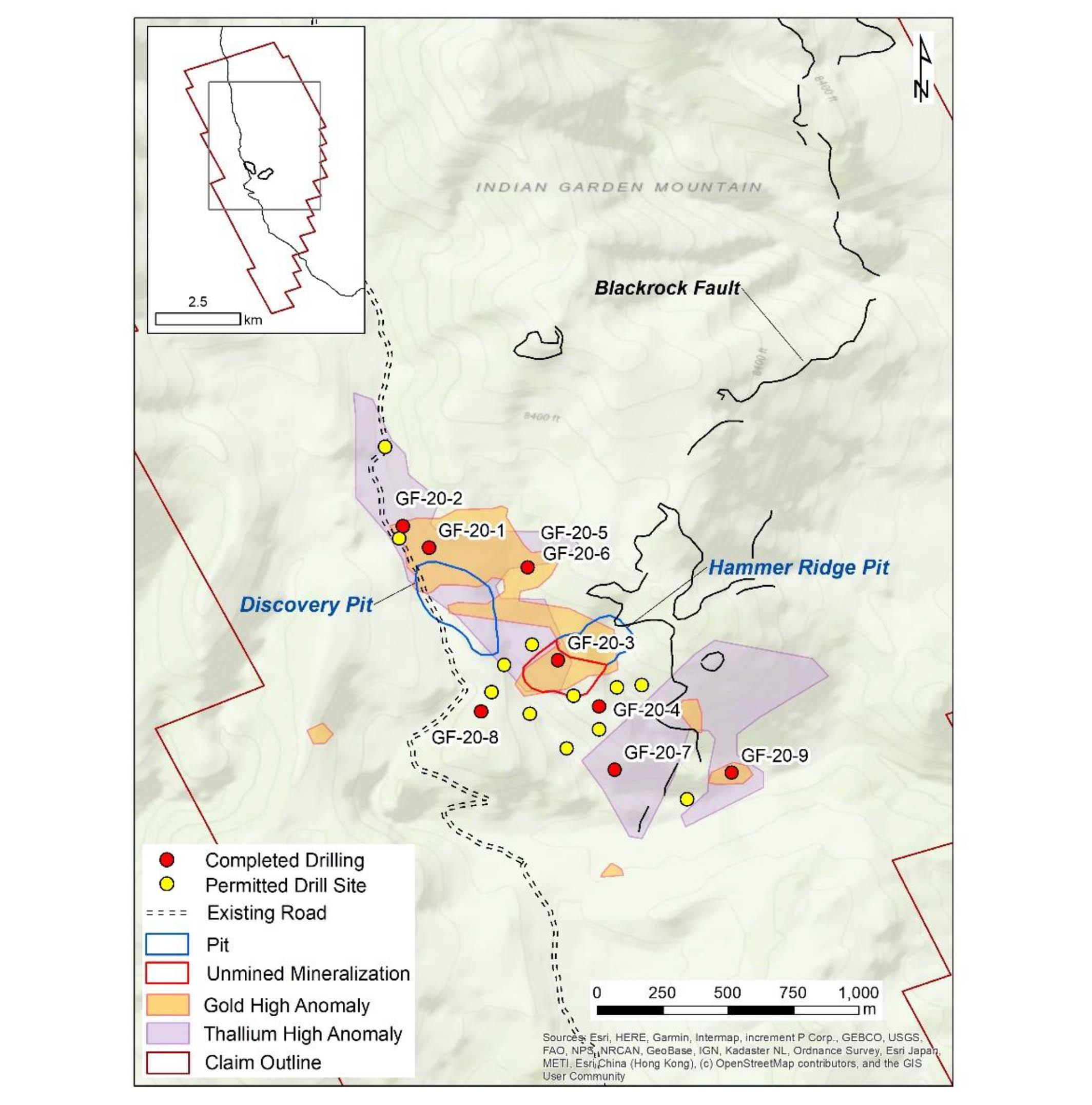

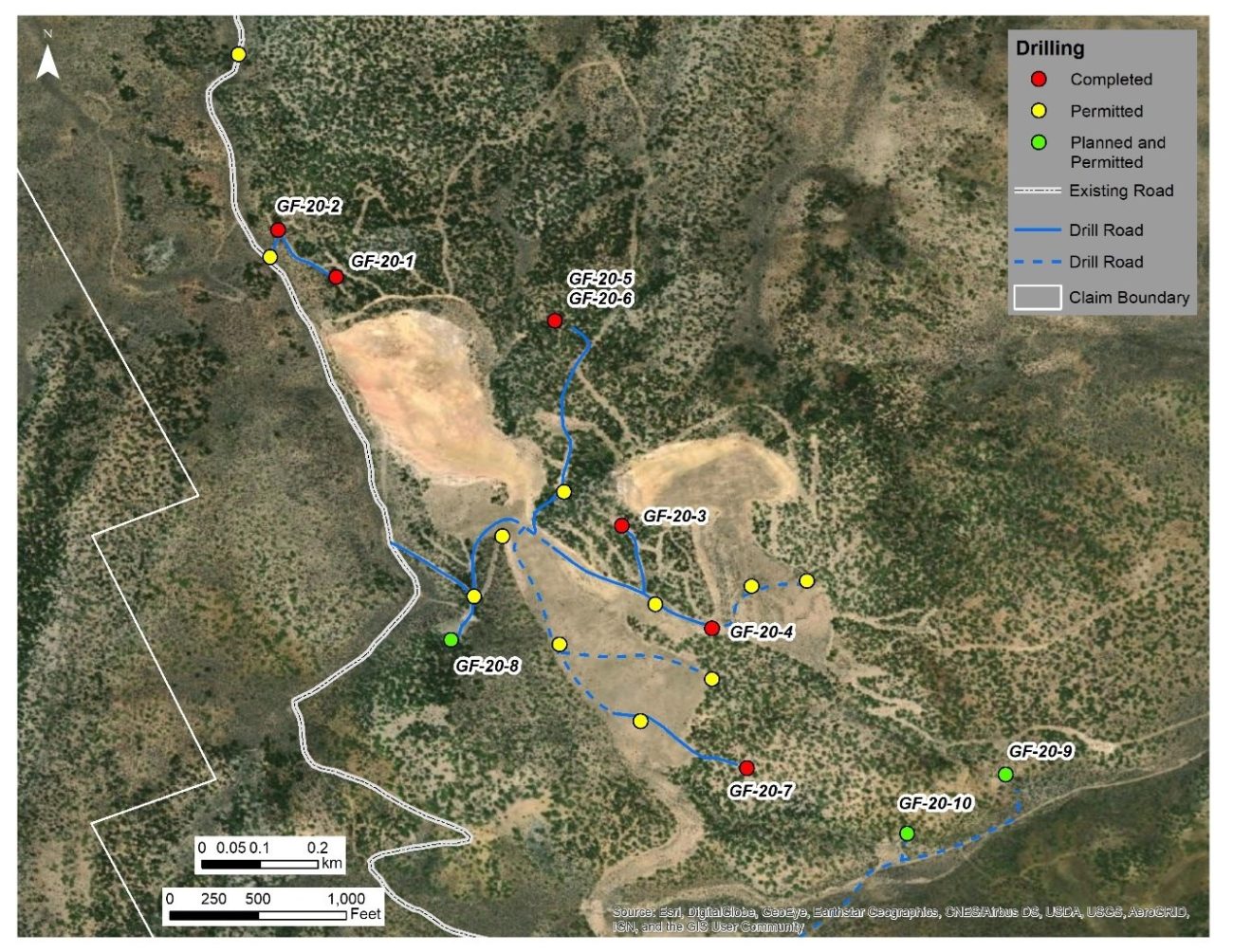

The drill program at Griffon started out well as the first batch of assay results included hole 3, the best hole of the entire campaign (hole 3) but also included holes 1 and 2, which were mediocre (consult the full drill results here). Hole 1 did not encounter any gold values while hole 2 encountered 30 meters of 0.3 g/t gold, including 8 meters of 0.71 g/t gold. 0.3 g/t gold. While hole 2 is low grade, the interval would likely be economic as it starts close to surface (at just 15 meters). However, the real eye-opener was hole 3 where Fremont intercepted a thick layer of high-grade oxide gold mineralization.

That hole intersected just over 50 meters containing 1.05 g/t gold starting at a depth of just 29 meters. Finding 1 g/t is very good. Finding a zone that’s 50 meters thick starting relatively close to surface is very good. And as the entire hole was drilled in oxide mineralization, the combination of all elements makes hole 3 an absolutely excellent interval as leachable material running at 1 g/t gold in Nevada would be highly economical.

While the first two holes were ‘meh’, hole three was definitely excellent, and we were looking forward to seeing the assay results from the remaining six holes.

Unfortunately, none of the remaining holes delivered the results we were hoping for. Holes 4, 7 and 8 didn’t encounter any significant values and holes 5, 6 and 9 only returned anomalous gold values, often lower than 0.1 g/t gold. Anomalous? Definitely. Economic gold values? Not by a mile.

Fremont is now working on interpreting the results and determining their next steps at Griffon. Will that include another drill program at Griffon in 2021? We guess we will just have to wait to find out. It is also important to keep in mind that the 2020 drill program consisted of just nine holes, although a total of 21 drill sites have been permitted.

Catching up with CEO Blaine Monaghan

Let’s cut to the chase, Blaine, the second batch of assay results from the Griffon drill program was very disappointing. After an initially very encouraging 50 meters containing in excess of 1 g/t gold in hole 3 which was announced in July, holes 4-9 were sub-par with three holes coming up empty while the gold values in the remaining holes were clearly anomalous, but also as clearly uneconomical. What went wrong?

