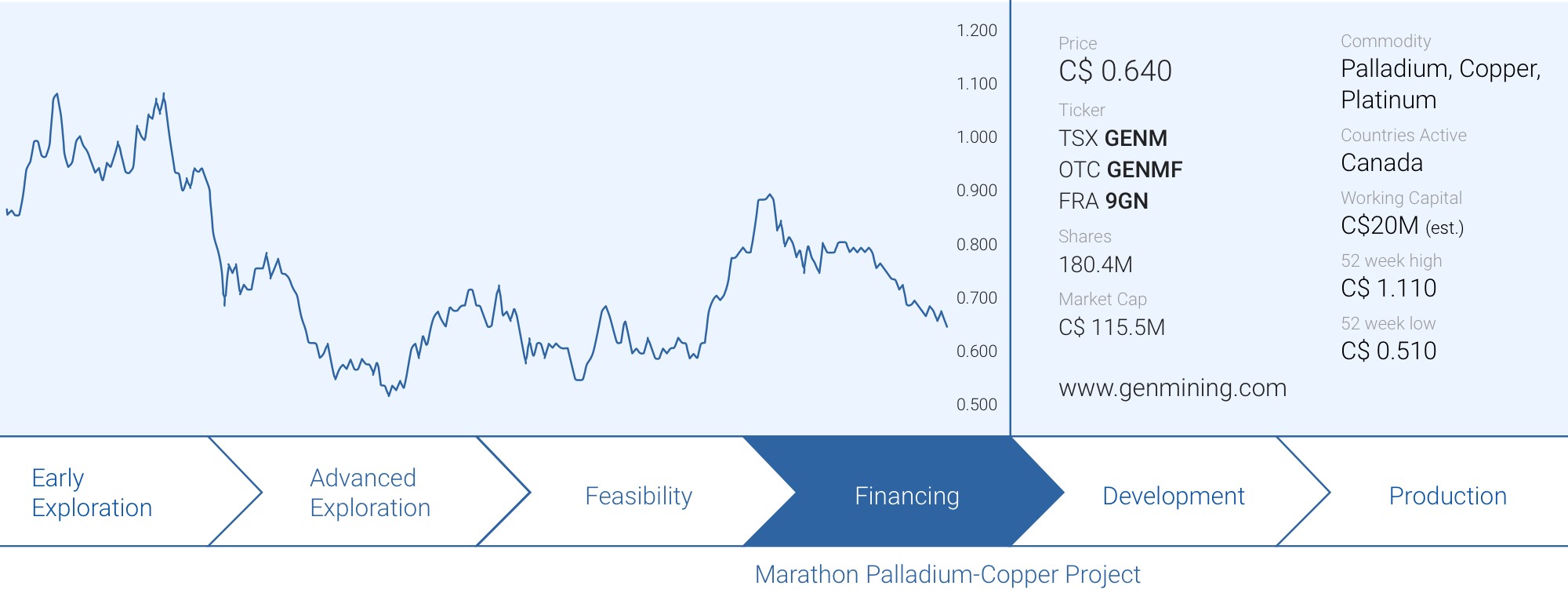

Generation Mining (GENM.TO) has done everything right in the past four years. It acquired the advanced stage Marathon PGM project from Sibanye-Stillwater (SBWC) and was able to confirm the resource, build an economic study and get the project through the most important stage of the permitting process which culminated in the approval of the environmental assessment for the Marathon palladium copper project in November of last year.

The share price initially reacted well but has recently shown some weakness. Understandable given the palladium price which has been on a constant slide since reaching new highs when the Ukraine-Russian war broke out. And although the palladium price is currently trading below the level used in the feasibility study, there is one important mitigating factor: the copper price.

Ticking a major box in the permitting process

It took the company quite a bit of time but in the end hard work paid off and Generation Mining secured the approval of the environmental impact assessment by the Federal and Provincial authorities. This is by far the most important step in the permitting process and as the company now has the local first nations, the provincial and the federal authorities on board, it can now start putting the final pieces of the Marathon copper-palladium project together.

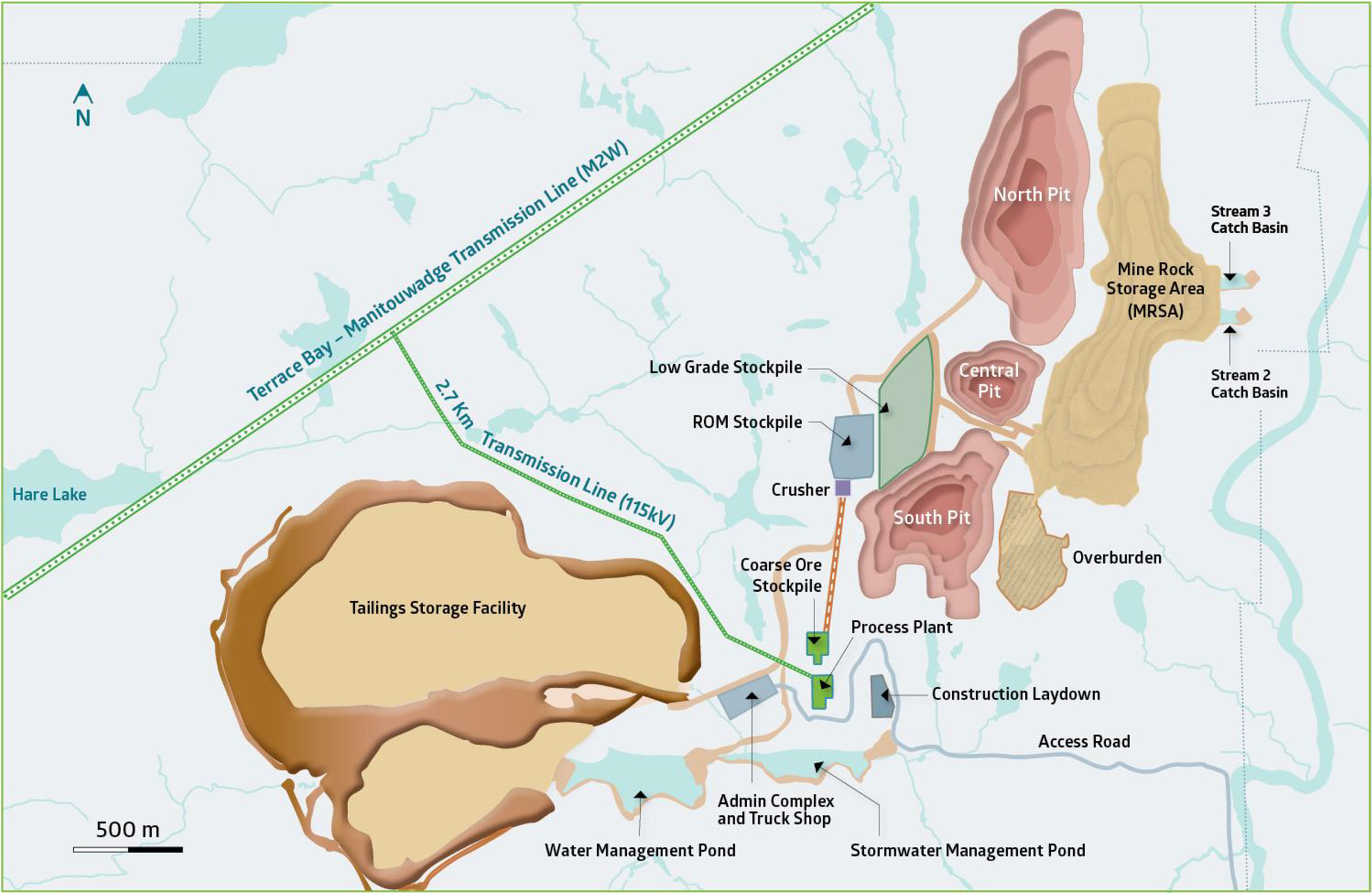

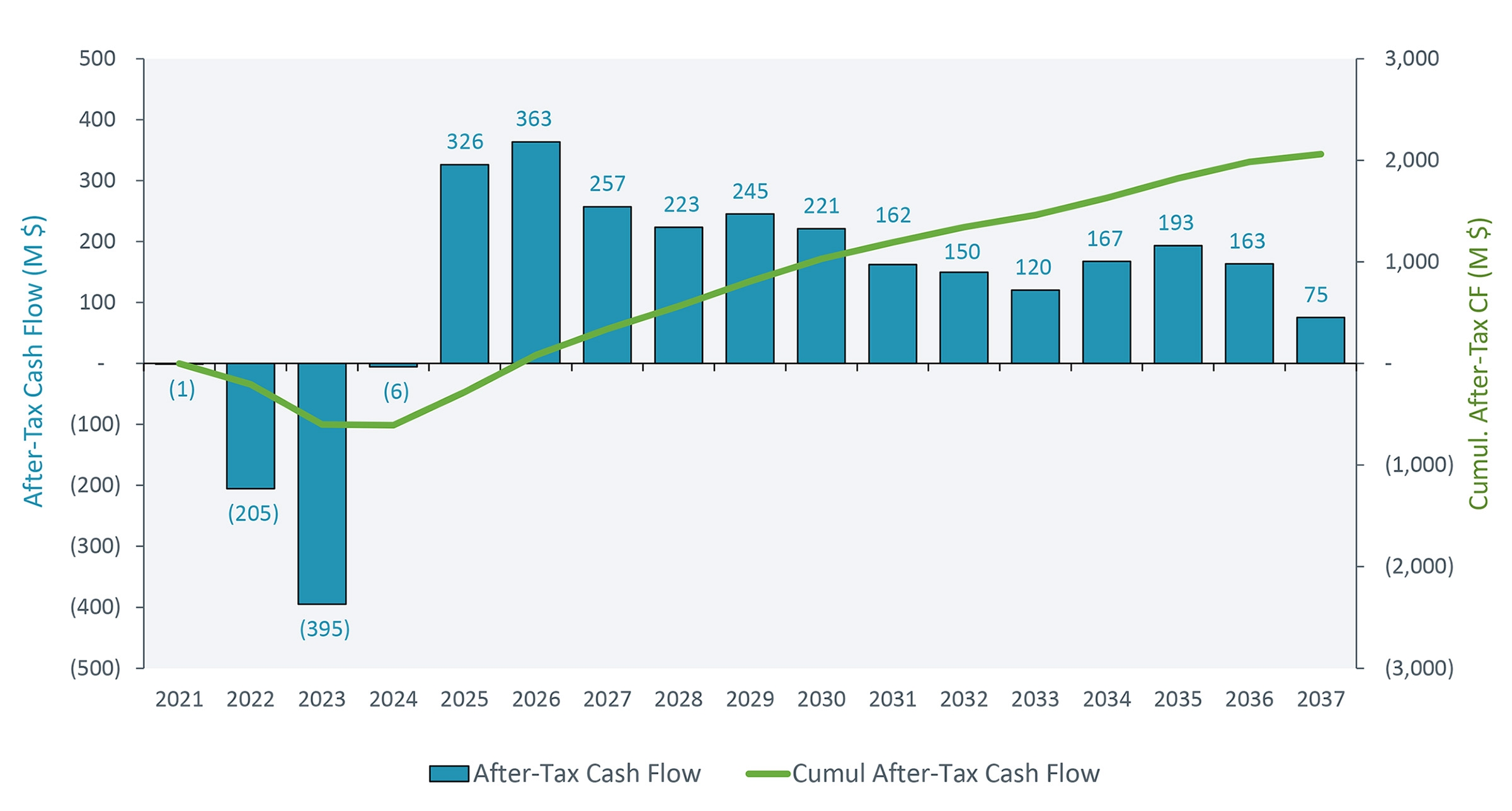

Generation Mining can now apply for all the relevant permits to construct and operate the mine as approval of the environmental impact assessment was the cornerstone approval needed to advance to permitting. We expect 2023 to be a busy year for Generation is it will have to break ground at Marathon while securing a funding package to see it through the construction and commissioning phase of the Marathon palladium copper project which will produce a total of 1.9 million ounces of palladium and almost half a billion pounds of copper. We expect to see an updated capex estimate as we get closer to a final financing package and then it’s up to Generation Mining to build Ontario’s newest open pit mine.

Subsequent to completing the environmental permitting phase, CEO Jamie Levy added an additional 50,000 shares to his position by completing an open