I think Griffon has excellent exploration potential and the phase 1 exploration was well thought out and well executed. Unfortunately, we just didn’t intercept enough gold in enough holes.

In your press release, you mentioned you will be planning the next exploration phases at Griffon. Does this indicate you still see a future for the project?

As I mentioned above, I still believe that Griffon still has excellent exploration potential. It’s important to keep in mind that this was a small drill program, approximately 2300 metres in nine holes. And while I wouldn’t characterize the drill program as a success, the results will help us to vector in on new targets. We will study the data and will use all of the available information to guide our next steps. However, we’ve learned that alteration and gold are tightly controlled by numerous faults. Drilling the projected faults that control gold mineralization in the Hammer Ridge pit will be a top priority in the next phase of exploration at Griffon.

You are acquiring the project from Liberty Gold (LGD.TO) and there still are a few payments left. On the first anniversary (coming up in December) you’ll be required to issue shares to Liberty Gold giving them a position equaling 9.9% of the Fremont share count. May we assume you intend to continue to make the required payments to Liberty Gold?

At the present time, we fully intend to live up the terms of the agreement.

Will you be looking for technical input from the Liberty Gold team to increase your odds for a subsequent Griffon drill program?

Certainly.

In your press release, you announced you will be drilling North Carlin next. What was the main reason to aim for a North Carlin drill program and not, for instance, Cobb Creek (which has a historical gold resource) or Hurricane?

We felt that the time was right to drill North Carlin. It is a project that we have always liked but, because it is an earlier stage project, we didn’t feel that the market would support a drill program when we first acquired the ground in 2017. The market is much more supportive now and our team has done an excellent job of further developing the targets.

Additionally, unlike Cobb, North Carlin is located on BLM land so we can turn around the permits much more quickly than Cobb, which is on Forestry ground. Lastly, while we have developed drill targets at North Carlin, we still have some work to do at Cobb, which we plan to do this spring, before we permit it for drilling.

Can you elaborate on the North Carlin drill program? What will you be targeting, and how extensive will the drill program be?