market purchase at C$0.84 for a total of C$42,000. This brings his total position to 4.37 million shares and seeing the CEO buying more stock after receiving the important permits is a nice vote of confidence.

As of the end of September, Generation Mining had a positive working capital position of approximately C$23M, including C$28.6M in cash. The cash burn was pretty high during the permitting process as Generation Mining spent in excess of C$8.5M on the Marathon palladium copper project during the third quarter but fortunately the cash burn will be somewhat mitigated in the near future thanks to the increasing interest rates which means Generation Mining will actually generate a return on its cash pile. We shouldn’t expect too much of it, but Generation will likely generate a few hundred thousand dollars in interest income in 2023. And every dollar which helps to reduce the net cash burn obviously counts.

Revisiting the economics of the project

Based on the feasibility study, the Marathon PGM project will produce a total of 456 million payable pounds of copper and 1.85 million payable ounces of palladium. This basically means that for every ounce of palladium, the project will produce almost 250 pounds of copper and this means we could likely look at the project from a ‘communicating barrels’ perspective. Based on the current spot price for the metals, the palladium price would be lower, but the copper price would be substantially higher than the US$3.20 per pound used in the feasibility study. Both price fluctuations should actually mitigate each other.

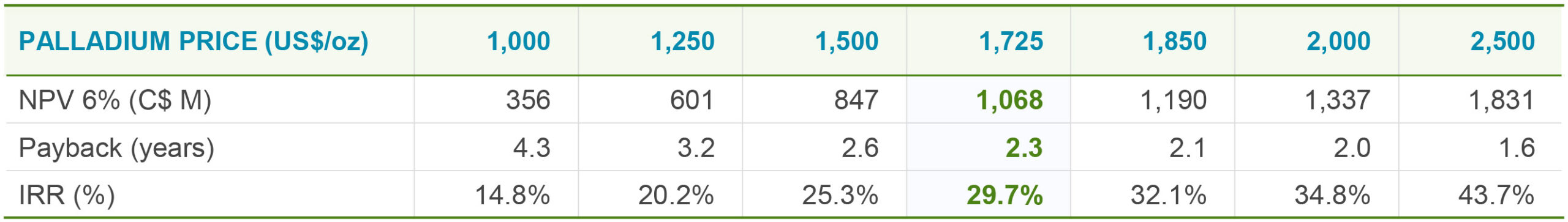

This is no new information and was/is clearly visible in the company’s own sensitivity analysis. In the image below, we see the project loses about C$220M in NPV if one uses a palladium price of US$1500/oz versus the $1725 base case scenario.