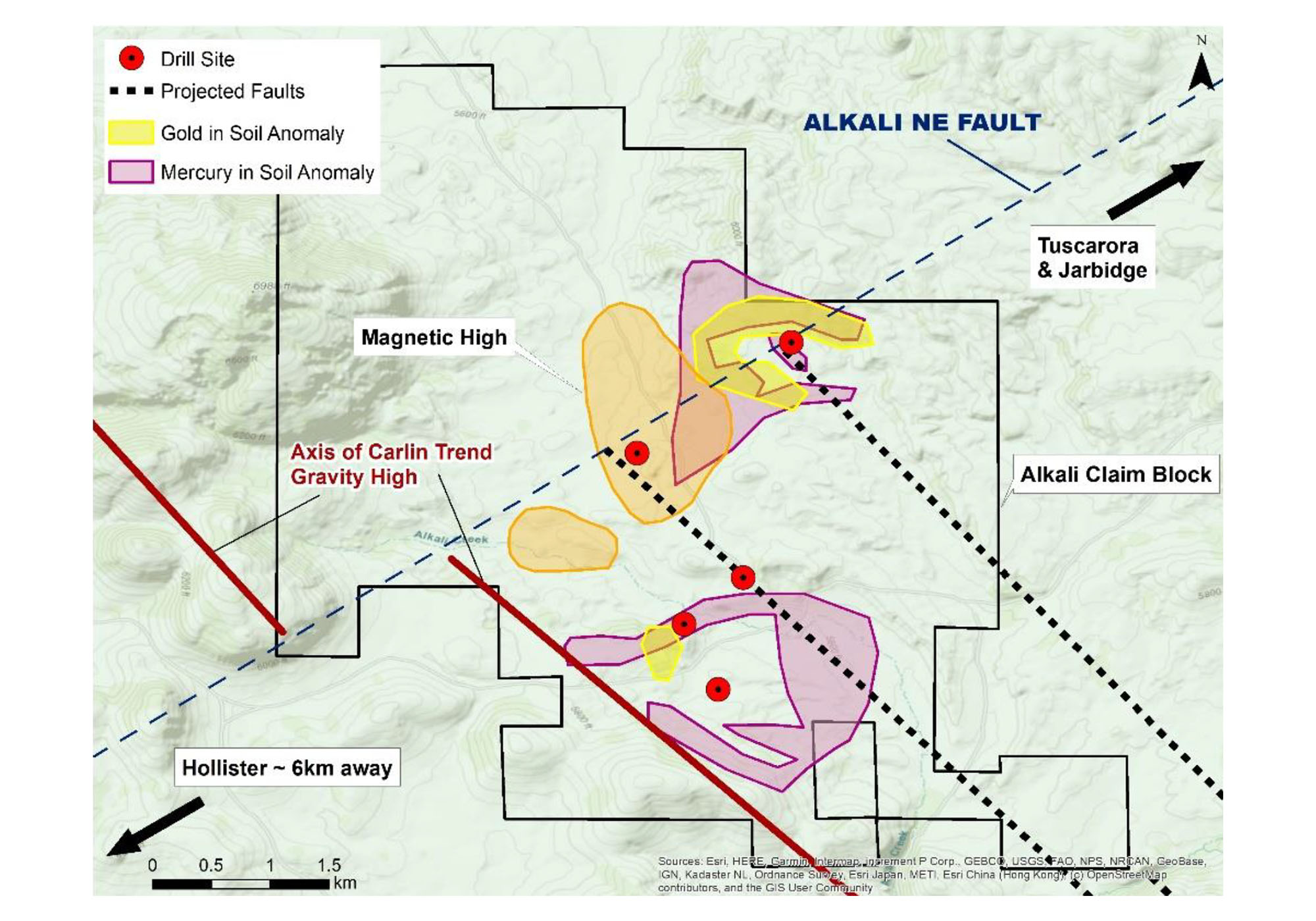

North Carlin is situated in the right geological setting for the discovery of a major gold deposit. Fremont has developed several drill targets based on soil geochemistry, gravity and geomagnetic surveys, and the projection of key faults that control gold mineralization in the Carlin Trend. We are permitting 10 holes and plan to drill at least three holes totaling 1,500 metres.

Your market cap has now dropped again to C$5M. How difficult will it be to raise money and to boost investor confidence after this setback?

We initially announced a raise of $1.0M with a $500K lead order. It is being very well received and we subsequently increased the total size of the placement to C$2M. This should provide plenty of runway to drill North Carlin and be in a good position to design and execute our 2021 exploration plans.

Can you elaborate what’s required to get the Cobb Creek project drill-ready? What are the hoops you need to jump through, and when do you expect to complete the permitting process at Cobb Creek?

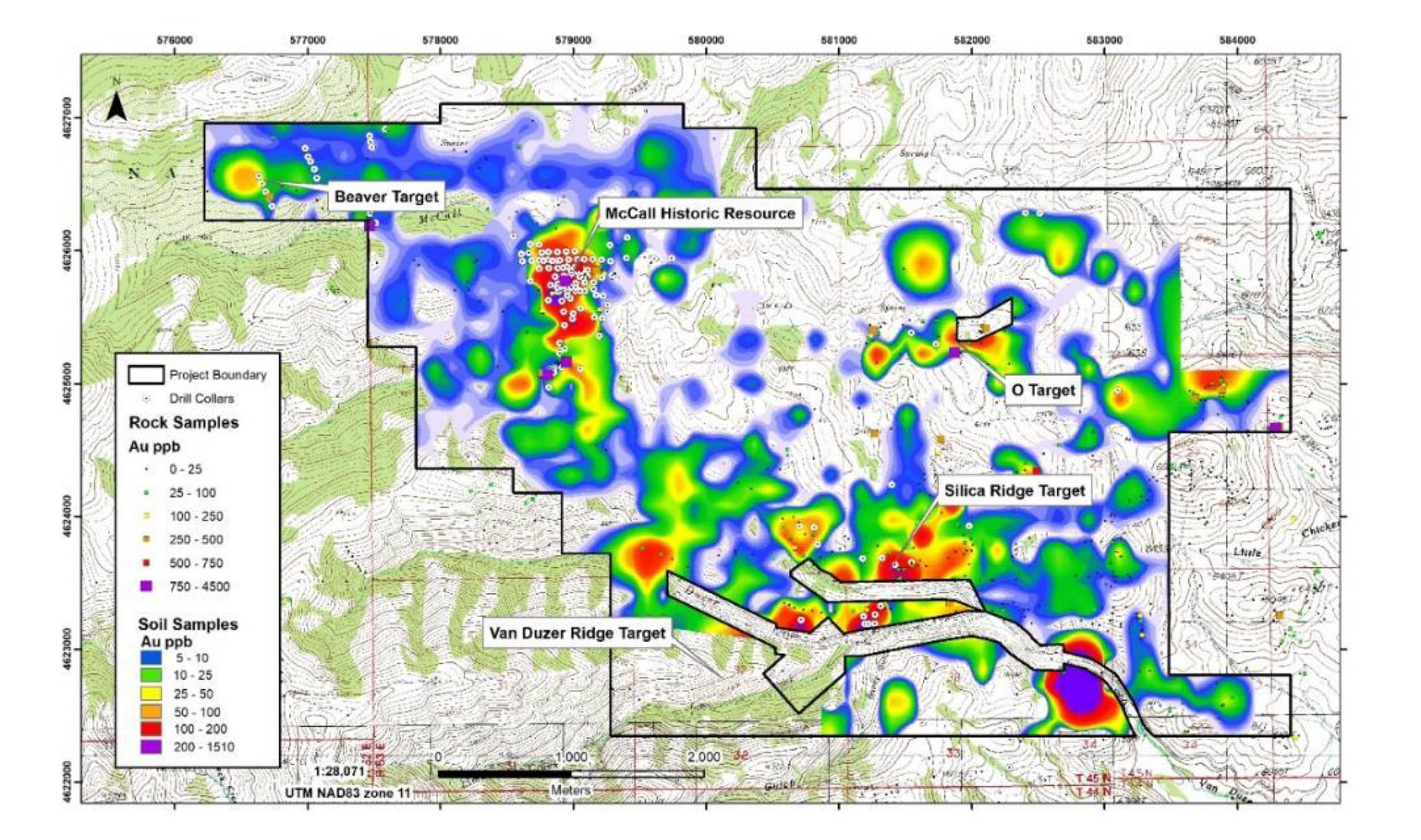

Although Cobb hosts a historic resource of nearly 200,000 ounces gold, it hasn’t been drilled since the early 90s, and it isn’t currently permitted for drilling. Further, the resource is hosted in an orogenic vein deposit. We think it has excellent potential for the discovery of a Carlin-type deposit so we need to get in there and conduct some early stage exploration to better identify what targets we might like to drill and then start the permitting process. Because it is on Forestry land, it will take longer to permit than a project located on BLM ground. However, I can’t provide guidance on how long that process might take.

North Carlin will be drilled soon, and Cobb Creek will be made drill-ready for 2021