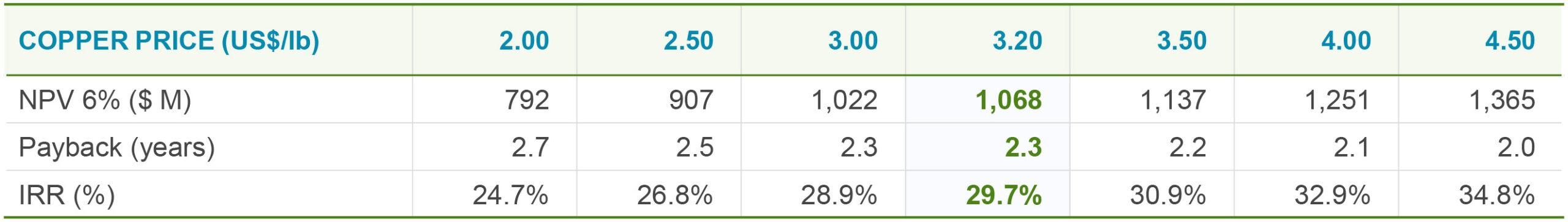

But in the table below, we see the after-tax NPV6% increases by just over C$180M if one would use a copper price of US$4/pound. So, in the scenario where the palladium price drops to $1500/oz during the entire mine life and the copper price is simultaneously increased to $4 per pound, the after-tax NPV6% on a combined basis would lose just C$40M, or less than 4% of the NPV.

Copper acts a little bit like the saving grace of the project. At $1250 palladium and US$3.20 copper the Marathon PGM project still has a positive NPV of in excess of C$600M, but a scenario with those commodity prices would make it more difficult to find funding for the asset. Additionally, we should expect the total initial capex to increase from the currently estimated C$665M. But in general, we can likely conclude the impact of the lower palladium price on the NPV should remain limited if – and only if – the copper price remains at the current levels.

The current weakness doesn’t mean palladium is dead. The situation in South Africa, the second largest producer of palladium (right behind Russia with a 2022 output of 80,000 kilograms versus Russia’s 88,000 kilograms) is worsening month after month. Impala Platinum Holdings, which refines approximately 1 million ounces of palladium per year has warned the energy crisis in South Africa is having a major impact on the production results and the operating performance. And it doesn’t look like the current crisis will end anytime soon as rolling blackouts are expected for at least two more years, according to a recent Bloomberg article. Impala is warning that 2023 may actually be worse than 2022 if the situation doesn’t improve soon (and it doesn’t look like it is) and Impala isn’t alone: peers Anglo American Platinum and Sibanye Stillwater have warned the market about the same issue.

While we can expect the demand for palladium from the automotive sector to decrease over time (the recent spike in palladium prices was co-fueled by the stricter emission standards as well as the sanctions against Russia), but that does not necessarily mean the equilibrium price for palladium will decrease as well: if the supply decreases at a faster pace than the demand is decreasing, odds are the palladium price may increase – that’s just the law of supply and demand. Of course it will take a few more years before the Marathon PGM project will be in commercial production and a lot can happen between now and then, but it for sure is a very interesting spectrum of the market to keep an eye on. It will also be interesting to see if the European Union takes a detailed stance on palladium when it unveils its Critical Raw Materials Act in four weeks.

Conclusion

Generation Mining still has all the cards in its own hands and still has some flexibility in determining how to move the project forward. Keep in mind 78% (408,000 ounces) of the payable platinum production remains unencumbered. Additionally, the 2.8 million payable ounces of silver can also be sold forward under a streaming agreement but that would only result in a negligible cash inflow of maybe C$25M. And although Generation Mining is firmly saying no at this point, even a copper streaming deal could make sense to trade forward price risk for an immediate lump sum upfront payment to complement the to-be-received C$200M tranche from Wheaton Precious Metals (WPM, WPM.TO) on top of the C$40M Generation Mining has already received from Wheaton.

We expect the capex to increase. Although the inflation rate is coming down, we simply cannot ignore the impact it has had in the mining sector in 2022 since the feasibility study was released. It’s tough to guesstimate by what percentage the capex will increase and we hope to see more clarity from the company on this in the next few months as a construction decision is coming closer by the day.

Generation Mining has done everything right in the past four years and hopefully the market will reward the company for its efforts.

Disclosure: The author has a long position in Generation Mining Ltd. Generation Mining Ltd. is a sponsor of the website. Please read the disclaimer.