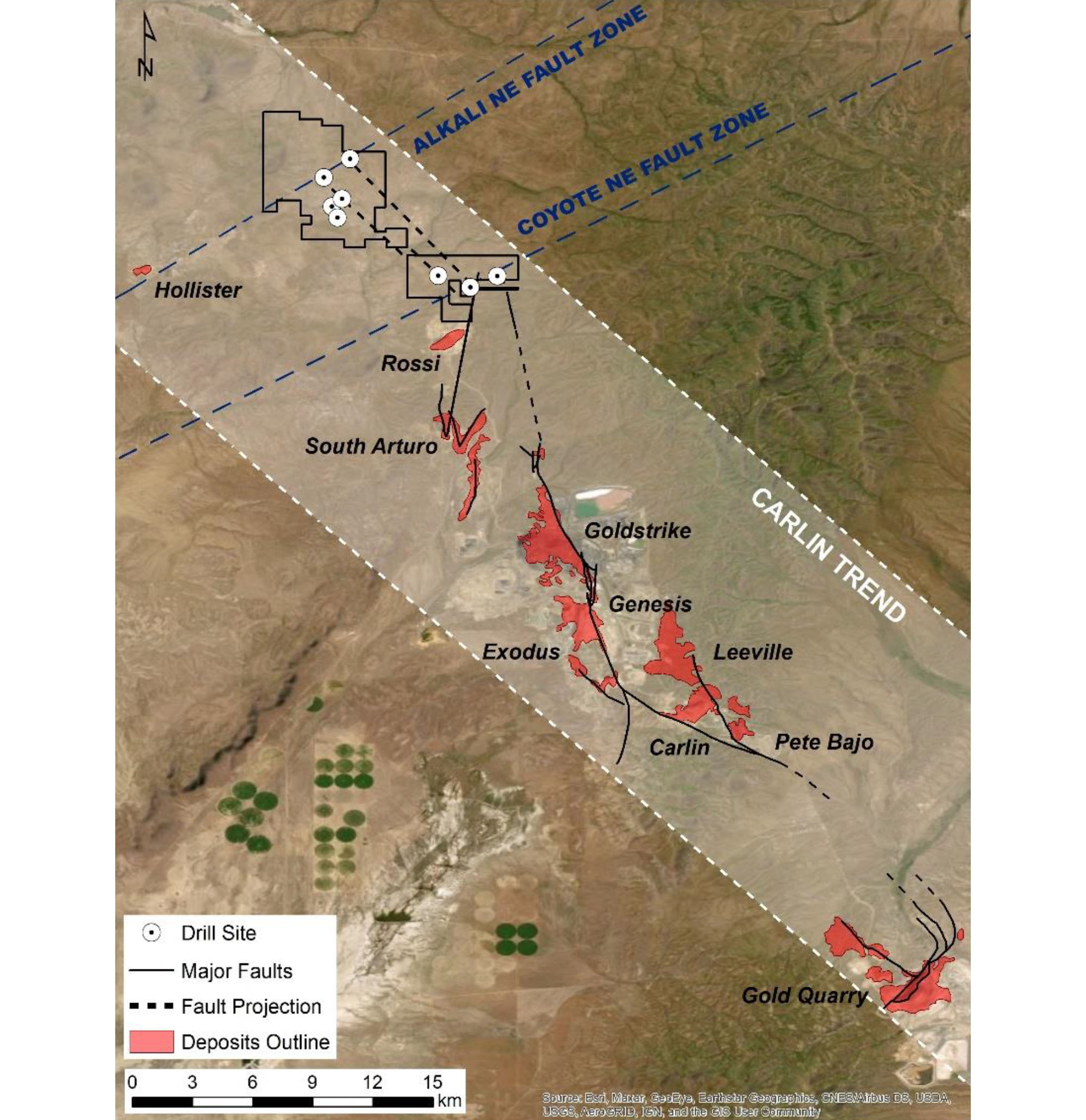

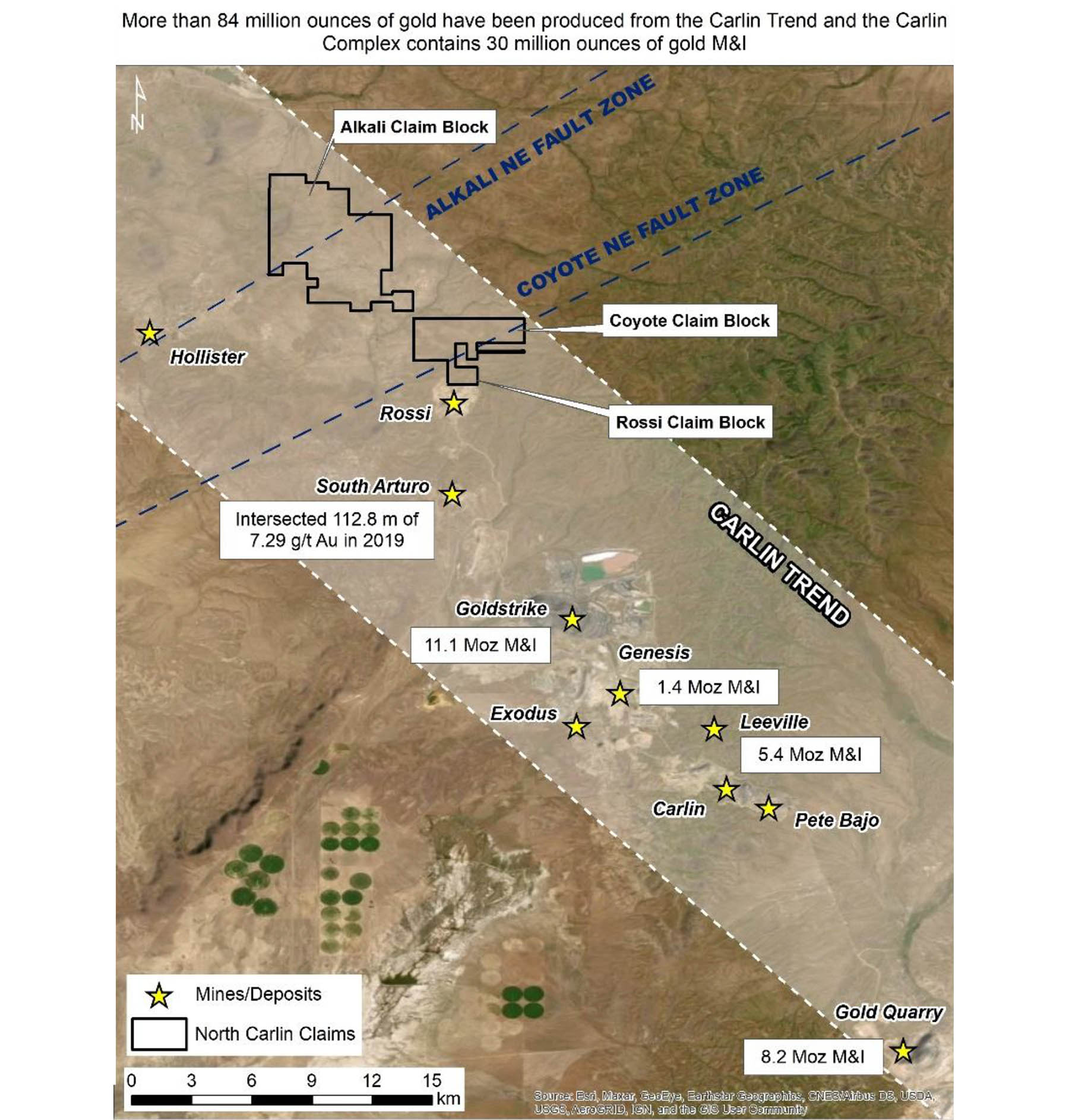

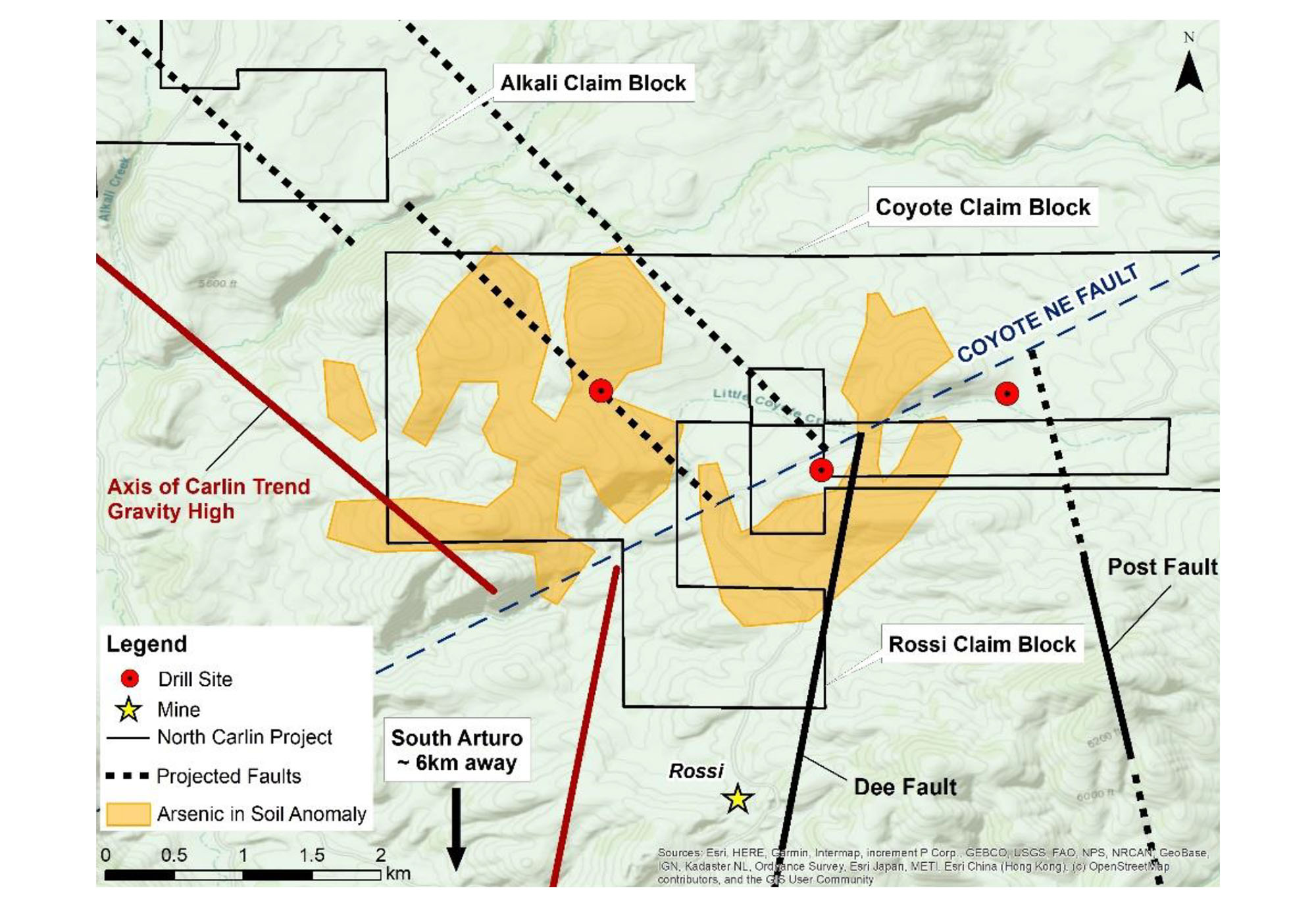

Fremont is now focused on North Carlin (comprised of the Alkali, Coyote, and Rossi claims), located at the northern end of the Carlin Trend. The Project is approximately 6 km north of and on-strike of Nevada Gold Mines/Premier Gold Mines’ South Arturo mine, where recent drilling intersected 39.6 metres of 17.11 grams per tonne gold, and 12 km north of Nevada Gold Mines’ Goldstrike mine, which hosts 11.1 million ounces gold in the measured and indicated category. The western edge of North Carlin is approximately 6 km east of Hecla Mining Company’s Hollister mine.

Since acquiring the ground in 2017, Fremont has developed several drill targets based on soil geochemistry, gravity and geomagnetic surveys, and the projection of key faults that control gold mineralization in the Carlin Trend.

Alkali is located at the intersection of projected Carlin Trend faults and the Alkali Northeast trending fault, a structural corridor that hosts Hollister to the southwest and Tuscarora and Jarbidge to the northeast. The Alkali NE fault cuts through a 1,500 metre by 2,000 metre magnetic high and coincident gold and mercury soil anomalies that occur on the eastern flank of the magnetic high. Together, the data suggests the presence of gold mineralization beneath alluvial cover.

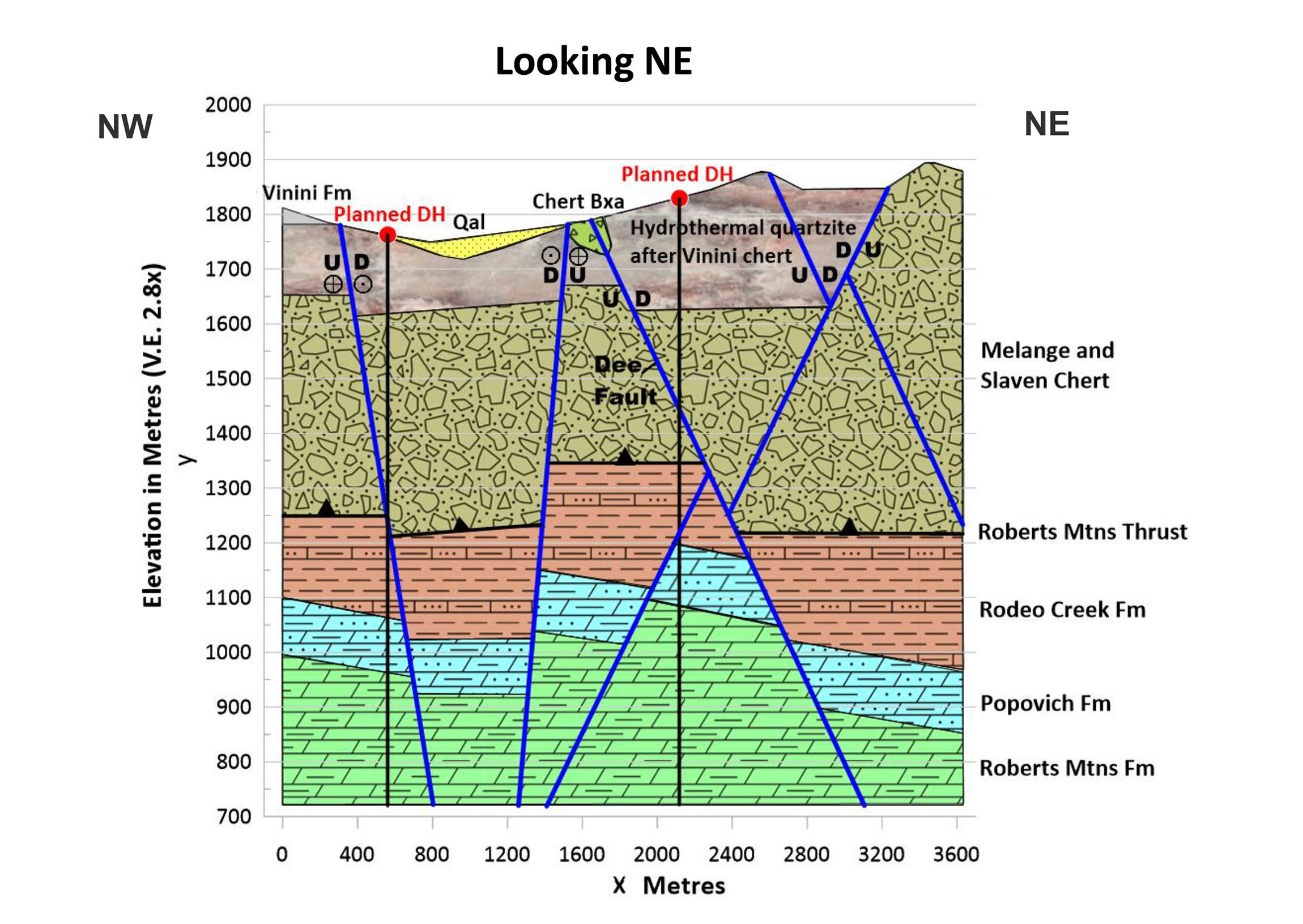

Coyote (see the image below) is located at the intersection of projected Carlin Trend faults and the Coyote NE Fault. Surface geology is upper-plate Ordovician Vining Formation, which is likely underlain by the Roberts Mountain thrust and lower plate Paleozoic carbonate rocks – common hosts of Carlin deposits.

Fremont believes that North Carlin is situated in the right geological setting for the discovery of a major gold deposit.

And as mentioned in the press release discussing the upcoming drill program, Blaine said “We are very excited to start drilling North Carlin. In terms of periodicity and alignment, the Project is strategically located at the northern end of the Carlin Trend. Based on North Carlin’s geological setting and the exploration results to date, we believe that it holds excellent potential for the discovery of a new Carlin-type deposit.”

Conclusion

Exploration isn’t an exact science. After publishing very encouraging results from Griffon in July, the subsequent results failed to deliver. However, instead of having a pity party, Fremont is boldly shifting its focus to North Carlin. The Company is raising C$2M to drill it and plans to launch a minimum 1,500 metre drill program there next month.

Disclosure: The author holds a long position in Fremont Gold Ltd. Fremont Gold Ltd. is a sponsor of the website.